Today, NevGold Corp. made a landmark announcement of securing 20 km2 of prime territory adjacent to the Mineral Project from Hercules Silver Corp. (TSX.V: BIG) in the emerging Hercules Copper Trend of Washington County in Idaho. Named “Zeus“, this new project positions NevGold strategically, just 20 km away from Hercules‘ major copper porphyry discovery. NevGold‘s move comes in the wake of Barrick Gold Corp.‘s substantial $30 million investment into Hercules, signaling a wave of confidence in the region‘s potential. The Zeus Copper Project covers some of the most prospective ground within the Hercules Copper Trend, boasting geological similarities to the renowned Hercules discovery. With historical significance as a copper producer and extensive geological mapping validating its potential, the Zeus Project area, named “Mineral District”, holds immense promise, with NevGold‘s recent work program already yielding promising finds of copper mineralization and porphyry copper alteration during the company‘s staking campaign over recent months.

NevGold‘s CEO, Brandon Bonifacio, was interviewed on today‘s news, explaining the significance of adding the Zeus Copper Project to its gold portfolio:

Click above player or here to watch the interview.

NevGold‘s CEO, Brandon Bonifacio, commented in today‘s news-release: “We are extremely excited to announce our Zeus Copper Project within the Hercules Copper Trend of Washington County, Idaho. Due to our presence in this region of Idaho with Nutmeg Mountain, our 100% owned resource stage, oxide, heap-leach gold project (see Note 1), our technical team had a very strong understanding of the regional geology. We were a first mover and based on our technical knowledge of the area we staked key strategic claims while consolidating some of the most strategic ground in this emerging copper belt. The Zeus Project has many of the same geological characteristics as the Hercules Project, and our team encountered signs of copper mineralization and copper porphyry alteration while staking over recent months. Although the Zeus Copper Project is an additional project added to the portfolio with significant potential value for our shareholders, we remain focused on expanding our oxide, heap-leach gold resource platform in the Western USA with Nutmeg Mountain (Idaho) and Limousine Butte (Nevada). We are fortunate to have a strong core team, and we are always looking for opportunities to create value for our shareholders. It is also very advantageous to have another project in the district, as we have already built a strong reputation in Washington County, Idaho and we have many relationships to leverage as we advance both Zeus and Nutmeg Mountain. We are looking forward to further developing our portfolio of top-quality assets in the world class jurisdictions of Idaho and Nevada, and we will have many updates from Zeus, Nutmeg Mountain, and Limousine Butte over the coming months.”

NevGold‘s VP Exploration, Derick Unger, added: “The Hercules copper porphyry discovery is one of the most exciting recent discoveries in the Western USA. Along with Hercules, NevGold was one of the only other operators in Washington County, Idaho. Since acquiring Nutmeg Mountain two years ago, we have established strong infrastructure and local relationships, while building a very good understanding of the local geology. This allowed us to move quickly to secure some of the most prospective ground on the entire Hercules Copper Trend, which saw a significant increase in land acquisition and exploration activity after the Hercules discovery was announced last October. We have spent significant time in the field completing the staking process, and our team has been encouraged by the numerous indications of a large copper porphyry system at Zeus. The work now begins to target the best part of the system, while we also continue to systematically advance Nutmeg Mountain and Limousine Butte.”

As announced today, NevGold plans an active exploration program at Zeus beginning in 2024. This program would include:

• Geological database review;

• Geological mapping;

• Comprehensive surface geochemical sampling;

• Geophysics such as magnetics, gravity, EM, CSAMT, or IP; and,

• Drill testing copper targets identified by the above activities.

Note 1: Nutmeg Mountain (100% owned) – 2023 Mineral Resource Estimate

Details of the MRE are provided in a technical report entitled “Technical Report on the Nutmeg Gold Property” with an effective date of June 22, 2023, prepared in accordance with National Instrument 43-101 (“NI 43-101”) standards, which is filed under the Company’s SEDAR+ profile.

Last month, Rockstone initiated coverage on NevGold (PDF), highlighting its near-surface, heap-leachable gold projects with significant resource growth upside: Nutmeg Mountain in Idaho with >1 million ounces, Limousine Butte in Nevada with historic resources and recent drill hits such as 61.6 m @ 2.19 g/t gold oxide and 175.2 m @ 0.86 g/t gold oxide, along with the earlier-stage gold project Cedar Wash in Nevada.

Full size / Cordillera Porphyry Copper Terrane including the Hercules Project and NevGold‘s Zeus and Nutmeg Mountain Projects in Idaho.

ZEUS

Location & Infrastructure: The Zeus Copper Project is located 120 km northwest of Boise, Idaho, and 40 km northwest of NevGold’s Nutmeg Mountain Gold Project. The recent Hercules copper porphyry discovery is 20 km northeast of Zeus. The area has strong road, water, and power infrastructure with numerous sources of power and water nearby, and a large network of access roads leading to the Project.

Land Position: NevGold has acquired ~20 km2 (~2,000 hectares, or 4,900 acres) of mineral rights through claim staking by the NevGold team. The claims cover both Bureau of Land Management (“BLM”) and United States Forest Service (“USFS”) ground.

District Geology: The Hercules Copper Trend is hosted in the Blue Mountain Province which is considered analogous to the Stikine and Quesnel terranes in British Columbia, which host continental-scale trends of large porphyry copper deposits that include the Highland Valley, Red Chris, and Mt. Milligan mines in British Columbia, and other large copper deposits such as Galore Creek. The Hercules copper porphyry discovery appears to be the first large-scale copper porphyry to be found in western Idaho and represents an entirely new province for potential copper discoveries along the North American craton boundary.

Adjacent Property – The Mineral Project: In October 2023, when Hercules Silver Corp. announced an option agreement to acquire 100% of the Mineral Property, CEO Chris Paul commented: “We’ve entered into a lease option agreement to secure another key piece of ground in the Hercules mining district, which the Company believes shows strong potential to emerge into a significant copper porphyry belt. The Hercules Copper Belt, as it’s referred to internally, represents a trend of underexplored copper porphyry targets with excellent discovery potential. Relative to Hercules, the Mineral Project appears to be the next best developed prospect in the district and adds another compelling copper-gold porphyry target to the portfolio. We are highly encouraged by Mineral’s historical drilling, strong soil geochemistry and similar geological setting to the Hercules project.” The news-release also noted: ”The Mineral mining district was so-named after prospectors discovered rhyolite-hosted silver-copper-lead-zinc-bearing replacement mineralization in the area during the 1870s. A town site was established, and small-scale mining began in the 1880s and continued in earnest until the repeal of the Sherman Silver Purchase Act by U.S. President Cleveland in 1893, which caused a collapse in the silver price and decimated the silver mining industry. The mines and smelters at Mineral shut down at that time, and subsequent mining was very sporadic and conducted at a small scale through to 1950. The district has been essentially dormant ever since, apart from a few years of historical exploration during the late 1960s/early 1970s, but has never had a modern, systematic exploration approach applied to it.“ Select rock grab samples by Newmont (2013) returned up to 5.9% copper, 30.3 g/t gold and 0.0852% molybdenum.

“Responsible modern-day mining that balances economic prosperity with environmental stewardship is the reason that Idaho is one of the best climates for mineral extraction. Mining has a bright future in Idaho.” (Idaho Governor Brad Little)

Full size / The figure “shows the location of Idaho’s two world-class mining districts, the Coeur d’Alene (CDA) district in north Idaho and the Phosphate district in southeast, as well as a number of mineral exploration projects around the state. Two mines have been operating in the CDA district (Silver Valley) and another one is on the road to reopen. As documented in a new publication by the Idaho Geological Survey (GeoNote 47), the total historic production is over 1.256 million troy ounces (39,085 metric tons) of silver metal plus significant base metals and antimony. Hecla Mining Company’s Lucky Friday mine was on target to produce about 4.3 million troy ounces during 2022...“ (Source, 2023)

“It is often missed, but if you look closely at the Seal of the Great State of Idaho, you will see a miner. Standing strong since the turn of the century, that miner is a lasting symbol showing the fundamental and important role mining has and still does play in each corner of Idaho. Emma Edwards Green designed our Great Seal in 1890, and when asked what her inspiration was, she wrote; “...as mining was the chief industry, and the mining man the largest financial factor of the state at that time, I made the figure of the man the most prominent in the design, while that of the woman, signifying justice, as noted by the scales; liberty, as denoted by the liberty cap on the end of the spear, and equality with man as denoted by her position at his side, also signifies freedom. The pick and shovel held by the miner, and the ledge of rock beside which he stands, as well as the pieces of ore scattered about his feet, all indicate the chief occupation of the State. The stamp mill in the distance, which you can see by using a magnifying glass, is also typical of the mining interest of Idaho. The shield between the man and woman is emblematic of the protection they unite in giving the state. The large fir or pine tree in the foreground in the shield refers to Idaho’s immense timber interests. The husbandman plowing on the left side of the shield, together with the sheaf of grain beneath the shield, are emblematic of Idaho’s agricultural resources, while the cornucopias, or horns of plenty, refer to the horticultural. Idaho has a game law, which protects the elk and moose...” Natural resources were then, and still are now, a vital element that was necessary for the settlement and growth of Idaho... Mining in Idaho plays a major role in our state and our nation’s future. Our abundant resources and diverse mineral deposits are important to securing domestic supply chains for farming, manufacturing, national defense, clean energy, energy storage, and beyond... Economists estimate that for every job created at a mine, two-and-a-half more are created throughout the community. The total economic impacts to Idaho include more than 10,000 jobs and produce more than one billion dollars in Gross State Product... From Idaho’s humble beginnings in 1890, to becoming one of the fastest growing states in 2023, Idaho miners continuing to put in the hard work. We are still the vision etched into history by Emma Edwards Green; providing critical, raw materials and protecting our natural resources for today and for future generations. “ (Benjamin J. Davenport, Executive Director of the Idaho Mining Association, 2023)

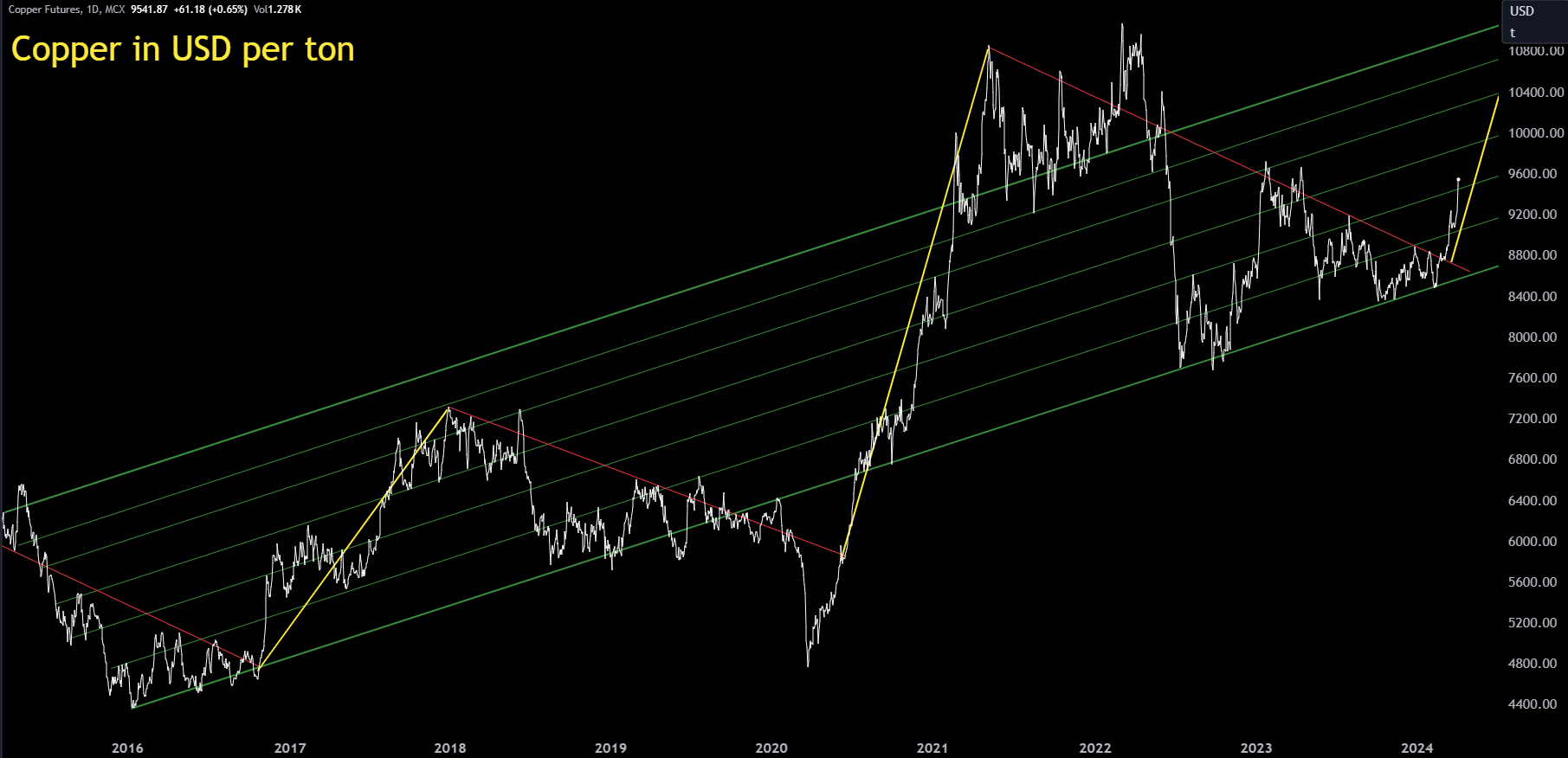

Copper futures prices are up 13% in the last 2 months, rising from $8,483 in early February to now $9,560 USD/t. As having broken the (red) resistance recently, a longer-term upward trend is anticipated:

“Open interest on copper has SKYROCKETED in March on the back of increased Chinese stockpiling. Has China set the stage for a bull-run in copper? Markets doesn‘t really seem to care what China needs the copper for, only that they buy it.“ (Source)

Jefferies Group on copper: “The fundamental outlook for copper is improving faster than we had previously anticipated. Based on our supply and demand forecasts, the copper market is entering an extended period of deficits now. We expect this to lead to declining inventories and higher prices sooner than we had previously anticipated. The supply response to these higher prices will take too long to balance the market as the lead time to bring new capacity online is 5+ years for brownfields and 10+ years for greenfield projects. If growth in supply lags growth in underlying demand, as we expect, then demand destruction will be needed for the market to balance. This demand destruction will require a significantly higher price. Ultimately, we believe the copper price will need to rise enough to incentivize the development of new greenfield projects that the world will need to meet demand, but that incentive price is well above $5/lb. If copper goes from $4/lb to $6/lb, as we expect over the next 2-3 years, copper mining equities should roughly double, on average. This leverage to the copper price in a cyclical upturn is clearly the reason to own the equities, in our view.“ (Source)

Morgan Stanley on copper: “Perennial copper supply deficit materializing. As of mid-2023, our house view was that the copper market would be in a slight surplus in 2024 and 2025. On the back of widespread copper concentrate supply disruptions and delays in the ramp of new mine projects, the copper supply balance has changed quickly and our commodity team is now forecasting a shortfall in 2024 and significantly higher deficit conditions throughout the rest of the decade.“ (Source)

According to “Traders bet on supply squeeze pushing up copper prices“ (Financial Times, March 30, 2024): “Traders are betting on a tighter copper market in coming months, as disappointment over China’s stumbling economic growth is overtaken by fears of a squeeze on global supplies... But many traders are placing bets on supply shortages as production cuts by miners begin to take effect. Macquarie has revised down its copper supply forecast by 1mn tonnes for 2024 since last September. Lower production is likely to have a lagged ripple effect through the supply chain. Many copper smelters, which refine the raw material into metal, have become lossmaking as there are too many facilities fighting over a tight supply of raw material. Traders are betting some will have to slow or halt production, tightening supply of refined metal and translating into higher prices in coming months. Goldman Sachs has predicted that copper prices will hit $10,000 per tonne by the year-end on robust Chinese demand and the “ongoing supply-side shock”. Chinese copper smelters are working on a joint plan to cut output to cope with the raw material shortage. News of the rare move earlier this month sent the benchmark copper price soaring above $9,000 per tonne. The volatile rally was further fuelled by speculative trading by hedge funds and others, which built net long positions on the expectation of a tighter market.“ ... “Elevated mine supply disruptions point to a deficit of 700,000 tonnes, and should start to feed through to refined production too,” said Morgan Stanley in a note, predicting a $10,200 per tonne copper price by the third quarter."

RBC on copper: “Chilean copper mine supply (~30% of global production) continues to trend lower on several factors, including technical challenges and falling grades, particularly at Codelco, which has seen significant declines (-16% y/y on January data). Refined copper output from Chinese smelters continues to climb. The current disconnect between refined and mine production is likely not sustainable with the lack of concentrate availability becoming more of an issue, which could tighten the refined market.“ (Source)

“Copper prices and miners are likely to benefit from the growing supply-demand gap. Some miners in particular are thriving due to the optimistic long-term outlook for copper demand. Copper’s strategic importance has driven significant M&A (merger and acquisition) activity in 2022-2023, with major mining companies like BHP and Rio Tinto acquiring copper miners at substantial premiums. Automakers [...] are also investing directly in mining companies.“ (Source: “Copper: Wired for the Future“, February 2024)

The gold price is up 15% since mid-February, rising from $1,995 to now $2,300 USD/oz. As having broken the multi-year (red) resistance at the $2,075-level, a longer-term upward trend is anticipated:

Junior gold miners, as shown with the VanEck Junior Gold Miners ETF, are finally following the gold price action and started its own strong upward trend by breaking the (green) resistance, with the subsequent pullback confirming it as new support and starting to accelerate upwards (“thrust“):

“On average, historically, when a major mining company has acquired an explorer, they have done so at 22% of the resource value as we have shown in the chart... As Warren Buffett advises, “It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. ‘Efficient’ markets exist only in textbooks.” It is the best value and macro timing opportunity that I have seen in my career to be rotating out of crowded overvalued large-cap tech stocks and into the mining industry...“ (Source)

“Western investor flows look like they are poised to return to gold [...] which include a probable M&A cycle as the major mining companies are in desperate need of scalable new discoveries to replace their dwindling reserves. They will need to acquire or do deals with companies [...] with sizable economic deposits if they do not want to die of old age... Given the US government debt and deficit problem, the likely government Keynesian fiscal and monetary stimulus response to the coming likely tech bust and recession should be the catalyst for one of the highest inflationary periods in US history along to go along with one of its biggest commodity bull markets ever... We believe the distressed value opportunity in the mining industry is creating an excellent entry point...“ (Source)

Company Details

![]()

NevGold Corp.

Suite 250 – 200 Burrard Street

Vancouver, BC, V6C 3L6 Canada

Phone: +1 604 337 5033

Email: info@nev-gold.com

www.nev-gold.com

CUSIP: 641536 / ISIN: CA6415361071

Shares Issued & Outstanding: 93,905,194

Canadian Symbol (TSX.V): NAU

Current Price: $0.38 CAD (04/03/2024)

Market Capitalization: $36 Million CAD

German Ticker / WKN: 5E50/ A3CTE1

Current Price: €0.254 EUR (04/03/2024)

Market Capitalization: €24 Million EUR

Contact:

www.rockstone-research.com

Disclaimer: This report and the referenced news-releases and video interview contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, NevGold Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to NevGold Corp.s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedarplus.ca. Please read the full disclaimer within the full research report as a PDF (see here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, currently does not own any equity of NevGold Corp., however he owns equity of Zimtu Capital Corp. and thus will profit from volume and price appreciation of this stock. The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. holds an equity position of NevGold Corp. and thus will profit from volume and price appreciation. Note that NevGold Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and NevGold Corp. (“NevGold“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the NevGold‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward looking include that NevGold, or any other company or market, will perform as expected; that exploration has or will discover a mineable deposit; that the Zeus Copper Project covers some of the most prospective ground within the Hercules Copper Trend, boasting geological similarities to the renowned Hercules discovery; that with historical significance as a copper producer and extensive geological mapping validating its potential, the Zeus Project area, named “Mineral District”, holds immense promise, with NevGold‘s recent work program already yielding promising finds of copper mineralization and porphyry copper alteration during the company‘s staking campaign over recent months; that the Zeus Project has many of the same geological characteristics as the Hercules Project, and our team encountered signs of copper mineralization and copper porphyry alteration while staking over recent months; that although the Zeus Copper Project is an additional project added to the portfolio with significant potential value for our shareholders, we remain focused on expanding our oxide, heap-leach gold resource platform in the Western USA with Nutmeg Mountain (Idaho) and Limousine Butte (Nevada); that we are fortunate to have a strong core team, and we are always looking for opportunities to create value for our shareholders; that it is also very advantageous to have another project in the district, as we have already built a strong reputation in Washington County, Idaho and we have many relationships to leverage as we advance both Zeus and Nutmeg Mountain; that we are looking forward to further developing our portfolio of top-quality assets in the world class jurisdictions of Idaho and Nevada, and we will have many updates from Zeus, Nutmeg Mountain, and Limousine Butte over the coming months; that since acquiring Nutmeg Mountain two years ago, we have established strong infrastructure and local relationships, while building a very good understanding of the local geology, and that this allowed us to move quickly to secure some of the most prospective ground on the entire Hercules Copper Trend, which saw a significant increase in land acquisition and exploration activity after the Hercules discovery was announced last October; that we have spent significant time in the field completing the staking process, and our team has been encouraged by the numerous indications of a large copper porphyry system at Zeus; that the work now begins to target the best part of the system, while we also continue to systematically advance Nutmeg Mountain and Limousine Butte; that NevGold plans an active exploration program at Zeus beginning in 2024, and that this program would include: Geological database review; Geological mapping; Comprehensive surface geochemical sampling; Geophysics such as magnetics, gravity, EM, CSAMT, or IP; and Drill testing copper targets identified by the above activities; that NevGold’s near-surface, heap-leachable gold projects have significant resource growth upside; that these projects are or will be amenable for heap-leaching, which must be confirmed by metallurgical programs first; that the Hercules copper porphyry discovery appears to be the first large-scale copper porphyry to be found in western Idaho and represents an entirely new province for potential copper discoveries along the North American craton boundary; that the Hercules mining district is believed to show strong potential to emerge into a significant copper porphyry belt; that the Hercules Copper Belt represents a trend of underexplored copper porphyry targets with excellent discovery potential; that relative to Hercules, the Mineral Project appears to be the next best developed prospect in the district; that mining has a bright future in Idaho; that a second mine is on the road to reopen; that Hecla Mining Company’s Lucky Friday mine was on target to produce about 4.3 million troy ounces during 2022; that mining in Idaho plays a major role in our state and our nation’s future; that our abundant resources and diverse mineral deposits are important to securing domestic supply chains for farming, manufacturing, national defense, clean energy, energy storage, and beyond; that as having broken the (red) resistance recently, a longer-term upward trend is anticipated for copper; that China has set the stage for a bull-run in copper; that based on our supply and demand forecasts, the copper market is entering an extended period of deficits now; that we expect this to lead to declining inventories and higher prices sooner than we had previously anticipated; that the supply response to these higher prices will take too long to balance the market as the lead time to bring new capacity online is 5+ years for brownfields and 10+ years for greenfield projects; that if growth in supply lags growth in underlying demand, as we expect, then demand destruction will be needed for the market to balance, and that this demand destruction will require a significantly higher price; that ultimately, we believe the copper price will need to rise enough to incentivize the development of new greenfield projects that the world will need to meet demand, but that incentive price is well above $5/lb; that if copper goes from $4/lb to $6/lb, as we expect over the next 2-3 years, copper mining equities should roughly double, on average; that this leverage to the copper price in a cyclical upturn is clearly the reason to own the equities, in our view; that on the back of widespread copper concentrate supply disruptions and delays in the ramp of new mine projects, the copper supply balance has changed quickly and our commodity team is now forecasting a shortfall in 2024 and significantly higher deficit conditions throughout the rest of the decade; that lower production is likely to have a lagged ripple effect through the supply chain; that traders are betting some will have to slow or halt production, tightening supply of refined metal and translating into higher prices in coming months; that Goldman Sachs has predicted that copper prices will hit $10,000 per tonne by the year-end on robust Chinese demand and the “ongoing supply-side shock”; that elevated mine supply disruptions point to a deficit of 700,000 tonnes, and should start to feed through to refined production too,” said Morgan Stanley in a note, predicting a $10,200 per tonne copper price by the third quarter; that the current disconnect between refined and mine production is likely not sustainable with the lack of concentrate availability becoming more of an issue, which could tighten the refined market; that copper prices and miners are likely to benefit from the growing supply-demand gap; that as having broken the multi-year (red) resistance at the $2,075-level, a longer-term upward trend is anticipated for gold; that junior gold miners, as shown with the VanEck Junior Gold Miners ETF, are finally following the gold price action and started its own strong upward trend by breaking the (green) resistance, with the subsequent pullback confirming it as new support and starting to accelerate upwards (“thrust“); that it is the best value and macro timing opportunity that I have seen in my career to be rotating out of crowded overvalued large-cap tech stocks and into the mining industry; thatwWestern investor flows look like they are poised to return to gold [...] which include a probable M&A cycle as the major mining companies are in desperate need of scalable new discoveries to replace their dwindling reserves, and that they will need to acquire or do deals with companies [...] with sizable economic deposits if they do not want to die of old age; that given the US government debt and deficit problem, the likely government Keynesian fiscal and monetary stimulus response to the coming likely tech bust and recession should be the catalyst for one of the highest inflationary periods in US history along to go along with one of its biggest commodity bull markets ever; that we believe the distressed value opportunity in the mining industry is creating an excellent entry point. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include: The receipt of all necessary approvals and permits for exploration and mining; the ability to find sufficient mineralization to mine; uncertainty of future production, uncertain capital expenditures and other costs; financing and additional capital requirements for exploration, development and construction of a mine may not be available at reasonable cost or at all; mineral grades and quantities on the projects may not be as high as expected; samples found to date and historical drilling may not be indicative of any further potential on the properties; that mineralization encountered with sampling and drilling will be uneconomic; that the targeted prospects can not be reached; the receipt in a timely fashion of further permitting; legislative, political, social or economic developments in the jurisdictions in which NevGold carries on business may hinder progress; there may be no agreement with neighbors, partners or government on developing the respective projects or infrastructure; operating or technical difficulties or cost increases in connection with exploration and mining or development activities; the ability to keep key employees and operations financed; what appear at first to be similarities with operating mines and projects may not be substantially similar; share prices and market valuations of NevGold and other companies may fall as a result of many factors, including those listed here and others listed in the companies’ disclosure; and the resource prices available when the resource is mined may not be sufficient to mine economically. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. As per NevGold’s Interim Financial Statements for the 3 and 9 months ended September 30, 2023, and 2022, filed on SEDAR: “The Company is a resource exploration stage company, which does not generate any revenue and has been relying on equity-based financing to fund its operations. The Company may require additional financing either through equity or debt financing, sale of assets, joint venture arrangements or a combination thereof to meet its long-term business objectives. There is no assurance that sufficient future funding will be available on a timely basis or on terms acceptable to the Company. These conditions indicate the existence of material uncertainties that cast significant doubt as to the ability of the Company to meet its obligations as they come due, and accordingly, the appropriateness of the use of accounting principles applicable to a going concern is in significant doubt. The application of the going concern concept is dependent upon the Company’s ability to generate future profitable operations and maintain an adequate level of financial resources to discharge its ongoing obligations. Management seeks to raise capital, when necessary, to meet its funding requirements and has undertaken available cost-cutting measures. There can be no assurance that management’s plan will be successful, as it is dependent on prevailing capital market conditions and the availability of other financing opportunities... The Company’s financial instruments are exposed to several financial and market risks, including credit, interest rate, liquidity, and commodity risks. The Company may, or may not, establish from time-to-time active policies to manage these risks.” As per NevGold’s MD&A for the 9 months ended September 30, 2023, filed on SEDAR: “Business risks: In the normal course of its mineral exploration business, the Company is exposed to various operational, technical, financial and regulatory risks and uncertainties, many of which are beyond its control and may significantly affect future results. Operations may be unsuccessful or delayed as a result of competition for services, supplies and equipment, mechanical and technical difficulties, the ability to attract and retain employees and contractors on a cost-effective basis, commodity and marketing risk and seasonality. The Company is exposed to considerable risks and uncertainties including, but not limited to; finding mineral resources and reserves on an economical basis; uncertainties related to estimating the Company’s mineral resource or mineral reserves should there be such an estimate; technical problems which could lead to unsuccessful drilling programs and environmental damage; obtaining timely permits and regulatory approvals; third party related operational risks including the ability to obtain access to certain properties, access to drilling rigs for exploration, road and other transportation infrastructure; adverse factors including climate, geographical and weather conditions and labour disputes; regulatory legislation and policies, including the fulfilment of contractual minimum work programs, the compliance with which may require significant expenditures and non-compliance with which may result in fines, penalties, production restrictions, suspensions or revocations of permits and contracts; changes to government’s policies, laws and interpretations thereof; and, obtaining comprehensive and appropriate insurance coverages at reasonable rates.” Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on NevGold’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of NevGold’s projects is no guarantee for mineralization on the properties from NevGold, and all of NevGold’s projects are exploration projects. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital, a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu Capital is to research and report on companies in which Zimtu Capital has an investment. So while the author of this report is not paid directly by NevGold Corp. (“NevGold“), the author’s employer Zimtu Capital will benefit from volume and appreciation of NevGold’s stock prices. The author currently does not own any equity of NevGold, but he holds an equity position in Zimtu Capital Corp., and thus will also benefit from volume and price appreciation of this stock. NevGold pays Zimtu Capital to provide this report and other services. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from NevGold, Tradingview, Stockwatch, and the public domain.