Sword of Damocles” (oil painting on canvas), 1812, by Richard Westall (1765-1836)

Introduction:

U.S. President Barack Obama recently in Japan:

“Competition (…) does not mean countries must prosper at the expense of other nations.”

“Competition (…) does not mean countries must prosper at the expense of other nations.”

U.S. President John F. Kennedy in 1961:

“The growth in foreign dollar holdings has placed upon the United Stated a special responsibility – that of maintaining the dollar as the principal reserve currency of the free world. This requires that the dollar be considered by many countries to be as good as gold. It is our responsibility to sustain this confidence.”

The French politician, economic & finance expert Jacques Rueff in 1972:

“It is that when a country with a key-currency runs a balance-of-payments deficit – that is to say, the United States, for example – it pays the creditor country dollars, which end up with the latter´s central bank. But the very same day, they are reloaned to the New York money market, so that they return to the place of origin. Thus the debtor country does not lose what the creditor country has gained. So the key-currency country never feels the effect of a deficit in its balance-of-payments. And the main consequence is that there is no reason whatever for the deficit to disappear, because it does not appear. Let me be more positive: If I had an agreement with my tailor that whatever money I pay him he returns to me the very same day as a loan, I would have no objection at all to ordering more suits from him and my own balance of payments would then be in deficit. Because of this situation, the United States could pay off its balance of payments deficit in paper dollars. (Â…) As the central banks received dollars, they used them immediately to buy U.S. Treasury Bills or certificates of deposit in New York banks, thus returning the dollars to their country of origin which thus recovered all the assets it had just paid out.”

Rueff warned that, if this system is continued for long, it would inevitably have 3 consequences:

“1) A permanent deficit would develop in the United States’ balance of payments whose overseas settlements would no longer automatically reduce the amount of credit available at home. (…) Thus the United States was in the privileged position of being able to buy, invest, loan or donate money in other countries without limit since its money markets would not feel any effects from this capital outflow. Having learned the secret of having a “deficit without tears”, it was only human for the United States to use that knowledge, thereby putting its balance of payments in a permanent state of deficit.

2) Inflation would develop in the surplus countries as they increased their own currencies on the basis of the increased dollar reserves held by their central banks.

3) The convertibility of the reserve currency, the dollar, would eventually be abolished owing to the gradual but unlimited accumulation of sight loans redeemable in the Unites States gold.” (Jacques Rueff: “The Monetary Sin of the West”; New York: Mac Millan, 1972)

Background:

According to the tales of Cicero, Damocles was a cheeky & snotty courtier that was strikingly warned & admonished about his own transience & volatileness by his king Dionysius.

At that time, King Dionysius was considered by his contemporary to be the luckiest man on earth – his pompous wealth was apparent to everyone as his immodest ways & lifestyles were not unobtrusive at all. In terms of opulent decadence, his court was not outperformed by anyone worldwide. Furthermore, the king loved to be gazed at & to hear praises offered onto him as his unsatisfiable ego inexorably hustled him into hiring flak-catchers & flatterers to compliment him day in & even day out – and Damocles was one of them.

After his hiring, Damocles was so much overwhelmed & seized by the grandiose magnificence & fulminant luxuriousness of the palace & the extravagance of the court of his ruler that he was not capable anymore to wish for anything else in his life but to live like a king – even if it was just for a day.

Upon hearing this, King Dionysius called & offered him as follows: “If you think I am so lucky, would you like to try out my life?” Damocles accepted with alacrity at the drop of a hat. And it was as sudden like a bolt out of the blue that he was bestowed the “exorbitant privilege” not only to see but to feel the world of his king.

King Dionysius ordered that Damocles be given the best of everything & be treated as he was the king. Damocles sat in a gold-alloyed couch eating from golden cutlery while inhaling the most exclusive perfumed incense burning around him, whereas the most awestruck & beautiful women were waiting for exceedingly kinky orders – if not solely to be able to schmooze & flatter him.

Amidst the light-hearted delightfulness & untroubled haughtiness, Damocles analogically sensed an outlandish sword hovering directly above him. Meanwhile, his astonishment instantly increased exponentially as he – despite his inebriation, frenzy & megalomania – spotted the sword solely hanging on a single (horse) hair which, when glanced at more precisely & gravely, was compliant to all rules & principles virtually screaming to break with the most distant wind not only killing but pushing him irrevocably & irrecoverably into the abyss without having the ghost of a chance & without any respect of his glamorous ego.

No single second or perceivable moment elapsed as Damocles lost any demand & appetite for this exorbitant privilege. He begged his king on his shivery & spongy kneecaps to be allowed to become an ordinary footman again & to immediately leave the function of being king. Dionysius agreed with the words “This is what life as ruler is really like!” putting a smile on the face of Damocles eagerly returning to his poorer, but safer life.

The legend of the DamoclesÂ’ Sword can be interpreted as follows in regards of the Dollar:

Although it seems enviable to wear the crown of power, even this privilege has a dark side namely that the carrier is constantly threatened by dangers. Dionysius made clear that one can not be happy over whom some fear always reigns:

The fear of the USA is (amongst others) that the rest of the world diagnoses that – in reality – the Dollar is (or shall be) not the king respectively the key-currency of the world – but solely a harebrained courtier & flatterer of the real king by the name of Gold. As soon as all those recognize that a sword dangles on a string above their dollar warehouses threatening to irrevocably annihilate its value, either the string automatically breaks immediately, or everyone fully loses the appetite not only to give someone a mouthful. Admittedly, everyone having taken a seat at the richly served table by the host USA the word & truth must arguably got around by now that such a sword not only hangs above their dollar inventory but as well their own (countrys’) head. However, the USA already anticipated the circumstance of all dinner guests knowing the truth serving them the following “trick” as per the Hollywood blockbuster “Speed”: as soon as you stop eating & chewing, the sword falls & immediately kills not only you but all of your dollars as well.

Hence, the fear of the USA is (above all) that someone at the table acts irrationally stopping to eat only to make the sword hit the Dollar not only making him a martyr but as well the (indirect) murderer of all the other guests at the table. The goal of the USA must be that all involved parties continue eating like a horse until they burst – thus, the problem/fear gets eliminated all by itself.

The value of the sword is not that it falls, but that it hangs threating to fall. Similarly, the military MAD-strategy (“Mutually Assured Destruction”) operates being also described as the “Equilibrium of Shock & Terror” dealing with the so-called “Nash-Equilibrium” – a central term of the (mathematical) theory of games according to which a strategic equilibrium is achieved in non-cooperative games as no single player gains an advantage. The military MAD-doctrine relies on that nobody is that irrational to hazard the consequences of being destroyed for the benefit of destroying the enemy. Thus, the fundamental idea is that the opponents resign on using nuclear weapons if the enemy (or its allies) still have the chance of striking back accordingly. The result is a stable peace, yet being full of suspense & nail-biting (with the latter being a first sign of irrational behavior).

„Uneasy rests the head that wears the crown“

Foreground:

Since the beginning of 2010, the U.S. Dollar virtually trades at a knifes’ edge. Since arriving at 74 index points, the decision is being made if a historic crash (“thrust to the downside”) or if a tremendous appreciation period (“thrust to the upside”) commences.

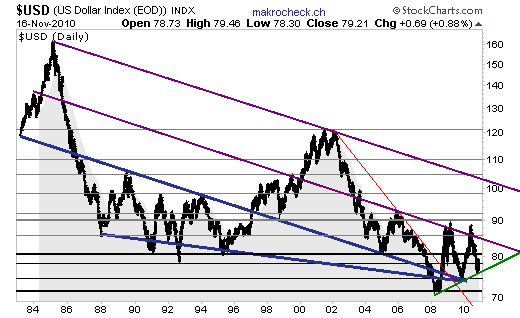

The Dollar index moves within a superior downward-trend since the beginning of the 1980s, whereas this movement was dominated by the downward-sloping (blue) triangle. In 1997, a breakout above the upper (blue) triangle-leg at approx. 92 points occurred rising to the 120-level until 2002. A protracted pullback to the (blue) triangle followed, whereas in 2008 (after a short breaching of the lower leg at approx. 74 points) another breakout to the 90-level was accomplished. However, the (violet) resistance at 88 points was not transformed into a support – hence, another pullback followed that went directly to the (blue) triangle-apex this time. Thereafter, the price began rising which action indicated a thrust to the upside having the goal to rise above the high of the breakout (approx. 120 points). However, the (violet) resistance at 86 points was not transformed into a support so that a pullback followed finding a hold at the (green) support recently. As this support is positioned above the price-level of the (blue) triangle-apex, a buy-signal was issued – sell-signal when breaching this (green) support, or when reaching the (black or violet) resistance at approx. 81 or 85 points, whereas a longer-term sell-signal à la thrust to the downside is generated only when breaching the price-level of the (blue) triangle-apex at approx. 74 points.

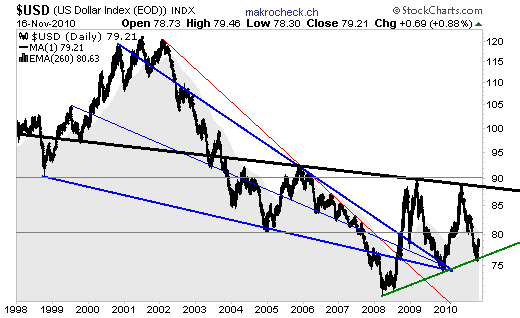

The close-up since 1998 shows that a buy-signal was issued at the (green) support recently (sell-signal when breaching it), as another rise to the (black) resistance at approx. 89 points became more probable (longer-term buy-signal when rising above it & as well above the grey horizontal-resistance at 90 points), whereas a first sell-signal is positioned at the (grey) horizontal-resistance at approx. 80.50 points (buy-signal when rising above it).

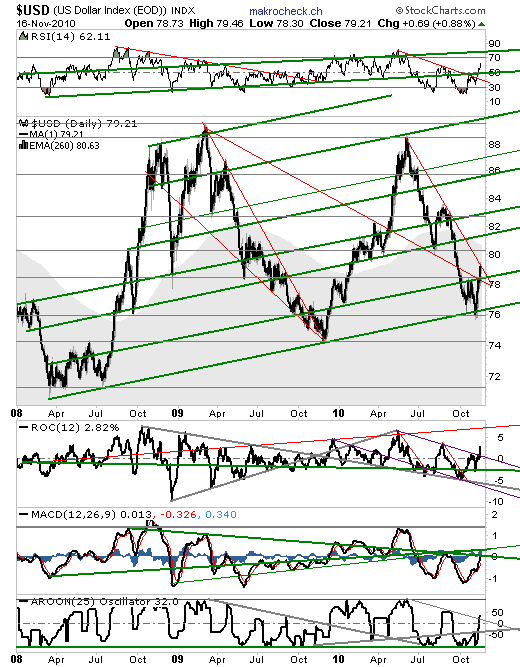

The close-up shows that the USD trades within a (green) upward-trend-channel since early 2008 whose lower (green) support at approx. 76 points was touched recently generating a buy-signal. As the price reached the (red) resistance at approx. 79.50 most recently, a sell-signal was issued – buy-signal when rising above it, or in case of a correction to the lower (green) trend-channel currently at approx. 76.50 points (longer-term sell-signal not until breaching this important support as an end of the upward-trend, that began in 2008, is expected then).

Indicators:

RSI: buy-signal since rising above the (red & green) resistance recently – next sell-signal when breaching the (green) support at 50 points, or when reaching the (grey or green) resistance at 70 or approx. 80 points.

ROC: buy-signal since rising above the (violet) resistance at 0% - sell-signal when breaching it, or when reaching the (red) resistance at approx. 7%.

MACD: buy-signal since both curves started to rise in early October 2010 – sell-signal as soon as both curves start to decrease which action can commence at the (green) resistances.

AROON: new buy-signal since rising above the (grey) resistance recently – sell-signal when breaching it, or when reaching the (red) resistance.