Ed. Note: This piece was originally submitted to Benchmark Mineral Intelligence in late August 2016 which may explain why some of the data is off. It was recently officially published in their magazine which is why I am now putting it on this site.

“Getting to profitability is the only way to build a sustainable business…”

-UBER CEO Travis Kalanick in response to UBER’s merger with Didi Chuxing

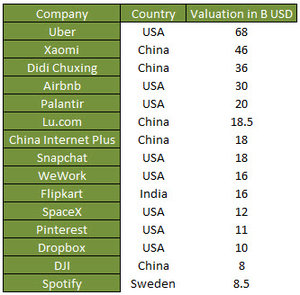

As convergence across industries continues apace and business models evolve, Mr. Kalanick’s statement above is a reminder to investors in early stage companies. As startups across various industries attain unicorn status – a valuation of at least USD $1 billion - the argument around growth at all costs versus profitability has become louder. There are over 170 unicorns in existence today, so the hunt for the “next big thing” is indeed on. With an abundance of cheap capital looking for yield, many investors appear to have set aside a preference for profitability in favor of parabolic growth. Here are the 20 largest unicorns (all privately held):

Given these valuations, is this preference for growth over profitability wise? How do you appropriately value a disruptive business model against traditional industries? This piece examines in greater detail how companies grow in this brave new world and which is an optimal investment strategy – pursuing growth or pursuing profitability.

There is a paradox in global commerce today where young companies (the primary job creators) are eschewing profitability in favor of gaining market share or scale. Uber is one such example, having lost approximately $1.2 billion USD in the first half of 2016 trying to gain market share in China. This is a company with an estimated $60 billion valuation. Any of the unicorns listed above would likely also follow the same model – hemorrhaging money in a bid to take market share from industry incumbents. While this model isn’t new, the lofty valuations for unproven business models are reminiscent of the dot com boom. That didn’t end well.

S&P 500 companies (ex-financials) had a cash balance of $1.45 trillion in 2015 according to FactSet which was the largest cash total in ten years. In many cases, this cash is sitting on the balance sheet and companies are issuing cheap debt to finance share buybacks or dividends in many cases. This is the new wealth creation paradigm in capital markets – invest in a unicorn and generate a high return but sacrifice liquidity or invest in an established company and generate returns through a “sit and wait” strategy of dividends and share buybacks. I would argue both strategies are unsustainable.

A NEW TECH PARADIGM TO THE RESCUE?

The reasons for this investing paradox are multiple but have a lot to do with the ubiquity of technology. The past decade has seen a technological shift unlike any the world has seen since perhaps the advent of the Industrial Revolution in the mid-Eighteenth Century. The ensuing technological age has increased the average citizen’s quality of life (QOL) exponentially.

In the New York Review of Books, Economist William Nordhaus stated:

“According to the economic historian Bradford DeLong, from the first rock tools used by humanoids three million years ago, to the earliest cities ten thousand years ago, through the Middle Ages, to the beginning of the Industrial Revolution around 1800, living standards doubled (with a growth of 0.00002 percent per year). Another doubling took place over the subsequent period to 1870. Then, according to standard calculations, the world economy took off.”

Mr. Nordhaus is discussing Robert Gordon’s recent tome titled “The Rise and Fall of American Growth: The US Standard of Living Since the Civil War”

Investors are betting that some of the en vogue technologies of today such as could computing, electric mobility, or renewable energy can deliver similar productivity gains to society and continue to make life “better” for the average citizen.

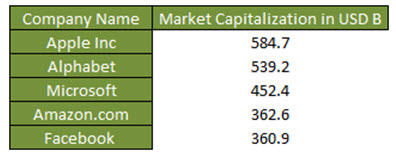

Looking at the largest companies in 2016 on the NASDAQ would indicate that market participants have placed their faith in technology companies to create wealth (and value) going forward:

Source: Bloomberg

50 years ago some of the largest companies included General Motors, Ford Motor Company, Exxon Mobil, General Electric, and Chrysler. Clearly, times have changed and while companies like General Motors still exist and successfully compete on the global automotive stage, investors are placing a premium on the dynamism and growth in the technology sector relative to others.

But where will the next Apple or Amazon.com come from? Furthermore, what is the optimal business model to look like? If history is our guide it’s likely to originate with two roommates in a dorm room with an idea and capability to scale quickly. With a mixture of cheap capital and ubiquitous technology it’s more likely than not that the largest companies in the world ten years from now will be a different list than the ones listed above complicating investment strategy somewhat.

Technology companies can grow quickly (in the case of Apple) making capital allocation decisions around growth versus profit challenging. The iPod/iPhone franchise became so successful that company management needed an activist investor in Carl Icahn to force the company to spend and attain a higher valuation. Given that iPhone sales are now on the decline, watching to see what Apple does to innovate through a build versus buy strategy will be telling for the future of the company.

BUILD OR BUY?

Growth can be organic (think iPhone introduction) or it can be bought. It would seem that the latter is more popular right now amidst industry shifts in the automotive sector in particular. There are an increasing number of companies in the automotive/tech sectors that are buying growth including:

· Samsung Electronics equity infusion in BYD for $450 million and talks to by Magneti Marelli from Fiat-Chrysler

· Ningbo ShanShan in talks to purchase a stake in Chilean lithium powerhouse SQM

· Total SA, an oil and gas super major, purchasing French battery maker SAFT for $1.1B USD

· Uber China merging with Didi Chuxing

· Delphi Automotive and Mobileye collaborating to develop a fully autonomous driving system

· General Motors investing $500M USD in ride sharing company Lyft

This is an admittedly short list, but the point is that established disparate businesses (automotive, natural resources, technology) have seen how their industries are being disrupted. A mix of new entrants and consumer choice and are forcing changes and these companies are responding through investment rather than total reinvention. Because of this, most unicorns will become acquisition targets of existing businesses – as long as they can demonstrate profitability.

GROWTH VERUS PROFITABILITY – KNOW WHEN TO SAY WHEN

It is entirely justifiable that startup companies shouldn’t be expected to generate cash flow early in their life cycles; however, as multiples grow and comparisons to mature companies become common, an expectation of “when” a company will be profitable is entirely justified. Exponential growth early in a company’s life cycle should lead to profitability which in theory is be plowed back into the business to innovate and drive further growth – a virtuous cycle. But how long should investors wait before demands for profitability outweigh those of exponential growth?

Perhaps no company today better personifies this debate between growth and profitability than Tesla.

Founded in 2003, the company has sold approximately 140,000 automobiles in its lifetime and is one of the few publicly traded companies that elicits strong opinions from both proponents and haters alike. The dichotomy of opinion likely has to do with the fact that while Tesla has built an incredible product in an electric vehicle, the financials behind this growth look less-than-promising to say the least.

Investors in Tesla must struggle with a fundamental question: Which is more important - building a product that consumers will pay a premium for (though is a money loser), or becoming self sustaining by generating ample free cash flow? Again, Mr. Kalanick’s words ring true. Tesla has returned 885% since its IPO in June 2010 while burning billions of dollars and leveraging subsidies and tax breaks to grow its business. That’s ok because Tesla is investing in its future through investment in capital intensive activities such as the Gigafactory. However, ultimately Tesla must become profitable on a top line, bottom line, and cash flow basis to be sustainable. Otherwise, when capital availability dries up, investors will run for the exits.

Tesla’s success has forced the automotive industry to “wake up” with every major OEM declaring their intentions to electrify their fleets in the coming five years. With dozens of automakers scaling up their own EV capabilities (reportedly 200 in China alone), how long will it be before Tesla’s lead in the EV space is eroded? Likely not long and that may be the reason behind the company’s proposed take out of Solar City – a strategically sensible, but financially foolhardy move - by Tesla management to diversify its business.

So is the company doomed, tied to the need for endless capital raises to survive? Or still in its growth phase and deserving of its $33 billion market capitalization? Value investors would say no it isn’t deserving, but they’ve missed out on triple digit returns.

CONCLUSION – AS YOGI BERRA SAID “THE FUTURE AINT WHAT IT USED TO BE.”

Ultimately, the debate between growth and profitability will be ongoing which makes it such a fascinating topic of discussion. This debate only grows in intensity and depth as established industries continue to clash and converge with new industries, creating new business models and a search for appropriate valuation metrics.

Ultimately, most of the unicorns in existence today will not survive for a host of reasons, but this entrepreneurial drive is what has pushed QOL higher throughout the world for centuries. Despite worries over Tesla’s financial sustainability and its inflated valuation, the company ought to be applauded for forcing other industries (automotive, technology, etc) to rethink their existing business models and evolve as new markets are created.

The “churn” we are seeing across industries the automotive, tech, and raw materials sectors is a good thing as it means companies are intent on investing in new markets and driving returns in a low interest rate environment. The fact that many of these companies have large market caps and a history of profitability is positive in that it implies innovation, even though it may be incremental rather than transformative.

High growth rates early in a company’s life cycle are important to capture market share, but this market share won’t be maintained or grow without profits to drive back into the business. Profit (and by extension cash) drives a business’ long term viability.

Any self-sustaining company should be able to generate a return for its investors above the cost of capital and in so doing, generate wage growth, enhancing the overall productive capacity of an economy. This tech convergence is hugely bullish for mankind, but it’s not so clear for investors.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

DISCLAIMER AND INFORMATION ON FORWARD LOOKING STATEMENTS

The material herein is for informational purposes only and is not intended to, and does not constitute, the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this report is provided solely for users’ general knowledge and is provided “as is”. We make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this research report or otherwise relating to such materials or on any websites linked to this report.

The content in this report is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. Chris Berry owns no shares in any of the companies mentioned in this report.

All statements in this research report, other than statements of historical fact should be considered forward-looking statements. Some of the statements contained herein, may be forward-looking information. Words such as “may”, “will”, “should”, “could”, “anticipate”, “believe”, “expect”, “intend”, “plan”, “potential”, “continue” and similar expressions have been used to identify the forward-looking information. These statements reflect our current beliefs and are based on information currently available. Forward-looking information involves significant risks and uncertainties, certain of which are beyond our control. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking information including, but not limited to, changes in general economic and market conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, exclusivity and ownership rights of exploration permits, dependence on regulatory approvals, the uncertainty of obtaining additional financing, environmental risks and hazards, exploration, development and operating risks and other risk factors. Although the forward-looking information contained herein is based upon what we believe to be reasonable assumptions, we cannot assure that actual results will be consistent with this forward-looking information. Investors should not place undue reliance on forward-looking information. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances, except as required by securities laws. These statements relate to future events or future performance. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. For a more detailed disclaimer, please click here.