Image: Sean Pavone

By Chris Berry (@cberry1)

As I’ve discussed before, all commodities are cyclical and the Energy Metals are no exception. Anecdotal evidence suggests that battery grade lithium pricing remains healthy in the $14,000/t USD range even as lithium share price returns have moderated from their triple digit returns in 2016. Despite this, lithium shares continue to post impressive gains. Year to date in 2017, an equally weighted basket of lithium names I track has returned 45.1%. This is compared to a return of 5.98% for the SPX, 2.42% for the TSX, and 4.07% for the ASX.

Here are the year-to-date returns for select lithium names sorted by USD market cap (minimum 30M):

Albemarle’s (ALB:NYSE) demand forecast revision to 35,000 tpy LCE to 2021 (up from 20,000 tpy to 2020) coupled with SQM’s (SQM:NYSE) plan to generate $1B in EBITDA by 2020 (up from $200M per quarter today) has only re-affirmed what many of us have believed for some time: the demand story is “real” and defensible.

Nemaska Lithium’s (NMX:TSX) positive results with high grade concentrate production only bolster the case that the company ought to be in line for the next sizeable lithium financing.

Lithium Americas’ (LAC:TSX) positive feasibility study results at their 50% owned Cauchari-Olaroz salar in Argentina re-affirmed strong project economics:

The numbers in any sort of an economic study can and will change, but I highlight the operating cost as this is the key to competing and winning in the lithium game – lowest cost of production.

LAC’s success has also kept eyeballs focused on Argentina as a growing presence in lithium production relative to neighboring Chile.

Barring some “fat tail” technological leap in battery technology, the risks to growth remain squarely on the supply side and a major question now is whether or not adequate investment is being made to meet these demand forecasts.

The answer appears to be no. Year-to-date in 2017 roughly $445 M USD has been raised for lithium projects and expansion globally. If you use ALB’s demand forecasts to 2021 as a base case, this would require almost the equivalent of two new lithium mines per year. With a rough cap ex estimate of $425 M USD to build a lithium project and bring it into production, clearly nowhere near enough capital is being devoted to lithium development.

This leaves the majors such as ALB, SQM, FMC (FMC:NYSE), Jianxi Ganfeng Lithium (002460:SHE) to carry the load and meet the demand forecasts in the near term. Watching how these companies employ a “build or buy” strategy to expand lithium capacity will be interesting. Any lag here or underinvestment in the lithium developer space could be the Achilles’ heel for the proliferation of electric vehicle and energy storage technologies. I still maintain that a structural lithium shortage is not the main issue, but the real pinch is in the processing capacity and knowledge. This is the area to watch.

Other risks are varied and include:

-- A general rise in interest rates making money more expensive

-- Any change in EV subsidy regimes (can battery prices fall fast enough to mitigate the elimination of EV subsidies?

-- The realization that lithium brine construction and production is very specific leading to unique difficulties with each project (this is still enormously underappreciated by investors based on my research)

-- Capital availability for mining projects in general (especially for niche metals like lithium and cobalt)

-- Technological change destroying demand for raw materials like lithium (this innovation could also create demand, however)

-- A lack of capital spending discipline (typically happens when commodity prices are on the rise or talk of a “new paradigm” surfaces)

-- A rush to get to production to catch the current wave of pricing momentum

As I’ve said in previous notes, none of these risks are binary and your analysis must have a probability attached to each. My sense is that the biggest risks are capital allocation and the rush to get into production too soon. As we saw with Orocobre (ORE:ASX), that rush has remained problematic for the company as it continues to ramp production.

Perhaps the biggest risk, though, involves investor psychology. We can have a healthy debate around where the lithium or cobalt cycles are currently, but admitting and managing biases is crucial. One such bias that I see as pervasive in the Energy Metals space is confirmation bias where new evidence tends to confirm an existing belief and outweighs other evidence.

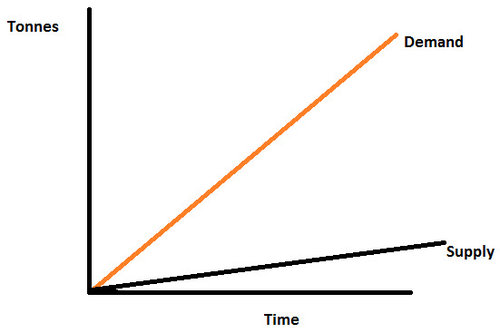

In short, many believe the lithium or cobalt supply and demand curves will look like this over time:

This belief was pervasive with uranium in 2007, with rare earths in 2011, and graphite in 2012. But reality is much messier and looks something like this:

The real money is made at specific points on this chart.

Make no mistake; the bullish thesis for lithium is still intact and “the train keeps a rollin’” to paraphrase the Aerosmith song. The general underinvestment in the sector implies relative lithium pricing strength and should allow for another round of project financing (NMX, PLS, AJM, etc). Cobalt pricing should remain healthy as well to 2018 though the risks are different thanks mainly to market structure.

As this cycle evolves, so do the risks and remembering that is likely the optimal approach for an investment strategy here going forward.

Chris Berry

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry (@cberry1) is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. I own no shares in any companies mentioned in this note. I have been granted options by Millennial Lithium and am an advisor to the company. I have no relationships with any other companies mentioned.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect.