Full size / Thumbs up for Saville Resources‘ President, Mike Hodge, and his hands-on organization of a successful winter drill program at the Niobium Claim Group Property in Québec, pulling out better than expected drill core enriched with niobium over long intercepts near surface. (Photo courtesy of Saville Resources Inc.)

Today, Saville Resources Corp. is making headlines again as the company announced “the most well-mineralized niobium drill hole completed to date at the Mallard Prospect within its Niobium Claim Group Property“ in Québec, Canada.

Assays for drill hole EC19-174A have returned “the strongest and widest mineralized intervals of niobium to date on the Property“, as Saville pointed out. “Starting from only 17 m depth (core length), results include 0.80% Nb2O5 over 31.5 m, including 0.98% Nb2O5 over 13.5 m or 1.36% Nb2O5 over 4.5 m, as well as a second sub-interval of 1.04% Nb2O5% over 7.7 m. This near-surface mineralization is followed by a second well-mineralized interval, starting from 96.5 m depth (core length), which assays 0.79% Nb2O5 over 37.0 m, including 1.01% Nb2O5 over 7.5 m, as well as a third mineralized horizon assaying 0.67% Nb2O5 over 20.0 m. A total of eleven (11) individual samples from EC19-174A returned >1% Nb2O5 with a peak sample of 1.68% Nb2O5 over 1.5 m.“

Saville‘s President, Mike Hodge, commented in today‘s news-release: “We are absolutely thrilled with the results of our maiden drill program at Mallard. Not only was the first hole of the program better than all the niobium holes completed historically, it was further surpassed by the last hole of the program (EC19-174A), which is the most well-mineralized niobium drill hole to date on the Property. As such, the potential at Mallard has increased considerably as a result of our drilling this past winter, and we are very excited for Phase II as we continue to delineate the mineralized body.“

Full size / Saville‘s President, Mike Hodge, positioning drill casings for the company‘s maiden drilling program at the Mallard Target within the Niobium Claim Group Property. (Photo courtesy of Saville Resources Inc.)

The United States remains 100% import-reliant for niobium. The US Department of Defense considers ferroniobium as such a strategic and critical material that it purchases and stores FeNb in the National Defense Stockpile. For almost 50 years now, only 3 primary niobium mines are responsible for global niobium supply, all of which have Chinese companies being involved as stakeholders.

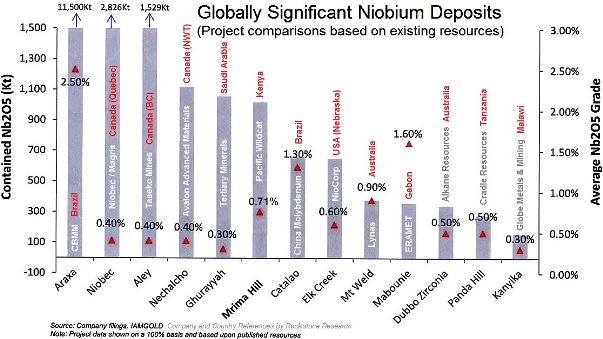

As the Niobec Mine in Québec is the only major niobium producer in North America, with grades averaging 0.42% Nb2O5 (probable reserves), the benchmark for Saville is clear.

As announced today by Saville, the entire hole EC19-174A returned “0.48% NB2O5 over 265 m“. What makes this discovery even more impressive is that mineralization starts near surface (from 4.97 m to 270 m core length).

Last week‘s announced hole EC19-171 assayed “0.51% Nb2O5 over 175.9 m“ (from 6.23 m to 182.16 m core length), whereas hole EC19-172 was announced to have assayed “0.40% Nb2O5 over 237.25 m“ (from 2.75 m to 240 m).

Full size / See Saville‘s June 11, 2019 News Release for Qualified Person’s review of technical information.

Lets also compare to the highest grade undeveloped niobium deposit in North America – the only primary niobium deposit known to be currently under development in the United States: The Elk Creek Carbonatite Project in Nebraska, owned by NioCorp Developments Ltd. (TSX: NB; current market capitalization: $136 million CAD).

In June 2014, NioCorp announced initial results from the first phase drilling program: 0.68% NB2O5 over 73 m. Note that this high-grade interval was drilled after 309 m of core length.

Saville today announced “0.80% Nb2O5 over 31.5 m“ starting from only 17 m depth (core length), thus being much closer to surface than Elk Creek.

In December 2014, NioCorp announced 0.95% Nb2O5 over 276 m (from 638 m to 914 m core length) and 0.85% Nb2O5 over 716 m (from 197 m to 913 m). Without doubt, these are impressive grades over very long intervals, however these occur at significant depth (total CAPEX for an underground mining operation: $879 million USD).

Essentially, Saville has only scratched the surface with its initial drill program of 1,049 m completed over 5 holes (210 m on average per hole) at the Mallard Target within its Niobium Claim Group Property. Several other drill-ready targets exist on the property. Moreover, niobium grades appear to increase even more at depth as Saville pointed out:

• “hole EC19-172 bottomed in mineralization at a depth of 240.0 m (core length) with the final sample assaying 0.78% Nb2O5 over 1.5 m.“

• hole EC19-171 “effectively bottomed in mineralization with two of the last four samples assaying >0.90% Nb2O5.“

Bottom Line

Certainly, it would be interesting to see deep drilling in the future at the Mallard Target within Saville‘s Niobium Claim Group Property as grades and widths at deeper levels could potentially be similar to the Elk Creek Deposit.

However, Saville does not really need to undertake such a costly deep drilling endeavour at this stage as the company has now successfully confirmed high-grade niobium mineralization near surface continuing to depths of around 200 m (core length).

According to today‘s news-release:

“To date, preliminary interpretation of the drill data indicates the Mallard Prospect is characterized by a series of sub-parallel, elongate, moderate-steep dipping, northwest trending mineralized horizons that extend from surface and remain open in all directions. These higher-grade mineralized horizons are separated by comparable horizons of moderate to low grade niobium mineralization. Given the elongate nature of the mineralized horizons, as well as their moderate-steep dip, the mineralized horizons encountered at depth in each hole have a reasonable potential to continue up-dip, and potentially to surface, and therefore, could be intersected at a shallower depth by stepping the drill forward. In addition, strong grades of tantalum and phosphate continue to be returned in association with the niobium with a zonation between all three evident. Additional mineralogical work is planned as part of Phase II to advance the understanding of the mineral relationships across the mineralized horizons...

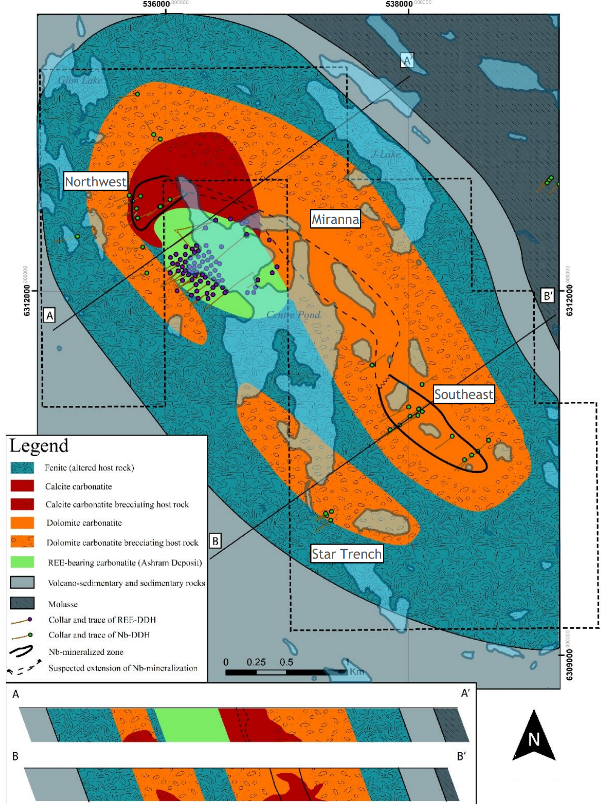

Coupled with the strong mineralization returned historically, the Company‘s Phase I drill program at Mallard will provide the foundation for advancement towards an initial mineral resource estimate. Further drilling at Mallard as well as several other high-priority targets, including Miranna, is planned as part of Phase II.“

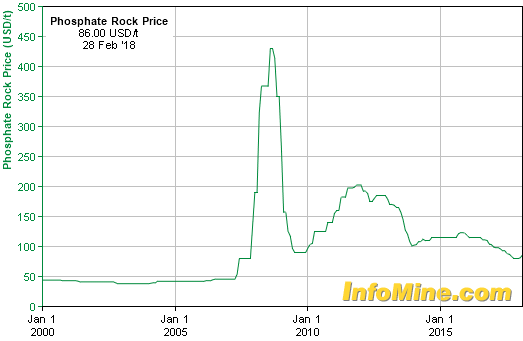

The phosphate grades reported thus far are also highly encouraging:

• 6.6% P2O5 over 175.93 m with a peak of 9.1% P2O5 over 26 m (EC19-171)

• 6.0% P2O5 over 237.25 m with a peak of 11.6% P2O5 over 1.5 m (EC19-172)

• 6.1% P2O5 over 265.03 m with a peak of 12.3% P2O5 over 4.5 m (EC19-174A)

The Catalao Mine in Brazil (owned by China Molybdenum) not only produces niobium but also phosphate as a highly profitable by-product, providing “strategically important diversification benefits“ as the phosphate sector has “attractive long-term fundamentals and positive outlook“ due to its use as fertilizer in the agricultural industry. Catalao‘s ore reserves average 12.5% P2O5, with resource grades between 8.2% and 11.8% P2O5.

Full size / The above figure shows the Eldor Carbonatite, which includes Saville‘s Niobium Claim Group Property (black-dotted; currently under Earn-In Agreement from Commerce Resources Corp. for up to a 75% interest) surrounding the Ashram REE Deposit (highlighted in green; 100% owned by Commerce Resources Corp.; TSX.V: CCE). Saville has renamed the Southeast Area as Mallard Target, where the company‘s maiden drill program (Phase-1) took place, with results announced last week and today. Several other targets exist on Saville‘s property, such as Miranna, Northwest and Star Trench, whereas Saville plans to continue drilling Mallard and other targets in Phase-2. Miranna is a high-priority and drill-ready target, where prior boulder sampling in the area showed “5.93% Nb2O5 and 1,220 ppm Ta2O5“ with phosphate present. (Source)

The above cross-section (Simandl & Mackay, 2014) of Québec‘s Saint-Honoré Carbonatite, which hosts the producing Niobec Mine, illustrates that the general geology is similar to the Eldor Carbonatite, which hosts the high-tonnage Ashram REE Deposit and the adjoining Niobium Claim Group Property. Also note that the Saint-Honoré Carbonatite not only hosts the Niobec Mine but also a large REE Zone of more than 450 million tonnes at a grade of 1.65% TREO. In other words: It was the niobium deposit which went into production first, although the core of the carbonatite consists of REE mineralization. Who sees a striking resemblance with the Eldor Carbonatite?

Only 3 Primary Niobium Mines Globally

Saville‘s niobium project is also attractive thanks to mineralization identified to date indicating a carbonatite host rock, which is also the dominant niobium source globally, making cost-effective conventional processing possible.

Moreover, note that all 3 primary niobium mines currently in production globally have Chinese stakeholders and that an escalating trade war with China may impact niobium supply to the United States.

With only 3 primary niobium mines currently in production worldwide, the time appears ripe for new supply, especially on the North American continent as the United States is still 100% import-reliant for niobium while having classified this superalloy metal as critical for its economic and national security (used e.g. in military aircraft engines, rockets, gas turbines, superconducting magnets)

Niobec (Québec, Canada)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.35-0.44% Nb2O5

• Owners (purchased from IAMGOLD Corp. for $530 million USD in 2014): Magris Resources Inc., CEF Holdings Ltd. (a Hong Kong based investment company owned 50% by the Chinese conglomerate CK Hutchison Holdings Ltd. from Hong Kong) and Temasek Holdings Ltd. (an investment company owned by the Government of Singapore)

Catalao (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.87-1.48% Nb2O5

• Owner (purchased from Anglo American PLC for $1.5 billion USD in 2016): China Molybdenum Co. Ltd.

Araxa (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~85%

• Average grade: 1.6-2.48% Nb2O5 (but with a low recovery of ~50%)

• Owners: CBMM as well as Chinese, Japanese and Korean consortiums

CBMM (Companhia Brasileira de Metalurgia e Mineração) is a private company founded in 1955. Since 1965, CBMM is controlled by the Moreira Salles family who became one of Brazil’s wealthiest families primarily thanks to its successful bet on niobium. Between 2006-2008, CBMM doubled the price of ferroniobium to address the strong demand growth that was, according to CBMM, not priced in correctly. As niobium prices remained somewhat flat over the last decade, CBMM may increase prices again to better reflect heightened demand.

According to Roskill (February 2018): “Niobium prices are historically very stable. They moved little in the period up to about 2006, when a producer-driven doubling in prices began, and have remained stable at the higher benchmark. Ferroniobium prices, in particular, are fairly demand-inelastic, with the 2009 slump in demand from the global steel industry having only minimal impact on pricing. The outlook for prices is one of gentle but steady increase... Almost all ferroniobium supply is from three industrialised producers, two in Brazil and one in Canada, and is derived from the mineral pyrochlore. Little, if any, pyrochlore enters international trade as it is converted into ferroniobium and other products before export... Niobium pentoxide (Nb2O5) is the starting product for most specialised non-steel applications.“

According to Roskill (February 2018): “Tantalum is a small industry and has historically been susceptible to rapid changes in market balance with volatile price movements. A production outage at just one operation can have a major effect, as can unforeseen upticks in downstream demand that catch processors off-guard and holding little inventory. A combination of such events in 2017 saw tantalum concentrate prices jump from little more than US$50/lb Ta2O5 at the start of the year to nearly US$90/lb Ta2O5 by year-end. Prices remain over US$100/lb Ta2O5 in mid-2018 although the sharp increases appear to have stopped. The impending surge of lithium by-product material is expected to have a moderating effect on future prices, though other factors may cause uncertainty...“

Full size / Source: “Critical Mineral Resources of the United States“ (USGS, 2017)

Niobium Usage Full size

Full size

Niobium: A Critical and Strategic Metal

The US Department of Defence has declared niobium as one of its top “strategic” metals as it is not mined domestically, is a matter of national security and is important to the nation’s economy. The US government maintains a stockpile of niobium at all times and according to the USGS, the DLA Strategic Materials plans to acquire more niobium to address the current shortfall. The US imports all of its niobium from Brazil (83%), Canada (12%) and others (5%). According to Reuters in December 2017:

"The United States needs to encourage domestic production of a handful of minerals critical for the technology and defense industries, and stem reliance on China, U.S. Interior Secretary Ryan Zinke said on Tuesday. Zinke made the remarks at the Interior Department as he unveiled a report by the U.S. Geological Survey (USGS), which detailed the extent to which the United States is dependent upon foreign competitors for its supply of certain minerals. The report identified 23 out of 88 minerals that are priorities for U.S. national defense and the economy because they are components in products ranging from batteries to military equipment. The report found that the United States was 100 percent net import reliant on 20 mineral commodities in 2016, including manganese, niobium, tantalum and others. In 1954, the U.S. was 100 percent import reliant for the supply of just eight nonfuel mineral commodities.

“We have the minerals here and likely we have enough to provide our needs and be a world trader in them, but we have to go forward and identify where they are at,” Zinke told reporters at an Interior Department briefing... Zinke said the report is likely to shape Interior Department policy-making in 2018, as the agency looks to carry out its “Energy Dominance” strategy, expanding mining and resource extraction on federal lands... It does not offer policy recommendations, but Zinke will rely on the findings as he prioritizes research into certain mineral deposit areas on federal land and plans policies to promote mining. “We do expect that to lead to policy changes. The USGS is not involved in policy, but I suspect you will see some policy changes,” said Larry Meinert, deputy associate director for energy and mineral resources at the USGS. The lead author of the report was Klaus Schultz, a geologist at the USGS.“

The USGS study “Critical Mineral Resources of the United States“ details 23 commodities deemed critical due to their possibility of supply disruption with serious consequences. See the niobium chapter here. (Source: “Critical Attention: The U.S. embarks on a national strategy of greater self-reliance for critical minerals“)

Full size / / Saville‘s President, Mike Hodge, inspecting core from the company‘s winter drill program, which was completed in late April 2019 and returned highly promising niobium, tantalum and phosphate assays as announced today and last week. (Photo courtesy of Saville Resources Inc.)

Company Details

Saville Resources Inc.

#1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: mhodge@savilleres.com

www.savilleres.com

Shares Issued & Outstanding: 63,415,400

Canadian Symbol (TSX.V): SRE

Current Price: $0.04 CAD (06/10/2019)

Market Capitalization: $2.5 Million CAD

German Symbol / WKN (Frankfurt): S0J / A2DY3Z

Current Price: €0.021 EUR (06/11/2019)

Market Capitalization: €1.3 Million EUR

Previous Coverage

Report #8: “On A Winning Streak In The Midst Of Trade Wars: Saville Drills High-Grade Niobium In Quebec“

Report #7: “Saville to start drilling for a niobium discovery in Quebec“

Report #6: “Saville Discovers High-Grade Niobium-Tantalum Boulders, And Possibly The Source, Ahead Of Drilling“

Report #5: “Strong potential for discovery of niobium-tantalum deposit(s) of significance, says independent report filed today“

Report #4: “Saville Releases High-Grade Assays from the Niobium Claim Group“

Report #3: “Eager to Start the Treasure Hunt for Niobium in Quebec“

Report #2: “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #1: “Saville Resources Getting Ready to Create Shareholder Value“

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Saville Resources Inc.´s and Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Saville Resources Inc.´s and Commerce Resources Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp., and is being paid a monthly retainer from Zimtu Capital Corp., which company also holds a long position in Saville Resources Inc. and Commerce Resources Corp. Saville Resources Inc. has paid Zimtu Capital Corp. to provide this report and other investor awareness services. Zimtu Capital Corp. is an insider and control block of Saville Resources Inc. by virtue of owning more than 20% of Saville Resources’ outstanding stock.