The gold market has entered uncharted territory. With spot prices surging past $3,750 per ounce, gold has decisively broken out of its long-term trading channel and is now heading toward the psychological $4,000 mark, and possibly much higher.

For investors, miners, and the exploration sector, this moment marks more than just a price milestone – it signals a structural shift in the economics of gold.

Full size / Source / Gold price in USD/oz over the last 12 months (since September 25, 2024).

Over the past 12 months, the gold price has surged by 95%, with its most powerful advances consistently emerging after extended periods of sideways consolidation beneath key resistance levels (marked in white). Each breakout from these consolidations has unleashed sharp upward momentum. The strongest rally so far occurred at the start of 2025, when gold climbed from around $2,700 to $3,500 in just 5 months. The most recent consolidation – lasting from April to August 2025 – was also the longest, and its breakout has now propelled gold into fresh record territory above $3,750.

Full size / Source / Gold price in USD/oz over the last 10 years.

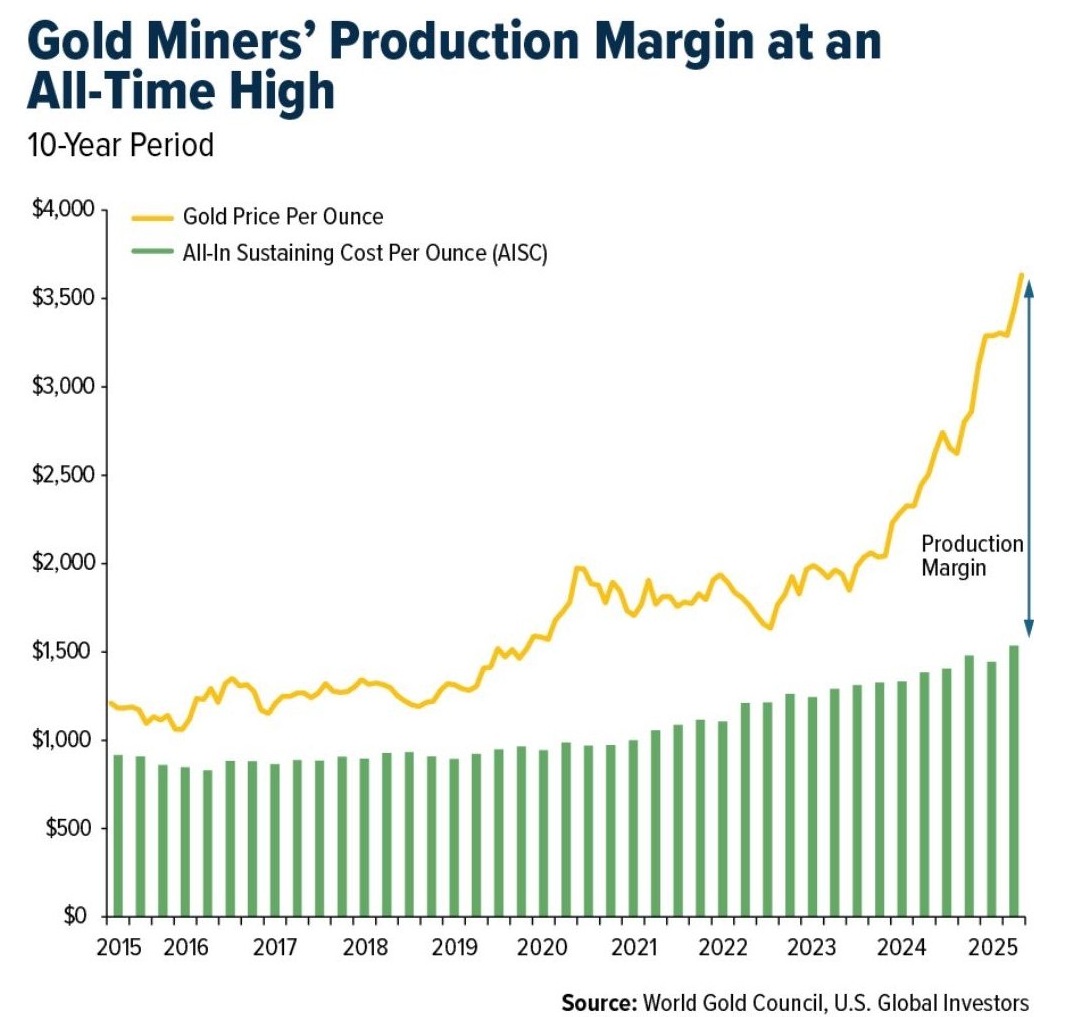

Full size / The chart shows that gold miners’ production margins are at all-time highs. While AISC (All-In Sustaining Cost; green bars) has inched up only gradually over the past decade, gold prices (yellow line) have surged to record levels above $3,500 USD/oz in 2025. The widening gap between production costs and market price highlights the strongest profitability the sector has ever seen, underscoring miners’ powerful leverage to rising gold.

With margins at record levels, majors are well-positioned to pursue M&A, acquiring defined ounces in the ground across stable jurisdictions. This not only secures future production pipelines but also allows them to replace depleting reserves, strengthen balance sheets, and capitalize on favorable market sentiment.

For investors, it points to an impending wave of M&A, where quality exploration and development assets are likely to emerge as prime takeover targets.

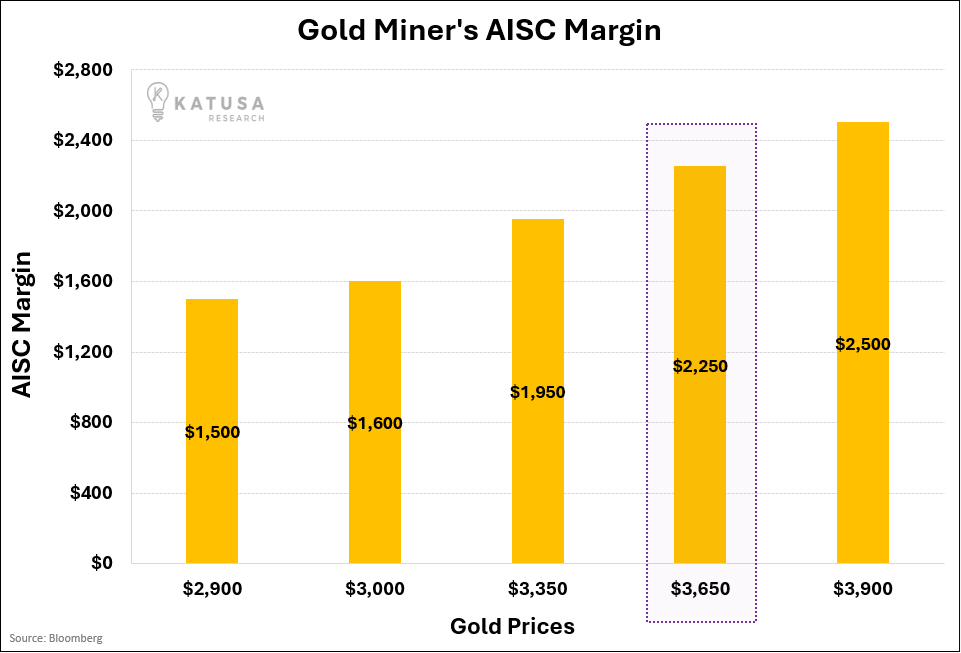

Full size / “This is what operational leverage looks like. Gold miners are literally printing money: ️ Gold at $2,900 = $1,500 profit per oz Gold at $3,650 = $2,250 profit per oz Their margins just went up 50% while gold rose 26%.“ (Katusa Research on X.com on September 14, 2025)

Miners’ margins expand ~1.5-2× faster than the gold price. Above chart highlights how AISC margins surge with rising gold, showcasing miners’ powerful operating leverage. A 10% increase in gold delivers about a 16% lift in margins. At lower prices, margins can nearly double the pace of gold gains, while at higher levels the effect remains strong, though somewhat moderated.

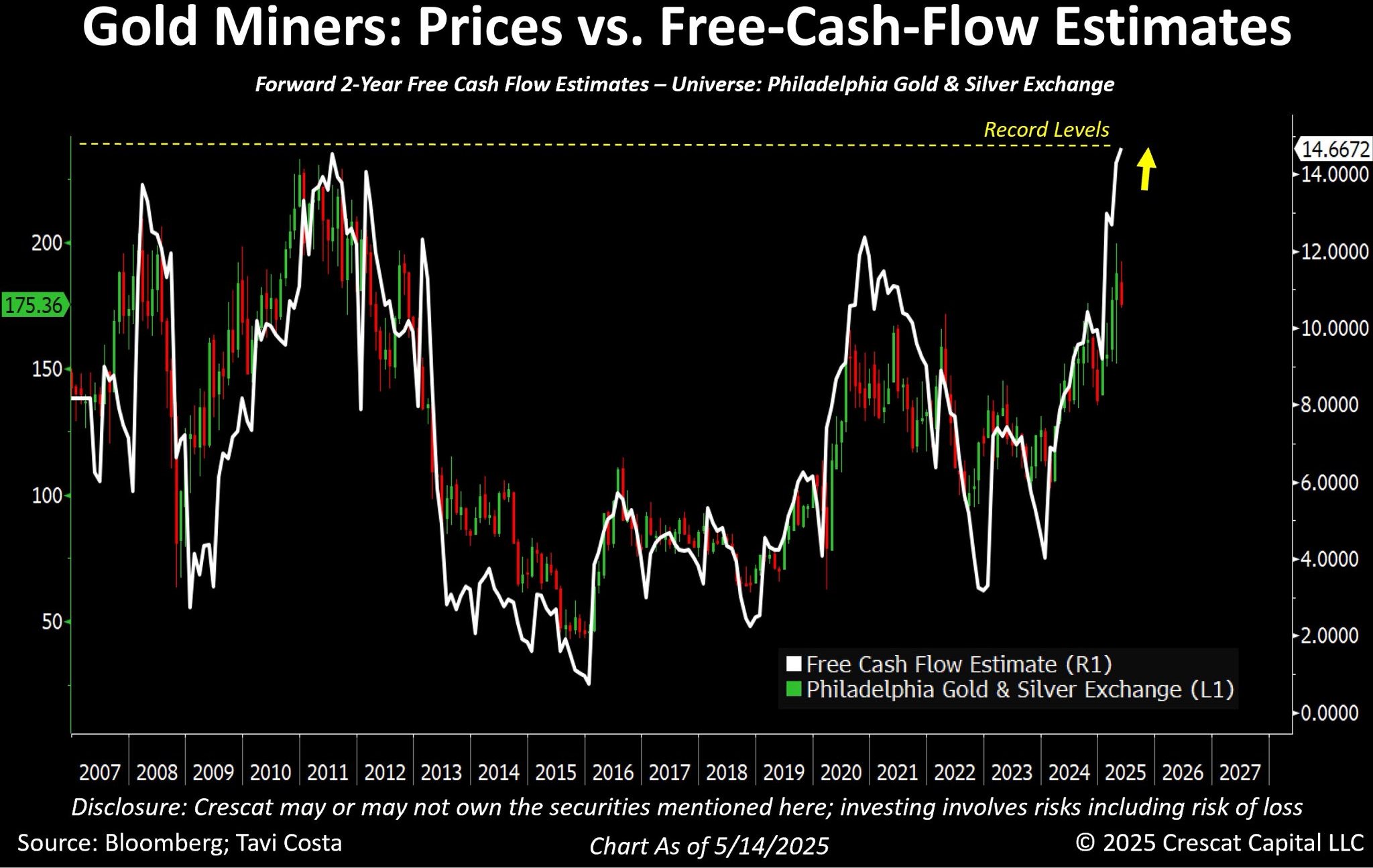

Full size / “Very impressive comeback in mining stocks today. We are likely entering the Golden Age of Mining. Cash flow estimate for 2026 is now approaching historic highs. This metric that has historically maintained a strong correlation with equity performance in the mining sector. Notice that miners remain 50% from their prior highs. Too large of a catch-up opportunity to ignore in my view.“ (Tavi Costa on X.com on May 15, 2025)

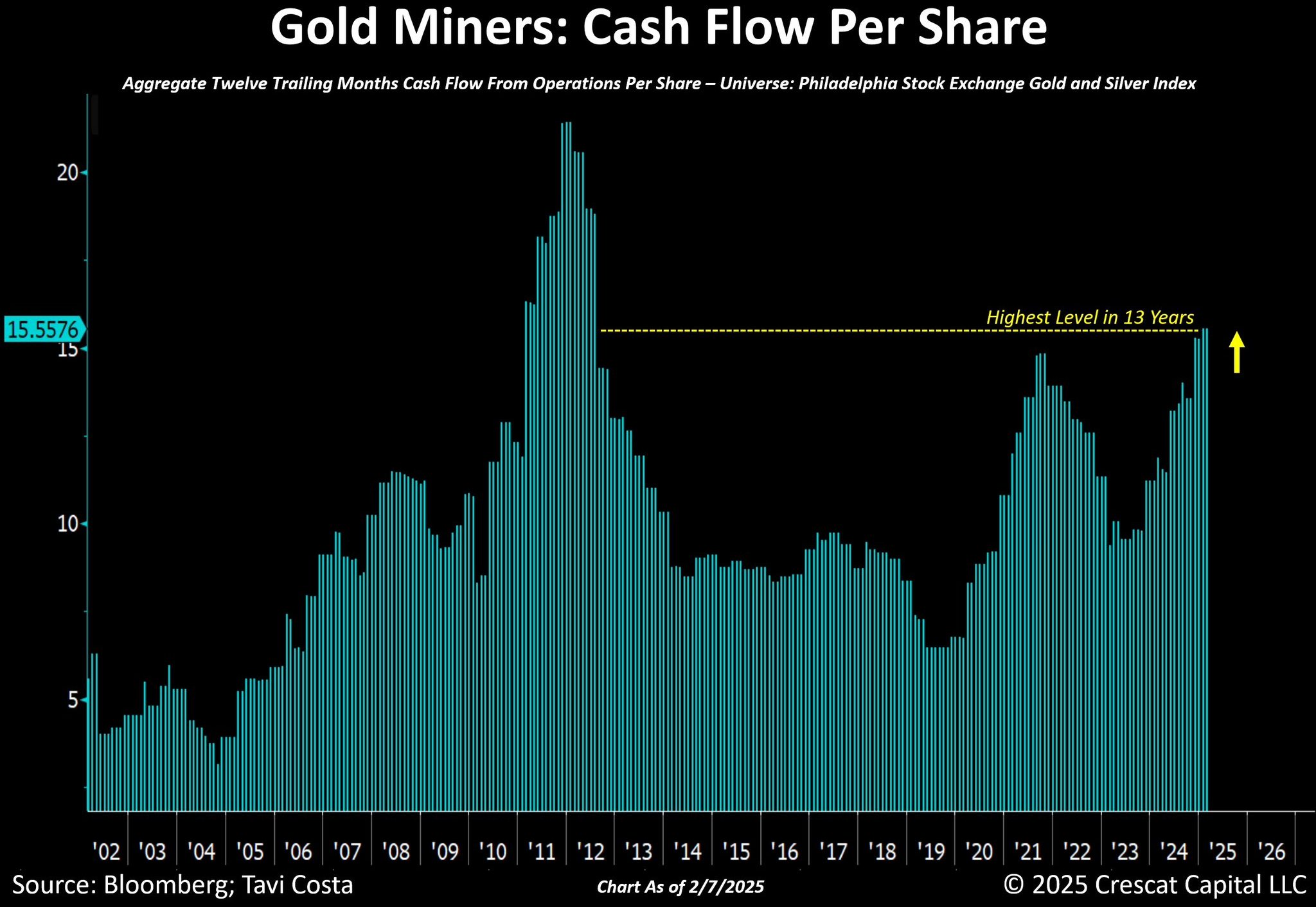

Data from earlier this year on gold miners’ cash flow metrics reveals a sector undergoing a powerful financial transformation. As shown in above chart from mid-May, the trend is clear: Aggregate trailing 12-month cash flow from operations per share for the Philadelphia Stock Exchange Gold and Silver Index has surged to levels not seen since 2012, reflecting a step-change in profitability.

Referring to below chart from February 9, Costa draws a compelling parallel to the energy sector’s turnaround, where years of investor skepticism gave way to record profits and efficiency gains. He suggests that mining is now entering a similar phase – one in which leaner cost structures, disciplined capital allocation, and elevated gold prices combine to deliver sustained free cash flow. The top chart reinforces this bullish view, comparing gold miner share prices to forward two-year free cash flow estimates. This divergence – record or near-record cash flow potential alongside equity prices still deeply discounted from previous peaks – points to a powerful re-rating opportunity.

Full size / “After another pivotal week for gold, it‘s worth emphasizing that mining companies are also undergoing significant fundamental improvements. Cash flow per share is rising rapidly, now reaching its highest level in 13 years. This trend in the mining sector bears a resemblance to what happened in the energy industry – where skepticism persisted for years, with many investors losing faith in its profitability. Of course, that was precisely the wrong time to hold such a view, as energy companies went on to become highly profitable and efficient. A similar transformation now appears to be unfolding in the mining sector.“ (Tavi Costa on X.com on February 9, 2025)

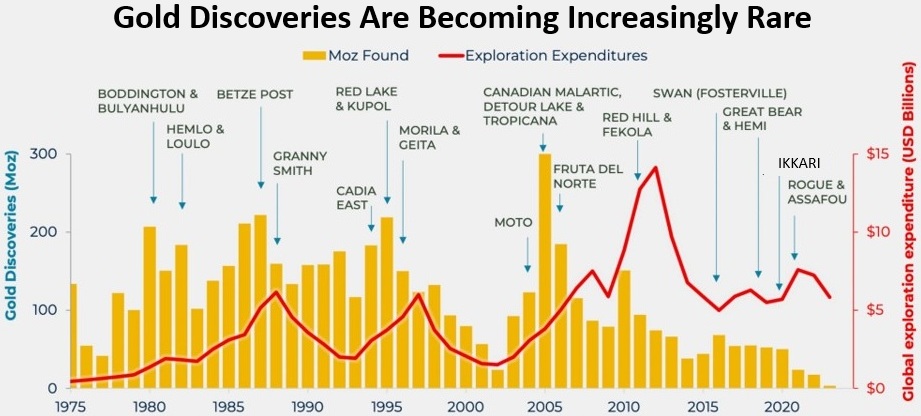

Full size / The New Gold Halving: Since 2005, the amount of gold discovered declined by 50% every 5 years. “We are running out of new gold discoveries.“ (Willem Middelkoop on X.com on February 19, 2025)

The era of easily discovered, near-surface deposits is over. Today, exploration oftentimes requires deeper drilling, riskier jurisdictions, and higher upfront capital.

This scarcity of new discoveries means that the ounces already defined in the ground are becoming exponentially more valuable, especially in stable and mining-friendly jurisdictions.

It also sets the stage for an accelerated wave of M&A. With margins at record highs and balance sheets flush with cash, major producers are incentivized to acquire high-quality development projects rather than attempt risky and costly greenfield exploration themselves.

This Time Is Different

Previous gold bull markets were often short-lived, driven by cyclical macro shocks. Today, the drivers appear far more structural:

• Global debt levels are at unprecedented highs.

• Central banks are accumulating gold at the fastest pace in decades.

• Inflationary pressures remain sticky even after aggressive rate hikes.

• Geopolitical tensions are reinforcing gold’s safe-haven status.

Combined with supply constraints and record margins, this backdrop suggests that the sector is in the early innings of a sustained bull cycle.

Investor Take-Away

Gold at $3,800 is not just a headline – it represents the foundation of a new era for the mining industry. Cash flows are at record highs, margins are at all-time peaks, and new discoveries are increasingly scarce. For investors, this means 2 things:

1) Producers will continue to generate windfall profits and return capital to shareholders.

2) Explorers and developers with quality ounces in the ground – particularly in stable jurisdictions – are poised to become prime takeover targets.

As history has shown, the real fortunes in gold are often made not at the beginning of a bull market, but in the consolidation and acquisition waves that follow. With the charts all pointing in the same direction, this may be the strongest setup the sector has ever seen.

Contact:

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell commodities. The author holds physical gold and silver, stored in Central Switzerland through Elementum International AG. The author does not hold any direct interests or financial instruments related to other commodities or companies mentioned in this article. All views and forecasts reflect the state of knowledge at the time of publication and are subject to change. There is no guarantee that future developments will unfold as described. Investing in commodities involves risks. Consultation with a licensed financial advisor is strongly recommended. The cover picture has been obtained and licenced from Shutterstock.com