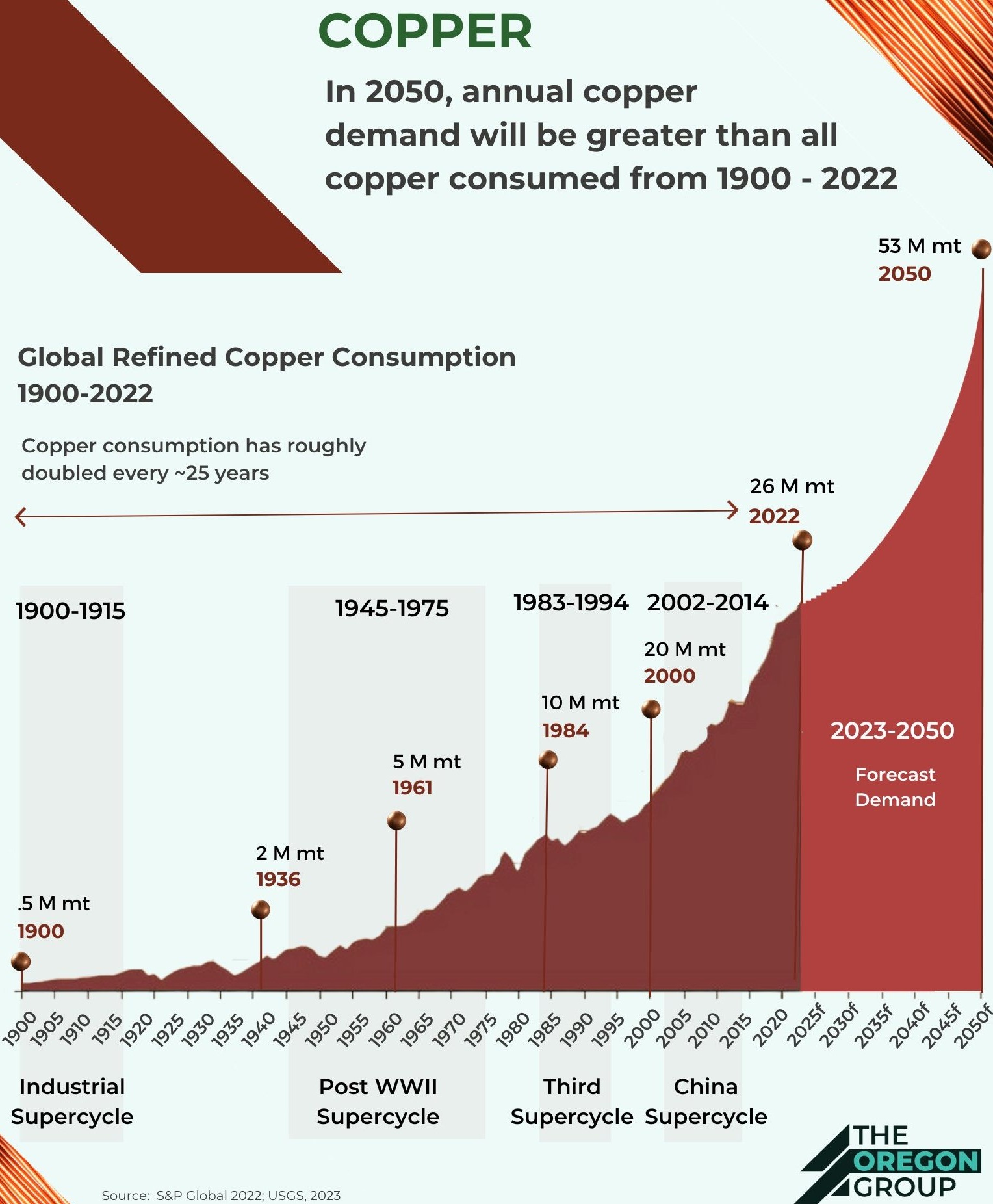

Copper has always been more than just a metal – it’s the silent backbone of human progress. From the telegraph wires that carried the first messages across continents to the power grids, EVs, and AI data centers shaping our future, every great leap forward has been etched into the price of copper.

Today, however, the world is entering uncharted territory: Demand is accelerating relentlessly, while supply falters under the weight of declining grades, soaring costs, and years of underinvestment.

This is not another cyclical upswing – it’s a structural collision between an inelastic demand curve and a fragile, lumpy supply base. Mines take decades to build, billions to finance, and face political and environmental hurdles at every step. Demand, by contrast, grows in a steady, predictable line: Electrification, renewable power, EV adoption, military spending, and now the explosion of AI infrastructure.

The result is a copper market unlike anything we’ve seen before: Tighter, riskier, and yet more strategically essential than ever. For investors, this isn’t just about higher prices – it’s about recognizing the scarcity value of new discoveries, the takeover appeal of juniors, and the opportunity to be early in the next supercycle.

The copper supply crunch has begun, and today’s juniors may well be tomorrow’s headlines.

Grasberg Outage Tightens Copper Market

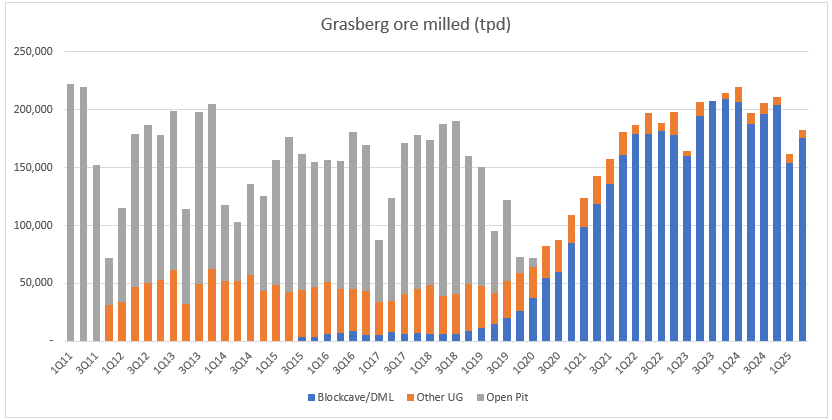

On September 25, 2025, Goldman Sachs has warned that the recent mud rush at its Grasberg Block Cave Mine in Indonesia – a key asset accounting for around 4% of global copper supply – will have ripple effects across the market through 2026.

The September 8 incident tragically left 2 workers dead, with 3 still missing, and has forced a full halt in operations. A phased restart is not expected until the 4th quarter of 2025, with full capacity only likely to resume in 2026.

According to Goldman Sachs’ commodities team, this disruption equates to a loss of approximately 525,000 tonnes (t) of copper supply, translating into a 160,000 t downgrade to their H2 2025 global supply forecast and a 200,000 t cut for 2026. For 2025 alone, they now expect 250,000-260,000 t of lost output from Grasberg, slashing prior production estimates of 700,000 t down to around 440,000 t.

The impact is significant: Goldman projects a 270,000 t supply shortfall in 2025 compared to its earlier guidance. This lifts their global mine production growth outlook for 2025/26 to just +0.2% per year, down from +0.8-2.2%. While the market was previously on track for a small surplus, the outage shifts the balance toward a deficit of 220,000-250,000 t in 2025, before stabilizing back into slight surplus in 2026 as production normalizes.

Copper prices have already responded, with the LME benchmark closing at $10,337 USD/t on September 24, up 3.6% in a single session. Goldman Sachs emphasizes that the risks for its December 2025 copper forecast of $9,700/t are now skewed to the upside, with prices expected to remain in the $10,200-$10,600/t range. In the medium term, the bank continues to hold a long-term bullish price target of $10,750/t by 2027, as structural supply constraints and recovering demand support higher levels.

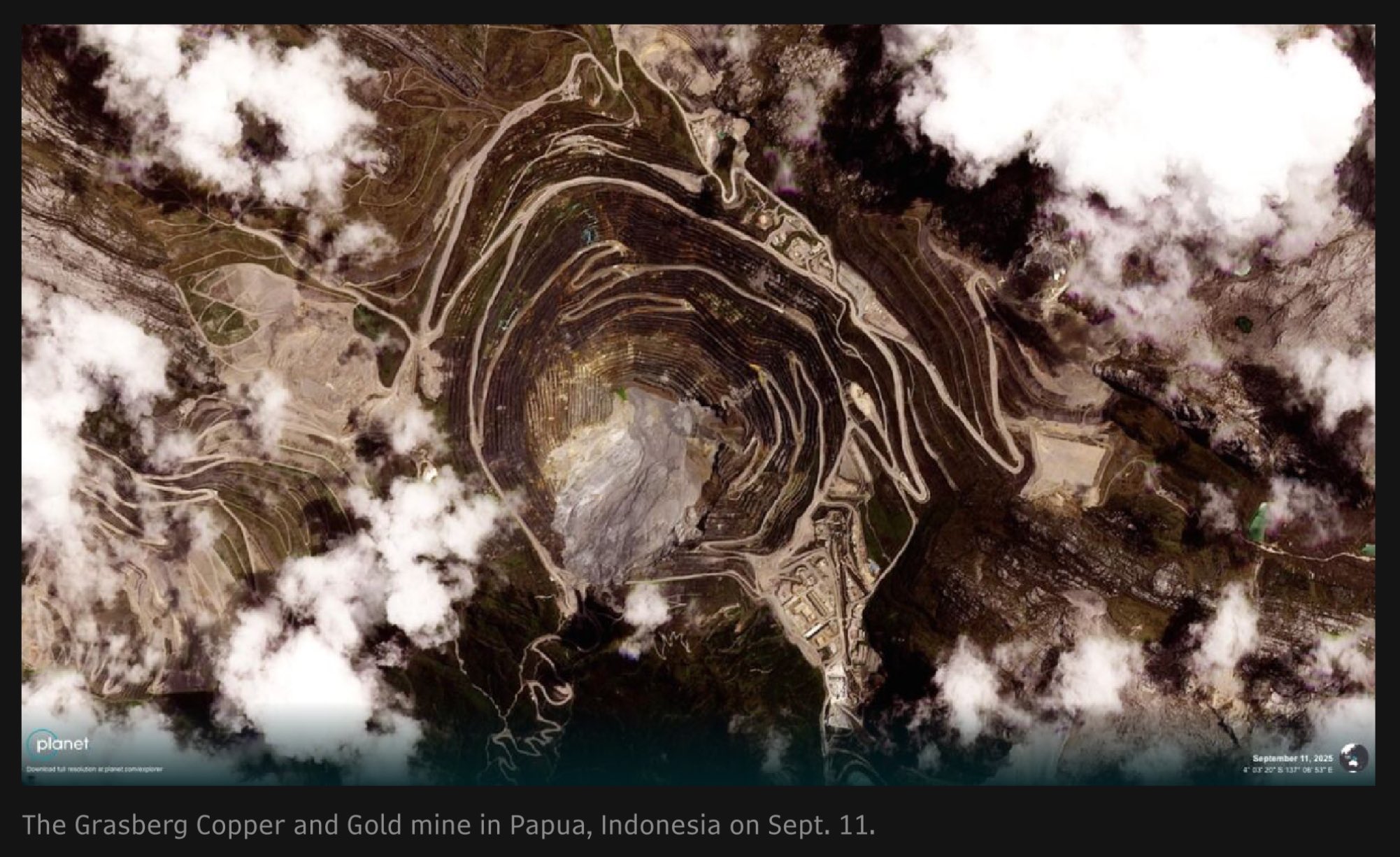

Full size / "Based on this Sept 11 sat-photo the Grasberg open pit (one of the largest worldwide) has been flooded with a huge (mud) slide." (Willem Middelkoop on X.com on September 25, 205)

"Grasberg is a giant. One of the largest mines on earth... Think of it as a vast underground city: 28,000 employees, 250 km of tunnels across dozens of levels. Each year, 35–40 km of new tunnels are added – roughly the length of Switzerland’s Gotthard Base Tunnel (57 km), the world’s longest rail tunnel. At its heart lies the Grasberg Block Cave (GBC), which accounts for ~70% of reserves and output... On Sept 8, disaster struck: ~800,000 tons of wet material suddenly rushed in, flooding multiple underground levels. The mud hit GBC directly – the very core of Grasberg’s production. A catastrophic failure. How was this even possible? Block caving itself may become central to the story..." (Alexander Stahel on X.com on September 24, 2025)

Full size / The Grasberg Copper-Gold Mine in Papua, Indonesia, is one of the world’s largest copper and gold mining operations. In production since the late 1980s, Grasberg has delivered more than 30 million t of copper and over 1,500 t of gold. The deposit, operated by Freeport-McMoRan in partnership with the Indonesian government, is renowned for its sheer scale, high-altitude location, and exceptional polymetallic endowment, with ore grades historically averaging around 1% copper and over 1 g/t gold.

"Out of more than 12,000 active mines worldwide, only ~20 have ever used block caving – a handful do so today - El Teniente in Chile; Oyu Tolgoi in the desert in Mongolia; Cadia East & Northparks, both Australia; Palabora, SA; who else? That’s <0.1% of all mines. None do so or did in the past within a similar rainy climate as Grasberg does. Block Caving is an extremely rarely applied mining method, reserved for very large, low-grade underground ore bodies which themselves are exceptionally rare. Most mining is open-pit, stoping, or cut-and-fill. Block Caving has economic appeal – low cost per ton – but the geotechnical risks are likely immense. Once caving starts, the process is essentially an engineered collapse of the mountain. What could possibly go wrong? That’s why this accident isn’t just a local disaster IMHO. It could become a case study for the entire mining method. Perhaps it wasn’t well understood how block caving behaves under Indonesia’s heavy rainfall and complex geology? I don’t know – but I wouldn’t be surprised if that proves decisive..." (Alexander Stahel on X.com on September 24, 2025)

"By year-end, Freeport will be fortunate just to understand the mechanics of this accident. Until then, production forecasts are pure guesswork. Such a failure should (a) have been impossible, and (b) means operations can only restart once it’s crystal clear why it happened and how it can be prevented from happening again. Analysts say full recovery is likely by 2027. That’s total nonsense. Nobody really knows... This is no quick fix. With infrastructure damaged, safety paramount, at least two confirmed dead and five still missing, investigations ongoing, potential class actions looming, and permitting hurdles ahead, the road back for Grasberg will be long and uncertain." (Alexander Stahel on X.com on September 24, 2025)

Full size / Source: Respeculator on X.com on September 24, 2025

Other Recent Copper Supply Disruptions

Grasberg’s disruption was shock enough – but it’s only the latest in a string of supply outages that are quietly reshaping the copper outlook.

From seismic-driven shutdowns in the DRC to tunnel collapses in Chile, and delays in flagship growth projects, supply risk is proliferating across jurisdictions. Each blow further erodes cushion in a market already running thin.

The copper industry has faced multiple setbacks recently, adding further stress to an already fragile supply side:

1) Kamoa-Kakula (Ivanhoe Mines, DRC): In May, seismic activity forced a temporary suspension of underground operations at Kakula. Dewatering and stabilization works are underway, and mining resumed in segments (western side) in June 2025. As a result, Ivanhoe slashed its 2025 guidance by ~28 % from previous forecasts. While the eastern side remains affected, the disruption underscores how geotechnical risk and water control can significantly derail output.

2) El Teniente (Codelco, Chile): On July 31, a tunnel collapse at Codelco’s flagship El Teniente Mine killed 6 workers, prompting a multi-day shutdown. The lost output is estimated at 20,000-33,000 t copper, forcing Codelco to lower its 2025 production guidance. This is significant: El Teniente is one of Codelco’s most important mines and any disruption carries outsized supply risk.

3) Teck / QB2 (Chile): On September 3, Teck Resources has postponed approvals for its Quebrada Blanca Phase 2 (QB2) growth projects until the existing operations stabilize. The move highlights how even future supply expansions are now being treated cautiously due to operational and financial pressures.

4) Constancia (Hudbay, Peru): On September 23, Hudbay Minerals temporarily shut down its Constancia Mill in Peru due to escalating social unrest and illegal blockades near the site. The company demobilized non-essential staff to prioritize safety and is using the downtime for maintenance, while engaging with authorities and local communities to restore operations. Although Hudbay maintains its 2025 guidance, the episode highlights the persistent social and political risks that can disrupt production in Peru’s southern mining corridor.

5) Other social, political and geotechnical risks: While not always publicly quantified, copper operations in Peru and elsewhere continue to face social unrest, permit delays, community opposition, and regulatory pressure. In many jurisdictions, lower grades and rising costs mean that even small hiccups (power cuts, labor strikes, permitting hold-ups) can ripple into material supply losses. Other examples of social unrest in Peru’s mining sector:

• Blockades on copper transport routes (summer 2025): In July, protesters (many of them informal miners) blocked a major copper transportation corridor in Peru, affecting output for multiple mining companies including Hudbay and MMG. The protests were tied to disputes over stricter permit rules for informal miners.

• Protests at Glencore’s Antapaccay Mine (Cusco Region): In March, indigenous communities blocked access roads to Glencore’s Antapaccay Copper Mine, opposing an expansion plan and demanding more consultation and environmental safeguards.

• Las Bambas EIA modification disputes: Local indigenous communities have protested modifications to the Environmental Impact Assessment (EIA) for the Las Bambas Project, asserting that the changes were made without proper consultation, especially around water and ecological impact.

• Violence linked to illegal mining in Pataz (Northern Peru, gold sector): While not copper-specific, there was a tragic incident in 2025 involving 13 miners who were kidnapped and killed in Pataz, reportedly tied to illegal mining gangs. This highlights the broader security and criminal risk in resource regions.

Argentina’s Copper Collapse and the Search for Stable Jurisdictions

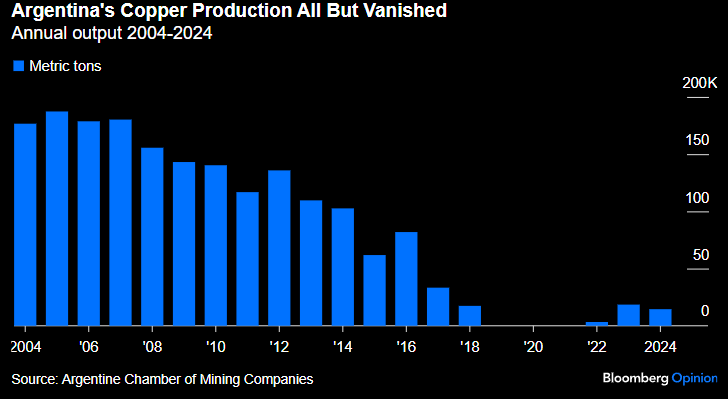

Full size / Argentina’s copper industry has all but disappeared over the past 2 decades, with annual production collapsing from over 180,000 t in the mid-2000s to near zero by 2024.

Argentina, once a modest copper producer, has seen its output collapse to virtually nothing. Years of policy uncertainty, high inflation, shifting taxation regimes, and weak investment incentives discouraged development and drove away capital. Despite its immense geological potential, the country’s copper pipeline has languished while neighboring Chile and Peru continued to dominate global supply.

Now, under President Javier Milei’s administration, Argentina is signaling a more market-friendly, mining-supportive stance. Regulatory bottlenecks are being eased, foreign investment is being attracted, and some majors are cautiously returning to develop copper deposits in the Andes.

Yet Chile – the world’s #1 copper producer – has been shaking investor confidence through constitutional uncertainty, royalty hikes, and tougher permitting requirements. Instead of providing clarity, these shifts have created confusion about long-term project economics and political stability.

Against this backdrop, the focus of mergers and acquisitions is tilting more than ever toward politically stable jurisdictions. Countries offering regulatory clarity, rule of law, and community support are becoming prime hunting grounds for majors eager to secure tomorrow’s supply.

For investors, this underscores a critical truth: Juniors with high-quality projects in safe jurisdictions are not just exploration plays, but some of the most strategic takeover targets in the next wave of consolidation. Majors don’t just buy deposits – they buy certainty. The next copper supercycle won’t be won by grade alone, but by jurisdiction.

Copper’s Structural Supply Gap Widens as Demand Surges

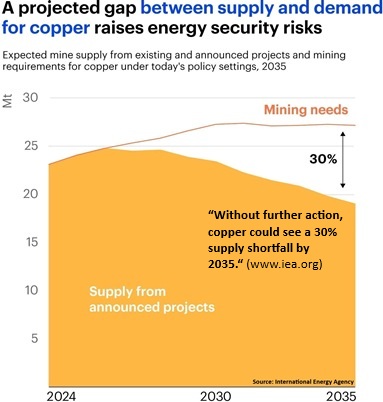

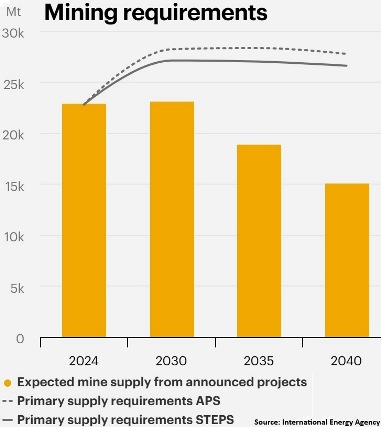

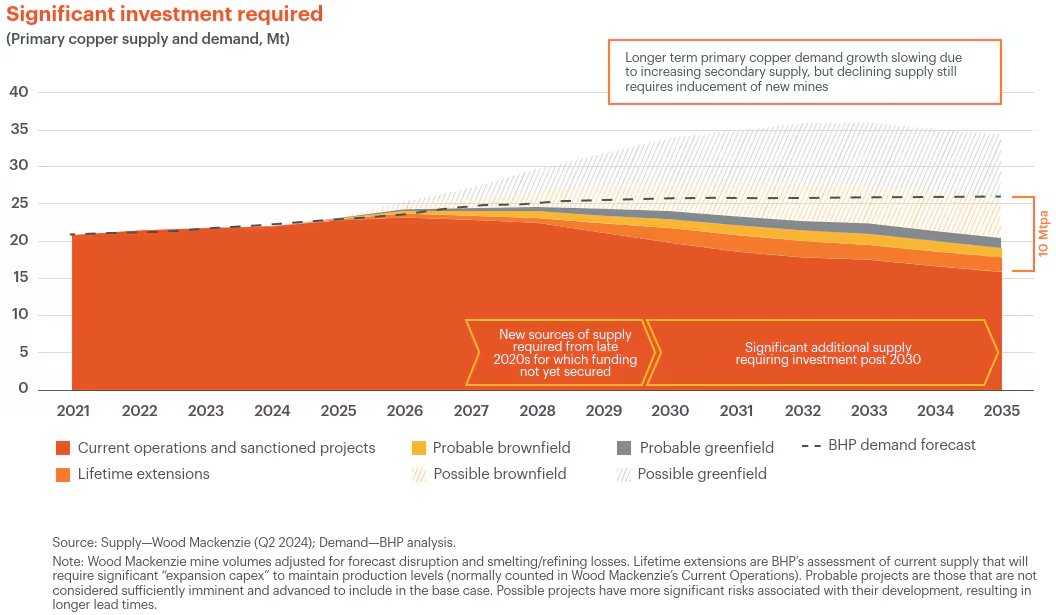

A new analysis from BHP and Wood Mackenzie underscores the scale of copper’s looming supply challenge. While current mining operations and sanctioned projects provide a solid base through the mid-2020s, the forecast shows a steep divergence between supply and demand from the late 2020s onwards. Without significant new investment, global copper supply will fall short of demand by the end of this decade, with the deficit widening sharply post-2030.

Full size / Supply analysis by Wood Mackenzie (Q2 2024); Demand analysis by BHP

Above chart highlights that even with lifetime extensions of existing mines and probable brownfield expansions, new sources of supply will need to be secured urgently. BHP’s demand forecast points to nearly 35 million t of copper needed annually by 2035, yet existing supply pipelines cover barely two-thirds of that requirement. This leaves a major investment gap in both greenfield and brownfield developments – projects that typically face long lead times, high capex, and rising regulatory hurdles.

This long-term picture dovetails with Goldman Sachs’ recent downgrade of global mine supply after the Grasberg outage. The forced shutdown at the Indonesian giant, which normally accounts for ~4% of global copper output, is expected to knock over 500,000 t of supply out of the market across 2025-2026, shifting the copper balance into deficit just as demand growth accelerates. Goldman now projects a 220,000–250,000 t deficit in 2025, with only a small surplus reappearing in 2026 if other mines deliver as planned.

“For years, copper bulls have talked up its key role in the transition to green energy, needed for wind turbines, electric cars and grid infrastructure. Now, the metal is riding two new megatrends: artificial intelligence and rising military spending. A proposed $53 billion merger between Anglo American and Teck Resources, the mining sector’s biggest deal for a decade, amounts to a giant play on future demand for the base metal. Copper consumption has been climbing for years but new supplies aren’t expected to keep pace with demand... The rise of artificial intelligence is powering a wave of extra demand for copper... “Significant amounts of copper are required to build, power and keep these centers cool,” said Anna Wiley, head of BHP’s South Australia copper business, at a conference last month. BHP, which sought to buy Anglo American last year to cement itself as the world’s biggest copper producer, forecasts a 70% increase in demand for the metal by 2050... All these factors are key reasons that help explain why copper has been at the heart of dealmaking in the mining sector in recent years – and why analysts say the proposed Anglo-Teck tie-up could spur rival offers as companies jostle for copper assets.“ (Excerpts from The Wall Street Journal‘s “Mining Megadeal Shows the World Is Crazy for Copper: Artificial intelligence and rising military spending are further buoying demand for the metal“ on September 10, 2025)

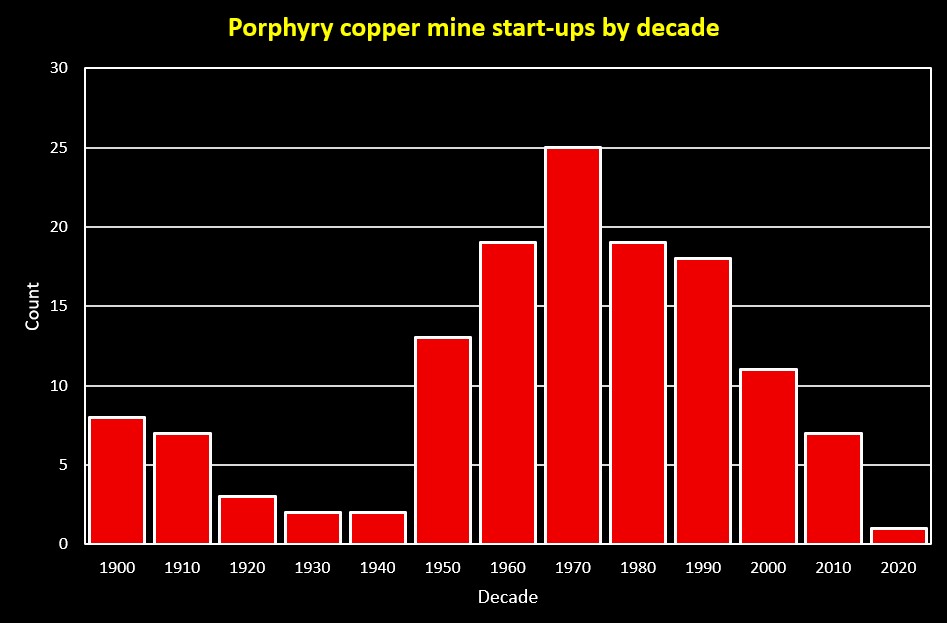

Full size / "The number of new porphyry copper mines in ten-year intervals- keep in mind that one of them from the 2010 decade was shut down a few years after it started (Panama). Remarkable that the LME warehouses have any copper inventory at all!" (J_Wise_geology on X.com on September 6, 2025)

The surge of new porphyry copper mines in the 1950-1970s coincided with rising global demand, robust exploration investment, and the development of large-scale open-pit mining methods. However, the sharp downturn in new start-ups from the 1990s onward reflects several converging factors:

• Maturity of discoveries: Many of the world’s largest and most easily developed porphyry systems were already discovered and put into production, leaving fewer “low-hanging fruit” opportunities.

• Falling grades and rising costs: Average ore grades declined, while permitting, development, and capital costs increased, slowing the pace of new start-ups.

• Price volatility: Periods of low copper prices reduced the economic viability of new projects, particularly large-scale, capital-intensive porphyries.

• Shift toward expansions: Rather than building new mines, many companies have focused on expanding or extending the lives of existing operations.

Investor take-away: The long-term decline in new mine start-ups highlights the scarcity value of genuine new discoveries. With demand for copper, gold, and molybdenum set to rise in the coming decades, companies advancing porphyry projects today are positioned to deliver outsized value as supply constraints tighten. This tightening supply pipeline highlights the scarcity value of new discoveries and underscores the upside leverage for companies advancing new projects today.

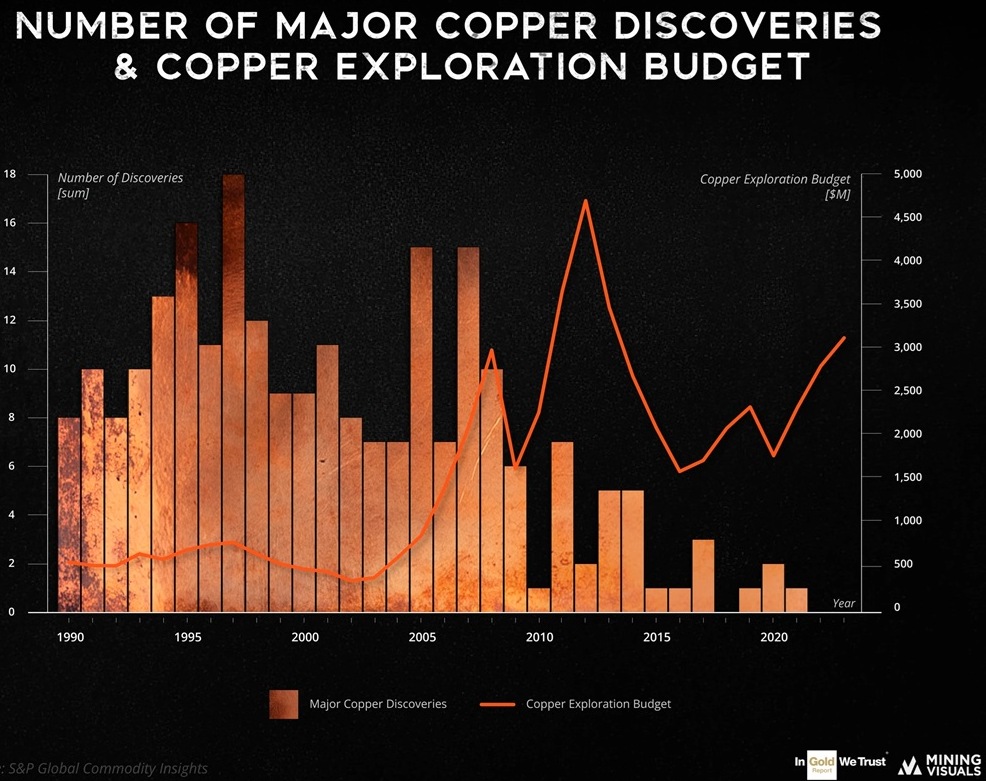

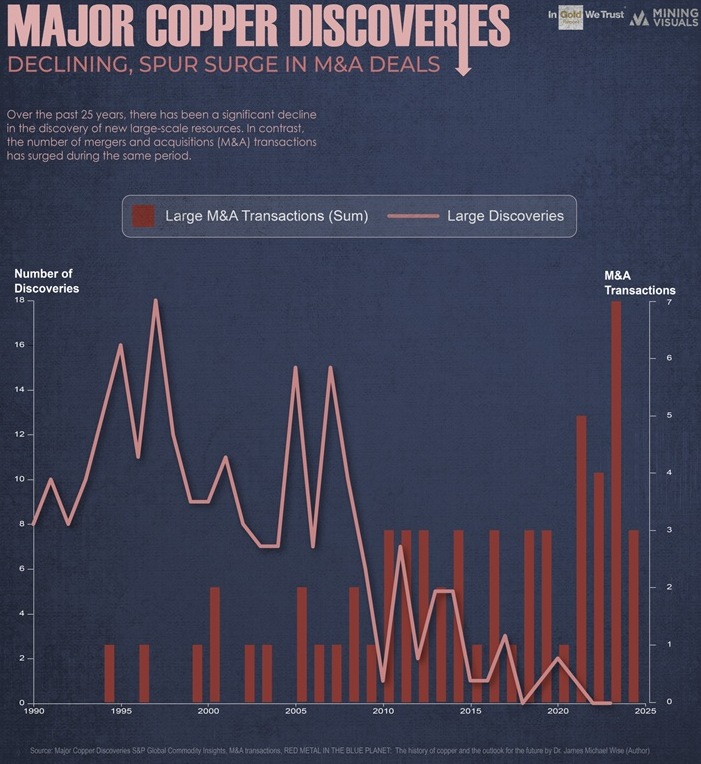

Full size / Source / Despite rising exploration budgets in recent years, major copper discoveries have dwindled to historic lows, underscoring the industry’s structural supply crisis. For investors, this shrinking discovery pipeline elevates the strategic value of high-quality exploration and development projects – particularly in stable jurisdictions –where genuine new finds represent a rare and highly sought-after addition to the global copper story.

Full size / Source / Over the past 25 years, the discovery of new world-class copper deposits has fallen dramatically, even as industry exploration spending has surged. The chart illustrates how large discoveries have trended steadily downward, while mergers and acquisitions (M&A) have accelerated to fill the gap. With fewer genuine discoveries being made, major producers are increasingly forced to grow through consolidation, bidding up the value of existing assets.

For investors, this industry backdrop underscores a critical point: Organic discoveries are now exceptionally rare, highly strategic, and increasingly valuable. As global copper demand accelerates alongside electrification, energy transition, and infrastructure growth, the scarcity of new projects magnifies the importance of junior mining/exploration companies advancing fresh discoveries in stable jurisdictions.

Growing demand from AI-driven data centers, surging renewable power infrastructure, and rising global military spending further reinforce copper’s strategic role. Combined with accelerating EV adoption, grid expansion, and industrial modernization, the case for new discoveries has never been stronger or more urgent. In a market where majors are hungry for growth but short on organic discoveries, new deposits stand out as prime acquisition and partnership targets.

“Did you know that every time you type a query into ChatGPT, it requires about 10 times as much electricity to process as a Google search? That’s according to Goldman Sachs, which writes in a new report that electricity consumption in the U.S. is poised for a major surge for the first time in years, due in large part to the rapid buildout of data centers that power AI platforms such as ChatGPT... To help put things in perspective, ChatGPT currently has over 180 million users, but there are around 5.3 billion internet users around the world. Imagine if each of them became a regular user of energy-intensive ChatGPT, whose servers are located in the U.S., according to owner OpenAI. The U.S. is currently home to nearly 5,400 data centers, the most of any other nation by far. Even so, additional capacity will need to come online to meet runaway demand, and giant tech companies – from OpenAI and Microsoft to Google, Meta, Amazon and more – are spending billions to position themselves as leaders in the nascent industry... While natural gas will be a key player in meeting future power needs, copper is equally essential, particularly for its role in the energy transition. Copper is the only critical mineral present in AI as well as all of the most important clean energy technologies, including electric vehicles (EVs), solar photovoltaics (PV) and wind power. Its combination of conductivity, longevity, ductility and corrosion resistance makes it an indispensable mineral... However, the supply side of the copper market is fraught with challenges. To meet current trends, an astounding 115% more copper must be mined in the next 30 years than has been mined in human history.“ (Frank Holmes in "Data Centers Are Driving an Electricity Demand Surge from AI Platforms like ChatGPT" on June 3, 2024)

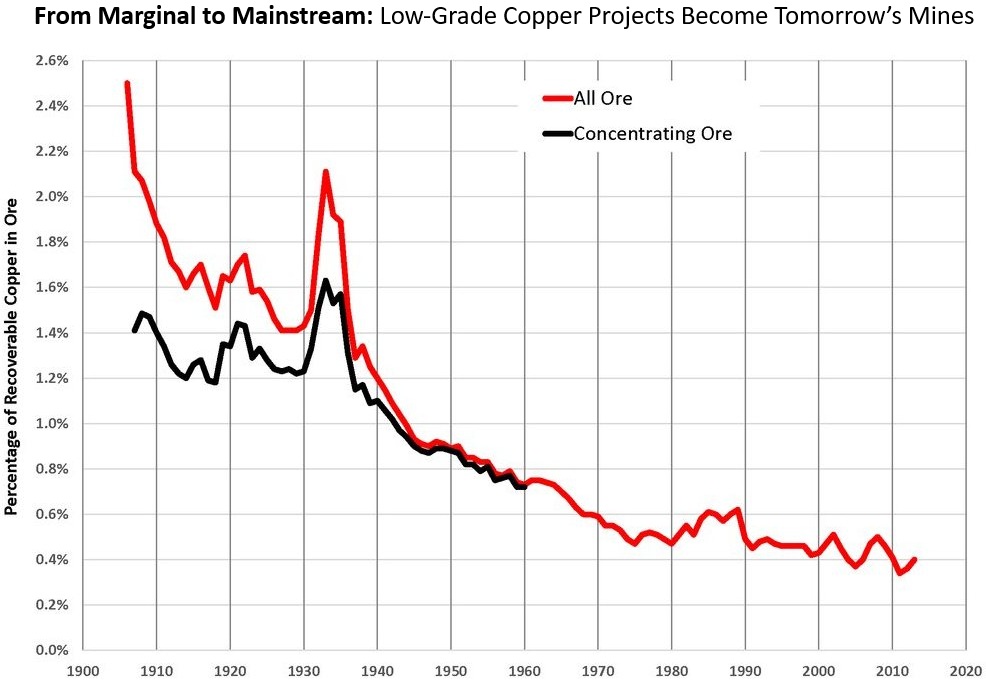

Lower Grades, Higher Stakes: The New Reality of Copper Supply

Above chart tells one of the most important stories in the copper industry: Ore grades have been in relentless decline for more than a century. A century ago, many of the world’s biggest copper mines operated on grades above 2%. Today, the global average has fallen to around 0.4%, a level that only a decade ago was considered uneconomic.

This long-term trend carries a powerful implication for the future. As high-grade deposits are depleted and new discoveries become rarer, projects with lower grades are no longer sidelined. Rising copper prices, advances in processing technology, and the desperate need for new supply are rewriting the economics of mining. Deposits once dismissed as “too low-grade to matter” are now being actively advanced by juniors – and watched closely by majors seeking future acquisitions.

For investors, this shift is critical. Scarcity turns marginal deposits into strategic assets. What once seemed like sub-par geology is increasingly viewed as tomorrow’s lifeline for global supply. In an environment defined by supply shocks, accelerating demand, and rising geopolitical competition, low-grade projects in stable jurisdictions may not only survive – they may become the most attractive takeover targets in the sector.

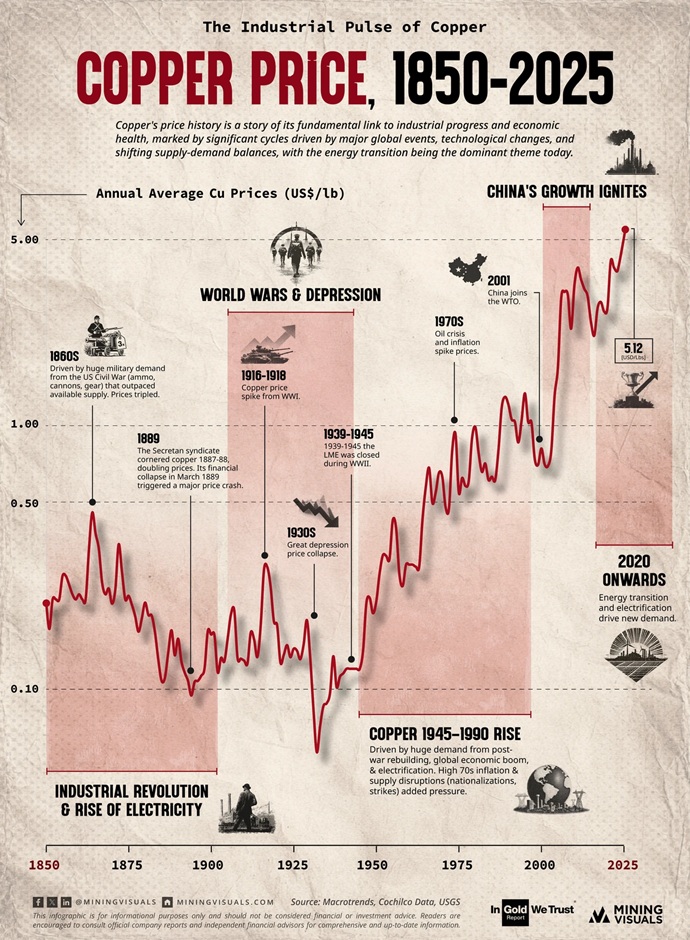

Copper: The Industrial Pulse of 175 Years

Full size / Often called “the metal with a PhD in Economics,” copper’s price has long mirrored the tides of industrial progress, global conflict, and technological revolution. From the telegraph wires of the 19th century to today’s data centers and EVs, every major shift in human history is etched into copper’s price curve.

• Industrial Revolution (1850s-1900s): Demand from electrification and war drove early spikes, with dramatic episodes like the 1880s Secrétan Syndicate attempting to corner the market.

• World Wars & Depression (1914-1945): Copper surged during war-time demand but collapsed in the Great Depression, with markets tightly controlled during WWII.

• Post-War Boom (1945-1990): Reconstruction, electrification, and industrial expansion fueled decades of steady growth, interrupted by the oil shocks and inflation of the 1970s.

• China’s Rise (2001 onwards): Entry into the WTO ignited the commodity supercycle, propelling copper into a new era of global demand dominance.

• The Green Transition (2020s): Today, copper underpins electrification, renewable energy, and digital infrastructure – driving structural demand that promises to shape the next supercycle.

Copper’s price history is more than economics – it is a chronicle of human progress. As the world accelerates toward a more electrified and sustainable future, copper remains at the heart of industrial and technological change.

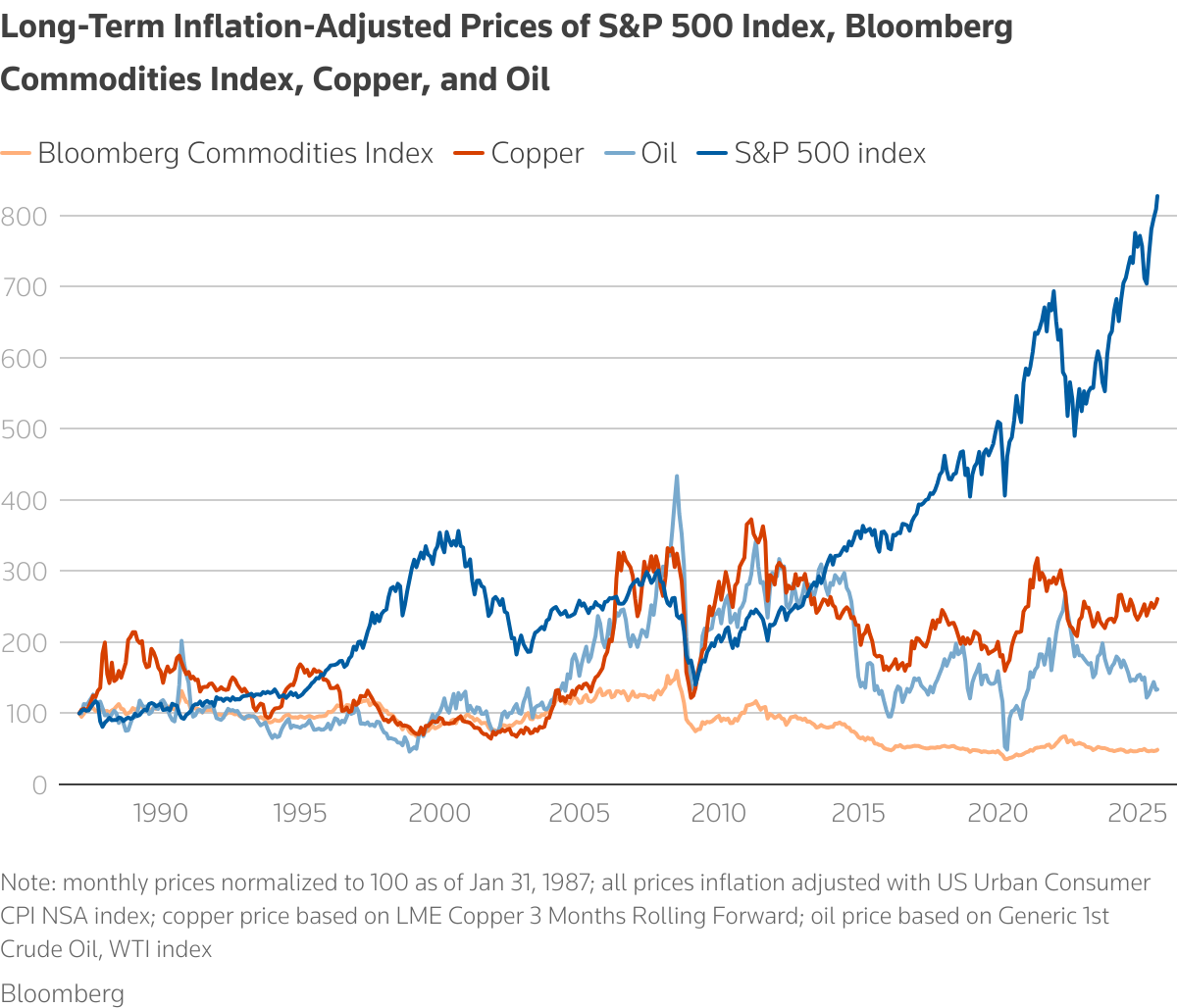

Full size / "Finally, the financial winds seem to be shifting in commodities´ favor. First, there’s the simple matter of price. The inflation-adjusted copper price remains 30% below its 2011 peak, while the inflation-adjusted oil price and the overall Bloomberg Commodities Index (which includes energy, industrial and precious metals, and agricultural produce) are 70% below their previous peaks in 2008. This is in stark contrast to U.S. equities where the S&P 500 index continues to hit all-time nominal highs and has almost tripled since its pre-Global Financial Crisis peak in 2007, even after adjusting for inflation." (Reuters in "Commodities could be on the verge of a new super cycle“ on September 18, 2025)

"Commodities have had a rough decade, but a confluence of structural factors suggests that after years of underinvestment, the stage may be set for the next super cycle. Commodities super cycles are long, powerful waves driven by major thematic shifts. The 1970s super cycle saw a mix of geopolitical supply shocks and loose monetary policy. The early 2000s super cycle was defined by China´s historic urbanisation boom. Today, there are structural factors on both the supply and demand sides of the commodities equation that could catalyze the next boom. To begin, the supply outlook for commodities overall has a few points of vulnerability that, if tested, could support a bullish long-term outlook. First, critical resources and the capacity to process them are highly concentrated in just a few jurisdictions. For instance, S&P Global reports that over 40% of the world´s copper production comes from Chile and Peru. Over 50% of the world’s iron ore is supplied by Australia and Brazil. And Kazakhstan alone accounts for over 40% of global uranium mine supply. This concentration extends beyond extraction to refining. China refines nearly 90% of the world´s rare earth elements, which are vital for everything from electric vehicles to defence systems. It also refines over 40% of the world’s copper, critical for AI and electrification. We have already seen examples of countries using their control of commodities supply as geopolitical leverage. China temporarily restricted rare earth exports in 2025 during trade disputes, and the U.S. included long-term Liquified Natural Gas (LNG) purchase commitments in its tariff agreements with the European Union and South Korea. This trend of weaving energy security and dependency into trade discussions and other geopolitical disputes creates a persistent risk premium that could erupt into severe supply disruptions down the line. Compounding this is a simple geological reality: the easy, high-grade deposits have likely already been found. Greenfield mining projects can now expect to face declining ore grades, soaring capital costs, and lead times that could exceed a decade. Years of underinvestment, partly due to shareholder pressure on miners to prioritise dividends over growth, have starved the pipeline of future supply." (Reuters in "Commodities could be on the verge of a new super cycle“ on September 18, 2025)

In its article, Reuters also highlights that copper demand is being driven not just by traditional construction but by powerful secular forces: The global electrification push, renewable energy systems, EV growth, and the massive grid infrastructure needed to support them. Added to this is an unexpected new driver – AI data centers, where tech giants are pouring hundreds of billions annually into energy- and copper-intensive buildouts.

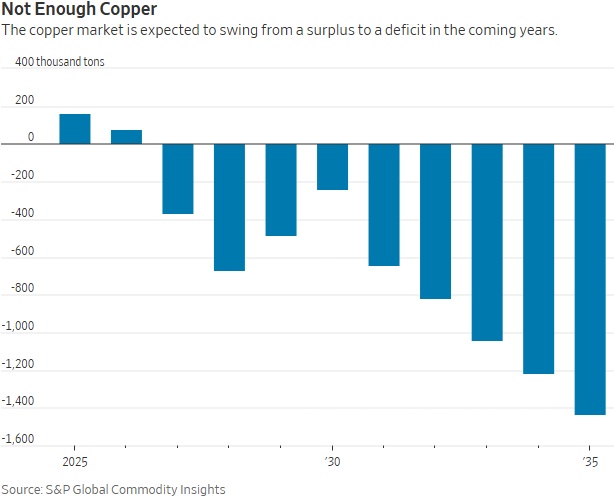

The International Energy Agency (IEA) estimates that even under current policies, copper demand could exceed supply from announced projects by 30% by 2035. This is not a cyclical shortage but a structural collision – a mismatch between an inflexible supply base and accelerating, inelastic demand.

As Reuters notes, once such commodity super cycles take hold, they are difficult to stop without major shocks like Volcker’s 1980s rate hikes or the U.S. shale boom. With inflation sticky, bonds losing reliability as hedges, and investors seeking alternatives, commodities – first and foremost copper – could increasingly be recognized as both inflation hedges and growth plays.

In plain terms:

• Copper demand grows in a steady, predictable line, driven by electrification, EVs, renewable energy, and now AI infrastructure.

• Supply, however, doesn’t follow the same path – it moves in sharp, uneven bursts because bringing new mines online is slow, capital-intensive, and constantly at risk from political, environmental, or technical setbacks.

This mismatch – stable demand versus lumpy, fragile supply – creates a powerful structural imbalance. For investors, that asymmetry is the foundation of a sustained copper bull market, where every disruption can trigger outsized price spikes.

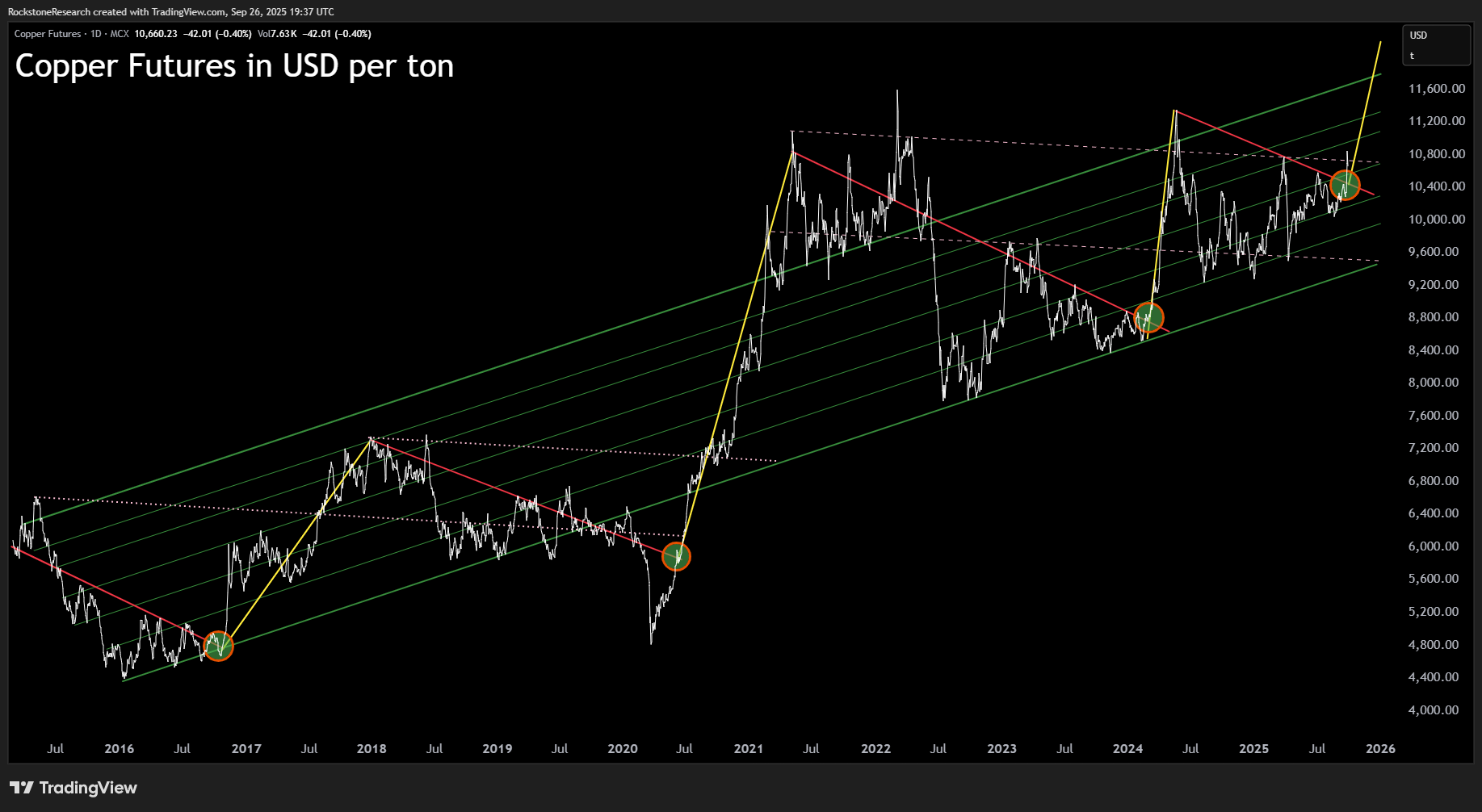

Copper Prices Go Ballistic: Charts Signal Breakout Momentum

Full size / Source / Copper Futures Breaking Out: The chart of copper futures in USD per kilogram shows a decisive move above a 2-year downtrend (red line). After consolidating between $9.50 and $10.50/kg through much of 2023-2025, copper has now broken higher, signaling renewed bullish momentum. With structural demand from electrification and AI infrastructure colliding with fragile supply, this technical breakout reinforces the fundamental case for a sustained copper bull market.

Full size / Source / Copper Futures in USD per Ton – Historical Breakouts Repeating: The chart highlights how copper consistently breaks major downtrends (red lines) with powerful rallies (yellow arrows), often triggered from long-term channel support (green). Each breakout has historically marked the start of a strong upside leg, as seen in 2017, 2020, and 2024. With the latest breakout now confirmed, copper is once again signaling the potential for a sharp move higher, targeting new highs above $11,000/t.

Bottom Line: Tomorrow’s Supply, Today’s Opportunity

One of the market’s biggest risks – supply reliability – intensifies. Global supply risks are mounting after Freeport-McMoRan confirmed that operations at its Indonesian Grasberg Mine remain suspended following a mudflow accident. Any prolonged disruption there, combined with Codelco’s warning of stagnant production in Chile due to declining grades and rising costs, could tighten global supply.

On the demand side, China continues to anchor the market. August imports of unwrought copper dipped month-over-month but still rose year-over-year, while concentrate inflows surged to a 4-month high. Rising Yangshan premiums and signs of economic stabilization point to resilient consumption heading into October. Macro conditions also lean supportive. Softer labor data in the U.S. has strengthened expectations for multiple Fed rate cuts this year, boosting liquidity and risk appetite.

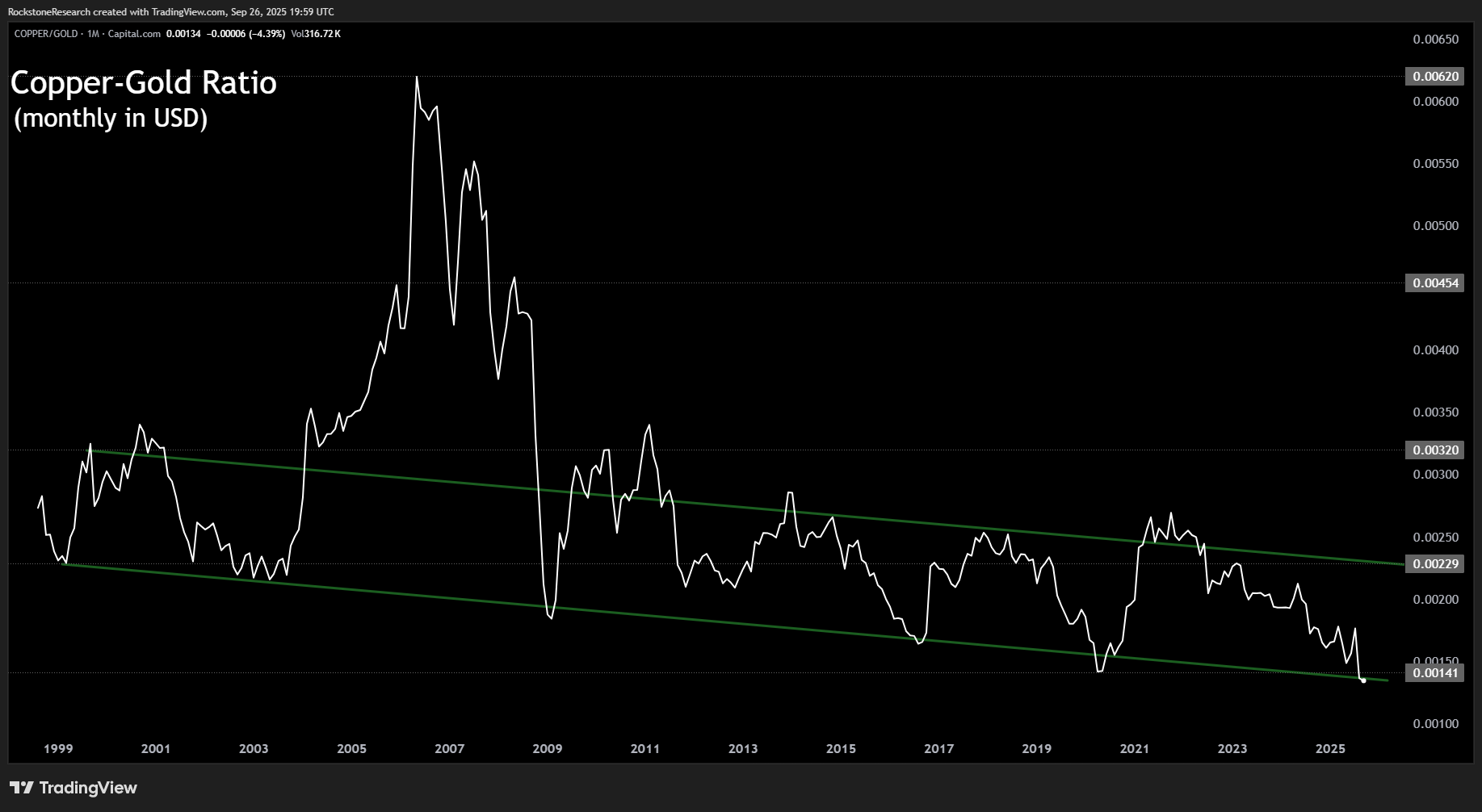

Analysts highlight that the copper-to-gold ratio remains historically low, often a signal that copper may rebound alongside stronger global growth.

Full size / Source / Copper-Gold Ratio Near Historical Support: The long-term copper-gold price ratio has been in a steady downtrend since 2006, with each major low marking a turning point where copper began to outperform gold. The current reading (~0.0014) is testing the lower boundary of this multi-decade channel, suggesting a potential bottom may be near. For investors, this setup implies that copper could soon enter a period of relative strength versus gold, driven by structural demand while supply remains constrained. Historically, such lows in the ratio have preceded powerful copper rallies.

Full size / Source / Copper Miners ETF (NYSE:COPX) Breaking Higher: The chart shows copper miners surging to new highs, reflecting the powerful combination of rising copper prices and expanding margins across the sector. Large-cap producers have already delivered outsized returns, but the real asymmetric upside lies with copper exploration and development companies.

Unlike the diversified ETF basket of senior copper miners, the real opportunity lies with the juniors – exploration and development companies in stable jurisdictions which are steadily advancing high-quality projects. These are the names that majors turn to when they need to secure tomorrow’s supply.

And when consolidation comes, it rarely moves in half measures: Valuations can soar well beyond the broader market, delivering explosive upside that has historically outpaced both ETFs and established producers.

For investors willing to look one step ahead, this is where fortunes are made – not in tracking the herd, but in owning the very projects that will become the next generation of mines. In a tightening copper market defined by scarcity and strategic competition, today’s juniors are tomorrow’s headlines.

Contact:

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell commodities. The author holds physical gold and silver, stored in Central Switzerland through Elementum International AG. The author does not hold any direct interests or financial instruments related to other commodities or companies mentioned in this article. All views and forecasts reflect the state of knowledge at the time of publication and are subject to change. There is no guarantee that future developments will unfold as described. Investing in commodities involves risks. Consultation with a licensed financial advisor is strongly recommended. The cover picture has been obtained and licenced from Shutterstock.com