In reading the Berkshire Hathaway annual letter this weekend, I was reminded of a response Charlie Munger gave to an investor on how he tests the validity of his investment thesis. Munger’s response was, “Invert. Always invert.” The meaning here is to consciously take the other side of your thesis and try and disprove your beliefs/biases.

I’ve spent the past month or so on the road at conferences and meeting with investors to take a temperature check and “invert” our investment philosophy. We’ve also witnessed a huge increase in our subscriber base in recent weeks and so an outline of our view of the world and how we’re positioning is in order and likely overdue.

While the content here may be repetitive for long-time readers, I welcome any (constructive) comments as they can only help refine and strengthen our outlook.

Despite the overwhelming complexity of the global economy, we simply see a huge struggle against two headwinds. Though we’ve been involved in commodity investment for over a decade, we view the commodity super cycle (2001 – 2011) as definitively over. The end of the super cycle has left the economy with additional supply of commodities now coming on stream just as demand continues to soften.

The second headwind involves the “hangover” and over leveraging to ignite growth in the wake of the Global Financial Crisis (GFC).

We are left with excess production capacity of numerous commodities and slack global demand as China continues to find her footing and chart a sustainable growth path forward. Central Banks around the world have attempted to ignite investment through several methods (quantitative easing, zero or negative interest rates being the most notable) with mixed success at best. Commodity producers, who levered up during the super cycle must now produce at a loss in many cases just to service debt interest payments. There are unfortunately too many examples here to point to, although the oil and gas business, where it is estimated that an additional $50 to $100 billion of deleveraging must take place is a notable example.

One of the real challenges we see is the fact that as more debt has been issued to generate that marginal dollar/yen/euro of growth, these debts must ultimately be repaid and so any incremental dollar of growth must repay debts before being applied to more productive uses. See the debt to GDP ratio in China below. China now issues five Renminbi (RMB) of debt for every one RMB of GDP growth.

Source: Bloomberg

Yield curves across the developed world are largely flat, with negative yields on $8 trillion of sovereign debt implying slow growth going forward.

The US Dollar is still strong on a trade-weighted basis, though this has moderated in 2016 somewhat and gold and silver have benefited:

Source: Bloomberg

This, along with the demand slowdown has hurt commodities overall. The Bloomberg Commodity Index (below) has fallen 53% in five years:

Source: Bloomberg

A final chart shows the producer price index (PPI) in China. Prices inside the country have fallen for 50 consecutive months. If this doesn’t prove the idea of China exporting deflation, we’re not sure what does. While we are as skeptical as anyone regarding the validity of Chinese economic data, the unrelenting fall of prices in the country coupled with the charts above have us still believing that deflation is still the more prevalent macro concern rather than inflation.

Source: Bloomberg

A final note on productivity. Productivity (output per worker per hour) increases are critical as they act as true wage drivers in an economy. US Non-farm business sector output per hour contracted by 2.2% in Q4 2015 and has averaged 1.1% growth between 2005 and 2015 and 3% growth between 1997 and 2005 during the dot com boom. Where is the next engine of growth to drive productivity?

The excess production capacity, excessive leverage, and muted demand are structural and NOTcyclical phenomena that require a careful examination of your investment philosophy. Here is the central question we think needs to be addressed against this backdrop:

How do you generate above average risk adjusted returns in a global economy choking on excess supply and failing to generate sufficient demand?

To be clear, there are a number of methods to employ or ways to address this. Investing isn’t and shouldn’t be a one size fits all endeavor.

That said, we think that given the structural impediments to growth listed above, the opportunity for new business models that leverage technology to lower costs is ripe. This thinking was the impetus behind the name change of this newsletter and shift in focus from merely discovery to disruptive discovery.

While economies are always subject to the laws of supply and demand and booms and busts, those disruptive business models that leverage technology to lower costs will be best positioned to take market share from incumbent producers.

While we do have an opinion on different pieces of the commodity business, the focus on what we call energy metals (those metals or minerals used in the generation or storage of energy) is a niche that can withstand the structural headwinds mentioned above. There are six reasons behind this:

-- Access to cheap energy is absolutely essential to building a strong middle class which serves as the backbone of a dynamic and growing economy. Focusing on the metals that help make energy “cheap” is one way to capture the upside from this phenomenon. The collapse in the price of oil has given the US consumer a $115 billion “tax cut” (though much of this has gone to pay down debt rather than consumption).

-- Demand for many of these materials (lithium and cobalt, in particular) is growing well above global GDP with lithium demand growing at a 10 to 13% CAGR and cobalt growing at a 7 to 9% CAGR. Even if demand for select energy metals slows somewhat, it is still insulated relative to the overall growth rate in the global economy.

-- Deployment of renewable sources of energy remains strong with $286 billion USD invested in the sector in 2015. This amounted to 152 GW of capacity. Deployment has actually outpaced fossil fuel-based sources each year since 2013 and ought to accelerate as coal plants are closed due to low prices acting as an economic disincentive. These renewable technologies (specifically solar, wind, and batteries) are underpinned by a secure supply of the energy metals such as lithium, graphite, or copper.

-- China isn’t the “only game in town”. By this, we mean that supply chains for almost all of the energy metals are diffuse and not entirely owned by China in the way that the rare earth industry is. With a lack of pricing power, the Chinese can’t set the price or demand technology transfer in the same way. Watching the Chinese lithium converters squirm as they must pay higher lithium concentrate prices has been an interesting dynamic to unfold.

-- Energy metals are typically small markets. Lithium only generates about $1 billion USD in revenues every year. Compare that to Exxon/Mobil (XOM:NYSE), a single (admittedly large) oil major that generated $260 billion in revenue in 2015 itself or Starbucks (SBUX:NYSE) that sold $14.5 billion worth of coffee in 2015. The fact that these markets are small leads us to believe that they can withstand a stagnant macro growth picture.

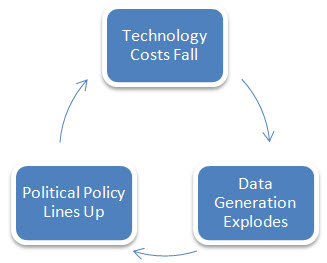

-- Finally, the energy metals are poised to benefit from what I call the “virtuous cycle”. Technology costs such as the lithium-ion battery or solar panels continue to steadily fall, this accelerates deployment and also generates data which can be leveraged into new business models (think the internet of things). Public policy also aligns behind these forces which allow renewable sources of power to proliferate as it finally appears governments are intent on fostering cleaner sources of growth in the wake of Paris COP 21. Though there are those that will bemoan government involvement in energy R&D history has proven that government funding of technology is a valuable incubator of ideas which can be accelerated by the private sector.

Regarding precisely where to invest is not a topic I’ll delve into today as several opportunities are under review and doing your own due diligence on the above thesis should uncover opportunities regardless. The energy metals space offers exposure to the entire energy value chain, from mining, to manufacture, to technology. Each sector demonstrates its own unique models and the margins that go along with them.

I’ve spent a great deal of time in recent months trying to “invert” the above thesis and while there are certainly holes to be plugged, the indispensable role of energy in our lives, the need for cleaner sources of growth, the dramatic decreases in energy technology, structural headwinds to macro growth, and the critical role that energy metals play in this cycle demonstrate that we are in the early stages of major changes in how energy is generated, stored, and used. The energy metals and associated technologies seem particularly well suited to capitalize on this mega trend.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

DISCLAIMER AND INFORMATION ON FORWARD LOOKING STATEMENTS

The material herein is for informational purposes only and is not intended to, and does not constitute, the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin. The information in this report is provided solely for users’ general knowledge and is provided “as is”. We make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this Research Report or otherwise relating to such materials or on any websites linked to this report. The content in this report is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. Chris Berry owns no shares in any of the companies mentioned in this report. He has been paid a fee by LAC for consulting services. All statements in this Research Report, other than statements of historical fact should be considered forward-looking statements. Some of the statements contained herein, may be forward-looking information. Words such as “may”, “will”, “should”, “could”, “anticipate”, “believe”, “expect”, “intend”, “plan”, “potential”, “continue” and similar expressions have been used to identify the forward-looking information. These statements reflect our current beliefs and are based on information currently available. Forward-looking information involves significant risks and uncertainties, certain of which are beyond our control. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking information including, but not limited to, changes in general economic and market conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, exclusivity and ownership rights of exploration permits, dependence on regulatory approvals, the uncertainty of obtaining additional financing, environmental risks and hazards, exploration, development and operating risks and other risk factors. Although the forward-looking information contained herein is based upon what we believe to be reasonable assumptions, we cannot assure that actual results will be consistent with this forward-looking information. Investors should not place undue reliance on forward-looking information. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances, except as required by securities laws. These statements relate to future events or future performance. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. For a more detailed disclaimer, please click here.