Disseminated on behalf of Capacitor Metals Corp. and Zimtu Capital Corp.

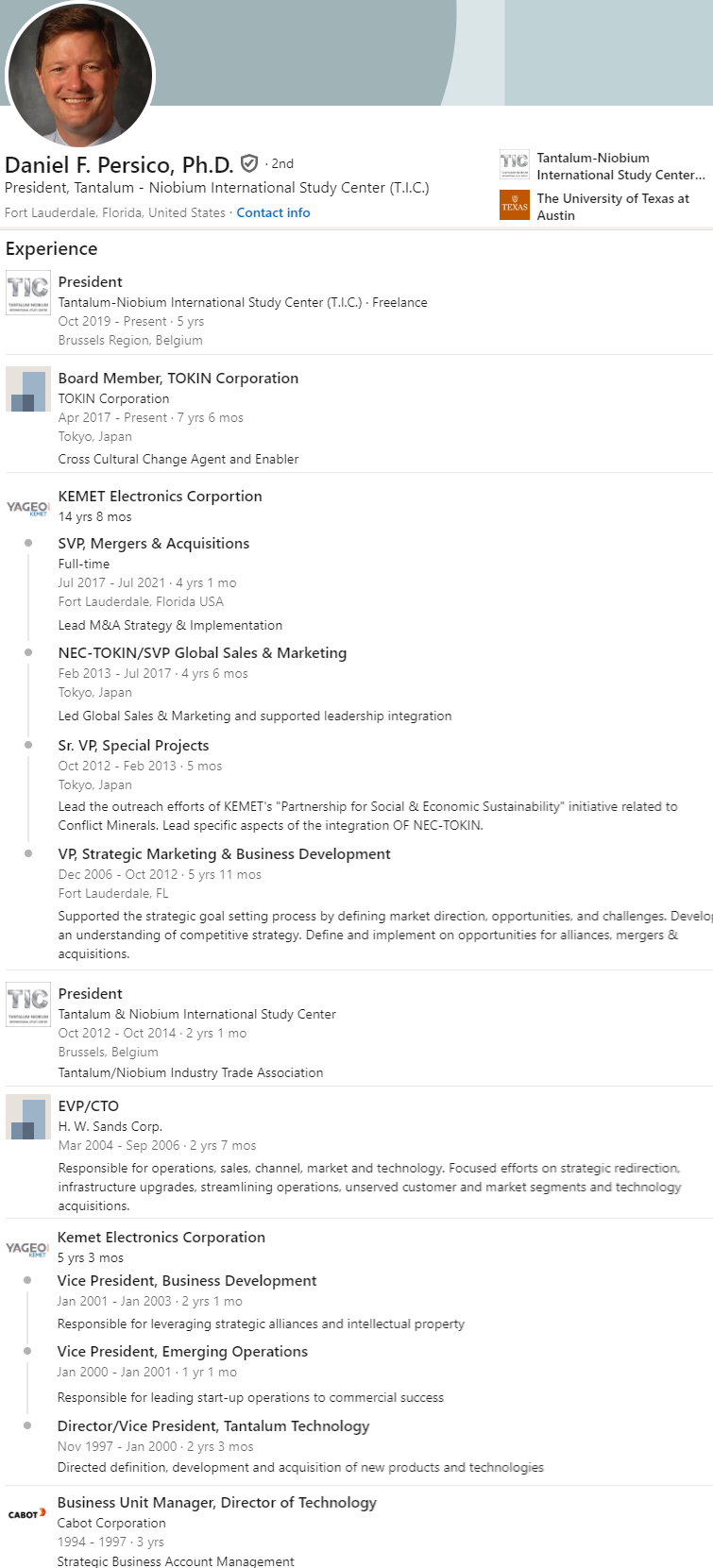

Capacitor Metals Corp. proudly announced the addition of US-based Dr. Daniel F. Persico to its Advisory Board. With nearly 30 years of experience in the tantalum and niobium industries, Dr. Persico is a leading figure, currently serving his seventh term as President of the Tantalum-Niobium International Study Center (T.I.C), the global association for these critical materials. He also heads MTAL LLC, a consultancy specializing in conflict minerals. His extensive expertise positions him as a highly valuable asset to Capacitor Metals. Together with Germany-based Dr. Axel Hoppe, the former Head of Technical Services and Engineering Group at H.C. Starck GmbH – once the world’s largest consumer of tantalum – Capacitor Metals has assembled an extraordinary team to drive the advancement of the Blue River Project. With a wealth of expertise, deep-rooted industry connections, and unparalleled knowledge in tantalum, this powerhouse team is uniquely positioned to accelerate the project’s success and establish Capacitor Metals as a key player in the global tantalum market. Their combined experience and influence make this a formidable force in the industry.

Until 2021, Dr. Persico served as Senior Vice President of Mergers & Acquisitions at KEMET Electronics Corp. (a subsidiary of Taiwan-based YAGEO Corp., the global leader in tantalum capacitors and chip resistors with 51 manufacturing sites and 40,000 employees worldwide, and a current market capitalization of $10 billion USD), where he held pivotal roles in R&D, Marketing, and Business Development. With a product line consisting of nearly 5 million distinct part configurations, KEMET manufactures a broad selection of capacitor technologies, including tantalum and supercapacitors. His career also includes a tenure as Senior Vice President of Global Sales & Marketing at NEC TOKIN Corp., where he was based in Tokyo, Japan. Dr. Persico holds a Bachelor of Science degree in chemistry from Boston College and a Ph.D. in chemistry from the University of Texas at Austin.

Chris Grove stated in Capacitor Metals‘ latest news-release: “I am very excited to have Dan working with us to advance the Upper Fir tantalum & niobium deposit here in British Columbia. I have known and respected Dan for many years. His leadership as President of the TIC for 7 terms, and his leadership at KEMET Electronics, gives him a unique professional experience that is basically unrivaled in this commodity. We look forward to benefiting from his significant input on advancing into production a new source of material for the world market.“

Dr. Dan Persico commented: “Looking forward, Capacitor Metals Corp. has the capability to play a key role in tantalum and niobium source diversification. This is extremely important given the global focus on critical minerals sourcing, in conjunction with existing concerns regarding ethical sourcing practices which are already impacting material availability.“

About Dr. Daniel F. Persico

Dr. Daniel F. Persico is a highly accomplished professional with a career spanning over 20 years at KEMET Electronics, where he held leadership roles in Technical Management, Business Development, Global Sales & Marketing, and Cross-Border M&A, including Post-Merger Integration. His extensive experience in shaping successful growth strategies has fueled his passion for supporting early-stage and mid-sized organizations, driving them to achieve their next level of success.

Throughout his career, Dr. Persico has held executive positions in industries ranging from specialty chemicals, plastics, and metals to electronic materials and components. His expatriate experience in Japan, where he worked with a pre-merger joint venture, gave him valuable insight into cross-border business integration and the cultural challenges that can impede communication and progress. With a track record of leading successful R&D, business development, technology scale-up, and global sales and marketing teams, Dr. Persico brings a unique blend of cross-functional expertise to both Fortune 500 companies and mid-sized organizations. His broad range of skills is highly sought-after by companies needing leadership that can navigate the complexities of the global corporate landscape.

Dr. Persico is currently serving his seventh term as President of the Tantalum & Niobium International Study Center (T.I.C.), a non-profit association dedicated to raising awareness of the extraordinary properties of tantalum and niobium. Early in his career at DuPont, he focused on market segmentation, a theme that continues to influence his work. He also spearheaded KEMET’s Partnership for Social & Economic Sustainability, an initiative aligned with the Dodd-Frank 1502 legislation and focused on conflict minerals and mining in the Democratic Republic of Congo. Before joining KEMET, Dr. Persico spent a decade at DuPont and held key roles at Cabot Corp. He has served as a board member for TOKIN Corp. and Novasentis Corp. (now part of KEMET) and is currently an advisor at LinkedIn.

Dr. Persico holds a BS in Chemistry from Boston College and a Ph.D. in Chemistry from the University of Texas at Austin. His wealth of experience and leadership make him a key figure in the tantalum and niobium industries.

About the Tantalum-Niobium International Study Center (T.I.C.)

• Founded in 1974 under Belgian law, the T.I.C. began as the “Tantalum Producers International Study Center“ and operates as an international non-profit association. In 1984, the name was changed to the “Tantalum International Study Center”, reflecting the broader membership. In 1986, the name was again changed to what we have today, the “Tantalum-Niobium International Study Center”, reflecting the influx of niobium producers and processors that started around 1983.

• Early on, membership at the T.I.C. was limited to tantalum miners and processors, with the by-laws changing over time to include traders, industrial consumers, commercial intermediaries, end-users, etc., resulting in a broad representation of the entire supply chain for tantalum and niobium that we have today.

• Today, the T.I.C. represents the global tantalum and niobium industries: Around 90 members from over 30 countries involved with all aspects of the tantalum and niobium industry supply chain (mining, trading, processing, metal fabrication, capacitor manufacturing, recycling, other end-users such as medical, aerospace...)

• T.I.C.‘s work includes a number of sub-topics such as responsible sourcing and artisanal and small-scale mining (ASM). The scope of this work is global, with the principles of responsible sourcing firmly based on the “OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas”. The T.I.C. has collaborated with the OECD since 2009 and helped in the drafting of these due diligence guidelines.

• T.I.C. produces annual statistical reviews of the tantalum and niobium industries. These statistics show the main trends in the quantities of niobium and tantalum produced and consumed. Detailed quarterly reports are circulated to participating T.I.C. members and annual summaries are available to non-members through “The Bulletin“ newsletters.

• Every year, the T.I.C. awards the renowned Anders Gustaf Ekeberg Tantalum Prize (“Ekeberg Prize“), recognizing excellence in tantalum research and innovation. The Ekeberg Prize increases awareness of the many unique properties of tantalum products and the applications in which they excel.

Investor Event with Capacitor Metals

Click above player or here to watch the recording of the online presentation.

New Interview about the Blue River Project and the Tantalum Market

Click above player or here to watch the interview, where Chris Grove discusses many fascinating insights, including the vital role of tantalum in the electronics industry and how this rare metal revolutionized mobile phone miniaturization.

Following the initiating coverage on Capacitor Metals Corp. last month, an interview was released recently in which the company‘s newly appointed President and CEO, Chris Grove, talks about the history and future of the Blue River Project and the dynamics of the tantalum market.

• According to the interview, Chris wanted to meet the world‘s two largest tantalum processors in Japan last week.

• Chris also mentioned: “The thing about tantalum is that it has recently gone through a major sea change in terms of supply and demand dynamics. The dominant source of tantalum supply over the last 15 years has been Central Africa. But for the last 5 or 6 years we have been hearing that the production amounts from Central Africa had been falling and continue to fall, and that the downstream industry was looking for new sources of raw material – and that potentially is our Blue River Project here in British Columbia.“

• Chris explained: “We ended up proving up one of the world‘s largest resources for tantalum and I am not sure that there is a larger defined resource of tantalum in the world at this point in time.“

• The Upper Fir Deposit at the Blue River Project hosts 54 million tons averaging almost half a pound (lb) of tantalum per ton (Indicated and Inferred; historic). This translates into ~24 million lbs (or 10.56 million kg) of contained tantalum. Additional >20 known carbonatite targets on the Blue River Property offer significant expansion potential.

• According to historic cost estimates (2013) for the Upper Fir Deposit, operating expenses (OPEX) of $38.44 USD/ton milled result in high operating margin and the lowest OPEX of direct developer peer group. As the deposit also hosts significant niobium as by-product, a credit of $36.04 USD/t was calculated, resulting in total OPEX of just $2.40 USD/t milled (including mining, processing, material handling, and G&A).

The historical information on the Blue River Property is relevant only as an indication that some mineralization occurs on the property, and no resources, reserve or estimate is inferred. A qualified person has not done sufficient work to classify the historical information as current mineral resources or mineral reserves; and neither Rockstone nor Capacitor is treating the historical information as current mineral resources or mineral reserves.

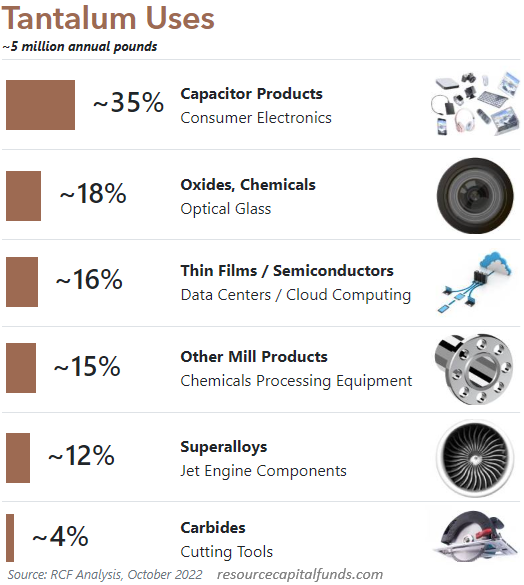

Full size / “Rare, resistant to corrosion, superconductive, and incredibly hard, tantalum may be the most intriguing – and the most important – metal you’ve never heard of... Over 50% of the tantalum produced is used in electronic capacitors and microchips...“ (Resource Capital Funds)

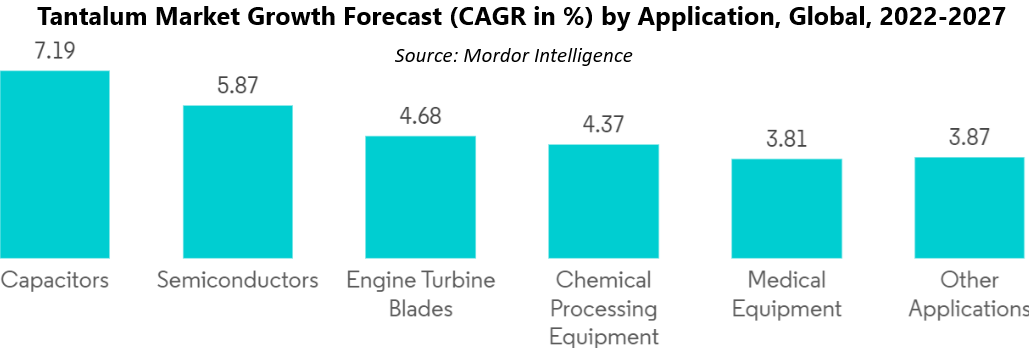

Full size / The global computers and information terminal devices export reached ~$2.9 billion USD in 2021, with a growth of 106.5%. This is further expected to grow in the coming years, thereby enhancing the demand for the tantalum market. Additionally, the global consumer electronics market is expected to grow by 5% in 2022. In 2022, the lighting segment should again manage a slightly higher growth of 6% to ~$147 billion USD, while domestic electric appliances (to ~$305 billion USD) and consumer electronics (to ~$285 billion USD) might each increase by 5%. This growth is expected to enhance the demand for tantalum-based capacitors from consumer electronics applications. (Source)

• "Tantalum has been a very quite player that supports a multi-trillion dollar industry and I think maybe a lot of investors might not be aware of the absolute essential importance of tantalum allowing for the miniaturization of all electronics. Tantalum highest and best use is in electronic capacitors. And capacitors regulate the flow of electricity into everything that is electrical or electronic." (Chris Grove)

• “In terms of moving forward, one of the exciting things is that we have a significant amount of material that was taken out in a bulk sample in 2009-2010. Some of that we have at the base of the mountain proximal to the deposit... but we also have 500-600 tons of material here in Vancouver in a warehouse. We actually went out yesterday and took about a hundred kilograms of that material... So in moving forward, we are looking to start this hydrometallurgical program, produce samples for industry and ideally attract an industry player into some kind of offtake or partnership agreement." (Chris Grove)

Click on the player above or here to watch a video from Capacitor Metals Corp. about the special properties and applications of tantalum, and the strategic importance of the Blue River Project.

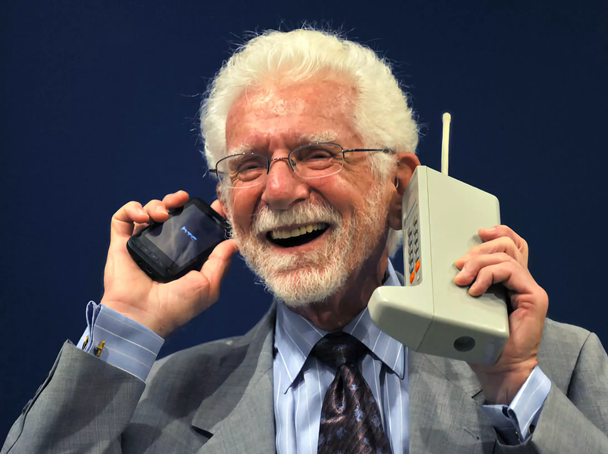

Full size / Source / “Martin “Marty” Cooper is better known as the “father of the cell phone,” and rightfully so. He invented the first handheld cellular mobile phone in 1973, led the team [at Motorola] that developed the DynaTAC 8000x (DYNamic Adaptive Total Area Coverage) and then successfully brought it to market in 1983. Measuring 10-inches long, it weighed in at a hefty 2.5 pounds... This mobile phone had only 30-minutes of talk time before needing a 10-hour recharge. Fortunately, for those who could afford the $10,950 USD (adjusted for inflation) phone back in the 1980s, battery life wasn’t really an issue since most couldn’t hold the device up for even close 30-minutes. On the bright side, after four iterations, the handset was reduced to half its original weight.“ (Source) As lighter and more compact phones emerged, made possible by the use of tantalum capacitors instead of aluminum capacitors, Motorola’s DynaTAC became known as “the brick.” “While the Motorola DynaTAC 8000X was a groundbreaking invention and paved the way for mobile communication, it had limited functionality compared to modern smartphones. However, at that time, it was a revolutionary device that introduced the concept of mobile telephony to the world.“ (Source)

Previous Coverage

Report #1: “Capacitor Metals: Big plans for one of the world‘s biggest deposits of tantalum and niobium“ (WEB / PDF / DEUTSCH)

Company Details

Capacitor Metals Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 484 2700

Email: info@capacitormetals.com

www.capacitormetals.com

Canadian Symbol: Not Listed

German Symbol / WKN: Not Listed

Contact:

www.rockstone-research.com

Disclaimer: This report, the referenced news-releases and external articles contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Capacitor Metals Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Capacitor Metals Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedarplus.ca. Please read the full disclaimer within the full research report as a PDF (see here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Capacitor Metals Corp., as well as equity of Zimtu Capital Corp., and thus will profit from volume and price appreciation of those stocks (Capacitor Metals Corp. is a private company not listed on a stock exchange at this date). The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. holds an equity position of Capacitor Metals Corp. and thus will profit from volume and price appreciation if the featured company will be listed on a stock exchange. Note that Capacitor Metals Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Capacitor Metals Corp. (“Capacitor“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Capacitor‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward looking include that Capacitor, or any other company or market, will perform as expected; that exploration has or will discover a mineable deposit; that Capacitor is advancing into production a new source of tantalum for the world market; that Dr. Persico’s extensive expertise positions him as a highly valuable asset to Capacitor; that together with Germany-based Dr. Axel Hoppe, Capacitor has assembled an extraordinary team to drive the advancement of the Blue River Project; that with a wealth of expertise, deep-rooted industry connections, and unparalleled knowledge in tantalum, this powerhouse team is uniquely positioned to accelerate the project’s success and establish Capacitor as a key player in the global tantalum market; that their combined experience and influence make this a formidable force in the industry; that we ended up proving up one of the world‘s largest resources for tantalum and I am not sure that there is a larger defined resource of tantalum in the world at this point in time; that for the last 5 or 6 years we have been hearing that the production amounts from Central Africa had been falling and continue to fall, and that the downstream industry was looking for new sources of raw material – and that potentially is our Blue River Project here in British Columbia; that in moving forward, we are looking to start this hydrometallurgical program, produce samples for industry and ideally attract an industry player into some kind of offtake or partnership agreement; that I am very excited to have Dan working with us to advance the Upper Fir tantalum & niobium deposit here in British Columbia; that we look forward to benefiting from his significant input on advancing into production a new source of material for the world market; that looking forward, Capacitor Metals Corp. has the capability to play a key role in tantalum and niobium source diversification, and that this is extremely important given the global focus on critical minerals sourcing, in conjunction with existing concerns regarding ethical sourcing practices which are already impacting material availability; that Chris wanted to meet the world‘s two largest tantalum processors in Japan last week; that the Upper Fir Deposit at the Blue River Project hosts 54 million tons averaging almost half a pound (lb) of tantalum per ton (Indicated and Inferred; historic). This translates into ~24 million lbs (or 10.56 million kg) of contained tantalum; that according to historic cost estimates (2013), operating expenses of $38.44 USD/ton milled result in high operating margin and the lowest operating costs of direct developer peer group, that as the Upper Fir Deposit also hosts significant niobium as by-product, a credit of $36.04 USD/t was calculated, resulting in total OPEX of just $2.40 USD/t milled (including mining, processing, material handling, and G&A); that additional >20 known carbonatite targets on the Blue River Property offer significant expansion potential; that the global computers and information terminal devices export reached ~$2.9 billion USD in 2021, with a growth of 106.5%, and that this is further expected to grow in the coming years, thereby enhancing the demand for the tantalum market; that additionally, the global consumer electronics market is expected to grow by 5% in 2022; that in 2022, the lighting segment should again manage a slightly higher growth of 6% to ~$147 billion USD, while domestic electric appliances (to ~$305 billion USD) and consumer electronics (to ~$285 billion USD) might each increase by 5%; that this growth is expected to enhance the demand for tantalum-based capacitors from consumer electronics applications. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include: Capacitor‘s securities will not get listed on a stock-exchange which means that shareholders may not be able to trade; the agreement between the vendors and Capacitor will not be completed or fulfilled; the receipt of all necessary approvals and permits for a stock exchange listing, property agreement, exploration and mining; the ability to find sufficient mineralization to mine; uncertainty of future production, uncertain capital expenditures and other costs; financing and additional capital requirements for exploration, development and construction of a mine may not be available at reasonable cost or at all; mineral grades and quantities on the projects may not be as high as expected; samples found to date and historical drilling may not be indicative of any further potential on the properties; that mineralization encountered with sampling and drilling will be uneconomic; that the targeted prospects can not be reached; the receipt in a timely fashion of further permitting; legislative, political, social or economic developments in the jurisdictions in which Capacitor carries on business may hinder progress; there may be no agreement with neighbors, partners or government on developing the respective projects or infrastructure; operating or technical difficulties or cost increases in connection with exploration and mining or development activities; the ability to keep key employees and operations financed; what appear at first to be similarities with operating mines and projects may not be substantially similar; share prices and market valuations of Capacitor and other companies may fall as a result of many factors, including those listed here and others listed in the companies’ disclosure; and the resource prices available when the resource is mined may not be sufficient to mine economically. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on Capacitor’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of Capacitor’s projects is no guarantee for mineralization on the properties from Capacitor, and all of Capacitor’s projects are exploration projects. The historical information on the Blue River Property is relevant only as an indication that some mineralization occurs on the property, and no resources, reserve or estimate is inferred. A qualified person has not done sufficient work to classify the historical information as current mineral resources or mineral reserves; and neither Rockstone nor Capacitor is treating the historical information as current mineral resources or mineral reserves. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies. As per Capacitor’s news-release on September 5, 2024: “Forward Looking Statements: This news release contains forward-looking statements, which includes any information about activities, events or developments that the Company believes, expects or anticipates will or may occur in the future. Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include that the Company is specifically focused on the development of its Blue River tantalum and niobium deposit in British Columbia, It is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Risks and uncertainties include economic, competitive, governmental, environmental, and technological factors that may affect the Company’s operations, markets, products, and prices. Factors that could cause actual results to differ materially may include misinterpretation of data; that we may not be able to get equipment or labour as we need it; that we may not be able to raise sufficient funds to complete our intended exploration and development; that our applications to drill may be denied; that weather, logistical problems or hazards may prevent us from exploration; that equipment may not work as well as expected; that analysis of data may not be possible accurately and at depth; that results which we or others have found in any particular location are not necessarily indicative of larger areas of our properties; that we may not complete environmental programs in a timely manner or at all; that market prices for tantalum & niobium may not justify commercial production costs; and that despite encouraging data there may be no commercially exploitable mineralization on our properties.”

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known, or if the company is private and not listed on a stock exchange with an intent to go public. The author of this report, Stephan Bogner, is paid by Zimtu Capital, a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu Capital is to research and report on companies in which Zimtu Capital has an investment. So while the author of this report is not paid directly by Capacitor Metals Corp. (“Capacitor“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of Capacitor’s stock prices if the company is successful in obtaining a listing on a stock exchange. The author also owns equity of Capacitor, as well as an equity position in Zimtu Capital Corp., and thus will also benefit from volume and price appreciation of those stocks if the company is successful in obtaining a listing on a stock exchange. Capacitor Metals Corp. pays Zimtu Capital Corp. to provide this report and other services. As per news-release on June 17, 2024: “Zimtu Capital Corp. (TSX.V:ZC)(FSE:ZCT1) (the “Company” or “Zimtu”) announces it has signed an agreement with Capacitor Metals Corp. (“Capacitor”) to provide its management & services program. Zimtu will receive $150,000 from the company for the duration of the one-year contract. Zimtu’s management & services agreement includes office space, accounting services & management consulting services, including guiding the company through its fundraising activities and it’s progression as a private company.” Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Capacitor and the public domain.