BACKGROUND

From Hunting to Catching Invisible Elephants in Nevada

In early 2011, we did our first interview with senior geologist David C. Mathewson, Vice President of Exploration with Gold Standard Ventures Corp. (NYSE/TSX: GSV; Frankfurt: 6AZ). Almost 3 years later, we could not hold our horses any more to ask some of the many newly emerged questions that rush into mind when reading through the news that this second-to-none exploration company released since then. DaveÂ’s answers are fascinating to say the least and uncurtain the kind of once-in-a-lifetime opportunity that investors are exploring for so desperately, especially since the last couple of years.

Gold Standard Ventures Corp. (“GSV”) is a company that was founded and is managed by two outstandingly smart entrepreneurs, namely Jonathan Awde and Luke Norman, who both deserve endless credit for their brave vision and hard work to perfectly coalescing a public company with the prospects of the Railroad property. This was uniquely achieved thanks to both their one-of-a-kind vision and conceptualized mission, experience and expertise, as well as delicate and fair negotiation skills, having all resulted in successfully consolidating and acquiring the Railroad District besides delivering the results to the market in such a prudent and wise fashion that other exploration companies can take a leaf out of their book. The shareholder structure of the company, that both are responsible for, speaks for itself and is a prime example and the result of how a public exploration company should be run.

The whole corporate and exploration team behind this company is a seemingly inimitable textbook-like example of how a junior exploration company should be shaped, yet we are sanguine that they are merely paving the pioneer way of becoming the “gold standard” for the mining industry of tomorrow on how to venture a prospective guess.

The companyÂ’s stock just started thriving despite precious metal prices correcting once again. We expect this outperformance to the general mining market to remain open-ended and donÂ’t even dare to imagine how the share price may bloom during booming metal prices.

Since our last interview, Dave and his team not only discovered the North Bullion deposit – that is likely to turn out to be larger than Newmont’s Rain Mine (+6 million gold ounces) in operation only a stone’s throw away – but they have recently unleashed the vast potential of soon discovering several other gold deposits, just like North Bullion, on their +10 km long Bullion Fault Corridor:

On October 2, the company reported highly important drill results from the center of its large Railroad property, also known as the Central Bullion target area or more specifically the Bald Mountain dome, where gold and copper were encountered in two separate zones of mineralization indicating the presence of a mineralized porphyry intrusion that is outcropping at surface.

This central area may not only represent a separate mineable deposit in completely oxidized rock (faster and cheaper to mine besides easier to permit) with potentially several polymetallic deposits surrounding it, but this large porphyry intrusion seems to have supplied the necessary heat and fluids to be the engine behind mineralizing distal gold deposits, just like North Bullion, so richly.

“We consider Railroad to be one of the few quality Tier 1 (+20moz potential) drill hole plays in the market.”

(Macquarie Capital Markets Canada Ltd. on October 3, 2013)

Live Chart: http://scharts.co/19TrOx6

INTRODUCTION

David Mathewson is one of the most renowned and respected geologists when it comes to Nevada – not only because he was the Head of Exploration for Newmont in Nevada and now already having an experience of +35 years focusing on this single US state. Numerous discoveries (+25 million gold ounces) on the Carlin Trend are credited directly to his hands-on work and knowledge. He also developed the famous and now commonly-used “Rain Model” on the prerequisites for the existence of Carlin-type gold deposits.

“I helped found and committed to become part of Gold Standard Ventures when it was evident that we were going to be able to acquire the Railroad district property. The Railroad district is located immediately south and adjacent to the Rain district on the Carlin Trend. I have many times referred to them both as “sister” districts because of their proximity to each other and their almost identical geological characteristics. In the past, Railroad has been very underexplored with none of the tools or ideas that worked so exceptionally well in the Rain District ever having been applied to Railroad. From 1992 through 1994, I worked the Rain district for Newmont and was responsible for discovering several new gold deposits, comprising 4 to 5 million ounces. During this time and later while with Newmont, I tried several times to acquire Railroad on behalf of Newmont for the purpose of exploring what I recognized many years ago as a very high potential district. At that time, the economic encumbrances of excessive gross royalties, in places exceeding 10%, could not be overcome. Gold Standard Ventures acquired the property in 2009 with very reasonable underlying royalties.”

(David C. Mathewson in an interview on February 19, 2011)

Interestingly, the Railroad district – which today is almost completely controlled by GSV – represents the last vastly underexplored district on the “Carlin Trend” that was once even called the “Railroad-Pinion Trend”. This is due to the fact that Railroad was not available to companies as strong hands held it until GSV successfully acquired and consolidated this district for their shareholder’s sole benefit.

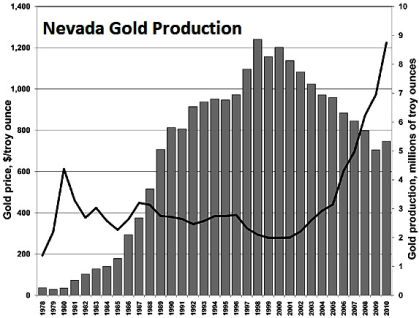

The rich and large Carlin-style gold deposits of Nevada were once overlooked by the 49ers in the late 1800s when rushing along Nevada’s Emigrant Trail to the gold fields of California. It was not until 1961 when commercial production started from Carlin-type gold mines. Both is due to the fact that Carlin-style gold occurs microscopic – only a few microns in size and thus invisible to the naked eye. While the gold grades at many Carlin-type deposits is extraordinarily high, no metal detector can notice micron-sized gold particles. Not even a gold pan can capture these. Only fire assay of sampled or drilled rock can reveal the gold without any difficulty. The obscure gold particles on the Carlin Trend were deposited so quickly near surface that they had no time to grow larger. While the gold is not visible, the deposits are typically located along several trends that constitute the world’s second largest concentration of gold, after the Witwatersrand Gold-Uranium Reef in South-Africa.

Carlin-type deposits dominate US gold production and have been responsible for the position of the United States as a leading gold producer. With around 6% of global mine output, Nevada even ranks among the Top-10 largest gold producing countries. However, on an acre-per-acre basis, the north-eastern quadrant of Nevada, where 85% of the stateÂ’s output comes from, is the most productive gold mining area on the planet.

More than half of NevadaÂ’s annual production originates from the Carlin Trend, where more than 40 deposits have been discovered and developed into mines since 1961, when the Carlin deposit was found. Since then, more than 100 geologically similar Carlin-type deposits containing +200 million ounces (6,000 tons) of gold have been identified in Nevada. Most of these deposits occur in a few linear-occurring districts, known as trends. Although a number of deposits around the world are described as Carlin-type, no district outside Nevada contains similarly large and numerous gold deposits.

Nevada has become to gold what Saudi Arabia is to oil with the difference that a lot of gold remains to be discovered. NevadaÂ’s total gold output over the last 160 years is greater than any other American gold rush, even California; yet this was achieved predominantly during the last 30 years.

On a per “Dollar spent on exploration” basis, Nevada is the cheapest place in the world to find gold and has the world’s highest success rate for new gold discoveries. Discovery rates have averaged 7 million gold ounces per year during the last 30 years. Until today, seven gold deposits with +20 million ounces have been identified in Nevada. Between 1835-2008, some 150 million gold ounces were mined in the “Silver State”. In 2011 alone, Nevada’s mine output exceeded 6 million gold ounces representing 83% of total US mine output . The biggest Nevada miners are Barrick and Newmont, whereas 22 major processing facilities are currently in operation. In 2011, the Carlin Trend accounted for 43% of Barrick’s and 34% of Newmont’s worldwide gold production – it was Carlin-type deposits that made Barrick and Newmont the world’s biggest gold miners as this region hosts many of the largest and most profitable gold deposits of the world.

“With a long history of mining, land ownership has changed significantly and advances in geological models have created opportunities in areas where historical exploration had not identified the potential for significant mineralization—especially blind deposits… It is rare for a junior precious metals explorer to secure a prospective, large, 100%-controlled land position in a productive gold trend, let alone the Carlin Trend. If Gold Standard Ventures can document a significant gold system then we believe the seniors will look to consolidate the Railroad project as it could become highly strategic to Nevada growth prospects, especially for the producers with processing facilities.”

(Macquarie Capital Markets Canada Ltd. on August 2, 2012)

THE INTERVIEW

Stephan Bogner: Please explain the significance of the North Bullion (NB) deposit discovery and the potential of numerous other gold deposits like NB along the +10 km Bullion Fault Corridor (BFC).

David C. Mathewson:

The North Bullion (NB) deposit is the first major north Carlin-style discovery in the Railroad District although hints of similar-style deposits were indicated by the small POD deposit and somewhat, but not so much, the Pinion deposit. Only a small portion, i.e. 1 km of the +10 km Bullion Fault Corridor (BFC) has received any prior drilling specific to targets along the BFC. The discovery of the NB deposit, that is still being expanded by drilling, was what may be considered a “breakthrough” discovery. The deposit is the biggest discovered to date in the district and has all the characteristics of the bigger and richer of Carlin-style deposits in Nevada. Interestingly, essentially every gold district in Nevada has had a history of the smaller deposits being discovered first because they are located and sometimes exposed within the ranges. The larger deposits are generally discovered later because they are under cover within big structural zones that tend to flank the ranges.

How many targets have you identified to date and how do these compare to the size of the NB deposit (expected depth, mineralization, brecciation, faults, rock permeability, etc.)?

Several targets have been identified based on a coincidence of fault intersections, anomalous geochemistry, and/or gravity and controlled source audio magneto-telluric (CSAMT) gradients. CSAMT is specifically applicable to identifying targets modeled after the recently discovered NB deposit, specifically the CSAMT model is designed to discover permissive rock packages elsewhere within the 10 km long BFC that hosts the NB deposit. The full extent of the NB deposit has not yet been determined, but the credentials are similar to North Carlin deposits, i.e. along the Post Fault, in the 1-5 million gold ounces range. The possibility also exists for a very large deposit to be present. The GSV exploration process is one of early “scout“ drilling to provide early sub-surface information where none essentially exists. Targets along the BFC are largely blind, i.e. without surface expression, again – very similar to the other district deposit settings on the Carlin Trend. We now understand that the Carlin-type gold systems have a large vertical aspect that may extend to 100’s or 1000’s of meters below the surface.

The NB deposit and the Central Bullion target area were both gravity and CSAMT based discoveries. Numerous gravity-indicated structural targets remain to be drill tested for the very first time. The lateral dimension of the gravity high at Railroad is almost four times as large as of the neighboring Rain Mine. Please compare the NB deposit and the BFC to the other 3 Windows and other districts in Nevada; do other districts have similar corridors with such an extensive brecciation, rock fractures and faults or is the BFC something special in terms of size, structure, depth, or else?

Other districts all have similar ingredients, i.e.:

- a) Large, strong geochemical and alteration expressions.

- b) Extensive development and presence of breccias.

- c) Doming by complex Tertiary intrusives; Railroad has same age and intrusive types as elsewhere on Carlin Trend.

- d) Permissive host rocks at or near surface. The Pinion deposit is exposed at surface. The POD deposit is exposed at surface. The NB deposit starts at about 100 to 150 meters below surface – the surface is comprised of weakly altered rock, and unaltered post-mineral rock and gravel (QAL).

- e) Large fault size and patterns are the same as elsewhere on the Carlin Trend, i.e. NS, WNW, and NE feeder fault directions.

What is the plan of action now, how many rigs are planned to be in action at the NB deposit and how many at the other targets along the BFC?

It is very important that we continue to both search for additional gold deposits and define the deposits that we have discovered. Optimally GSV could use one RC rig and 2-3 core rigs for the BFC and the NB deposit delineation. The number of rigs could and should increase to two additional rigs for each discovery indicated by favorable results from scout and follow-up holes.

What is the maximum depth GSV will drill out the NB deposit and how deep will GSV drill test the other targets? Only core drilling planned?

The currently known upper portion of the NB deposit bottoms in the 500 meters range but high grade underground mineable feeders may also exist. We do our best to follow and chase the gold systems to depth, but this becomes increasingly difficult and more expensive the deeper we go. For now, we are largely focused on discovering the more shallow deposits. Core drilling provides important geological information and one core hole is worth two to three RC holes in understanding the important mineralization controls and the deposit model. RC drilling assay results are not generally as reliable because of mixing and washing of the barren and/or mineralized chip material.

Any other exploration methods active and planned?

All exploration methods (geological, geochemistry, geophysics models) have been considered and utilized, or not as the case may be. Fundamentally, discovery comes as a result of drilling holes and drilling holes in the right places.

Please also explain the significance of your recent news from September 19, 2013, announcing assays of drill hole RR13-11 that intersected 98 m of 3.3 g/t gold (incl. 17 m of 10 g/t gold) in the lower breccia. All previous high grade mineralization on NB was hosted in the upper breccia (typically, the large Carlin-type gold deposits elsewhere in Nevada were discovered in the lower breccia). What is the difference of lower and upper breccia and why is this important to understand, especially when comparing with previous drill holes in proximity.

This high grade intercept followed up RR13-08 that intersected 73.5 meters of 3.67 g/t gold about 50 meters to the east. The two intercepts in combination defined excellent continuity and uniformity of mineralization within the lower breccia body host unit comprised almost entirely of dissolution related collapse breccia. The upper breccia zone is more of a tectonic breccia, that is fault related, and tends to be erratic in character; therefore gold grade distribution is erratic / erratically distributed within the upper breccia zone. The lower breccia in comparison is uniform, i.e. open-space and configuration; largely wedge shaped with true flat-tabular thicknesses of 300-500 feet (91-152 meters), almost completely untested strike length, and indicated breccia body widths of 150-250 meters; grade tends to decrease going away from feeder zone which is often a “thickened collapse trough“ within the breccia body.

What is the plan of action now after having discovered high grade mineralization in the lower breccia, will you drill some existing or newly planned holes deeper to explore for the lower breccia zone that is now likely to be located also beneath the shallow NB deposit found to date?

Exploration at North Bullion is now largely focused on pursuing and defining the lower breccia zone. Interestingly, the lower breccia style of host was actually the original gold deposit model pursued, but the upper breccia mineralization, that included some very high grades of mineralization, to some extent diverted our attention from more focus on collapse breccia zones. We simply did not have a good idea of the gold controls and distribution in the early discovery period. The lower breccia maintains good thickness, uniform grades from low grade into high grades, i.e. 1 to 3-4 g/t with zones of 10 g/t gold and has now become our primary target.

On November 13, 2012, GSV entered into a new lease agreement within the Pinion district encompassing around 19,000 net mineral acres (of which 2,620 acres of land is both within and contiguous to the south of GSVÂ’s Railroad district/property). GSV estimates this new acquisition to give control of approximately 51% of Pinion Section 27 which contains the bulk of the historic deposits called South Bullion, discovered by Newmont, and Trout Creek, discovered by Teck (together these are known as the Pinion deposit) for which considerable geologic and exploration data exist. Kindly inform us about these deposits and why these are important in the overall picture of the BFC. How does the southern Pinion deposit compare to the NB deposit up north (e.g. size, depth, state of oxidation, mineralization, alteration, etc.)?

An in-house model of the Pinion deposit developed by Cyprus Mining Company in 1995 indicates that the Pinion deposit is comprised of a total (known) resource of 30.6 million tons at 0.026 oz/st (0.89 g/t) gold for about 800 thousand ounces. Approximately half of the known ounces in the Pinion deposit are controlled by GSV. The other half of the known ounces is controlled by another junior mining/exploration company. Additional exploration potential exists in a westward to southward direction. At his time, nothing can be done by either controlling party until consolidation has been completed. The Pinion deposit is comprised of uniform grade oxide material hosted in a shallow dipping tabular breccia at/near the Webb Devils Gate contact. The average grade of this oxide material is about 1 g/t gold. The Pinion deposit is geologically and character-wise analogous to NewmontÂ’s currently in production, run-of-mine, heap leach Emigrant operation located in the Rain District just to the north. In comparison, the NB deposit is structurally complex and comprised of complex multi-stage breccias with locally much higher grades, i.e. 10 g/t gold. The Pinion deposit is a low strip, oxide deposit that could be permitted and put into production quickly. The mineralization is open to the west and south, and has the potential to be substantially large. It is open-ended and could perhaps be two times or more of the current size.

Historic drilling at Bald Mountain (Central Bullion area) indicated the possibility of a porphyry copper-gold deposit, however GSV was not able to drill test targets in this area, because disturbance for exploration on the public lands portion of the area was restricted. In December 2012, GSVÂ’s Plan of Operations for these public lands was approved so that exploration drilling could commence. Assays from GSVÂ’s first hole (first ever core hole, historically only RC) encountered gold mineralization in nearly completely oxidized hornfels breccia, which means that such a deposit could ultimately be amenable to low-cost cyanidization and/or acid leaching extraction (mine permission also less difficult to obtain). Latest news release of October 2 reported drill hole RRB13-1 to have intersected a gold-rich zone averaging 1.5 g/t for 56 m (incl. 7 m of 5.7 g/t gold). Immediately below this remarkable gold intercept, a separate copper-rich zone was discovered returning 23 m of 0.4% copper. Please comment on this.

In December 2012, GSV completed an Environmental Assessment (EA) and Plan of Operation (POO) for the purpose of being able to access and drill several additional target opportunities on the public lands portion of the Central Bullion and surrounding project areas. With the POO in place, GSV expanded the drilling program in the Central Bullion target area in 2013. The Central Bullion area is the historically mined area of the Railroad project that was mined and previously explored for copper, silver, gold, lead, zinc, and molybdenum. The host rocks in the Central Bullion area are comprised of intrusives, skarn, marbles, and hornfels, generally considered to be moderately high temperature (mesothermal) environments of metal emplacement. The epithermal temperature regime which hosts the gold dominant systems seems to meld with more mesothermal environment and suites of metals, i.e. the Central Bullion area and metallization is high in mercury. Prior to GSV exploration, very little geological information from previous drill holes was available, essentially only assay info and some of this was inconsistent and incomplete. GSV drilling in the Central Bullion area has encountered deep oxidation; this Railroad project. RRB13-1 intersected 56 meters of 1.5 g/t gold in oxide mineralization and 23 meters of 0.4% copper, also oxide, was intersected immediately below the gold zone. Significantly anomalous silver in the 10 g/t range was also encountered.

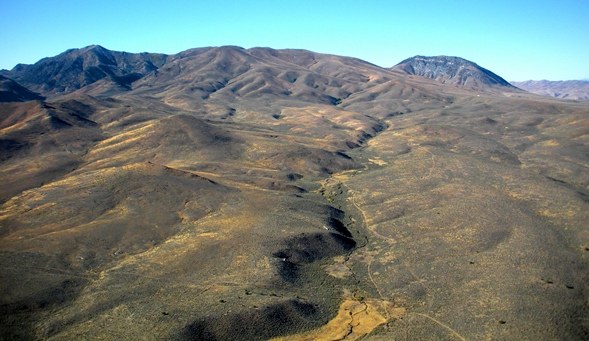

Looking towards the Railroad Dome aka Bald Mountain in the Central Bullion target area

with outcropping mineralization

Kindly explain the significance of both zones in regards of a potential deposit. Is this oxidized zone to be understood as an oxide cap of a sulfide deposit that lies beneath it?

Oxidation depths are highly variable throughout the Railroad district; both supergene (low temperature) and hypogene (high temperature) systems of oxidation appear to have been operative in the Central Bullion area and elsewhere in the district. This mix of temperature of oxidation origin lends toward the potential presence of completely obscured (even below zones of sulfides) mineralized oxide material. Oxide material has advantages of being easier to permit, and quicker and cheaper to exploit, i.e. CIL leach and/or heap leach operations vs. roaster and autoclave. The Central Bullion area now appears to have the necessary indications and ingredients for possible large tonnages of oxide material.

Land consolidation of 30 square km on a trend like this in Nevada has become very rare, really exceptional, these days, especially for a junior exploration company that just entered the region. Kindly elaborate in this respect, what could be the consequences in regards of a take-over by a senior mining company? Please also inform us on your shareholder structure and who is behind the recent placement of around 8 million shares at a price of $0.63/share for gross proceeds of $5 million, as we have heard from the street that Agnico-Eagle Mines Ltd. (TSX: AEM; market cap: $5 billion) has become a large shareholder.

From the time of the initial acquisition in late 2009 of about 12 square miles of area, we pursued and added additional lands we believed to be prospective for gold deposits. We now have full control of mineral rights and much surface rights for about 27 square miles and about another 11 square miles of partial mineral rights and full surface rights. Obviously the large property package assembled by GSV over the past four years makes the project much more attractive to majors, specifically providing multiple additional discovery opportunities, synergies and advantages of a multi-faceted district, and mine exploitability and sustainability enhancement. Yes, AEM has become a shareholder and is regularly monitoring GSV exploration progress.

Most of the deposits in Nevada occur along linear trends (Carlin, Battle Mountain-Eureka and Getchell Trends) that host the giant Betze-Post and Gold Quarry Mines, as well as the Carlin, Cortez, Cove, Deep Star, Genesis, Getchell, Lone Tree, Marigold, Meikle, Pipeline and Twin Creeks deposits, just to name a few. Early geologists came to the conclusion that Carlin-type deposits are a variety of shallow epithermal deposits. Others concluded that they likely formed under different conditions. After more than 40 years of mining these deposits in Nevada, most agree that Carlin-type deposits have unique characteristics, are different from typical epithermal systems and thus deserve their own classification as likely having formed under different conditions. However, a comprehensive and widely accepted genetic model does not exist. Sedimentary-hosted, disseminated gold deposits sometimes have been separated into two specific classes: Carlin-type and distal-disseminated gold-silver deposits. Although distal-disseminated deposits share many physical and geochemical characteristics with Carlin-type deposits, they are differentiated from Carlin-type deposits based on more links with porphyry related deposits. Virtually all deposits in Nevada occur as peripheral components of large, complex, hydrothermal systems. Some of the largest gold deposits in several districts in Nevada (especially Battle Mountain and McCoy) have been found zoned along major fault systems from proximal gold ±copper porphyry and/or skarn deposits, through surrounding polymetallic occurrences, to more distal distal-disseminated deposits. In 2003, Johnston used fluid inclusion, metal zoning and isotopic data to link Eocene magmatism, gold-silver skarn ore at McCoy and Carlin-type-distal-disseminated deposits ore at nearby Cove. At the McCoy-Cove, Battle Mountain and the Carlin Trend, exposed intrusions are shallow expressions of much larger intrusions at depth that are thought to have supplied heat and metal-bearing fluids to Carlin-type and distal-disseminated deposits. What are your comments in that respect when interpreting with your findings on Railroad?

Heat from intrusives undoubtedly drove the metal-bearing hydrothermal systems that were responsible for the base and precious metal deposits, including the Carlin-type deposits. The source of the metals and probably in particular the gold has remained enigmatic. A commonly believed best guess for the source of the huge amounts of gold that found its way to the upper crustal levels in Nevada is that the gold may have been extracted from lower crust, possibly in particular oceanic composition crust. Big, really big, structures appear to be an important component of where the biggest gold systems occur, i.e. Post Fault, Good Hope Fault, Rain Fault, Cortez Fault, and possibly the Bullion Fault zone at Railroad. This consistent big fault association with big gold deposits in Nevada would probably not be the case if metals were brought closer to surface by and within the magmas. In addition to major structural features, especially faults, another deposit ingredient to look for and to key in on are the more detailed structural complexities and potentially associated multiple mineral events. For example the collapse and tectonic breccias appear to have had multiple stages of development. Each stage potentially was accompanied by an additional influx of gold-bearing fluids thereby cumulatively imparting high grades of gold.

What can you tell us about the size and influence of the intrusion on your property when comparing with other intrusions in other windows? (“The Railroad District is underlain by large, Tertiary age, multi-phase intrusive complex which outcrops west of the Pinion anticline. The Bullion Stock is granodiorite with a later stage rhyolitic and quartz porphyry core and outcrops over less than a half of a square mile. Numerous dikes are found adjacent to and peripheral from the Bullion Stock.”)

The size, extent and complexity of intrusion activity at Railroad are comparable with all the best gold (and base metal) districts in Nevada, i.e. North and Central Carlin Trend, Cortez, Battle Mountain, Eureka, and Getchell-Twin Creeks. The Railroad district aeromagnetic expression is several square miles, i.e. 6-8+-. Our intrusive rock dates, including many types and sizes of dikes, show two age groupings, i.e. 38.3 mya and 37.5 mya, both Late Eocene typical of Nevada Carlin settings and even more in particular consistent with the Carlin Trend deposit dates. The Railroad, or Bullion, intrusive complex evolved into more siliceous from intermediate composition during this approximate 1 million years of time.

What does that mean in respect of a potentially very large porphyry-related copper-gold deposit on your property? Eroded away? Only skarns left besides distal-disseminated gold deposits like NB and likely several others like that in some distance away along trend?

The main porphyry-related metal system comprised of copper, silver, gold and other base metals, if it does in fact exist at Railroad, should be near current depths or possibly deeper. Indeed the presence of this large metal system is becoming more evident as we continue to drill more holes in the Central Bullion area, i.e. RRB12-3, RRB13-1 and -2. The local geology, especially the presence of portions of flanking proximal volcanic eruptive rocks, and the same age as the plutonic intrusive rocks, suggests shallow intrusive emplacement. The Railroad intrusive/extrusive system, along with alteration and metallization, is strongly suggestive of being near the top of a copper-base metals-precious metals porphyry system.

GSV announced on October 2, 2013, that vertical hole RRB13-1 (collared at Bald Mountain / Central Bullion target) intersected 56 m @ 1.5 g/t gold (incl. 7 m @ 6 g/t) in completely oxidized hornfels breccia and that immediately below this gold interval a separate copper zone returned 23 m @ 0.4% copper along with narrower but high grade intercepts of other base metals and silver (e.g. 1.5 m @ 764 g/t silver, 1.6% copper, 12% lead and 2.4% zinc). There is no doubt that this represents a major discovery, especially as the ore occurs close to surface and strongly oxidized which means that such a deposit can be brought into production relatively inexpensive and fast, because it looks open-pitable and gold recovery from oxidized material is typically much easier/cheaper. What are your comments in that respect?

The thicknesses and grades of copper and gold and silver mineralization are indicative of a porphyry-copper-style deposit. Much more drilling is necessary to establish the credentials of this targeted deposit. The mineralization encountered is associated with strong deep oxidation. All this mineralization was encountered at depths near to, and above the Davis tunnel level, meaning that the ore zone may be either a pitable depths or bulk-tonnage underground mining by means of lateral extraction. The presence of oxidized metal-bearing material bodes well for metal beneficiation and relatively easy and quick mine permitting.

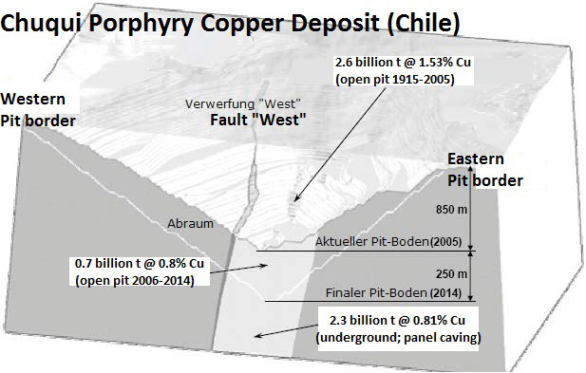

How does this recent discovery relate to your first discovery of the NB deposit in 2010, which is 1,500 m to the north? Is it possible that NB represents a distal-disseminated gold deposit and that Bald Mountain represents a supergenely-enriched oxidation zone/cap of a large porphyry copper-gold system that lies immediately beneath that oxidized cap? (Supergene mineral enrichments not only represent a valuable mining zone, but play an important role in the discovery of the actual deposit beneath and probably several smaller deposits around. The worldÂ’s largest porphyry copper deposit, Chuquicamata in Chile, started production in 1915 (4,500 tons copper per year) increasing output to 51,000 tons in 1920 and 136,000 tons in 1929. Until 1951, the oxidized cap above the actual deposit was mined. Thereafter and thereunder, the secondary formed copper sulfides were mined which formed by the leaching out of the above oxidation zone.)

Though some metal enrichment is possible, if not likely, the bulk of the mineralization and metal grades are probably more or less reflective of protore grades. The deeper portions of the holes penetrate into largely sulfidic material with similar grades to that in the oxidized zones. The NB deposit, that is essentially just gold, was formed in a metal depositional environment which was more distal to the intrusive. Early evidence suggests that all metals were introduced at or near the same periods of geological time, that is in the range of 38.3 to 37.5 mya. The more we have drilled the more we have come to believe that we are dealing with a large, polymetallic metal system with a variety of target environments and types. We yet have a long way to go to better understand what we are working on.

Essentially, does all that imply that several other gold deposits just like NB are likely on your property and that between Bald Mountain and NB lies a highly prospective target area for polymetallic deposits? And even more importantly, isnÂ’t it suggestive that GSV is looking at a large porphyry copper-gold deposit that is likely to be discovered soon? What are your comments in that respect?

The discovery process at Railroad has been and will continue to be incremental, and a systematic and somewhat slow building process. It is essentially a process of drilling hole to hole to hole and vectoring toward and into the various concentrations of gold, and or other metals. It has taken us almost four years to get to where we are at now, and that is the discovery of at least one significant deposit: North Bullion. We have learned a lot and have advanced our program on a number of fronts. Perhaps our current momentum will continue and deliver additional discoveries at a faster rate. Once a discovery has been made another drilling system of qualifying and quantifying tons and grades commences; this will add an additional increment of time to what we are doing, but this is a good thing and where we want to be in a number of localities on the Railroad property.

If Bald Mountain represents a major porphyry system, there may be several deposits near-by. Is it possible that the Rain Mine a few km up north is solely a distal-disseminated gold deposit (just like NB) that was formed in relation to the potentially huge porphyry system/deposit on Railroad’s Bald Mountain and that – typically – more high grade gold and base metal deposits are likely on your property? What are the potential consequences of your Bald Mountain porphyry and/or skarn discovery?

We believe the Rain gold system is associated with a satellite apophysis intrusive of approximately the same age as the Railroad intrusive. Rain and Railroad are thought to be separate systems that may connect, however, in the South Ridge / North Ridge area of our Railroad project to the north. The Rain intrusive, the presence of which is indicated by hornfels encountered in deep drilling at Rain, did not erupt / reach the surface except through dikes. The Rain District is not nearly as heavily intruded or is as structurally complex. The size and strength of the Rain hydrothermal system appears to be lesser than that of Railroad. The gold deposits in the Rain district, with the exception of the Saddle deposit, are generally somewhat lower than what we are encountering in the Railroad district. The potential consequence of the Central Bullion, polymetallic discovery is that ultimately this will contribute to the total economically mineable metal endowment and value of the Railroad district. It is becoming easier to envision Railroad becoming a major mining center in Nevada.

Kindly inform us about similarities between Railroad and the other 3 Windows, especially if porphyries were also discovered and what the consequences were in terms of exploration, mining/tonnage and depositional genesis.

Geologically the four windows or domes have many similarities and few dissimilarities. All of them are bounded, at least in part, by major structural corridors that have served as gold feeders zones. All of the windows include very permissive rock units and contacts favorable for gold deposition, and all the windows express large, strong geochemically anomalous hydrothermal systems. The Railroad geochemical system is in the upper tier category of the four. Copper-zinc-gold-silver porphyry in Maggie Creek dome area, i.e. Mike deposit in vicinity (Mike = 10-15 million ounces gold, +4 billion pounds copper, +4 billion pounds zinc and +100 million ounces silver). Our gold in hornfels is similar to Mike and the copper-zinc below the gold zone is similar to Mike. Is the Railroad “system“ as large as and does it contain as much metal as Mike? Very possibly.

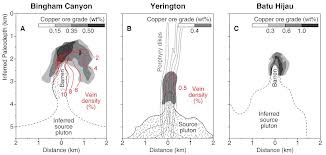

If GSV owns a porphyry copper deposit on its property, is it more like Bingham Canyon, Yerington-style mineralization, Chuqui, or what?

I would rather compare with Cove-McCoy, Copper Canyon (Fortitude), perhaps Yerington except for the presence classic Carlin-style gold deposits at Railroad. And the Carlin Trend is the best place to be in Nevada for the discovery of the biggest gold deposits. Gold StandardÂ’s primary focus is on discovery of more Carlin-type gold deposits.

What about alteration zoning encountered up to now? Any indication if the ore pockets or even the porphyry core have been drilled through yet? What are your plans in that respect?

The core intrusive porphyry zone was drilled to some extent by Kennecott, Amax, El Paso, but without significant copper results (at least that are known and were also reported as drill results). GSV is drilling the outer hornfels, skarn, and marble zone peripheral from the intrusive. The altered “shell“ extends to at least half mile laterally from the stock. The almost completely unexplored west flank of stock exhibits wider alteration and geochemical expression, i.e. up to one mile plus. Surface geochemistry indicates we are dealing with a very large porphyry metal system of dominantly copper, silver and gold. The anomaly appears like a “donut” with the Bullion intrusive at the center and it extends at least 2 kilometers in all directions from the center. The anomaly also appears to extend in greater portion to the west where the rocks at the surface are not as permissive. This geochemical “bulge” coincides with the big aeromagnetic high that also skews to the west. No drilling has ever been conducted to the more difficult to access west flank of the intrusive.

How does the porphyry on Railroad compare to the Copper Mountain copper-gold porphyry near Princeton, BC, Canada, especially when looking at the virtually outcropping intrusion at their Alabama Zone which may compare with the intrusion outcropping at your Bald Mountain? (The Copper Mountain Mine aka “Superpit” has resources exceeding 5 billion pounds copper and booked revenues of $230 million from the sale of around 60 million pounds copper, 20,000 ounces gold and 400,000 ounces silver in 2012. The average head grade is 0.31% copper at a cut-off grade of 0.15% copper.)

The systems appear to favorably compare. A second Carlin Trend porphyry system exists within the Maggie Creek dome complex that includes the Gold Quarry and Mike deposits. The Mike deposit is comprised of copper, zinc, gold and silver of probably porphyry origin. The Copper Mountain section looks very much like the Bullion/Railroad model circa 37.5 mya. However, distal Carlin-type gold deposits outboard for up to 4-5 miles (6-8 km) distance from Central Bullion Stock and could be added to the comparable cross-section.

What are your comments to the below cross-section of generalized porphyry deposits in respect to Railroad?

This idealized cross-section of a porphyry copper setting is a fair representation of the Railroad/Bullion intrusive metal system. Additional geologic feature might include dips on the intruded rock units that exhibit the presence of a forcefully uplifted dome and coincident multiple low-angle listric-style slide-blocks that tend to complicate and obscure the presence of big, high-angle, hydrothermal feeder faults, and multiple, large, Carlin-type gold deposit representations.

Railroad project area looking southwest

REFERENCES

(1) “Interview with Senior Geologist David C. Mathewson” (February 19, 2011)

(2) “Michael Gray of Macquarie Capital Markets Canada Ltd.” (October 3, 2013)

(3) “Gold Standard Venture Corp.’s Corporate Presentation” (October 2013)

(4) “Video on the Railroad Project in Nevada, USA” (YouTube.com)

(5) “Technical Report on the Railroad Project” (May 29, 2012)

(6) “The Origin of Carlin-Type Gold Deposits” (Arehart)

(7) “Controversies on the Origin of World-Class Gold Deposits, Part I: Carlin-type Gold Deposits in Nevada” (Muntean, Cline, Johnston, Ressel, Seedorff, Barton)

(8) “Carlin Trend Exploration History - Discovery of the Carlin Deposit” (J. Alan Coope, Newmont Exploration Ltd.)

(9) “Geologic Overview of the Rain Sub-District” (Longo, Thompson, Harlan)

(10) “Geologic Overview of the Carlin Trend Gold Deposits” (Teal, Jackson)

(11) “Geology and Mineralization of the Maggie Creek District” (Harlan, Harris, Mallette, Norby, Rota, Sagar)

(12) “Geology and Mineral Systems of the Mike Deposit” (Norby, Orobona)

(13) “Overview of the Yerington Porphyry Copper District: Magmatic to Nonmagmatic Sources of Hydrothermal Fluids, Their Flow Paths, Alteration Affects on Rocks, and Cu-Mo-Fe-Au Ores” (Dilles, Einaudi, Proffett, Barton)