Disseminated on behalf of Formation Metals Inc. and Zimtu Capital Corp.

Formation Metals Inc. (CSE: FOMO) is chasing one of the rarest prizes in mining: A high-grade, expandable gold deposit in a world-class district – at the perfect moment in the gold cycle.

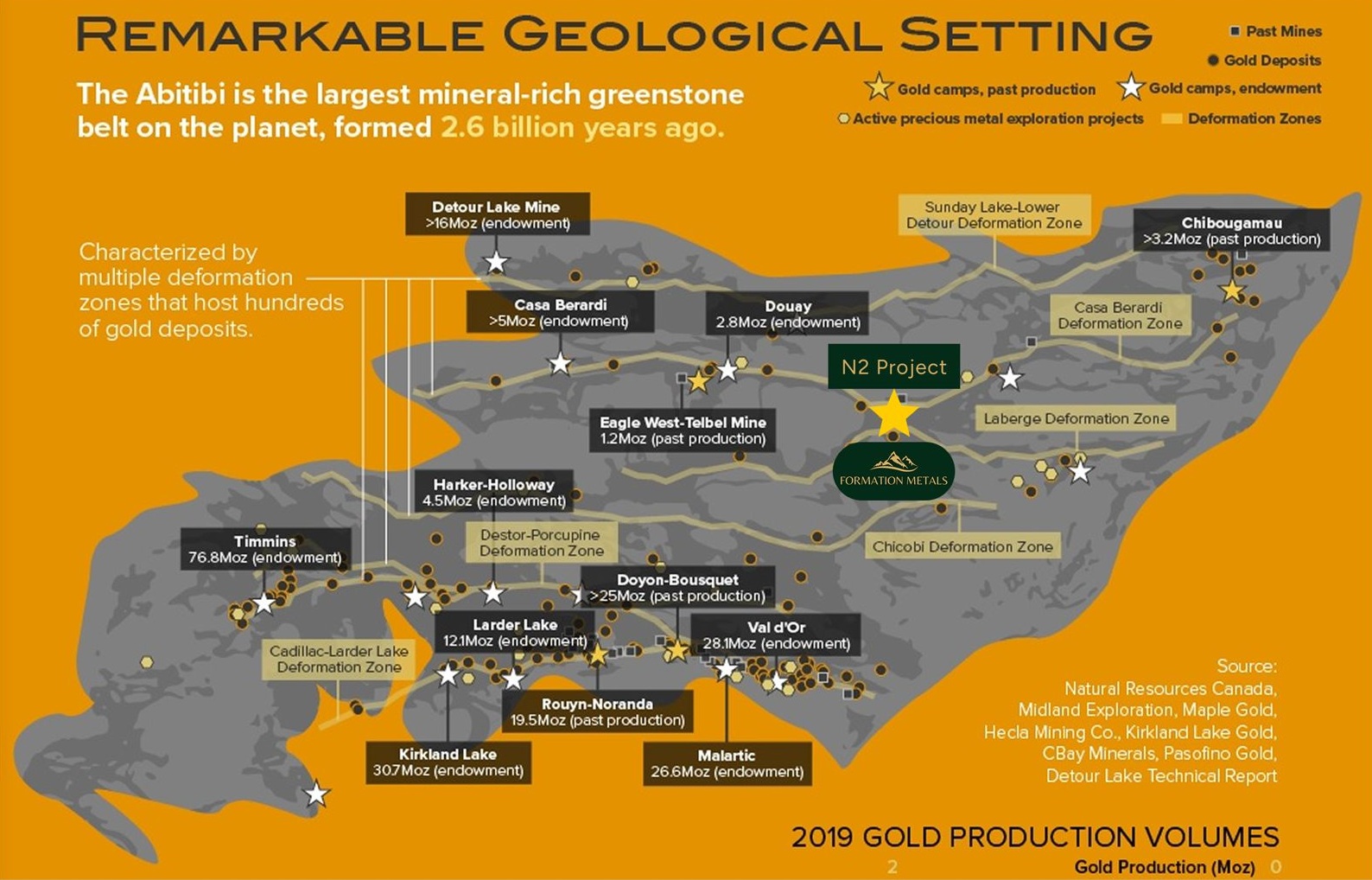

With approximately $12.7 million in working capital, no debt, and a dedicated $8.1 million exploration budget for 2025-2026, Formation Metals has commenced a Phase 1 drill program in late September at its flagship N2 Gold Project in Quebec’s prolific Abitibi region – home to more than 200 million ounces of historical production – targeting both the validation and expansion of its ~870,000-ounce historical resource. In a market where gold discoveries are scarce, the fear of missing out (FOMO) is very real.

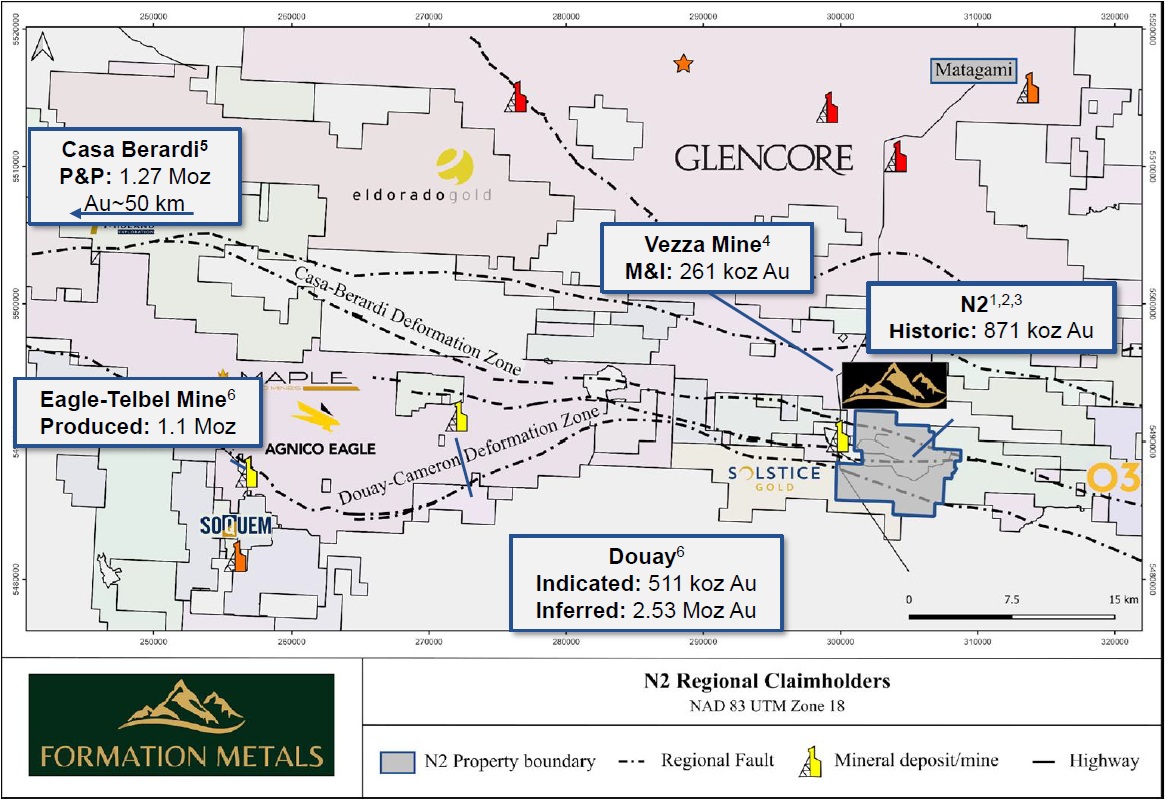

Surrounded by Giants: The N2 Property is flanked by operations from Agnico Eagle ($115 billion market cap), Glencore ($75 billion), and Eldorado Gold ($7 billion).

The N2 Gold Project boasts multiple zones, combining bulk-tonnage potential with high-grade targets, and historical drilling has tested only a fraction of its strike length and depth. With the drills turning since late September, Formation Metals is positioned to grow its ounces in a mining-friendly jurisdiction that majors know – and covet.

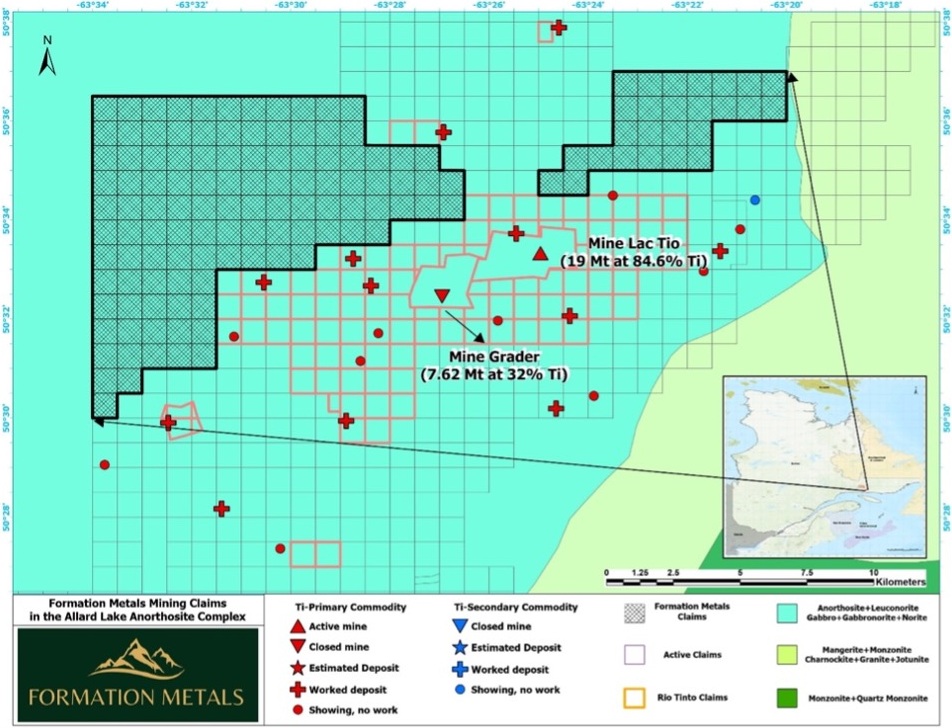

But gold is just the start. Formation Metals has built a diversified pipeline of growth-catalyst projects: The Rio Titanium Project, directly adjacent to Rio Tinto’s world-class Lac Tio Mine, and the Nicobat Nickel-Copper-Cobalt Project in Ontario’s emerging battery metals belt. Together, these assets provide exposure to gold, titanium, and critical battery metals – the commodities set to define the next decade.

Led by a team with over 80 years of combined experience in project development, capital markets, and high-value transactions – and backed by ~67% insider and strategic ownership – Formation Metals is laser-focused on proving potential, scaling resources, and positioning for a premium-value exit.

In the Abitibi, the gap between drill results and a takeover offer can be razor-thin. With ounces in the ground, multiple discovery fronts, and a ticker that says it all, Formation Metals is poised to turn exploration success into the next big North American mining story.

Full size / Source / Historic snapshot of Abitibi M&A activity up to 2021. Since then, major deals have continued to reshape the region – such as Agnico Eagle’s $13.5 billion merger with Kirkland Lake Gold in 2022, its full ownership of Canadian Malartic in 2023, and the strategic acquisition of Osisko Mining by Gold Fields in late 2024 – proof that this belt remains a hotbed for high-stakes consolidations.

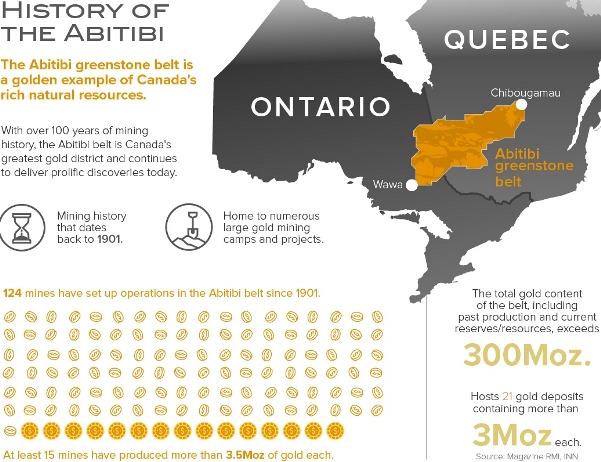

Abitibi: Where World-Class Gold Stories Begin

In the heart of Canada’s mining country lies the Abitibi Greenstone Belt – one of the most prolific gold-producing regions on Earth. Over the past century, it has yielded more than 200 million ounces of gold, built mining empires, and attracted the biggest names in the industry. Here, high-grade deposits are not just a possibility – they are a legacy.

For Formation Metals Inc. (CSE: FOMO), this isn’t just a location – it’s an opportunity to be part of the next great Abitibi discovery. The “fear of missing out” is real in this district, where senior producers are armed with record cash flows, strong balance sheets, and a constant need to replace depleting reserves. With discoveries increasingly rare, they are prepared to pay premiums for high-grade, expandable resources in safe jurisdictions.

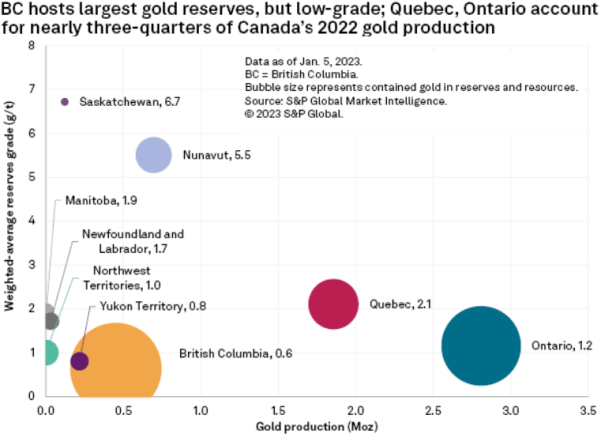

Why? Because gold discoveries are getting rare. High-grade gold is rarer still – and that’s exactly what Quebec offers. In fact, Quebec ranks among the world’s leaders in average gold grades, outshining many other mining jurisdictions. Grade is king, and investors know that a smaller, richer deposit often delivers better economics than a sprawling low-grade one.

Formation Metals’ N2 Gold Project sits squarely in this world-class district. Historical drilling has already outlined a resource, and the ongoing drill program aims to confirm and expand it. If successful, Formation Metals could be exactly the kind of target the majors are hungry for – especially now, when gold prices are at historic highs, margins are fat, and senior producers are sitting on billions in cash.

In the Abitibi, the line between a drill program and a takeover offer can be surprisingly short. With high-grade potential, ounces in the ground, and a proven district, Formation Metals is positioned for the kind of “FOMO moment” investors dream about.

Full size / Since 1901, the Abitibi Greenstone Belt has yielded more than 200 million ounces of gold, securing its reputation as the world’s most prolific mineral-rich greenstone belt and Canada’s largest gold district, home to hundreds of deposits and numerous active mining operations. The Casa Berardi Deformation Zone: A major gold-bearing structural corridor in Québec, hosting world-class deposits such as Casa Berardi, Estrades, and Vezza, and recognized as a proven source of high-grade gold production. (Source)

Where Majors Hunt Their Next Billion-Dollar Mine

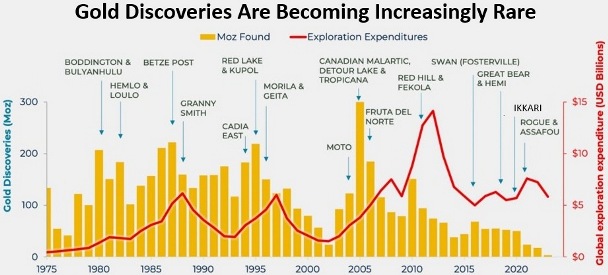

If you want to know where the next billion-dollar gold deal might happen, look to the Abitibi. Over the past decade, the Abitibi has been the stage for numerous high-value acquisitions, as senior and mid-tier producers compete for projects in stable jurisdictions with proven resources. What draws them is a combination of scale potential, exploration upside, and the security of operating in one of the world’s most mining-friendly regions. With new gold discoveries globally in steep decline, well-located deposits are becoming strategic assets. Major miners, buoyed by strong balance sheets after years of robust gold prices, are actively seeking to replace depleted reserves – and the Abitibi remains one of the few districts capable of delivering.

Full size / The New Gold Halving: Since 2005, the amount of gold discovered declined by 50% every 5 years. “We are running out of new gold discoveries.“ (Source)

Grade is King – And Quebec Wears the Crown

In today’s market, grade dictates profitability. Quebec’s average gold grades consistently rank among the highest in the world, giving projects here a competitive edge even when commodity prices fluctuate.

High-grade advantages:

• Lower cost per ounce produced

• Quicker payback periods

• Greater investor interest

Full size / Source / This chart shows gold production (Moz) versus average reserve grade (g/t) by province. Quebec (2.1 g/t) and Ontario (1.2 g/t) produced nearly 75% of Canada’s gold, while British Columbia holds the largest reserves but with the lowest grade (0.6 g/t).

Positioned for the Upside

Formation Metals is drilling at N2 to validate and grow a historical resource in a tier-one jurisdiction. Success could place the company squarely on the radar of acquisitive majors seeking high-grade ounces with room to expand.

The right ingredients are in place:

• A world-class gold belt with a history of takeovers

• High-grade potential in a proven mining district

• A supportive gold price environment and cashed-up producers

With major drill programs totaling 20,000 m ongoing into next year, the stage is set for a pivotal moment in the Formation Metals story.

N2 Gold Project

The N2 Gold Project, located 25 km south of Matagami, Québec, is Formation Metals’ highest-priority exploration asset and the sole focus of the ongoing, fully funded drilling program. Sitting within one of the most prolific gold belts in the world – the Abitibi Greenstone Belt – N2 offers a compelling mix of known mineralization, district-scale upside, and near-term catalysts that have the potential to significantly advance the project’s development and strategic importance.

“We are incredibly grateful for the support Formation has received from new and past shareholders. With nearly thirteen million in working capital, Formation is now funded through 2027 to complete 20,000 metres of drilling at N2. Building on the success of our predecessors, this 20,000 metre drill program will be critical in our goal of developing N2 into a near-surface multi-million-ounce deposit. With gold breaking $4,200, over 5 times the price in 2008 when Agnico last drilled the project, we believe that the timing is perfect for N2 and look forward to a very busy upcoming field season.“ (Deepak Varshney, CEO of Formation Metals Inc., in the news-release on October 15, 2025)

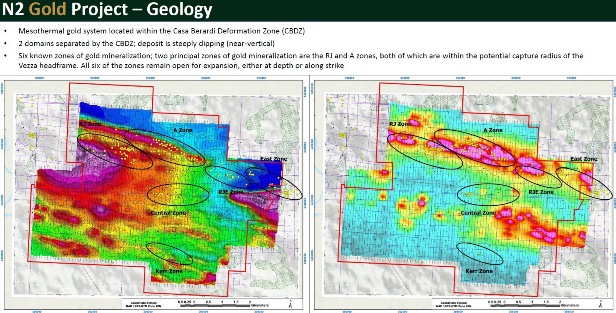

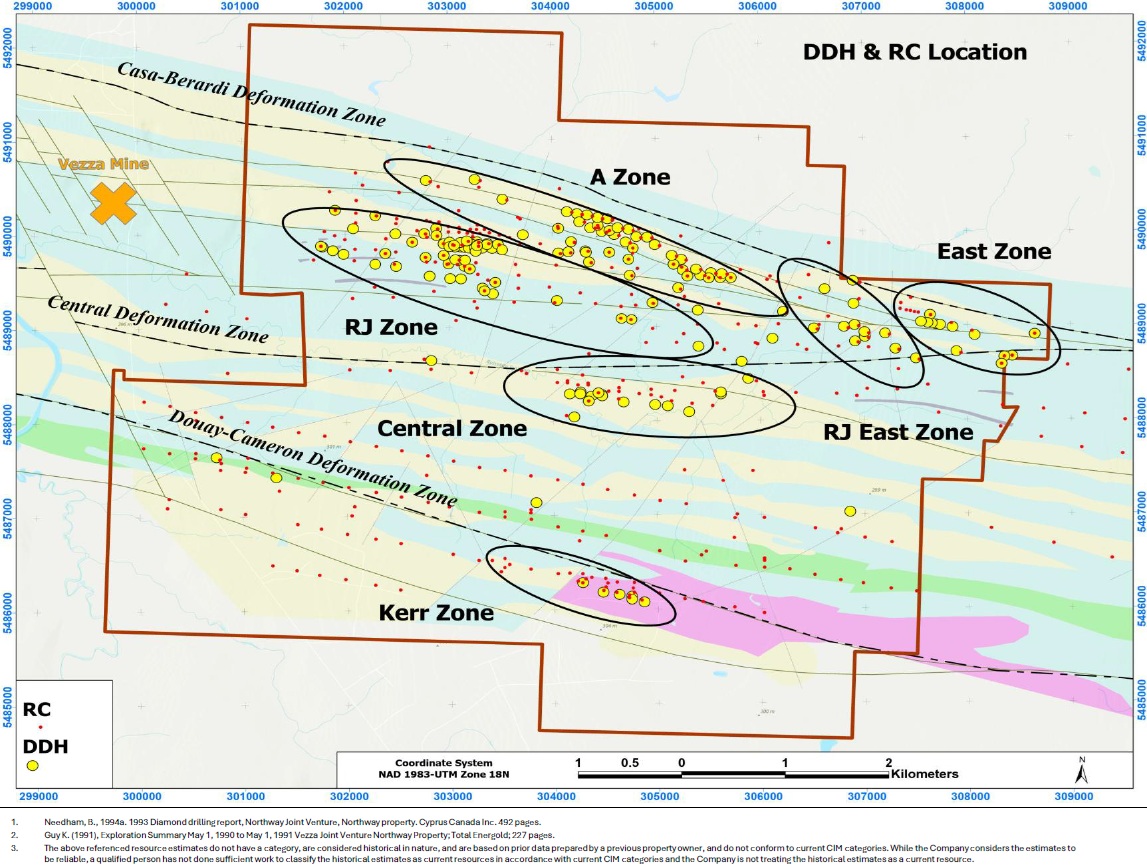

• Covering ~4,400 hectares in 87 claims held 100% by Formation Metals through acquisition from Wallbridge Mining Company, the N2 Gold Project is a mesothermal gold system situated within Québec’s prolific Casa Berardi Deformation Zone.

• The property lies just 1.5 km east of the past-producing Vezza Gold Mine (Measured & Indicated: 261,110 ounces of gold based on 1.25 million tonnes averaging 6.5 g/t gold) and about 120 km east of Hecla Mining‘s Casa Berardi Gold Mine (Proven & Probable: 1.3 million ounces of gold; a recent technical report outlines a 14-year open-pit reserve mine plan, anticipated to produce approximately 1.04 million ounces of gold over that timeframe).

• Historical exploration at N2 includes 236 diamond drill holes totaling 55,517 metres, which underpin two 1994 historical resource estimates totalling ~877,000 ounces of gold across 6 mineralized zones – each open along strike and at depth. Importantly, mineralization begins at surface, offering strong potential for near-surface resource definition.

Prime Location in a Proven Mining District

The N2 property lies along the Douay-Cameron Deformation Corridor, a major east-west structural feature hosting multiple multi-million-ounce gold deposits across the Abitibi Greenstone Belt. The N2 Project is ideally positioned:

• Near infrastructure: Year-round road access, grid power, and proximity to skilled mining labor.

• Close to operating mills: Potential for streamlined development and lower CAPEX.

• In a mining-friendly jurisdiction: Québec consistently ranks among the top global destinations for mining investment.

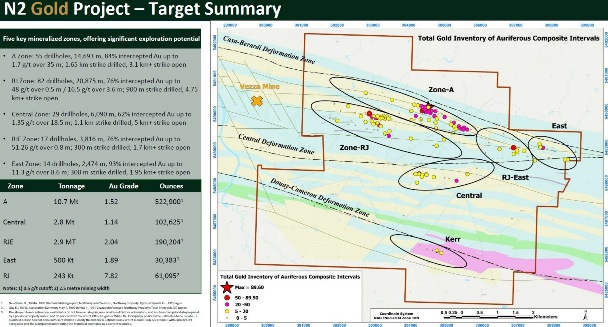

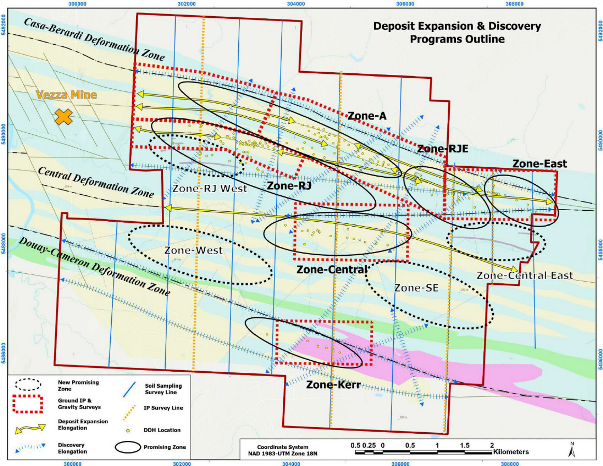

Historical Gold Endowment

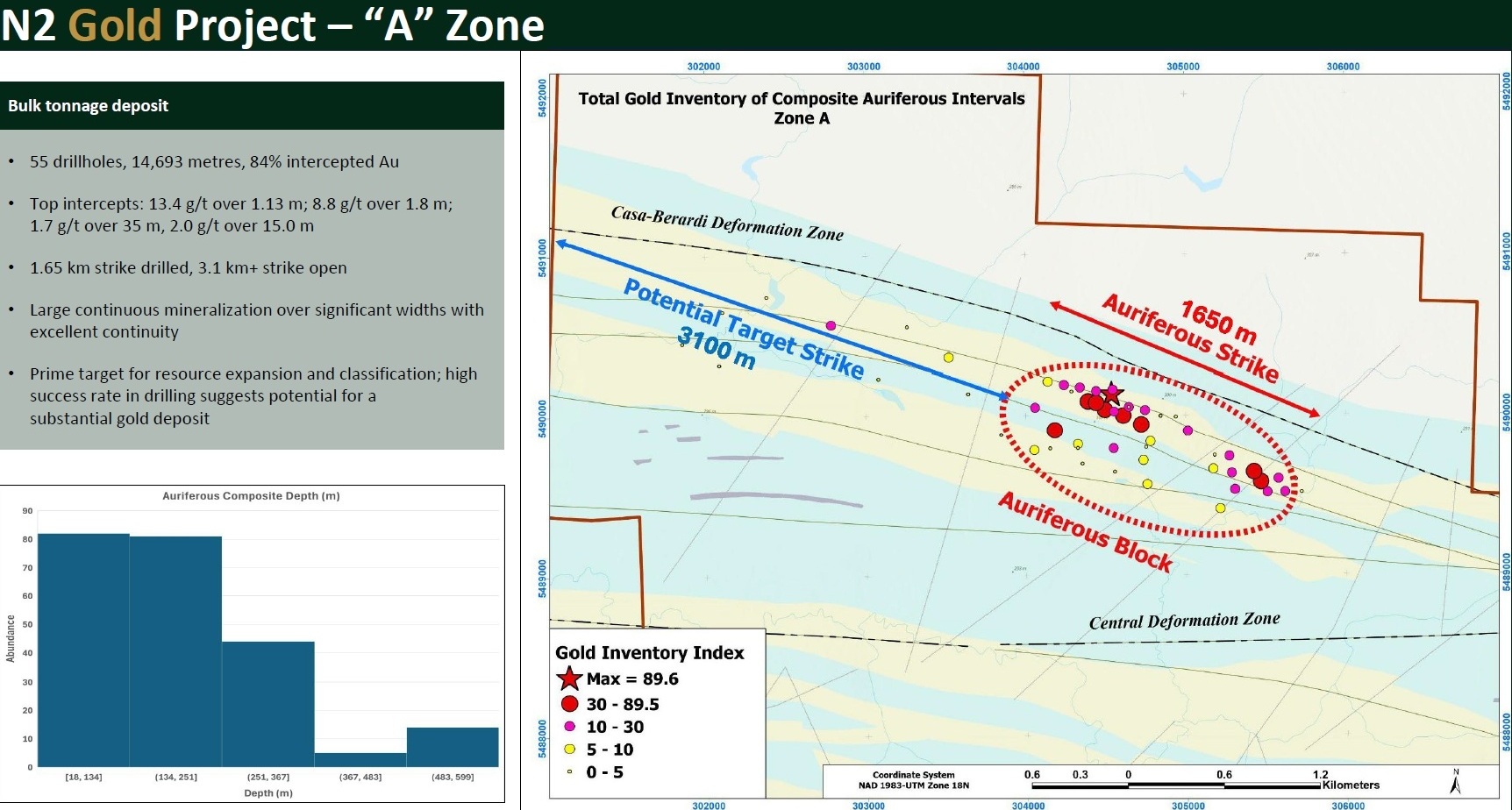

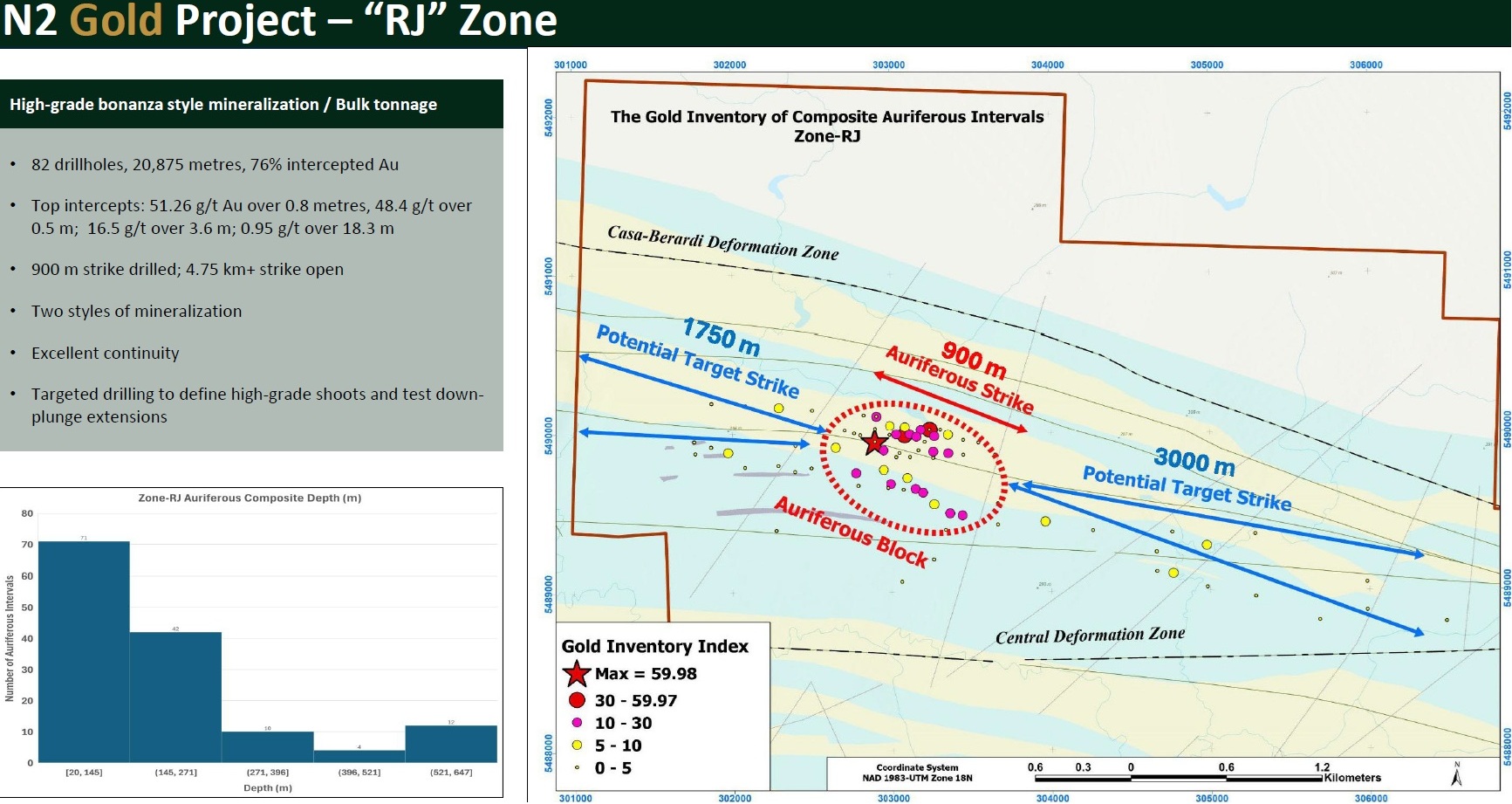

N2 has been extensively explored over decades, with multiple operators defining 7 distinct gold zones, the most significant being the A Zone and RJ Zone.

• A Zone: In 1993, Cyprus Canada reported a historical (pre-NI 43-101) resource estimate of 10.7 million tonnes grading 1.52 g/t gold (~520,000 ounces). These historical estimates were prepared before the introduction of NI 43-101 standards and therefore cannot be relied upon as current mineral resources. However, they provide a well-documented foundation for targeted drilling.

• RJ Zone: Multiple high-grade historical drill intercepts, open along strike and at depth, suggesting strong expansion potential.

Full size / “The strongest mineralization zones discovered on the property are in the “A” Zone (along the Douay-Cameron North Fault) and the “RJ” Zone. The drill spacing in these zones is sufficient to establish a resource estimate for them, although it would be an inferred resource estimate... The authors believe the N2 property, with gold mineralization occurring in a range of different structures and lithologies, deserves further exploration by drilling to find the lateral and vertical continuity of the known zones and find other parallel zones.“ (Source: Technical Report on the N1 & N2 Properties; May 28, 2015)

The N2 Gold Project has a rich exploration history spanning more than 4 decades:

• Since the initial discovery of gold mineralization by Minnova Inc. in 1981, the project has seen multiple waves of drilling and geological work. In 1983, Cyprus Canada Ltd. identified 5 key gold zones, laying the groundwork for resource delineation. By 1991, Cypress reported a historic resource estimate for the RJ Zone of 243,000 tonnes grading 7.82 g/t gold (~61,000 ounces), followed in 1993 by a much larger historic estimate for the A, Central, RJE, and South Zones of 18.2 million tonnes at 1.48 g/t gold (~810,000 ounces). The referenced historical estimates were prepared before the introduction of NI 43-101 standards and therefore cannot be relied upon as current mineral resources. However, they provide a well-documented foundation for targeted drilling.

• Exploration has been extensive, with 236 diamond drill holes totaling 55,517 metres completed to date. The deepest hole reached 682 metres, with an average drill depth of 244 metres. Remarkably, 77% of drill holes within the resource area intercepted gold grades exceeding 0.5 g/t, highlighting the consistency of mineralization.

• Metallurgical testing has been encouraging, with preliminary flotation concentrate recovery rates of 91.7% gold. Complementing the drilling, multiple geophysical surveys – including induced polarization (IP), magnetics, and VTEM – have refined exploration targets and guided subsequent drill campaigns.

• From 2007 to 2009, Agnico-Eagle Mines expanded the project’s potential by discovering new hanging wall zones at the RJ Zone. Beginning in 2011, Balmoral Resources advanced the project through property-wide geophysics and extensive data compilation, identifying new high-priority targets that remain to be tested.

With gold prices now trading at multiples of the levels seen during earlier exploration phases, the timing has never been better to advance the N2 Gold Project with greater intensity than ever before.

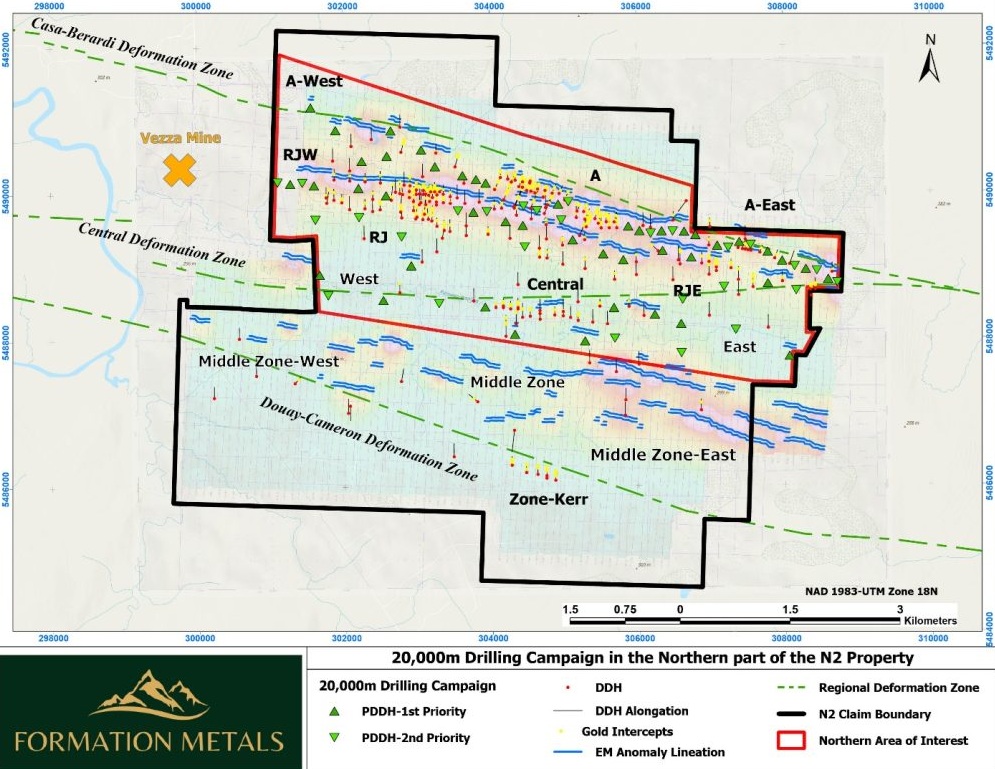

Full size / “The drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the “A”, “RJ” and “Central” zones in the northern part of the Property in order to discover new auriferous trends and unlock new zones of gold mineralization. The program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to-date... The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures, oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.“ (Source)

The Investment Significance of a Historical Resource

The ongoing drill program is designed not only to test for extensions of the known mineralized zones but also to validate and upgrade the historical resource to NI 43-101 compliance. This step is critical because:

• NI 43-101 compliance provides verified, auditable ounces in the ground, the key basis for institutional valuation models.

• Once compliant, investors can make direct peer comparisons using metrics such as enterprise value per ounce (EV/oz), a standard benchmark for gold developers.

• Confirmation plus expansion can deliver a double re-rating effect – first from verification of ounces, then from resource growth.

Full size / “In the Sub-province of Abitibi, the Douay-Cameron Deformation Zone is an important metallogenic break where many deposits are present. These include the Vezza deposit (1.24 Mt at 6.5 g/t Au; d’Amour et al., 2013), the Douay West deposit (2.6 Mt at 2.77g/t Au; Puritch et al., 2015), the Flordin deposit (678 900 t at 4.25 g/t Au; Turcotte and Pelletier, 2010) and the Discovery deposit (measured resources of 3,109 t at 8.95 g/t Au and indicated resources of 1.3 Mt at 5.74g/t Au; Pelletier, 2008). In the Grevet Township, the Gonzague Langlois Mine (Total Mineral Reserves of 2.54Mt at 9.20% Zn, 0.80% Cu, 0.32% Pb, 51.09 g/t Ag and 0.06 g/t Au and Measured and indicated Mineral Resources of 4.43Mt at 10.40% Zn, 0.66% Cu, 0.26% Pb, 51.70 g/t Ag and 0.07 g/t Au; Nyrstar News release, 29 April 2015) represents a deposit of VMS which appears spatially associated with Douay-Cameron Deformation Zone.“ (Source: Technical Report on the N1 & N2 Properties; May 28, 2015)

Geological Setting: A Robust, Multi-Zone Gold System

The N2 property straddles 2 geological domains:

• Cartwright Volcanic Domain: Tholeiitic volcanic units with abundant sedimentary strata.

• Taïbi Sedimentary Domain: Intercalated clastic sediments and basalt.

Mineralization in the A Zone occurs as disseminated arsenopyrite and pyrite within altered basalt units near sedimentary contacts, often in halos around quartz-carbonate veinlets. This geological setting is typical of large, structurally hosted gold deposits found throughout the Abitibi Greenstone Belt.

Drilling Program: A High-Impact Catalyst

The fully permitted 20,000 m drill program (10,000 m planned for 2025) aims to:

• Confirm historical drill results to underpin an NI 43-101 compliant resource.

• Step out along strike and down dip to expand mineralized zones.

• Test new targets identified from reinterpreted geophysics and structural mapping.

The initial focus of the drilling program will be on the A Zone and RJ Zone, where previous operators intersected broad zones of mineralization that remain open.

“Historical highlights from the top two priority zones include: A Zone: A shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces identified at a grade of 1.52 g/t Au. ~15,000 metres have been drilled historically across 1.65 km of strike, with over 3.1 km of strike remaining to be tested. 84% of historical drillholes intercepted auriferous intervals including up 1.7 g/t over 35 m. RJ Zone: a high-grade historic gold deposit with ~61,100 ounces identified at a grade of 7.82 g/t Au, with high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres and 16.5 g/t Au over 3.5 metres. This zone was the target of the most recently drilling at the Property by Agnico-Eagle Mines in 2008, when the price of gold was ~US$800/oz. Only ~900 metres of strike has been drilled, with 4.75+ km of strike remaining to be tested.“ (Source)

Bottom Line

Gold prices have reached new all-time highs, and market interest is strong for projects with a clear path to resource definition and growth. For investors, Formation Metals offers:

• Short timeline to value creation: Drilling has started in late September, with initial assays expected in Q4.

• Leveraged exposure to gold price: Each additional compliant ounce in Québec can translate directly into enterprise value.

• District-scale upside: The 7 known zones and underexplored targets give N2 potential far beyond its historical estimate.

In summary: The N2 Gold Project offers a rare combination of proven mineralization, untapped growth potential, and a clearly defined near-term catalyst. A successful 2025-2026 drill program that confirms and expands the historical resource into NI 43-101 compliance would provide the market with a clear, independently verified measure of gold ounces in the ground, enabling informed comparisons with other projects in the region and across the sector.

“Drilling and magnetic data suggests the presence of numerous faults; both crosscutting and strike slip on the N2 property. Low angle faults intersecting with volcanic-sediment contacts appear to be favourable locations for gold mineralization. In addition, some of the auriferous lenses are proximal to northeast striking cross faults, some of which form a graben-like magnetic low feature in the central portion of the N2 property... From mineralization found on the N2 property, two main deposit types could be interpreted. The main deposit type found on the N2 property is a greenstone-hosted quartz-carbonate vein deposit model. This deposit type is characterized by quartz-carbonate veins associated with carbonatization related to fault zones and shear zones. To support this model for gold zones on the N2 property, gold zones are found in the Douay–Cameron Deformation Zone as the “A” Zone, “East” Zone, “RJ” Zone, “RJE” Zone and “South” Zone. They are in close relationship with major faults, as the Douay-Cameron North fault, the Douay-Cameron South fault and the RJ fault... The second model type deposit is a gold-rich VMS deposit. A possible deposit of this type may exist on the N2 property. This deposit type is characterized by massive sulphide lens enclosed in volcanic rock...“ (Source: Technical Report on the N1 & N2 Properties; May 28, 2015)

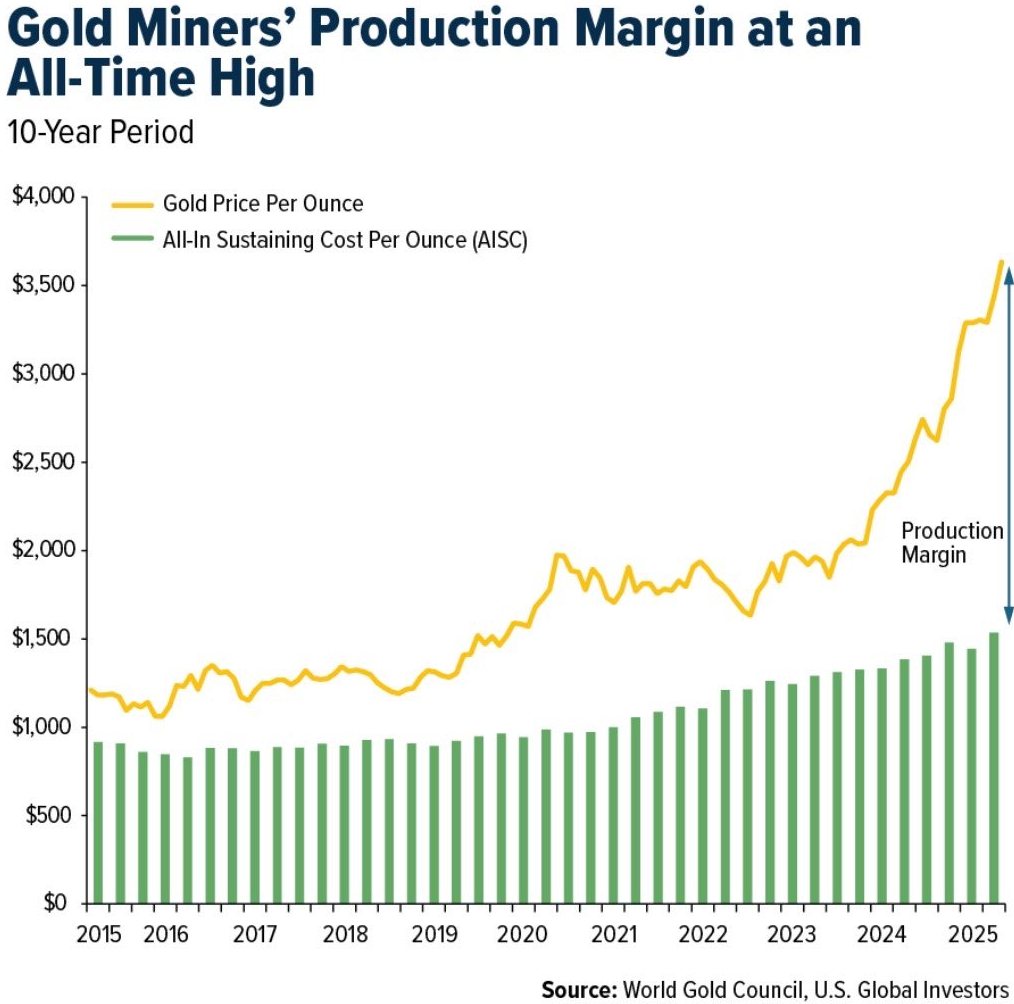

Above chart shows that gold miners’ production margins are at all-time highs. While AISC (All-In Sustaining Cost; green bars) has inched up only gradually over the past decade, gold prices (yellow line) have surged to record levels above $3,500 USD/oz in 2025 (currently above $4,000 USD/oz). The widening gap between production costs and market price highlights the strongest profitability the sector has ever seen, underscoring miners’ powerful leverage to rising gold. With margins at record levels, majors are well-positioned to pursue M&A, acquiring defined ounces in the ground across stable jurisdictions. This not only secures future production pipelines but also allows them to replace depleting reserves, strengthen balance sheets, and capitalize on favorable market sentiment. For investors, it points to an impending wave of M&A, where quality exploration and development assets are likely to emerge as prime takeover targets. Formation Metals is well positioned in Québec’s Abitibi – one of the world’s most prolific and mining-friendly gold belts – to define the kind of high-quality ounces that majors are actively seeking.

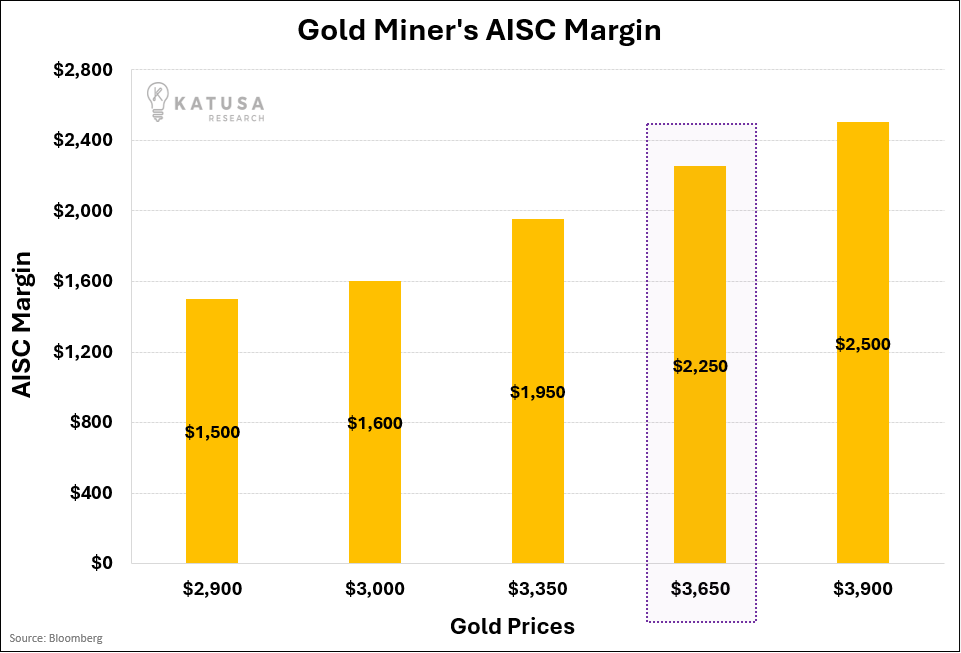

“This is what operational leverage looks like. Gold miners are literally printing money: ️

Gold at $2,900 = $1,500 profit per oz

Gold at $3,650 = $2,250 profit per oz

Their margins just went up 50% while gold rose 26%.“ (Katusa Research on September 14, 2025)

With a current gold price at $4,000 USD/oz, the estimated AISC margin of ~$2,600 USD/oz underscores record-level profitability and cash flow potential for producers, assuming operating costs remain steady. Miners’ margins expand ~1.5-2× faster than the gold price. Above chart highlights how AISC margins surge with rising gold, showcasing miners’ powerful operating leverage. A 10% increase in gold delivers about a 16% lift in margins. At lower prices, margins can nearly double the pace of gold gains, while at higher levels the effect remains strong, though somewhat moderated.

Nicobat Project

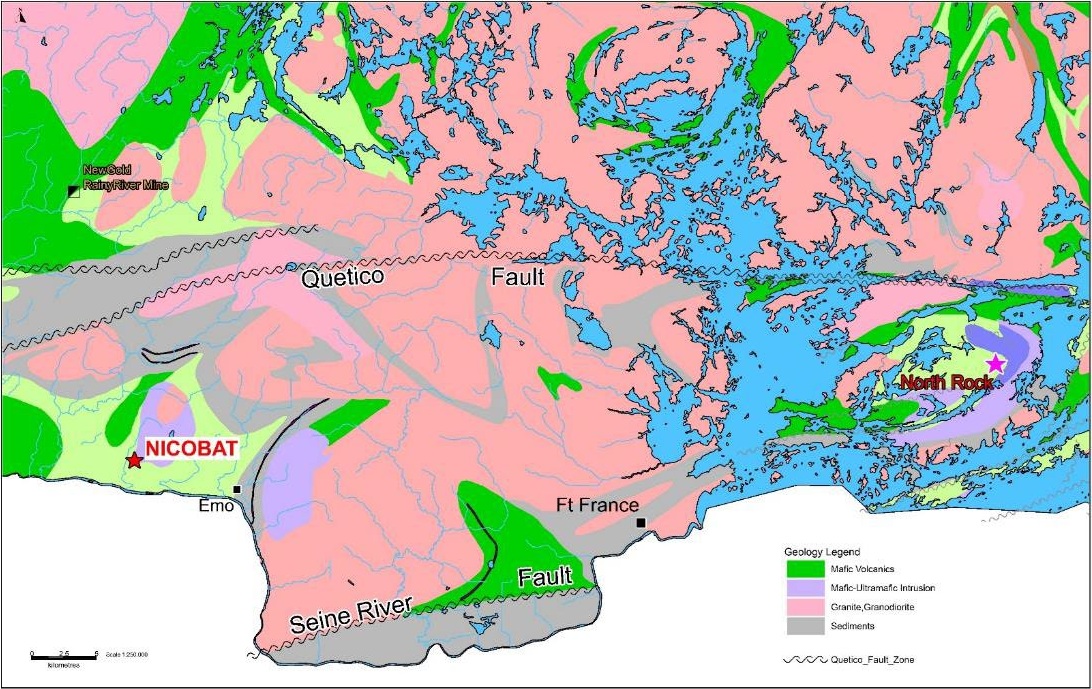

While Formation Metals’ current exploration focus is on advancing its flagship N2 Gold Project in Quebec, the company also holds the 100%-owned Nicobat Project in Northwestern Ontario – a strategically positioned and historically proven battery metals property that offers significant upside.

Strategic Location & Infrastructure Advantage

• The 2,490-hectare Nicobat property is located in the Rainy River District, within the mining-friendly Wabigoon Subprovince of the Superior Province.

• The project benefits from year-round road access via provincial highways and is close to the Ontario–Minnesota border, providing potential direct access to U.S. markets.

• The region offers established mining infrastructure, a skilled labor force, and supportive communities.

Full size / “NewGold’s Rainy River Mine located just 21 kilometres north [of Formation Metals‘ Nicobat Project] is a gold operation with a dismembered layered mafic intrusion cutting the 17-gold zone. The intrusion hosts the 34-Sulphide Zone, a contact style Cu-Ni-Co mineralization along the base of the intrusion. This information was publicly disclosed at the time of discovery in 1995. Metalcorp’s North Rock Property is a second similar occurrence 67 kilometres to east. This occurrence is underlain by the 20km long Grassy Portage layered mafic intrusion and hosts four known zones of magmatic copper-nickel sulphide mineralization. All these properties are regionally proximal to the major transcurrent Quetico fault that separates northern Wabigoon and the southern Quetico Subprovinces.“ (Source: Technical Report on the Nicobat Project; April 19, 2022)

Historical Resource Base

• Nicobat hosts a historical resource estimate of 5.3 million tonnes grading 0.25% nickel, 0.14% copper, and 0.03% cobalt based on ~35,000 metres of diamond drilling. Formation Metals views these historical estimates as a foundation for future exploration and resource definition work, with the potential for expansion and discovery of additional mineralization. Note that a qualified person has not carried out any work to classify the above mentioned historical resources numbers as a current resource or mineral reserve. Formation Metals is not treating the historical estimate as a current mineral resource or mineral reserve.

• The mineralization is associated with a gabbro-peridotite intrusive complex, and historical work identified multiple high-grade “ribs” or shoots within a larger disseminated sulphide body. These zones remain open for expansion, and the project has seen limited modern exploration – representing a clear opportunity to add value through new drilling and updated resource definition.

Full size / “The NICOBAT Project [...] is a base-metal project in which a nickel-copper-PGE polymetallic sulfide zone has been partially outlined by drilling and further work is proposed. USHA Resources’ 2020 drill program confirmed previous drill results and tested the potential for adding tonnage and grade. The [...] 1,439 m of diamond drilling in 7 holes intersected a potential magma conduit composed of cumulate textured olivine gabbro with disseminated and net-textured sulphide Cu-Ni mineralization. Wide mineralized intervals from 25 metres to 46 metres were intersected and consisted of disseminated blebs to semi-massive sulphides hosting pyrrhotite and pyrite plus chalcopyrite and trace pentlandite. Where drill hole A‐04‐15 drilled subparallel to the plunge of the feeder conduit, all but one of the A20 holes drilled across the conduit confirming its substantial width and exploration potential. [...] Based on the drilling completed to date, the mineralized conduit unit appears to be plunging to the northeast at -45°. Additional drilling is required to extend the plunge of the mineralized unit and test the potential to host semi-massive to massive Cu-Ni mineralization.“ (Source: Technical Report on the Nicobat Project; April 19, 2022)

Exploration Potential & Modern Approach

• The property has a rich exploration history dating back to the 1950s, including over 220 diamond drill holes, bulk sampling, and geophysical surveys. However, no significant work has been done since the 1980s, leaving the mineralized system largely untested with modern methods.

• Formation Metals intends to re-evaluate the historical dataset, deploy advanced geophysics, and execute targeted drilling to confirm and potentially expand the resource base.

• Metallurgical studies and environmental baseline work will also be part of the program to position Nicobat for future development.

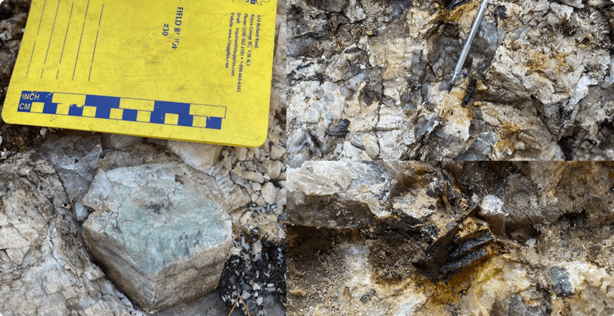

Full size / Drill core showing 12 cm of massive pyrrhotite with olivine inclusions. (Source: Technical Report on the Nicobat Project; April 19, 2022)

Full size / Drill core showing pyrrhotite + chalcopyrite sulphide aggregate. (Source: Technical Report on the Nicobat Project; April 19, 2022)

Full size / Drill core showing cumulate textured olivine gabbro with interstitial pyrrhotite. (Source: Technical Report on the Nicobat Project; April 19, 2022)

Battery Metals Market Context

• Nickel, copper, and cobalt are essential components in electric vehicle batteries, renewable energy storage, and high-performance alloys.

• With the clean energy transition accelerating, demand for these critical minerals is forecast to grow strongly in the coming decade.

• Nicobat’s jurisdictional advantages and existing mineral endowment position it as a compelling, low-risk optionality asset for Formation Metals.

Value on the Backburner

• Although Nicobat is not an immediate work priority while the N2 Gold Project advances toward drilling and resource expansion, it represents an important part of Formation’s project pipeline.

• As the gold program at N2 delivers results and market conditions for battery metals remain robust, Nicobat could quickly move to the forefront of the company’s exploration plans.

Rio Titanium Project

In addition to its gold and battery metals portfolio, Formation Metals holds the 100%-owned Rio Titanium Project in the Côte-Nord region of northeastern Quebec – a large, strategically located property adjacent to one of the world’s largest operating ilmenite mines. While not currently an exploration focus, Rio represents a significant long-term opportunity in the rapidly growing critical minerals sector.

Full size / Rio Tinto Iron and Titanium (RTIT) has been operating in Quebec for over 70 years, producing high-grade titanium dioxide feedstock (about 19% of global supply), iron, steel, and high-purity metal powders. Operations are centered in Sorel-Tracy and include the world’s largest open-pit ilmenite mine at Lac Tio, 43 km northeast of Havre-Saint-Pierre, the largest solid ilmenite deposit globally. Lac Tio Mine: High-quality ilmenite ore mined, crushed, and transported by rail to the port terminal, then shipped 880 km to Sorel-Tracy (7 interrelated plants over an area the size of 100 football fields, employing 1,450 people). (Source)

Prime Location in a Proven Titanium District

• The Rio Titanium Project comprises 136 mining claims covering ~7,440 hectares, situated approximately 43 km northeast of Havre-Saint-Pierre.

• The property is directly adjacent to Rio Tinto’s Lac Tio Mine, a world-class ilmenite operation that has been producing since the 1950s. This proximity provides not only geological validation but also logistical advantages, with year-round road access via provincial highways and close transport links to the port at Havre-Saint-Pierre.

Full size / Formation Metals‘ mining claims in the Allard Lake Anorthosite Complex, adjacent to Rio Tinto‘s Lac Tio Mine (19 million t @ 84.6% Ti) and the Grader Mine (7.62 million t @ 32% Ti). The Grader Mine lies ~4 km southwest of the Lac Tio ilmenite open-pit mine. The area connects via Rio Tinto’s private railway, the Chemin de fer de la Rivière Romaine, which links the mine to Havre‑Saint‑Pierre port. On June 12, 2025, it was announced that Rio Tinto, with $2.5 million in support from the Quebec government, will invest $7.6 million in an industrial demonstration project to test ore-sorting technology at its Lac Tio Mine.

Geological Potential

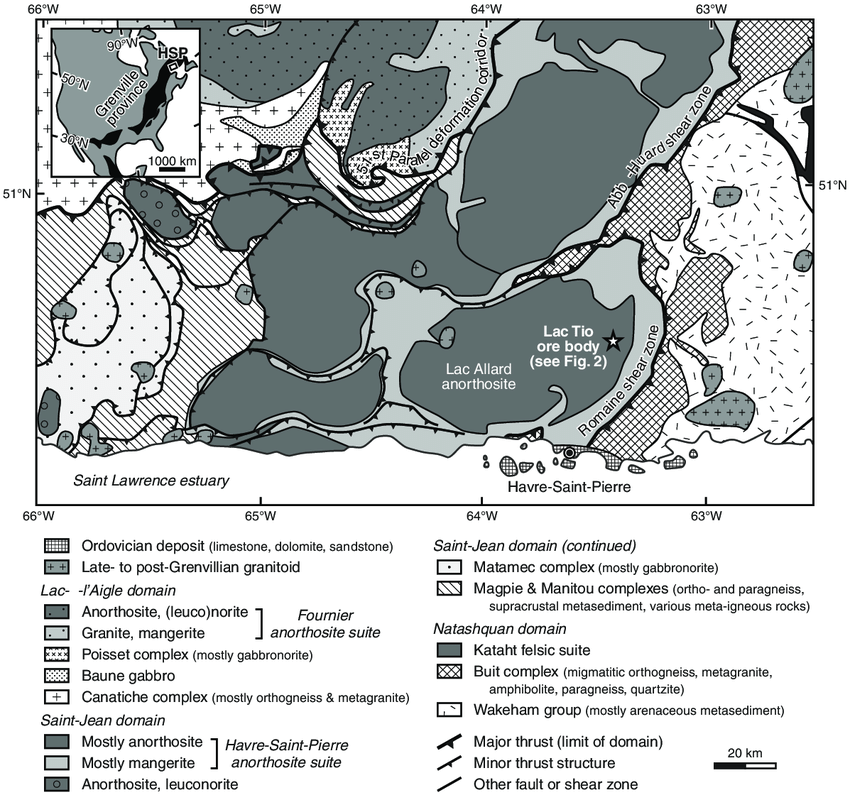

• The Rio Project lies within the southern portion of the Havre-Saint-Pierre Complex, also known as the Allard Lake Anorthosite Complex, a geological unit globally recognized for hosting high-grade titanium-bearing mineralization.

• llmenite (FeTiO3), the primary titanium mineral in the region, is in high demand for aerospace, automotive, medical applications, advanced manufacturing, and as feedstock for titanium dioxide pigments.

• While no NI 43-101 compliant resource exists yet for the Rio Titanium Project, the presence of large-scale titanium resources next door – such as Lac Tio’s estimated 153 million tonnes of ilmenite-rich ore – underscores the property’s strong potential.

Full size / Geological map of the Havre Saint Pierre (HSP) anorthosite suite (simplified after Gobeil et al). The HSP anorthosite suite s an intrusive complex covering ~11,000 km². It hosts the Lac Tio deposit – the world’s largest hard-rock ilmenite mine – and several other Fe-Ti-P oxide-rich intrusions such as the Grader layered intrusion. The Lac Tio Mine is producing hemo-ilmenite for titanium dioxide pigments. The Lac Tio Mine is one of only two major hard-rock ilmenite producers worldwide (the other being Tellnes, Norway). The HSP anorthosite suite is not only geologically significant but also economically strategic. Its massive ilmenite resources, proven mining history, and potential for additional Fe-Ti-P oxide discoveries make it one of the most important titanium districts globally. In a world shifting toward critical mineral security, the HSP suite’s titanium endowment is a tier-one asset.

Exploration Strategy

• Formation Metals acquired the claims in June 2025 via direct staking, securing 100% ownership without the cost or complexity of earn-in agreements.

• Formation Metals intends to conduct early-stage work programs, including prospecting, geological mapping, and surface sampling, to define targets for potential future drilling. This low-cost, staged approach allows Rio to remain a low-maintenance, high-optionality asset within the company’s pipeline.

Market Context – A Critical Mineral in High Demand

• Titanium’s unique combination of light weight, high strength, and corrosion resistance makes it a strategic material for multiple high-tech and defense applications. Titanium is essential for aerospace, electric vehicles, renewable energy systems, and advanced medical devices, and with limited global producers and few large-scale deposits, the market faces a persistent structural supply gap that supports strong long-term pricing.

• Global demand for titanium is increasing, while supply chains are tightening – particularly given speculation around potential export restrictions from major producers such as China.

• Projects like Rio, in a mining-friendly and geopolitically stable jurisdiction, offer strategic value.

Value in the Project Pipeline

• While Formation Metals is currently focused on advancing the N2 Gold Project, the Rio Project remains a strategically positioned critical minerals asset.

• Located beside Rio Tinto’s world-class Lac Tio Mine, the Rio Project could become an attractive M&A target for Rio Tinto or other major players if initial exploration confirms significant titanium potential, offering a clear path for rapid advancement in a proven mining district.

Deepak Varshney, CEO of Formation Metals, commented: “Our focus as a company is to acquire exciting exploration opportunities where we see significant upside. While assessing the regional geology for M&A opportunities, our technical team identified the Rio Project as a high-potential acquisition in an interesting space. Titanium, an ultra-light, ultra-strong, and corrosion-resistant metal, is everywhere – powering the next-gen aerospace revolution, driving innovations in electric vehicles, and saving lives in high-tech medicine. Titanium demand is exploding, and global supply chains are tightening. With growing military budgets, booming EVs, and the rise of sustainable tech, titanium is becoming the quiet backbone of the future economy. China is the world’s largest producer of titanium ore. As of now, China has not officially imposed export restrictions or bans on titanium. However, there is growing speculation that such measures may be forthcoming, given China’s recent actions to control exports of other critical minerals, and so we believe opportunities such as the Rio Project provide unique leverage to our shareholders, where we can advance a high-quality project at low cost.”

Management & Directors

Formation Metals’ leadership combines over 80 years of collective sector experience with a track record of raising more than $70 million for mining ventures and executing high-value transactions. The management team and largest shareholders are part of the Varshney Family Office, renowned for their successful ventures in mining and real estate. Over the past three decades, they have founded and funded projects exceeding $100 million, demonstrating a consistent ability to create and scale high-value enterprises. This unique blend of technical knowledge, capital markets access, financial discipline, and deal-making capability positions Formation Metals Inc. to aggressively advance its N2 Gold Project while maintaining a tight share structure and strong insider alignment. Approximately 67% of the company’s shares are held by insiders, management, and strategic ownership.

DEEPAK VARSHNEY (P.Geo.)

President, CEO, and Director

Deepak brings over 15 years of experience in capital markets, mineral exploration, and corporate development. A professional geologist with a Bachelor of Science in Geosciences from Simon Fraser University, he has been instrumental in raising more than $40 million in the past few years for mining ventures. His career spans identifying, developing, and monetizing high-potential mineral assets, with leadership roles in multiple public companies including Doubleview Gold Corp. Through the Varshney Family Office – a well-known Vancouver-based investment group responsible for founding and funding over $100 million in mining and real estate projects over the past three decades – Deepak has helped build companies from exploration stage to value-generating operations. His blend of technical and financial expertise enables Formation Metals to execute a dual focus: Resource expansion and capital market re-rating. Investor Takeaway: Deepak’s ability to raise substantial capital, coupled with his proven skill in advancing projects in competitive jurisdictions, provides Formation Metals with a leadership foundation capable of unlocking the full potential of the company’s assets while maximizing shareholder value.

KHALID NAEEM (CPA, CGA)

Chief Financial Officer

Khalid brings over 18 years of financial and operational expertise, with a strong focus on the resource sector. A Canadian Chartered Professional Accountant, his skills include financial management, tax compliance, M&A, risk assessment, and public company reporting. He currently serves as CFO for multiple listed companies – including Usha Resources Ltd., Core Critical Metals Corp., and Totec Resources Ltd. – and has held senior roles across various industries, notably as CEO of Sam’s Food Store LLC. This diverse background enables him to combine rigorous financial controls with a pragmatic, growth-oriented approach. Investor Takeaway: Khalid’s multi-company CFO experience and disciplined financial stewardship ensure Formation Metals can advance exploration programs while maintaining capital efficiency, compliance, and shareholder value.

NAVIN VARSHNEY

Director

Navin has a four-decade career in capital markets, mineral exploration, and venture development. He has served as President, CEO, and CFO for several TSX-listed issuers and has an extensive history of structuring and financing early-stage ventures, particularly in mining and technology. His fundraising record exceeds $30 million in the past 10 years, and his strategic deal-making was instrumental in the $26 million USD asset sale by Usha Resources Ltd. Navin’s boardroom experience across numerous public companies gives him deep insight into governance, risk management, and capital market timing – all critical factors for scaling a junior exploration company. His proven ability to identify undervalued assets and advance them to liquidity events aligns directly with Formation Metals’ exploration-to-development roadmap. Investor Takeaway: Navin’s capital markets expertise, deal execution skills, and broad industry network provide Formation Metals with a competitive edge in securing funding, striking value-accretive deals, and positioning the company for potential strategic transactions.

DAVID ELLETT

Director

David’s career combines elite-level sports leadership, entrepreneurship, and mining industry involvement. A 16-year veteran of the National Hockey League, he played 1,129 games for teams including the Winnipeg Jets, Toronto Maple Leafs, and Boston Bruins. His professional sports career instilled discipline, strategic thinking, and resilience – qualities he has successfully applied to his business ventures. While still active in the NHL, David co-founded ProIce Management, a wealth management firm serving professional athletes. Post-retirement, he owned and operated an automotive dealership and a Central Hockey League franchise, demonstrating his versatility as a business operator. In the mining sector, David has served as a director for multiple junior exploration companies, focusing on logistics, fundraising, and project acquisition. Since 2016, he has also been a licensed Mortgage Loan Originator with American Pacific Mortgage, adding further financial expertise to his portfolio. Investor Takeaway: David’s diverse operational background, combined with his network and leadership skills, strengthens Formation Metals’ ability to attract capital, manage logistics-intensive exploration programs, and broaden its visibility in both resource and investment communities.

ADRIAN SMITH (P.Geo.)

Advisor

Adrian is a corporate advisor and mining executive with extensive experience in precious and base metals projects across North America. A geology graduate, he began his career as an Underground Mine Geologist, where he played a key role in identifying, modeling, and producing ore beyond known reserves. His expertise in project evaluation, resource development, and operational oversight is complemented by his current role as CEO of First Atlantic Nickel Corp. Investor Takeaway: Adrian’s combination of mining experience and executive leadership brings Formation Metals an asset-level operational perspective that complements its exploration focus. His ability to bridge technical geology with strategic corporate decision-making strengthens the company’s capacity to evaluate, advance, and de-risk projects across multiple commodities.

Company Details

Formation Metals Inc.

#1245 – 300 Granville Street

Vancouver, BC, V6C 1V4 Canada

Phone: +1 778 899 1780

Email: info@formationmetalsinc.com

www.formationmetalsinc.com

CUSIP: 34638F / ISIN: CA34638F1053

Shares Issued & Outstanding: 84,973,511

Canada Symbol (CSE): FOMO

Current Price: 0.31 CAD (10/16/2025)

Market Capitalization: 26 Million CAD

Germany Symbol / WKN: VF1/ A3D492

Current Price: 0.193 EUR (10/16/2025)

Market Capitalization: 16 Million EUR

Contact:

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Formation Metals Inc. (“FOMO“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the FOMO‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward looking include that FOMO aims to unlock the gold ounces majors want; that, with the drills now turning, Formation Metals is positioned to grow its ounces in a mining-friendly jurisdiction that majors know – and covet; that gold is just the start; that gold, titanium, and critical battery metals are the commodities set to define the next decade; that FOMO is laser-focused on proving potential, scaling resources, and positioning for a premium-value exit; that FOMO is poised to turn exploration success into the next big North American mining story; that the majors are prepared to pay premiums for high-grade, expandable resources in safe jurisdictions; that a smaller, richer deposit often delivers better economics than a sprawling low-grade one; that FOMO’s ongoing drill program aims to confirm and expand the historical resource and, if successful, FOMO could be exactly the kind of target the majors are hungry for; that FOMO is drilling at N2 to validate and grow a historical resource in a tier-one jurisdiction; that success could place FOMO squarely on the radar of acquisitive majors seeking high-grade ounces with room to expand; that N2 offers a compelling mix of known mineralization, district-scale upside, and near-term catalysts that have the potential to significantly advance the project’s development and strategic importance; that, based on our ongoing review and planning for Phase 1, we feel comfortable in expanding our maiden drill program to a fully funded 10,000 metres; that mineralization begins at surface, offering strong potential for near-surface resource definition; that, with N2 being close to operating mills, there is potential for streamlined development and lower CAPEX; that, at RJ Zone, there are multiple high-grade historical drill intercepts, open along strike and at depth, suggesting strong expansion potential; that the drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the “A”, “RJ”, and “Central” zones in the northern part of the property in order to discover new auriferous trends and unlock new zones of gold mineralization; that the program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to date; that FOMO also believes that N2 has significant base-metal potential; that there is strong potential for elevated base-metal (Cu-Zn) concentrations across the property; that the drill program is designed not only to test for extensions of the known mineralized zones but also to validate and upgrade the historical resource to NI 43-101 compliance; that confirmation plus expansion can deliver a double re-rating effect – first from verification of ounces, then from resource growth; that this geological setting is typical of large, structurally hosted gold deposits found throughout the Abitibi Greenstone Belt; that the planned 10,000-metre program aims to confirm historical drill results to underpin an NI 43-101 compliant resource, step out along strike and down dip to expand mineralized zones, and test new targets identified from reinterpreted geophysics and structural mapping; that the initial focus of the drilling program will be on the A Zone and RJ Zone; that, for investors, there is a short timeline to value creation, there is leveraged exposure to the gold price with each additional compliant ounce in Québec translating directly into enterprise value, and that there is district-scale upside with the seven known zones and under-explored targets giving N2 potential far beyond its historical estimate; that we are likely entering the Golden Age of Mining; that major gold producers are not only more profitable than they have been in over a decade, but also financially positioned to pursue aggressive growth strategies, including acquisitions; that these cash-rich miners may soon turn their attention to well-positioned exploration companies – precisely the kind of opportunity that Formation Metals’ N2 Gold Project represents; that a similar transformation now appears to be unfolding in the mining sector; that the Nicobat Project offers significant upside; that, at Nicobat, there is a clear opportunity to add value through new drilling and updated resource definition; that FOMO intends to re-evaluate the historical dataset at Nicobat, deploy advanced geophysics, and execute targeted drilling to confirm and potentially expand the resource base; that metallurgical studies and environmental baseline work will also be part of the program to position Nicobat for future development; that, with the clean-energy transition accelerating, demand for these critical minerals is forecast to grow strongly in the coming decade; that Nicobat could quickly move to the forefront of the company’s exploration plans; that Rio’s proximity provides not only geological validation but also logistical advantages; that Rio Tinto, with $2.5 million in support from the Quebec government, will invest $7.6 million in an industrial demonstration project to test ore-sorting technology at its Lac Tio Mine; that, at Rio, FOMO intends to conduct early-stage work programs, including prospecting, geological mapping, and surface sampling, to define targets for potential future drilling; that the titanium market faces a persistent structural supply gap that supports strong long-term pricing; that the Rio Project could become an attractive M&A target for Rio Tinto or other major players if initial exploration confirms significant titanium potential; that titanium is becoming the quiet backbone of the future economy; that, as of now, China has not officially imposed export restrictions or bans on titanium, however, there is growing speculation that such measures may be forthcoming given China’s recent actions to control exports of other critical minerals, and so we believe opportunities such as the Rio Project provide unique leverage to our shareholders, where we can advance a high-quality project at low cost; that Deepak is capable of unlocking the full potential of the company’s assets while maximizing shareholder value; that, with Khalid as CFO, FOMO can advance exploration programs while maintaining capital efficiency, compliance, and shareholder value; that, with Navin as Director, FOMO has a competitive edge in securing funding, striking value-accretive deals, and positioning the company for potential strategic transactions; that David, as Director, strengthens FOMO’s ability to attract capital, manage logistics-intensive exploration programs, and broaden its visibility in both resource and investment communities; and that, with Adrian as Advisor, he strengthens the company’s capacity to evaluate, advance, and de-risk projects across multiple commodities. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Key risks and uncertainties include, but are not limited to: Permitting and Regulatory Approvals: Exploration and development depend on timely receipt of permits and regulatory approvals. Delays or denials may materially affect planned work. Exploration Risk: Mineralization identified in sampling, historical drilling, or geophysics may not extend as anticipated, may differ in grade or geometry, or may prove uneconomic. Geological and Technical Uncertainty: Grades, continuity, tonnages, and metallurgical recoveries may differ from expectations. Apparent similarities to nearby producing mines may not be geologically or economically comparable. Capital Requirements: Additional financing will be required to fund exploration and potential development. Such funding may not be available on acceptable terms, or at all. Operational Challenges: Drilling and field programs may face cost overruns, technical failures, equipment shortages, or access issues. Commodity Price Volatility: The economics of gold, titanium, nickel, copper, cobalt, and other commodities are highly sensitive to market conditions. Price declines may render projects uneconomic. Political, Economic, and Social Risks: Unfavorable policy changes, economic instability, local opposition, or lack of agreement with Indigenous groups, partners, or governments may impede progress. Personnel and Execution Risk: The Company’s ability to deliver exploration programs relies on retaining qualified personnel, contractors, and financial resources. Valuation and Market Risk: Junior exploration equities are inherently volatile; share prices may decline for reasons unrelated to actual project performance. Specific risks in respect to the N2 Gold Project (Québec), but are not limited to: Historical Resource Risk: The N2 property hosts ~870,000 ounces of historical resources that are not NI 43-101 compliant. A qualified person has not completed sufficient work to treat these as current mineral resources. There can be no assurance that future drilling will verify or expand these estimates. Drilling Risk: Planned step-out and infill drilling may not confirm historical results or lead to resource growth. Exploration targets may not host mineralization of economic grade or continuity. Metallurgical and Processing Risk: While N2 is near existing mills, no current metallurgical testing confirms that material could be processed economically. Infrastructure and Access: Although close to infrastructure, unforeseen logistical, environmental, or permitting challenges could increase costs or delay programs. Comparison to Past Work: Historical success by Agnico-Eagle and others does not guarantee similar outcomes under current exploration. Specific risks in respect to the Nicobat Project (Ontario), but are not limited to: Historical Estimate Risk: The project’s 5.3 Mt grading 0.25% Ni, 0.14% Cu, and 0.03% Co is a historical resource, not NI 43-101 compliant. Verification, re-sampling, and drilling are required. There is no certainty that any portion will become current resources or reserves. Exploration Gap: The project has seen limited modern work since the 1980s. Historical data may be incomplete, inaccurate, or not to modern standards. Geological Complexity: Mineralization is structurally controlled within the Dobie Mafic Intrusion. The geometry and depth extension remain uncertain. Metallurgy and Recovery: Limited metallurgical work has been completed. Future studies may show recovery challenges or concentrate quality issues. Community and Indigenous Engagement: The property is adjacent to Manitou Rapids First Nation. Future exploration and development may require consultation and agreements that could affect timelines and costs. Specific risks in respect to the Rio Titanium Project (Québec), but are not limited to: Early-Stage Risk: The Rio Project is at a grassroots stage with no NI 43-101 resources or reserves. There is no guarantee of identifying economic mineralization. Commodity-Specific Risk: Titanium prices are influenced by aerospace, defense, pigment, and industrial demand. Market volatility or substitution could affect project viability. Geological Risk: Although adjacent to Rio Tinto’s Lac Tio Mine, mineralization on nearby properties is not necessarily indicative of mineralization on Formation’s claims. Exploration Execution: Planned prospecting, mapping, and sampling may not yield drill-ready targets or may reveal mineralization below economic thresholds. Strategic and Competitive Risk: The project’s proximity to Rio Tinto could create opportunities for partnership or acquisition, but also risk if results do not meet thresholds attractive to major producers. Statements herein assume the availability of financing, successful permitting, exploration results that validate historical data, continued favorable commodity pricing, and supportive regulatory and social conditions. There can be no assurance that these assumptions will prove accurate. Caution to Readers: Forward-looking statements are not guarantees of future performance. Actual results may differ materially due to the risks and uncertainties described above and in the FOMO’s public disclosure. Readers should not place undue reliance on forward-looking information. Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on FOMO’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of FOMO’s projects is no guarantee for mineralization on the properties from FOMO, and all of FOMO’s projects are exploration projects. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Formation Metals Inc. (“FOMO“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of FOMO‘s stock prices. The author also owns equity of FOMO, and he also owns equity of Zimtu Capital Corp. and thus will profit from volume and price appreciation of these stocks. FOMO pays Zimtu Capital Corp. to provide this report and other services. FOMO has signed an agreement with Zimtu Capital Corp. (TSX.V: ZC) (FSE: ZCT1) (“Zimtu”) whereby Zimtu will provide marketing services under its ZimtuADVANTAGE program, effective August 1, 2025, for an initial term of 12 months at a cost of $12,500 per month. The program is designed to provide opportunities, guidance, marketing and assistance. Services include investor presentations, email marketing, lead generation campaigns, blog posts, digital campaigns, social media management, Rockstone Research reports & distribution, video news releases and related marketing & awareness activities. Zimtu is based in Vancouver, at Suite 1450 - 789 West Pender Street, Vancouver, BC V6C 1H2. Zimtu may be reached at 604.681.1568, or info@zimtu.com. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Formation Metals Inc., Tradingview, Stockwatch, and the public domain.