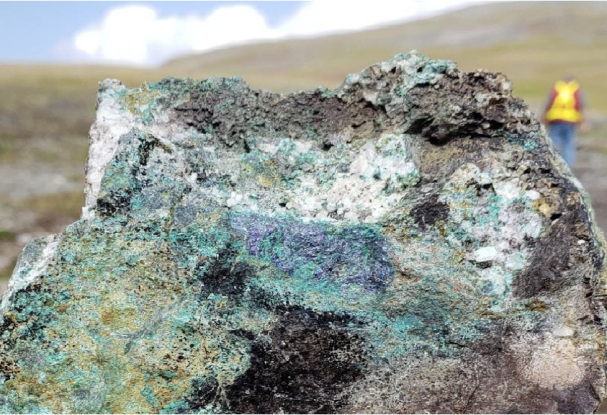

Full size / Copper at Surface – Scale Below. Copper-rich rock sample from Copper Quest’s flagship Stars Project in central British Columbia’s emerging copper hub, with malachite-azurite staining – clear evidence of a fertile porphyry system and sulphide mineralization at depth.

Disseminated on behalf of Copper Quest Exploration Inc. and Zimtu Capital Corp.

After a period of strategic restructuring, Copper Quest Exploration Inc. has emerged uniquely positioned to advance an exceptional portfolio of discovery-stage copper, gold, silver, and molybdenum projects in British Columbia’s prolific Bulkley and Toodoggone Porphyry Belts – among Canada’s most richly endowed porphyry districts. With 3 road-accessible projects already proven to host mineralized porphyry systems, Copper Quest stands at the heart of 2 districts anchored by major producers and past-producers including Imperial Metals, Centerra Gold, and Newmont. The time has come for Copper Quest to deliver scale and value.

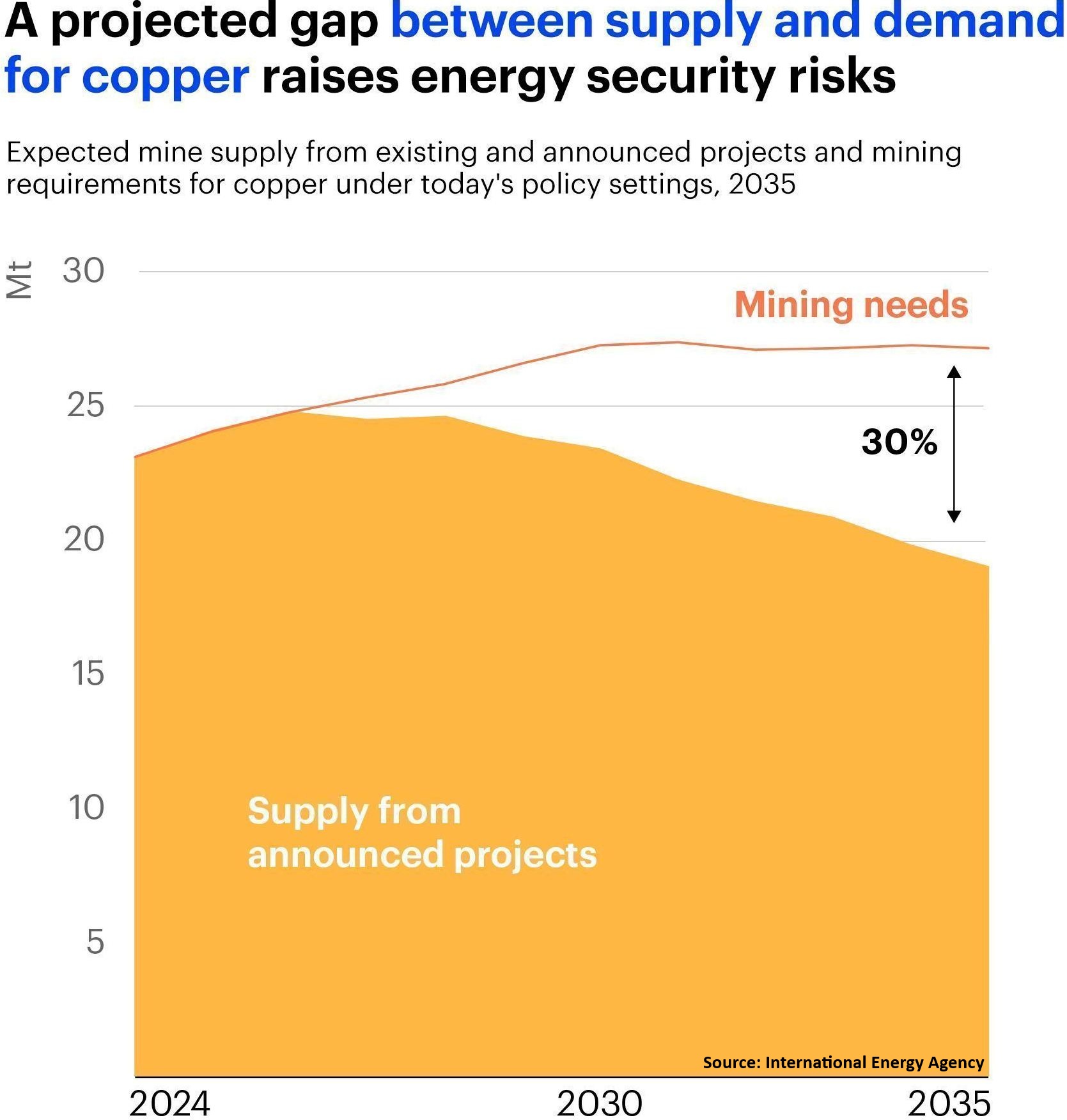

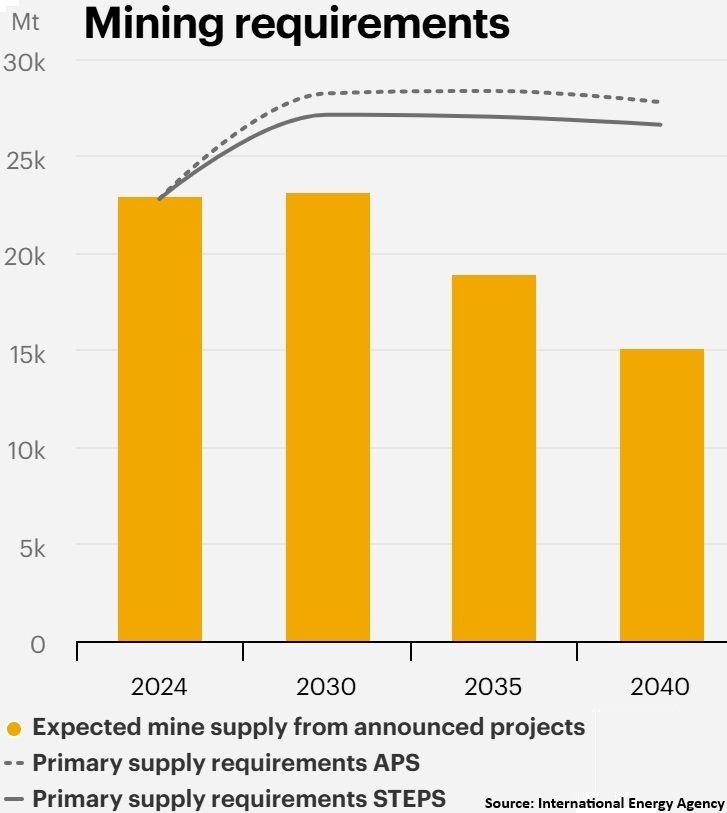

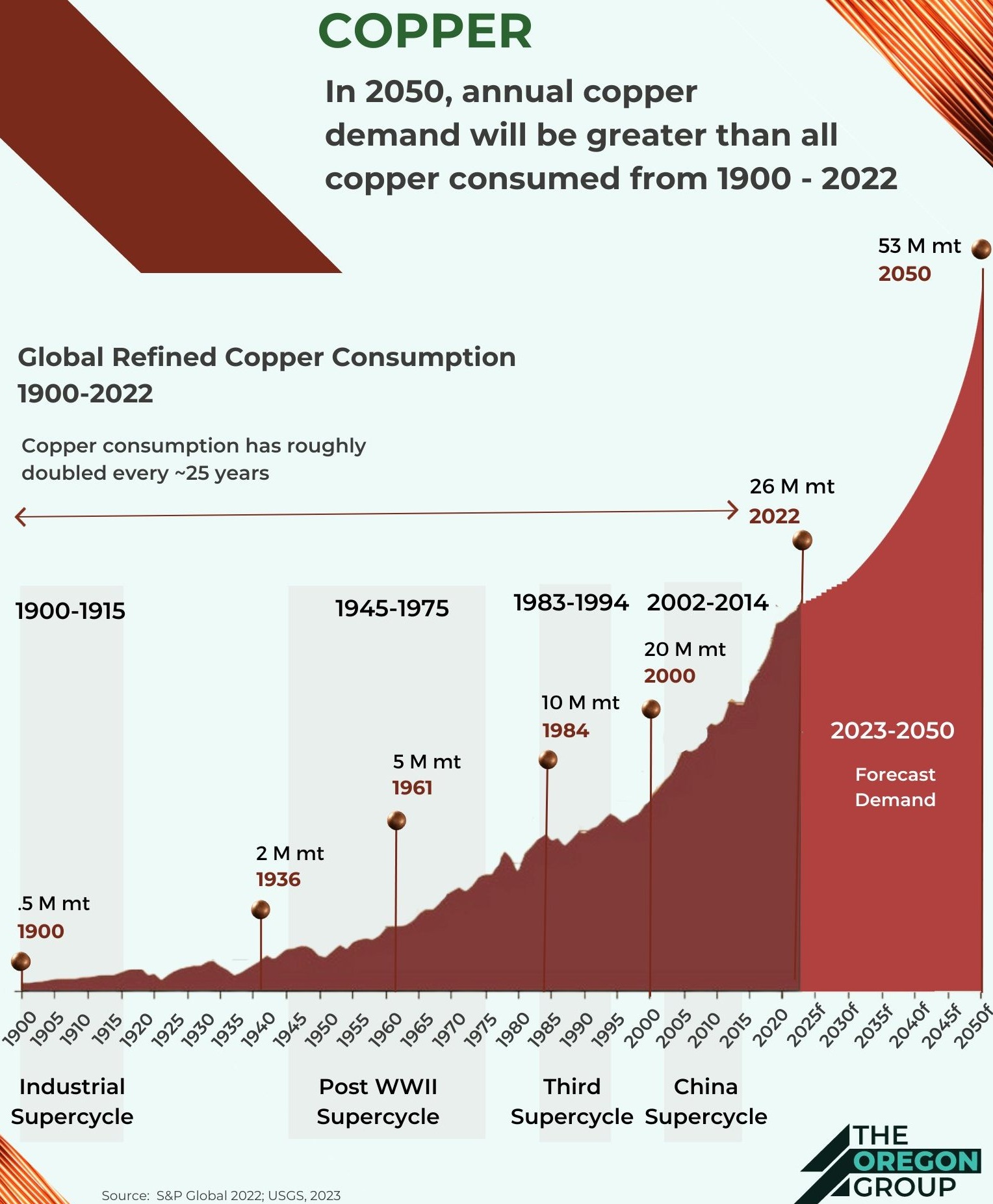

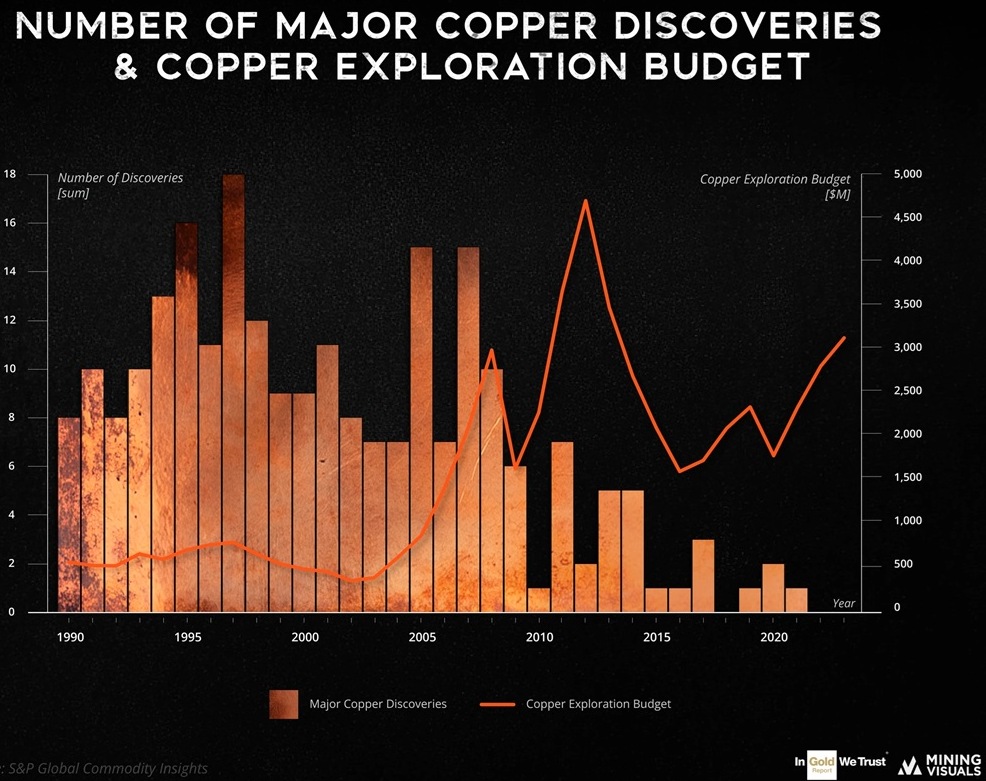

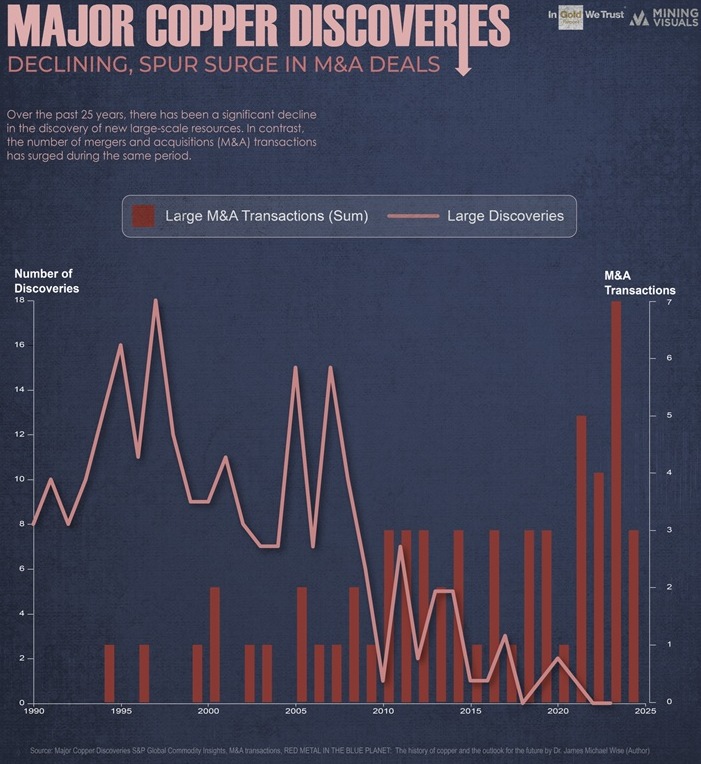

What sets Copper Quest apart is scale, optionality, and timing. Global copper demand is accelerating under the twin forces of electrification and supply security, while new discoveries in stable jurisdictions are increasingly rare.

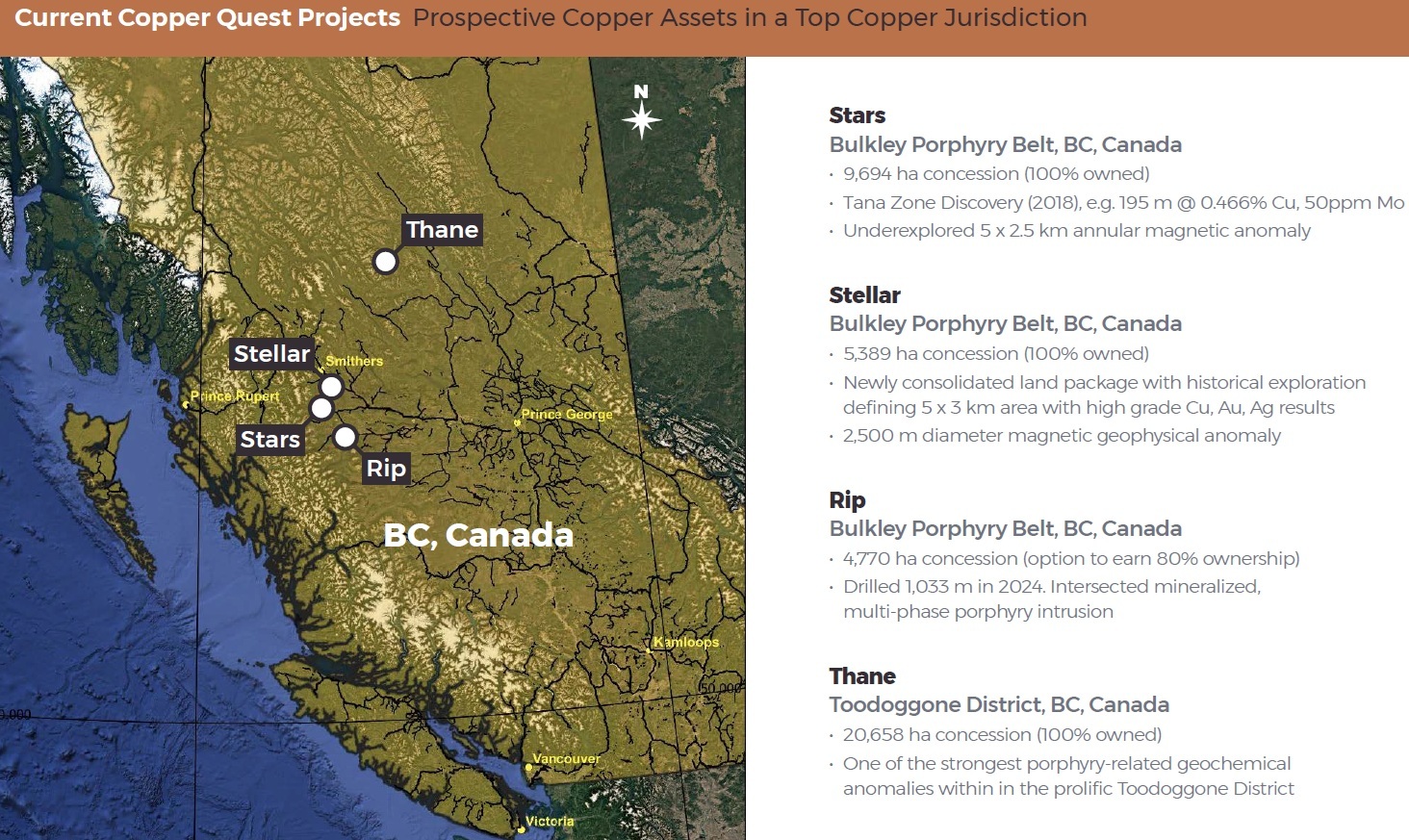

Copper Quest‘s projects – Stars, Stellar, Rip, and Thane – provide exactly that: Large-footprint porphyry systems, complemented by high-grade showings and anchored by existing regional infrastructure. Each project offers discovery potential on its own; together, they create the framework for a district-scale growth story.

Copper Quest is guided by a leadership team with top-tier experience from Freeport, Glencore, Kinross, and Lundin – professionals who have discovered, financed, and developed multi-billion-dollar mines worldwide. Their mission is simple: Unlock the next generation of copper supply in North America, responsibly and profitably, while creating significant shareholder value.

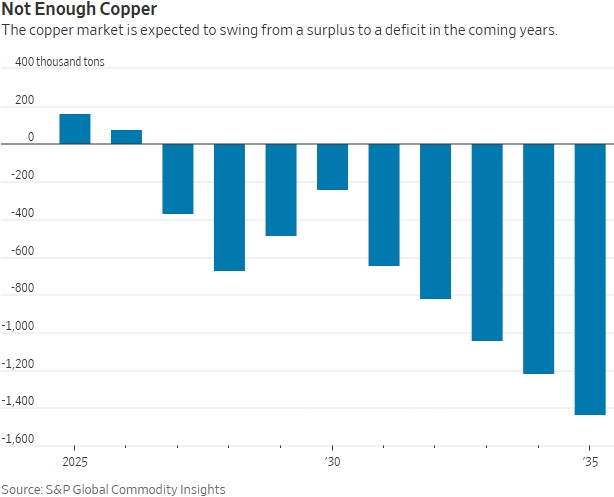

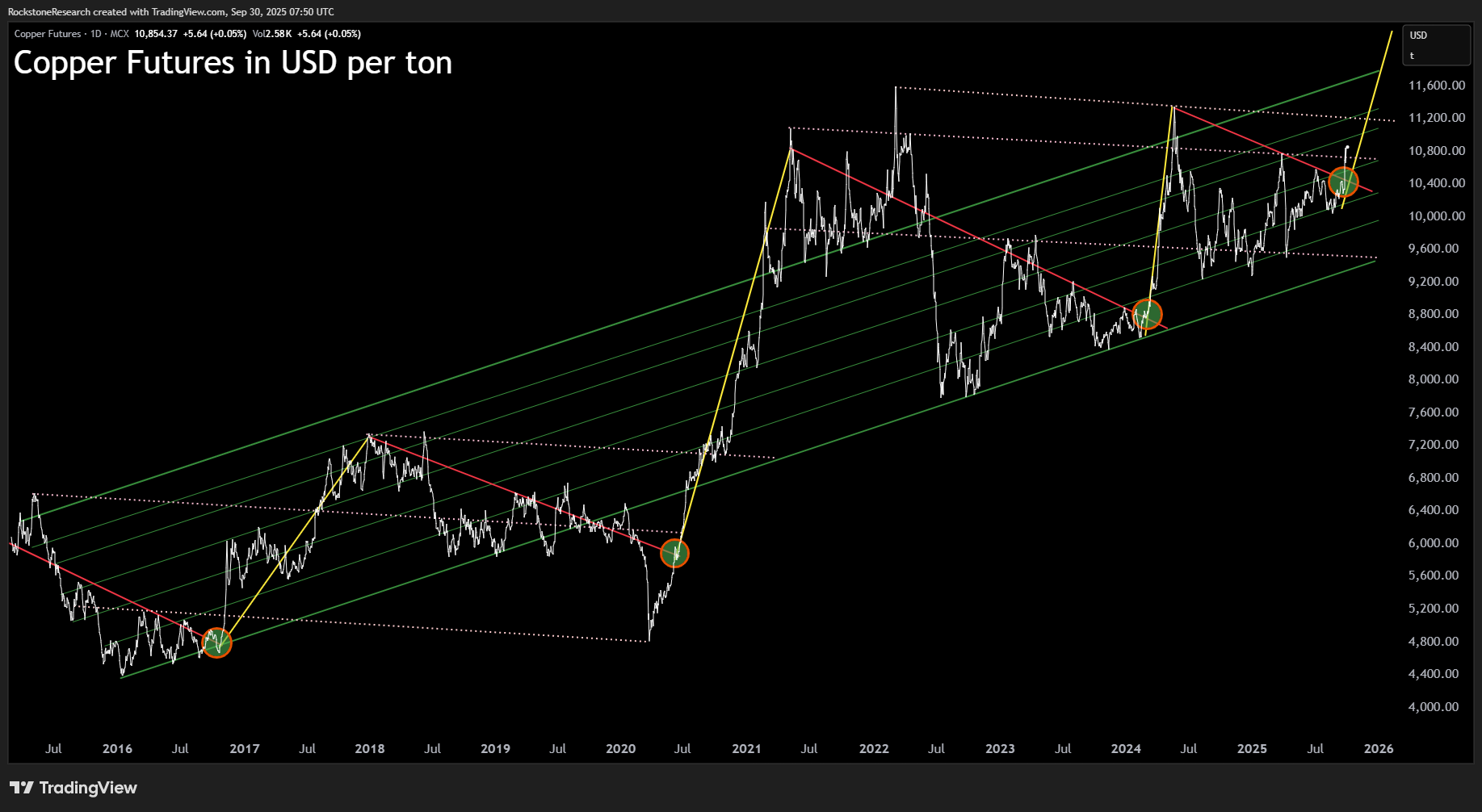

Excerpts from The Wall Street Journal‘s “Mining Megadeal Shows the World Is Crazy for Copper: Artificial intelligence and rising military spending are further buoying demand for the metal“ (September 10, 2025): “For years, copper bulls have talked up its key role in the transition to green energy, needed for wind turbines, electric cars and grid infrastructure. Now, the metal is riding two new megatrends: artificial intelligence and rising military spending. A proposed $53 billion merger between Anglo American and Teck Resources, the mining sector’s biggest deal for a decade, amounts to a giant play on future demand for the base metal. Copper consumption has been climbing for years but new supplies aren’t expected to keep pace with demand... The rise of artificial intelligence is powering a wave of extra demand for copper... “Significant amounts of copper are required to build, power and keep these centers cool,” said Anna Wiley, head of BHP’s South Australia copper business, at a conference last month. BHP, which sought to buy Anglo American last year to cement itself as the world’s biggest copper producer, forecasts a 70% increase in demand for the metal by 2050... All these factors are key reasons that help explain why copper has been at the heart of dealmaking in the mining sector in recent years – and why analysts say the proposed Anglo-Teck tie-up could spur rival offers as companies jostle for copper assets.“

Read more about the recent supply disruptions and looming price escalation in Rockstone´s recent article "Riding the Copper Supply Crunch: Today’s Juniors Are Tomorrow’s Headlines" – an analysis of how structural demand meets fragile supply, why majors are scrambling for growth, and where the real opportunities lie for investors positioning ahead of the next copper supercycle, with a spotlight on juniors poised to become tomorrow’s takeover targets and market leaders.

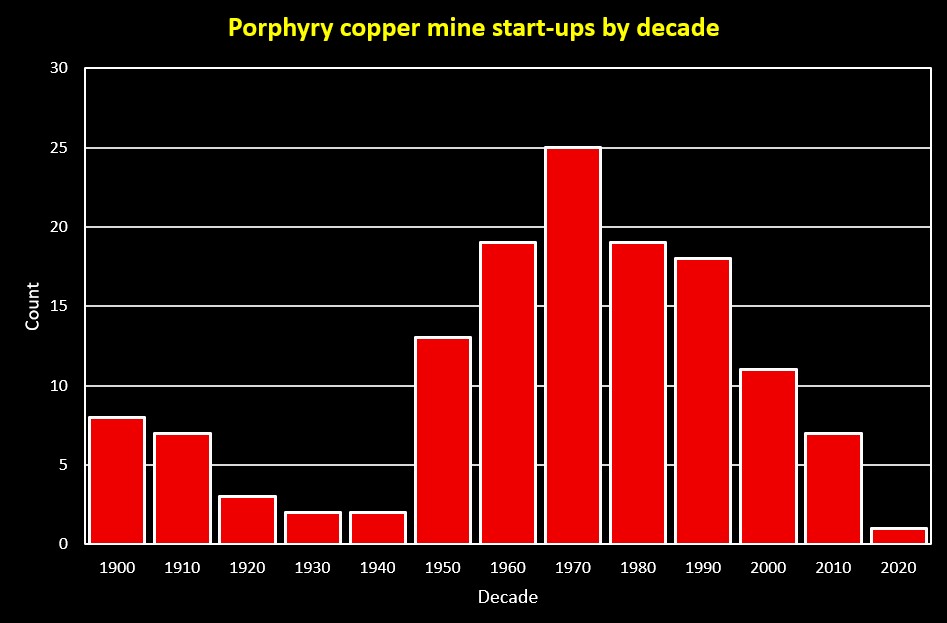

The surge of new porphyry copper mines in the 1950-1970s coincided with rising global demand, robust exploration investment, and the development of large-scale open-pit mining methods. However, the sharp downturn in new start-ups from the 1990s onward reflects several converging factors: Maturity of discoveries: Many of the world’s largest and most easily developed porphyry systems were already discovered and put into production, leaving fewer “low-hanging fruit” opportunities. Falling grades and rising costs: Average ore grades declined, while permitting, development, and capital costs increased, slowing the pace of new start-ups. Price volatility: Periods of low copper prices reduced the economic viability of new projects, particularly large-scale, capital-intensive porphyries. Shift toward expansions: Rather than building new mines, many companies have focused on expanding or extending the lives of existing operations. Investor take-away: The long-term decline in new mine start-ups highlights the scarcity value of genuine new discoveries. With demand for copper, gold, and molybdenum set to rise in the coming decades, companies advancing porphyry projects today are positioned to deliver outsized value as supply constraints tighten. This tightening supply pipeline highlights the scarcity value of new discoveries and underscores the upside leverage for companies advancing new projects today.

Momentum Building: Both in Canada and the United States

In British Columbia (BC), Copper Quest is advancing its flagship Stars discovery, the contiguous Stellar polymetallic project, and the Rip copper-moly porphyry – each defined by district-scale geophysical footprints, extensive alteration systems, and multiple untested anomalies that could each deliver new discoveries. Together with the highly prospective Thane Project, located between Centerra’s Mt. Milligan and Kemess operations, Copper Quest now controls one of the strongest exploration pipelines in BC, strategically positioned within two of the world’s most productive copper belts and surrounded by majors actively seeking scalable new supply opportunities.

Porphyry copper systems are the backbone of global copper supply. They host the largest, longest-lived, and most economically significant copper mines on the planet. Yet in stable jurisdictions like Canada and the U.S., new discoveries are becoming now exceedingly scarce in stable jurisdictions as easy-to-find deposits have already been mined. This scarcity makes Copper Quest’s portfolio especially compelling: Large-scale anomalies in proven belts, road accessible, with nearby infrastructure to shorten timelines and lower costs. For majors and mid-tiers looking for scalable growth, early-stage projects with proven fertility and strong discovery potential like these are in increasingly short supply and carry outsized strategic importance in today’s tightening market.

The Stars Project already shows signs of being a major porphyry discovery. Multiple holes have already returned 200-400 m intercepts, placing Stars firmly in the league of globally significant porphyry systems. These results confirm that Stars is part of a robust, fertile system, still wide open for expansion both laterally and at depth. The scale of the magnetic anomaly, combined with consistent mineralization across nearly every hole, underscores that Stars is far more than a typical grassroots play. Few early-stage projects demonstrate this combination of grade, thickness, and district-scale upside, making Stars a standout among BC’s emerging porphyries.

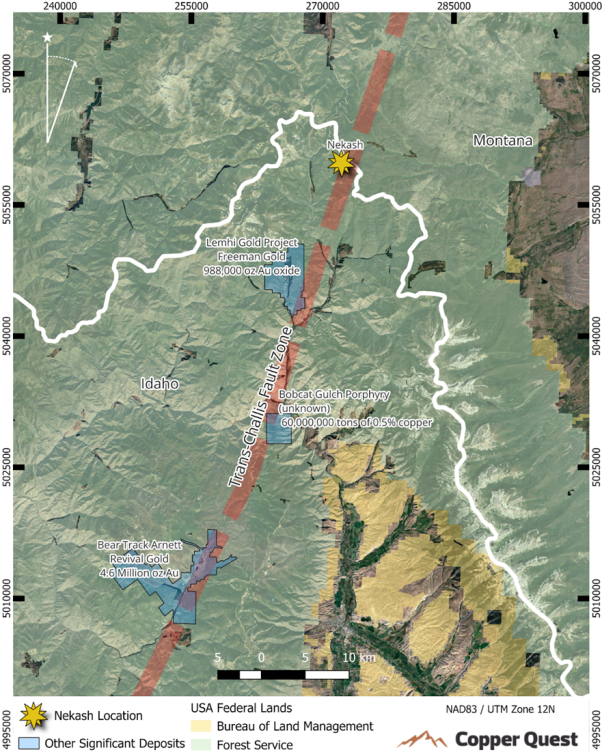

Adding to this momentum, Copper Quest has now completed the acquisition of the Nekash Copper-Gold Project in Idaho, a newly emerging porphyry belt that already hosts world-class systems such as Butte, CuMo, and the recent Grizzly Porphyry Copper-Gold discovery by Hercules Metals Corp. Historical surface work at Nekash returned multi-percent copper with strong gold and silver grades, while regional geology highlights the potential for a large, concealed porphyry system. With local management in place, Nekash anchors Copper Quest in a second tier-1 jurisdiction and significantly expands its North American footprint. This U.S. entry broadens the company’s profile for investors and adds another high-impact catalyst to the pipeline in 2025.

With multiple catalysts ahead in 2025-2026, Copper Quest offers investors rare exposure to scale, discovery, growth potential, and jurisdictional diversification in copper, the world’s most strategic, supply-constrained, and increasingly valuable metal for global electrification.

Regional Context: A District-Scale Opportunity

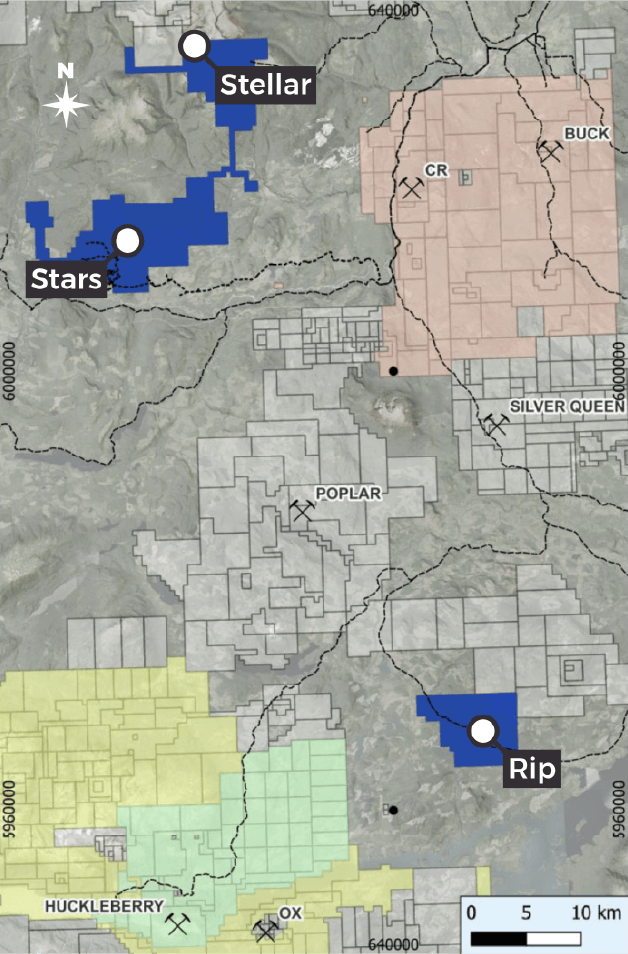

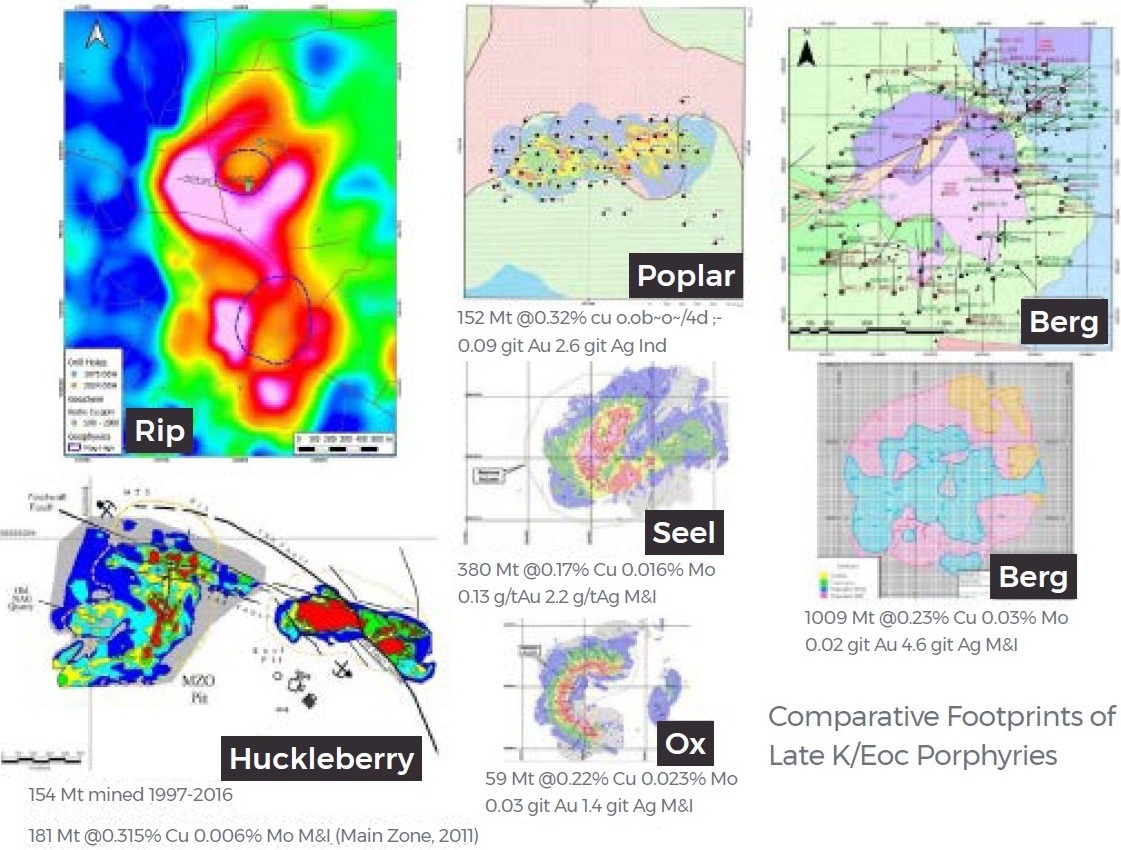

Copper Quest’s Stars, Stellar and Rip Projects sit at the heart of a proven copper-gold-silver camp hosting multiple advanced deposits. Nearby projects such as Huckleberry, Berg, Ox, Poplar, Silver Queen, Buck, and CR highlight the scale, grade diversity, and active development across central British Columbia (BC). Collectively, they underscore the potential for a consolidated production hub anchored by Huckleberry’s existing infrastructure.

In 2024, Vizsla Copper Corp. (current market cap: $36 million) acquired Universal Copper Ltd. and its flagship Poplar Project, securing one of central BC’s largest undeveloped porphyry copper systems. Historical resources outline 152 million tonnes (Mt) @ 0.32% copper (Indicated) and 139 Mt @ 0.29% copper (Inferred), together containing well over 2 billion pounds of copper plus significant molybdenum, gold, and silver credits. When set beside the Huckleberry Mine’s 1.25 billion pounds of copper in resources and reserves controlled by Imperial Metals Corp. (current market cap: $962 million), Poplar underscores the district-scale copper endowment of the region.

The map also highlights other advanced-stage projects adding depth to the camp. Buck (Sun Summit Minerals Corp.; current market cap: $41 million) offers bulk-tonnage gold-silver potential with 1.2 Mt @ 0.496 g/t gold (Indicated) and 52 Mt @ 0.462 g/t gold (Inferred). Silver Queen (Equity Metals Corp.; current market cap: $49 million) delivers high-grade polymetallic ounces, with 3.5 Mt containing 63 million ounces (Moz) of silver equivalent (AgEq) (Indicated) and 1.92 Mt containing 22.5 Moz AgEq (Inferred). Imperial Metals‘ Ox, adjacent to Huckleberry, represents a potential satellite porphyry copper-moly deposit that could extend mill feed. To the northeast, the CR Property represents an early-stage copper-molybdenum porphyry target. While no resource estimate has yet been defined, its position along the same mineralized belt highlights its potential importance within the broader district.

For Copper Quest (current market cap: $7 million), advancing Stars, Stellar and Rip in the midst of this cluster reinforces the district’s evolution into a multi-asset copper camp, where multiple deposits could ultimately converge around the infrastructure at Huckleberry. The presence of an existing permitted mill and tailings facility dramatically reduces the capital intensity and timeline typically required to develop a stand-alone project, while also providing a clear pathway to production. As additional discoveries are made and resources grow, the potential for a truly integrated mining hub becomes more tangible, with Huckleberry acting as the anchor that ties together several deposits across the belt. This creates an environment in which Stars and Stellar can move from promising exploration projects into key contributors within a district-scale copper growth story.

Huckleberry: A Past Producer with a Future Still in the Ground

The Huckleberry Mine was developed and commissioned under the leadership of Imperial Metals Corp. (current market cap: $962 million), which built the mine in the mid-1990s, brought it into production in 1997, and continued to manage operations throughout its life.

Full size / Existing infrastructure at the past producing Huckleberry Mine. (Source)

From its commissioning in 1997 to early 2011, the Huckleberry Mine processed roughly 90 million tonnes of ore from multiple open pits, producing nearly 870 million pounds of copper and 8 million pounds of molybdenum, along with significant by-products of gold and silver. Average head grades over this period were about 0.39% copper and 0.012% molybdenum, with copper recoveries approaching 89% and molybdenum recoveries near 26%. These strong metallurgical results translated into a copper concentrate averaging 27% copper, providing steady annual production of around 45-50 million pounds of copper and making silver, at roughly 250,000 ounces per year, an important revenue contributor alongside molybdenum.

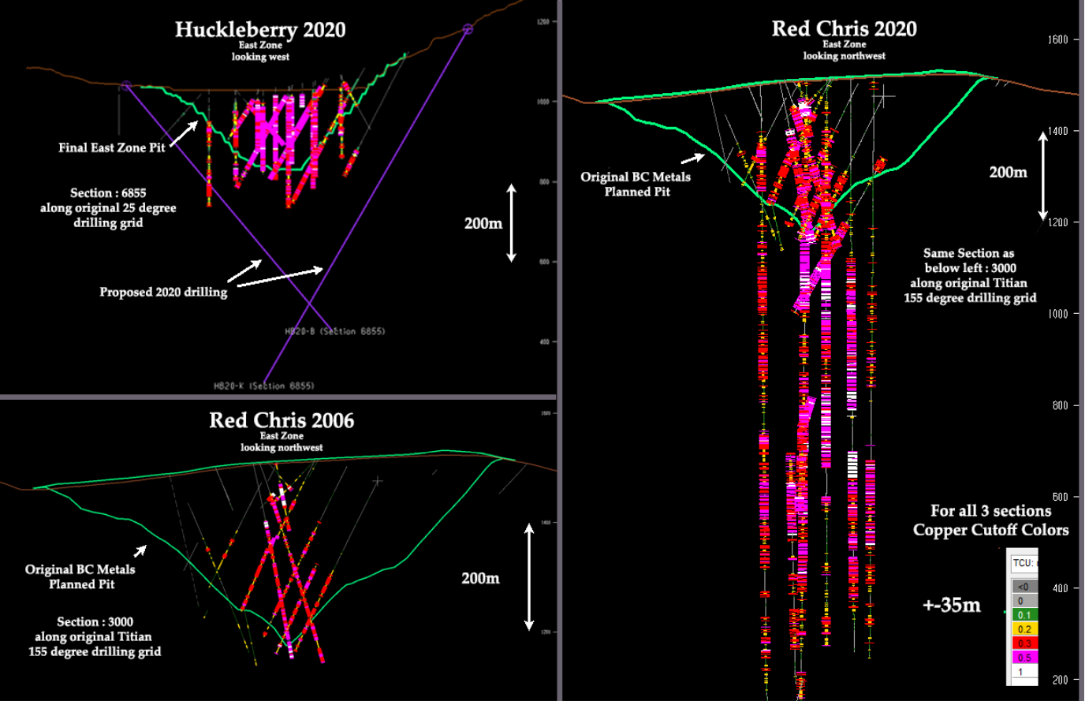

Huckleberry mine operations ceased in August 2016. The mine remains on care and maintenance status. The focus during the current closure of the Huckleberry Mine is to conduct exploration on the property to expand the resource. As of the most recent NI 43-101 Technical Report (January 2011), the Huckleberry Mine hosts a sizeable copper inventory. Proven and Probable Reserves stand at 39.7 Mt @ 0.34% copper and 0.009% molybdenum, containing roughly 300 million pounds of copper. In addition, Measured and Indicated Resources total 181 Mt @ 0.32% copper and 0.006% molybdenum, for more than 1.25 billion pounds of copper, with a further 48 Mt @ 0.26% copper classified as Inferred. A low-grade stockpile of 3.7 Mt @ 0.18% copper is also available for potential processing. Together, these reserves and resources underscore that Huckleberry remains a large, long-life copper asset with significant remaining endowment.

On top of that, the Huckleberry Property offers multiple avenues of upside that could support a restart of operations. Past drilling has already confirmed that mineralization continues well below the current pit limits, with long intercepts of copper and molybdenum at attractive grades, indicating room for deeper pit pushbacks or eventual underground development. In addition, exploration has outlined extensions like the Main Zone Extension and Saddle zones, both capable of adding new tonnage adjacent to historic workings. Beyond the immediate pit area, the company controls a large land package within a proven porphyry copper belt, including satellite targets such as Whiting Creek only 10 km to the north. Geophysical and geochemical surveys also highlight untested anomalies, underscoring the potential for new discoveries. Taken together, these opportunities position Huckleberry as more than just a past producer – it remains a district-scale copper asset with clear pathways to renewed production and growth. (Source)

Full size / Huckleberry’s 2020 East Zone cross-section looks strikingly similar to Red Chris in 2006, where early drilling stopped short in mineralization. At Red Chris, deeper drilling later unlocked some of the richest grades at depth – pointing to the same untapped upside potential at Huckleberry and elsewhere in the camp. (Source)

Restarting the Huckleberry Mine would do more than unlock its remaining copper – it would establish a regional hub that Copper Quest could leverage to fast-track development of its nearby Stars and Stellar projects. With permitted infrastructure and a mill already in place, Copper Quest could cut both capital costs and timelines by potentially processing material at Huckleberry. This synergy elevates Huckleberry from a simple restart into a central hub for district-wide growth, enabling Copper Quest to develop and feed multiple deposits into a single, integrated operation. Just as importantly, Stars and Stellar – given their location and potential to supply future mill feed – would be prime strategic targets for Imperial Metals, reinforcing their value in any regional consolidation scenario.

Stars Project

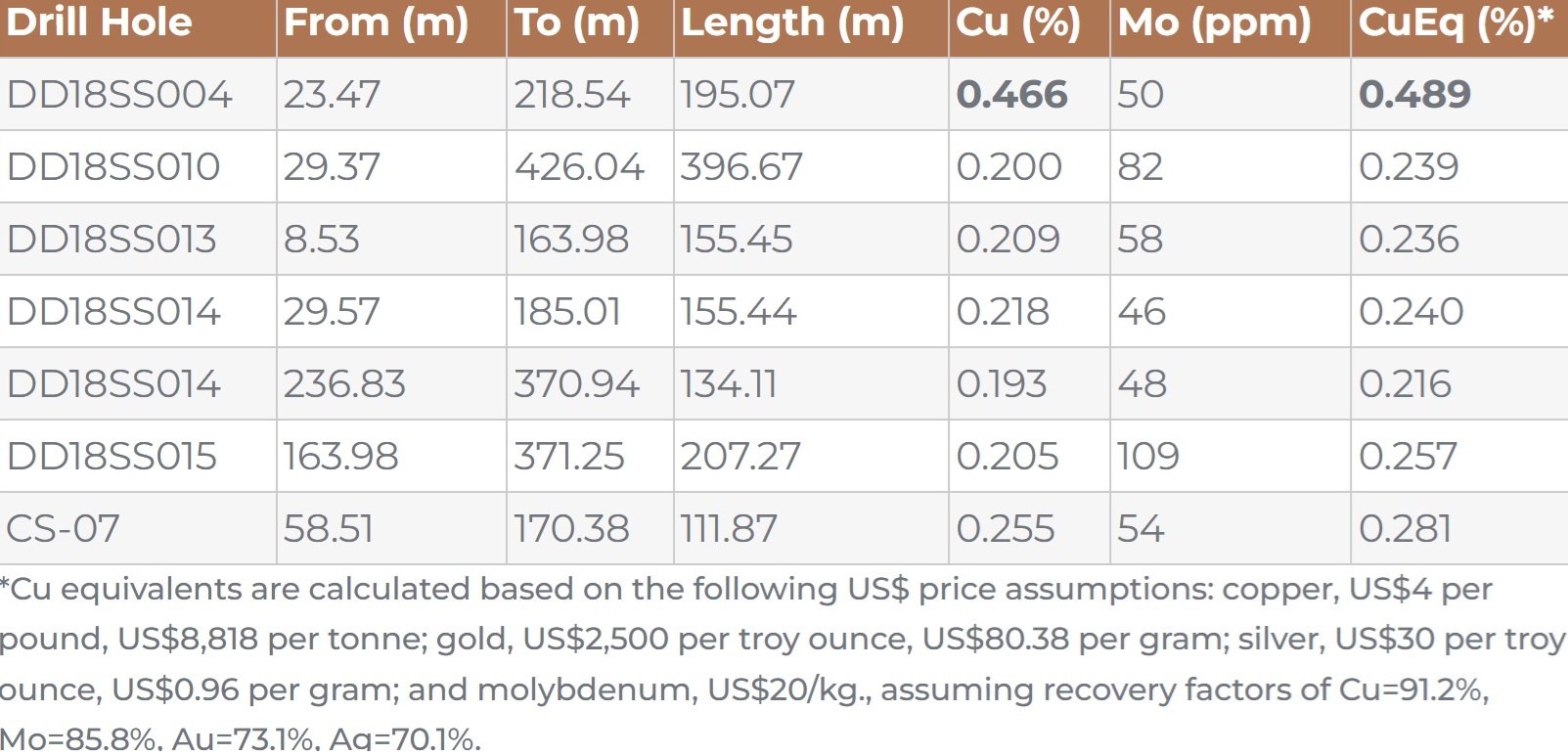

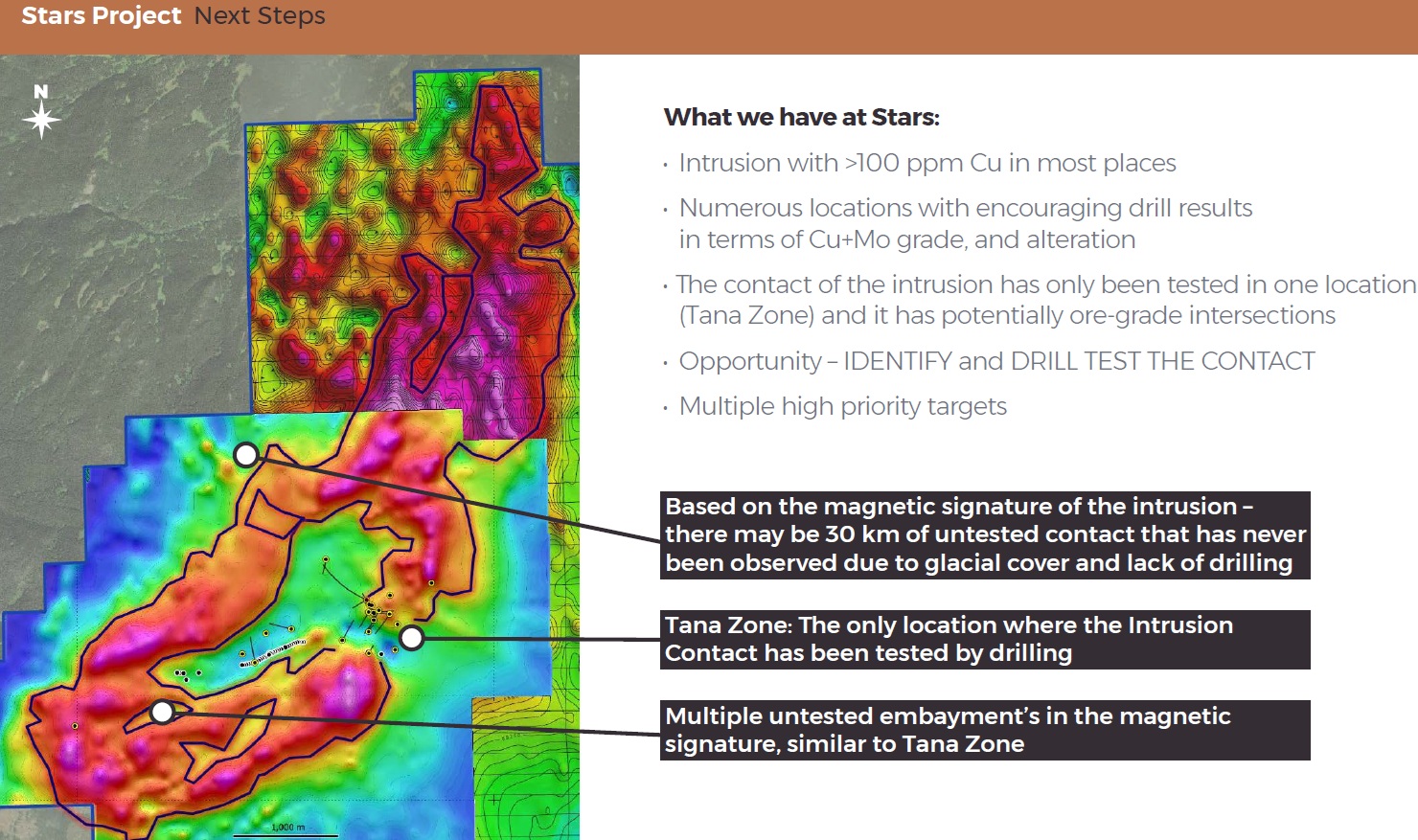

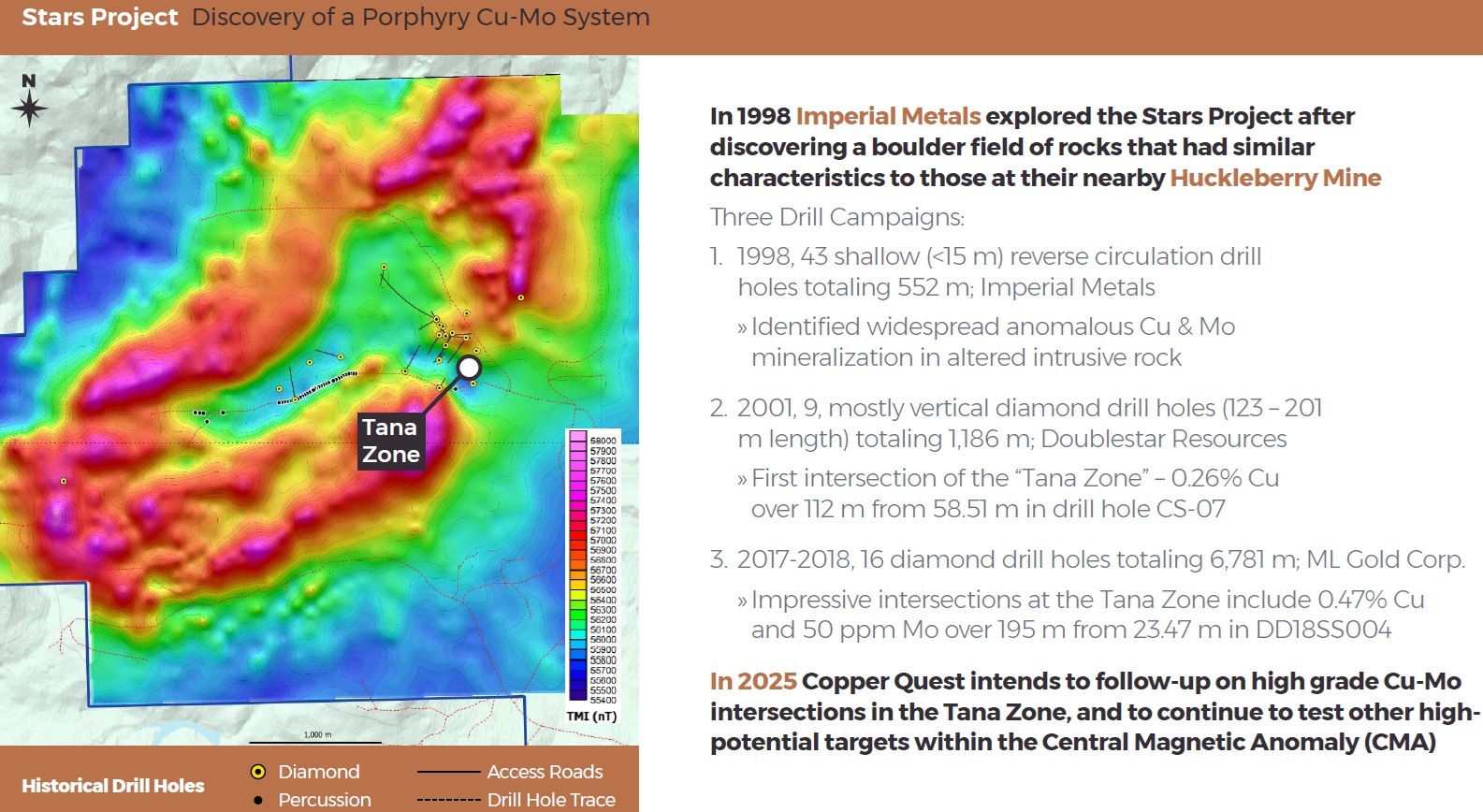

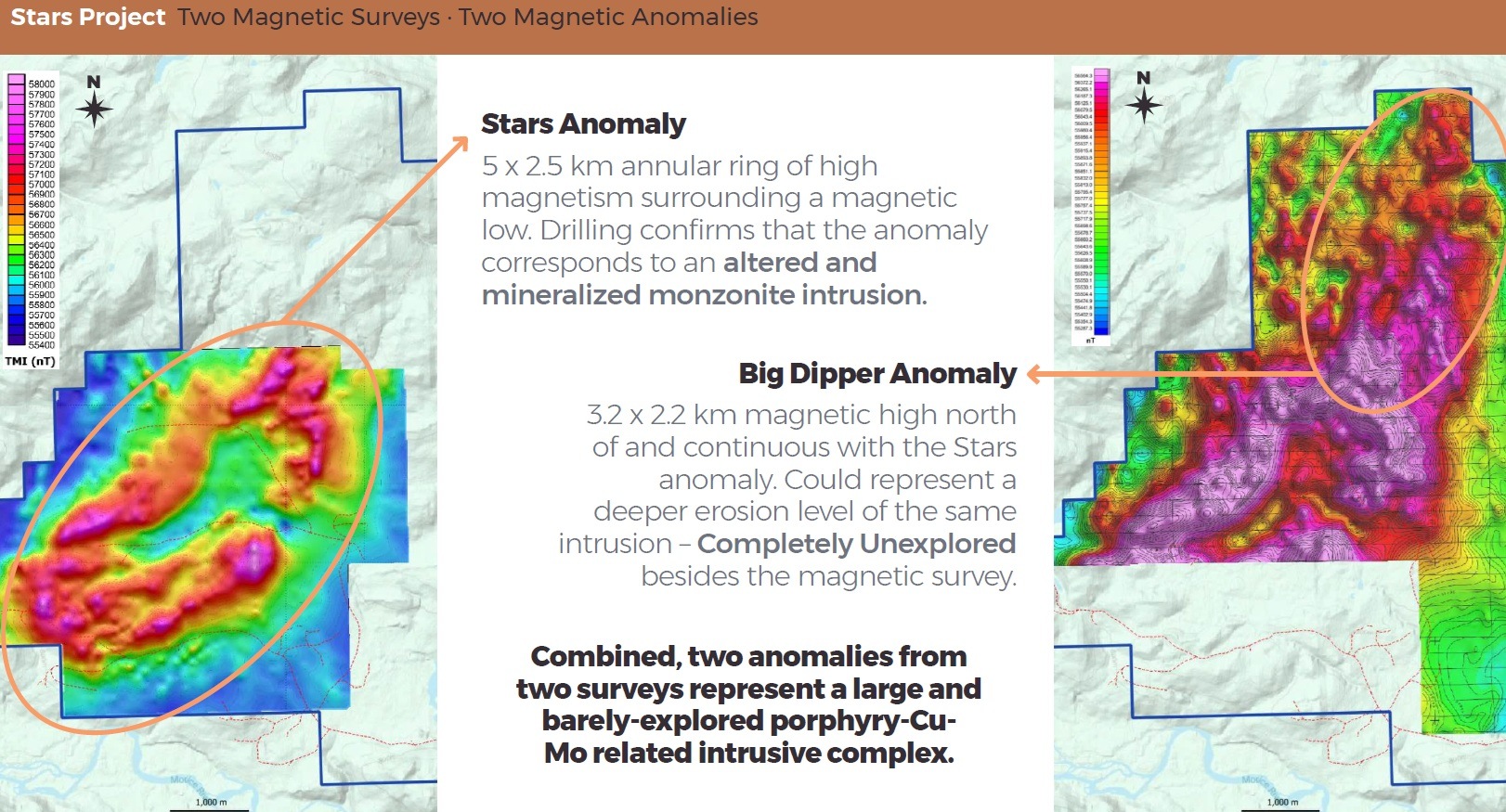

The Stars Project represents Copper Quest’s first major growth engine – a road-accessible, 100%-owned, 9,693-hectare copper-molybdenum system in the Bulkley Porphyry Belt, BC. With proximity to past-producing porphyry mines such as Huckleberry (Imperial Metals) and Equity Silver (Newmont), Stars sits in one of Canada’s most productive copper districts. The property’s significance is anchored by a 5 x 2.5 km annular magnetic anomaly – a classic geophysical fingerprint of large porphyry systems – with mineralization already drill-confirmed at the Tana Zone.

Full size / “If this enormous, continuous, and strong bedrock anomaly were exposed for all to see, it would have seen vigorous historical exploration” (Brian Thurston, CEO of Copper Quest) The entire magnetic anomaly is covered by glacial till with very sparse outcrop. This lack of surface exposure is actually an opportunity – it means a potentially large porphyry system remains hidden and underexplored, with drilling as the key to unlocking a company-making discovery.

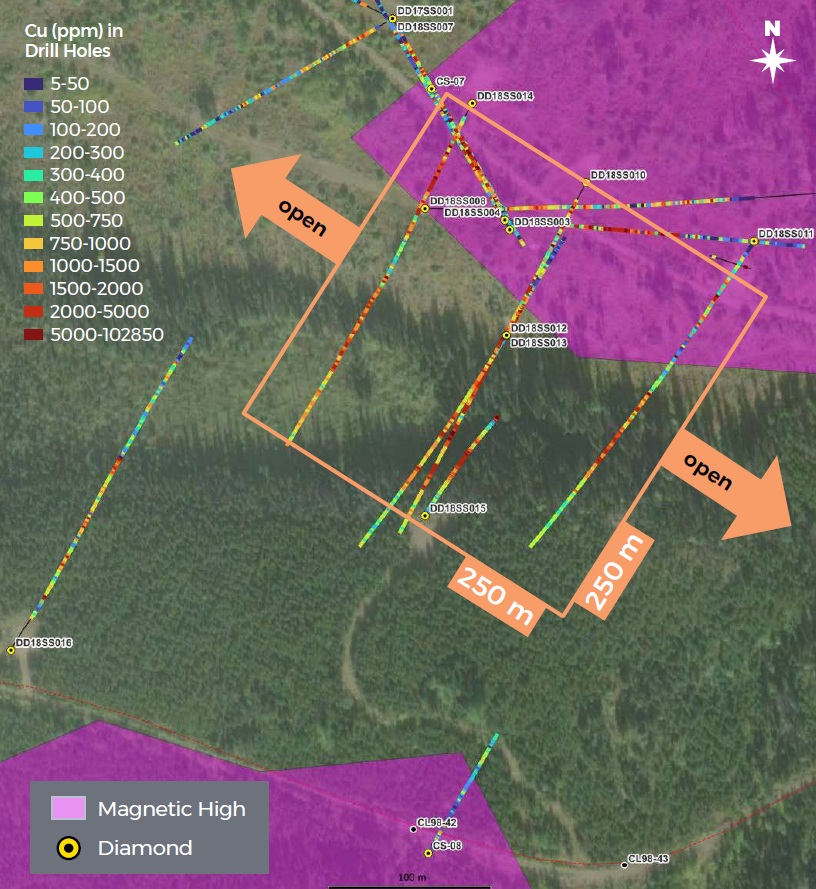

Tana Zone: Copper Discovery with Room to Grow

Previous drill campaigns at the Tana Zone have intersected wide copper-bearing intervals both near surface and at depth, including:

• 195 m @ 0.466% copper + 1.64 g/t silver (DD18-004, from 23.5 m), including

40.2 m @ 0.93% copper + 3.27 g/t silver

• 396 m @ 0.2% copper (DD18-010, from 29.4 m), including 30.5 m of 0.4% copper + 1.34 g/t silver

• 207 m @ 0.205% copper (DD18-015, from 164 m), including 67 m @ 0.35% copper (from 231 m) and 9.9 m @ 0.45% copper (from 444.4 m to end of hole)

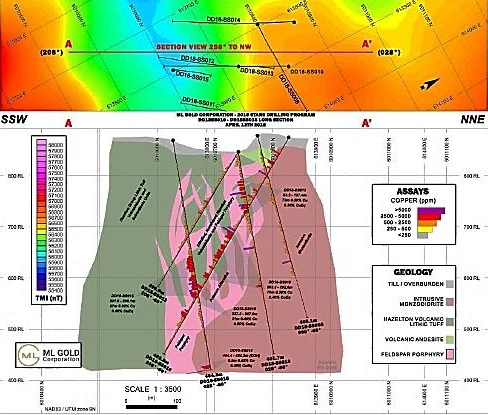

Consistent, thick copper intercepts compare favorably to many porphyry mines in production today, where grades often range between 0.2% and 0.4% copper. Importantly, the intrusion contact – a key mineralization control – has only been drilled in a single location. The system is wide open. These results confirm a robust copper system with economic potential, yet vast portions of the anomaly remain untested beneath glacial cover – presenting a clear opportunity for new discoveries. In addition to copper, drilling confirmed that Stars hosts silver, molybdenum, and gold, with assays returning up to 1.36 g/t gold and localized samples exceeding 10% copper. These multi-metal credits strengthen potential project economics compared to copper-only porphyry systems. This reinforces that Stars is more than just copper.

At Stars, nearly every drill hole has returned copper concentrations between 10x and 400x higher than natural background levels. What it means technically: 1) Background copper levels in unmineralized rock are very low (often 50–150 ppm). 2) Stars drill holes consistently show multiples above that baseline, confirming a pervasive mineralizing system throughout the intrusive body. 3) The fact this applies to “almost all drill holes” – not just a few isolated intercepts – suggests copper is widely distributed across the system, a hallmark of large-scale porphyries. Why it’s more significant than many other BC porphyry projects: 1) Many early-stage porphyry projects report isolated high-grade intervals surrounded by large volumes of weakly mineralized rock. 2) At Stars, the data shows copper enrichment is systematic and consistent, pointing to a robust, long-lived hydrothermal system. 3) This increases confidence that follow-up drilling will continue to hit copper, and raises the odds of defining a large porphyry copper deposit. Investor take-away: Wide-spread copper enrichment at 10-400 times background makes Stars much more than just another porphyry prospect – it’s evidence of a big, fertile copper system already in place. For investors, this dramatically lowers exploration risk compared to projects where mineralization is patchy or inconsistent, and it highlights the potential for Stars to evolve into a large, long-life deposit. This kind of consistency is exactly what attracts majors seeking scalable copper projects.

The Importance of Near-Surface + Depth Continuity

Near-Surface Hits

• Easier and cheaper to mine (open-pit potential).

• Faster payback in development scenarios.

• More attractive to majors seeking low-cost growth projects.

Depth Continuity

• Indicates a vertically extensive porphyry system.

• Supports the potential for long mine life.

• Enhances scalability: deeper zones can be developed after initial open-pit production.

Investor take-away: Wide copper intercepts both from surface and at depth suggest Stars could evolve into a large, long-life deposit with the economics to attract strategic partners or acquirers. Importantly, an independent Qualified Person reviewed and re-sampled the 2017-2018 drill core, verifying the reported copper grades and confirming the presence of widespread porphyry-style mineralization. This third-party validation de-risks the dataset and underpins confidence in future exploration results.

“Drill Logs and historical petrographic work indicate that most drill holes were collared in, and drilled almost entirely within a phyllic and potassic altered monzonite intrusion and porphyry dykes.“ (Copper Quest in its corporate presentatio) What it means: 1) Phyllic and potassic alteration: These are hydrothermal alteration styles strongly associated with productive porphyry copper systems. They often occur close to the core of mineralizing intrusions. 2) Monzonite intrusion and porphyry dykes: These are the host rocks most commonly tied to copper-molybdenum mineralization in BC porphyry camps (e.g., Huckleberry, Highland Valley). 3) Most drill holes stayed inside this environment: Historical drilling largely tested the interior of the intrusion itself, not the contact zones where higher copper grades often concentrate. Why it’s important for upcoming drilling: 1) Upside still untapped: If strong mineralization is already present inside the intrusive body, even better grades may lie along the intrusion contacts that remain mostly untested. 2) Improved targeting: Knowing the alteration and rock types confirms the system is “alive” and fertile, giving geologists a clear roadmap for expanding mineralization. 3) Relevance: The next drill program will deliberately test these contact zones beneath glacial cover, where the best copper discoveries in porphyry systems are often made. Investor take-away: Past drilling proved Stars hosts a fertile porphyry system; upcoming drilling will target the most prospective parts of that system – the intrusion margins – where the potential for larger, higher-grade discoveries is greatest.

Untested High-Priority Targets

Beyond Tana, several district-scale anomalies remain untested:

• Central Magnetic Anomaly (CMA): A 5 x 2.5 km ring-shaped anomaly typical of porphyry centers. Only partially drilled, it may host multiple mineralized centers.

• Big Dipper Anomaly: A 3.2 x 2.2 km magnetic high, interpreted as a preserved deeper porphyry system. No drilling yet.

• Intrusion contacts under cover: Over 30 km of potential contacts remain untested. These are often the sweet spots for copper mineralization.

Full size / Two massive magnetic anomalies – one already drill-confirmed as mineralized, the other never tested – together outline a rare, company-making copper porphyry system with scale that could attract major partners.

Investment Relevance

Porphyry copper systems are the world’s primary copper sources. The most important attribute: Scale. Even modest-grade deposits can support decades of production if tonnage is large. The combination of 1) already-confirmed thick copper intercepts, 2) a district-scale magnetic footprint, and 3) a lack of systematic drilling in the past, means Stars has the profile of a company-making discovery. In plain terms: Copper Quest already knows copper is there in significant quantities – what’s missing is defining how big it really is.

Full size / On-site photo of the Stars Project area. The 9,594 ha property benefits from road access and a favorable setting within a proven mining district, with nearby infrastructure supporting future exploration and development.

A Transformational Acquisition

In January 2025, Copper Quest completed the acquisition of Stars from Aurwest Resources. President & CEO Brian Thurston called the deal “transformative for Copper Quest”, noting that the company now controls nearly 9,700 ha of district-scale ground. He added: “Copper Quest now controls 9,693 ha covering the Stars Property and prospective surrounding area with two complementary exploration upsides being an established zone of higher-grade mineralization that Copper Quest can grow and define, and a much broader under-explored area with high potential for new discovery. Combined with the recently acquired and contiguous 5,389 ha Stellar Property, Copper Quest has assembled a dominant land position and created a unique opportunity that unlocks a district scale copper porphyry project in the Bulkley Porphyry Belt.”

A Strong Partnership and Board Support

The acquisition also strengthened Copper Quest’s bench of capital markets expertise. Cameron MacDonald, CEO of Aurwest, joined the Copper Quest board, stating: “I am looking forward to assisting Copper Quest in financing exploration of the Stars Property and exposing the Aurwest shareholders to the upside potential of advancing the Stars Property. Given the global movement towards electrification, environmental concerns, infrastructure development, and the forecasted demand for copper, the combined properties of Copper Quest make a very compelling exploration package.”

Full size / Plan map of the Tana Zone showing drill holes color-coded by copper content (ppm). Consistent mineralization has been intersected across a 250 x 250 m area and remains open in multiple directions. The association with magnetic highs (purple zones) underscores the potential for a much larger porphyry system beyond the currently drilled footprint, highlighting significant growth and discovery potential with upcoming drilling.

2025-2026: A Company-Making Exploration Window

Copper Quest is preparing an aggressive exploration campaign for 2025-2026, including multiple high-impact initiatives designed to unlock value:

• Drill permitting and core relogging: Upgrading geological models, refining target areas, and ensuring the most efficient use of capital.

• Reconnaissance of new ground: Expanding beyond known drill areas and evaluating newly staked claims.

• Follow-up drilling: Expanding Tana’s higher-grade intercepts.

• First-ever drill tests of CMA and Big Dipper: Each hole has the potential to reveal a new copper center.

Full size / Drilling cross-section (AR38139) through the Tana Zone showing shallow copper intercepts within altered monzonite. Investor take-away: Drilling has only tested the upper few hundred metres, leaving the deeper roots and lateral extensions of the porphyry system entirely untested and wide open for discovery.

Bottom Line

With its combination of discovery-stage results, a district-scale land position, and multiple untested high-priority targets, the Stars Project is set to become Copper Quest’s first major catalyst in 2025-2026 and the cornerstone of its growth strategy in the Bulkley Belt. The project is already defined by wide, consistent copper intercepts at the Tana Zone, but its true value lies in the much larger potential footprint of mineralization that has yet to be systematically drilled.

With copper, silver, molybdenum, and gold all present, Stars carries a diversified metal endowment that strengthens project economics and makes it more competitive with producing porphyry camps in BC. Precious-metal credits are particularly important, providing by-product value that can lower effective production costs and improve margins in a development scenario.

The untested anomalies across the property – including the Central Magnetic Anomaly (CMA), the Big Dipper feature, and more than 30 km of concealed intrusion contacts – are geophysical signatures of large porphyry systems. Success on even one of these high-impact targets could instantly elevate Stars into the league of significant copper discoveries in Canada. These features remain almost entirely undrilled, underscoring both the scale of the opportunity and the degree of underexploration to date.

For investors, this creates a binary but high-reward scenario. Follow-up drilling is no longer about proving whether copper exists – that milestone has already been achieved through thick, near-surface intercepts – but about defining the overall size, continuity, and grade distribution of the system.

In the porphyry copper space, scale is everything: It attracts major partners, defines mine life, and ultimately delivers transformational value. With Stars, Copper Quest is positioned to deliver that scale, making the next phase of exploration potentially company-making.

Full size / Malachite-stained outcrop with visible chalcopyrite and bornite mineralization from the Stars Project area, providing surface evidence of a fertile copper porphyry system. The striking green malachite is a copper oxide mineral, formed when primary copper sulphides such as chalcopyrite and bornite are exposed to oxygen and water at surface. This natural process, known as oxidation or weathering, alters sulphides into colourful oxides and carbonates. Chalcopyrite and bornite are the primary copper sulphides – they crystallize deeper in the rock and represent the true source of copper. Near surface, these sulphides undergo chemical breakdown, producing secondary oxides and carbonates like malachite (green) and azurite (blue), often creating vivid staining along fractures and outcrops. The presence of both residual sulphides (chalcopyrite, bornite) and oxidized copper minerals (malachite) at Stars is geologically significant because it shows the system is mineralized at depth and has a surface expression of copper mobility. This combination suggests a long-lived hydrothermal system with a robust metal endowment, similar to world-class porphyry copper camps. In practical terms, the oxidation zone acts as a surface “flag” pointing to a larger mineralized body beneath weathered cover. Investor take-away: Copper oxides at surface are more than visual indicators – they confirm copper-bearing fluids moved through this rock, creating alteration halos and leaving behind secondary minerals. While the colourful oxides themselves are not the economic target, they provide strong evidence that the underlying sulphides host the real potential for a large-tonnage porphyry copper deposit capable of long mine life and scalable production.

Stellar Project

Expanding the Footprint

The Stellar Project lies directly north of Copper Quest’s Stars Project, together forming a contiguous land position in the heart of BC’s Bulkley Porphyry Belt. While the 2 projects adjoin and could easily have been grouped under a single name, Copper Quest deliberately retained them as separate entities: Stars is a proven porphyry copper system, whereas Stellar is emerging as a multi-commodity target area with distinct geological signatures and mineralization styles. This differentiation underscores the company’s strategy to advance each project on its own technical merits.

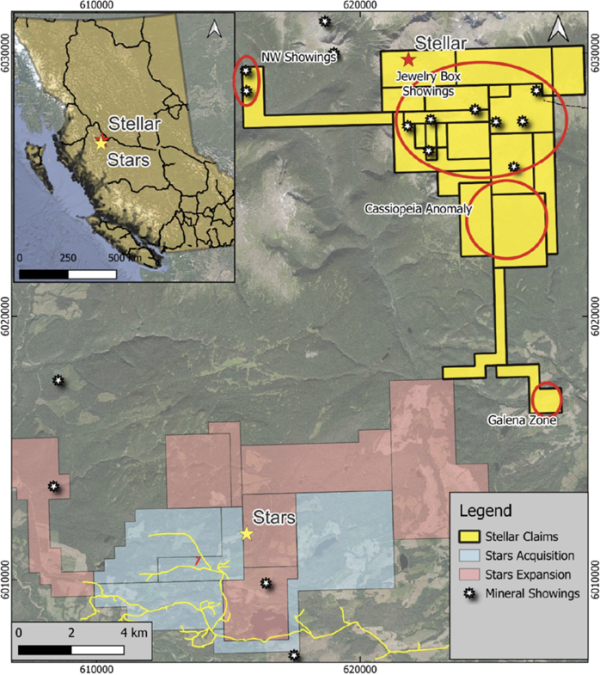

Full size / Location and claim map of the Stellar and Stars Properties with mineral showings and prospective areas.

A Newly Consolidated Land Package

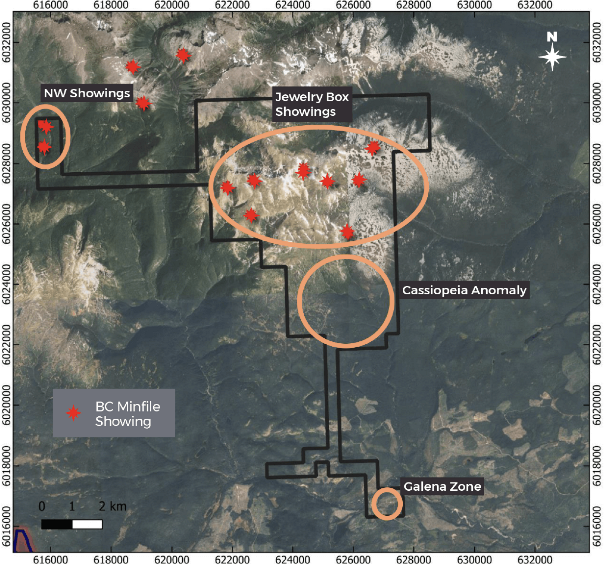

Stellar is a 100%-owned, 5,389-hectare concession that was consolidated by Copper Quest in late 2024. Historical exploration across the property has already outlined a 5 x 3 km zone of high-grade copper, gold, and silver results, supported by modern geophysical surveys and selective drilling. The property hosts multiple target areas including:

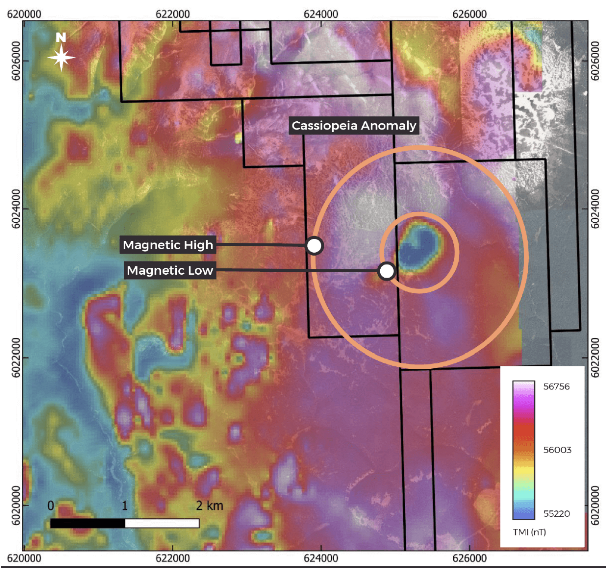

• Cassiopeia Anomaly: A 2,500 m diameter “bullseye” magnetic anomaly discovered in 2019, never drill-tested. Its annular magnetic high surrounding a central low is a textbook porphyry copper-moly-gold signature, representing one of Stellar’s most compelling untested porphyry targets.

Full size / Magnetic map showing the 2.5 km diameter Cassiopeia Anomaly, a textbook porphyry-style geophysical feature characterized by a circular magnetic high encircling an 800 m magnetic low. Discovered in 2019 and never drill-tested, Cassiopeia lies within the heart of the Stellar property and represents one of the most compelling untested porphyry copper-moly-gold targets in BC’s Bulkley Belt. Cassiopeia Magnetic Anomaly – Discovery Awaits: The anomaly’s scale, geometry, and lack of historical exploration highlight its strong discovery potential and make it a priority target for Copper Quest’s 2025-2026 exploration program.

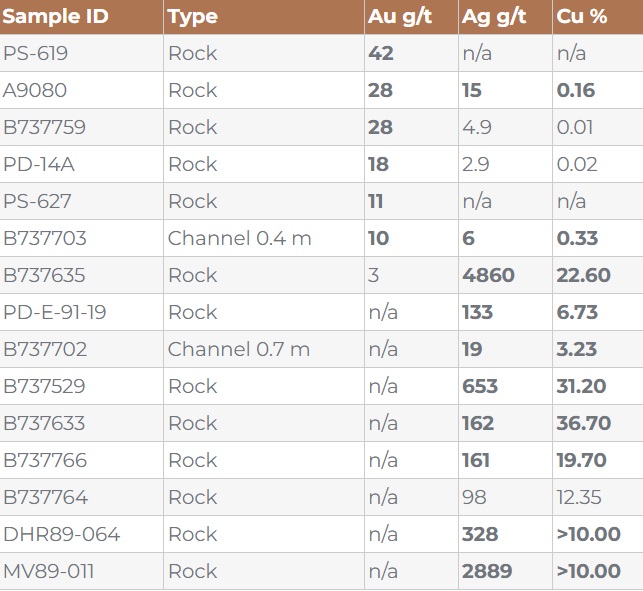

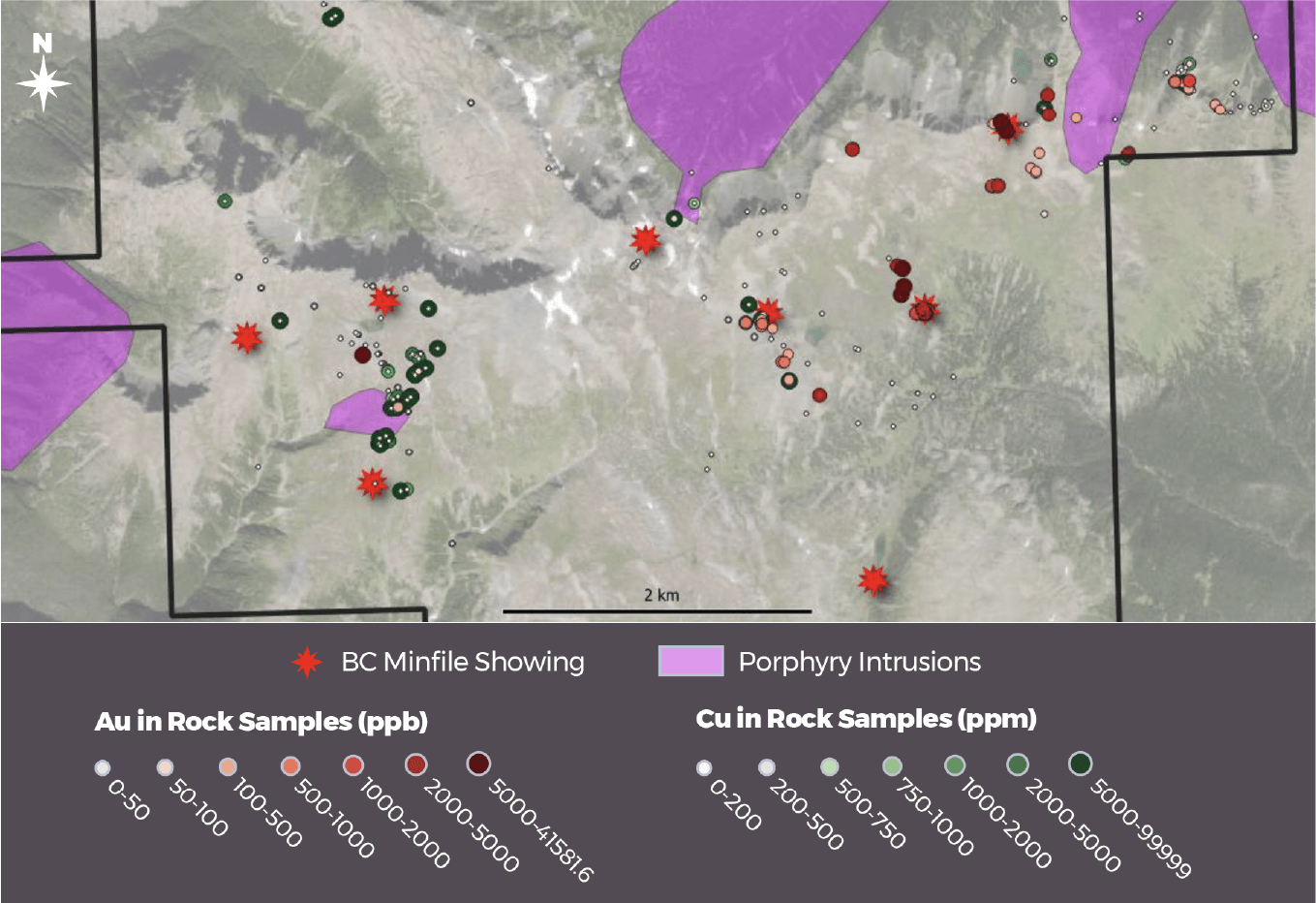

• Jewelry Box Area: Encompasses 8 BC Minfile showings across 15 km² where a porphyritic intrusion cuts Hazelton Group volcanic rocks and limestone. Historical and recent sampling returned exceptionally high grades, including up to 42 g/t gold and over 30% copper from select samples, alongside silver and the semi-precious mineral rhodonite.

• Galena Zone: A 100 x 150 m zone with strong lead-silver-zinc mineralization, first outlined in 2021. Rock sampling identified argentiferous galena with assays up to 1,500 g/t silver and >5% lead.

• Northwest Showings: Copper-lead-zinc showings associated with magnetite alteration and a syenite intrusion, further diversifying the range of mineralization styles present at Stellar.

Exploration History and Potential

Stellar has seen sporadic but promising exploration since the 1960s, ranging from trenching and early drilling by Phelps Dodge and Granges, to modern IP and airborne magnetic surveys. The 2021 work program by Aurwest Resources Corp. (a previous operator) included IP, soil, rock, and silt sampling across the Jewelry Box and Galena areas, returning encouraging results such as 28.3 g/t gold from the Ridge Showing and multi-percent lead from the Galena Zone. Despite these results, large parts of Stellar remain underexplored, particularly around the Cassiopeia Anomaly and western portions of the claim block. Together with the contiguous Stars Project, the combined land position now secures control of an emerging copper-gold-silver district anchored by multiple large-scale geophysical and geochemical anomalies.

Full size / High-grade historical rock and channel sample results from the Jewelry Box area. Samples highlight the polymetallic character of the system, with assays returning up to 42 g/t gold, 4,860 g/t silver, and 36.7% copper. The diversity and grade of results underscore Stellar’s potential to host both high-grade vein-style mineralization and a larger porphyry-related hydrothermal system, making the Jewelry Box area a priority focus for upcoming exploration.

Full size / Jewelry Box and associated mineralized zones. The map shows the cluster of BC Minfile showings (red stars), gold and copper rock sample results (circles), and mapped porphyry intrusions (purple) across the Jewelry Box area. This 15 km² zone hosts at least 8 documented showings with exceptional grades, including up to 42 g/t gold, 4,860 g/t silver, and 36.7% copper, and is notable for its occurrence of rhodonite, a semi-precious mineral. Mineralization is controlled by porphyritic intrusions cutting Hazelton Group volcanics and limestones, suggesting potential for both high-grade veins and a larger porphyry-related hydrothermal system. To the northwest, additional copper-lead-zinc showings linked to syenite intrusions highlight Stellar’s polymetallic character, while the Galena Zone defines a 100 × 150 m area of lead-silver-zinc mineralization untested. Taken together, Stellar hosts a rare mix of porphyry-style copper targets and high-grade polymetallic zones – a key reason Copper Quest advanced Stellar as a standalone project adjacent to Stars, rather than consolidating the two. Investor take-away: The Stellar Project offers exposure to both large-scale porphyry copper discovery potential and near-surface high-grade polymetallic showings. With multiple untested anomalies, assays confirming exceptional gold, silver, and copper grades, and district-scale synergies with Stars, Stellar represents a rare opportunity for discovery-driven value creation in one of BC’s most accessible porphyry belts.

Strategic Importance

By keeping Stellar and Stars as separate projects, Copper Quest emphasizes their complementary but distinct potential: Stars is an advanced-stage porphyry copper system with demonstrated grade and scale, while Stellar is a polymetallic target field offering discovery potential in gold, silver, copper, and lead-zinc systems. Advancing Stellar alongside Stars not only strengthens Copper Quest’s footprint in the Bulkley Belt but also enhances the optionality of the company’s portfolio – copper dominance at Stars, and a broader commodity mix at Stellar.

Full size / Key target areas of the Stellar Project. Satellite map showing the distribution of BC Minfile showings (red stars) and major target zones within the 5,389 ha Stellar Property. Together, these targets underscore Stellar’s polymetallic potential and its complementary role alongside the adjacent Stars Project in Copper Quest’s portfolio. Investor take-away: Stellar offers exposure to multiple untested, high-grade copper, gold, silver, and polymetallic targets. Its proximity to Stars creates district-scale discovery potential, positioning Copper Quest to deliver both scale and commodity diversity in one of BC’s most promising porphyry belts.

Next Steps

With the consolidation of Stellar complete, Copper Quest is now positioned to systematically explore what has been a historically underexplored property. The 2025-2026 work program will focus on advancing the highest-priority targets toward drill readiness:+

• Cassiopeia Anomaly: Initiate ground-based geophysical surveys (IP) to define the depth and shape of this large porphyry-style magnetic anomaly. Drill testing is anticipated to be the first ever conducted on this target.

• Jewelry Box Area: Undertake detailed mapping, sampling, and structural analysis to integrate decades of high-grade results into a cohesive geological model. The goal is to identify vectors toward a porphyry center that may explain the cluster of gold- and copper-rich showings.

• Galena Zone & Northwest Showings: Expand prospecting and geochemical coverage across lead-zinc-silver occurrences, including trenching and potential first-pass drilling to evaluate grade continuity.

• Property-Wide Prospecting: Compile historical datasets with new fieldwork to generate additional targets across the 5,389 ha claim block, building a robust pipeline of prospects for follow-up.

Full size / Aerial view across the Stellar Property, showcasing its high-elevation terrain, excellent exposure, and easy access for exploration.

Bottom Line

Copper Quest views Stellar as a discovery-stage project with the potential to add a significant and highly valuable multi-commodity dimension to its Bulkley Belt portfolio. Historical sampling has already confirmed exceptionally high-grade copper, gold, and silver values, while geophysics highlights a large, never-tested porphyry target that could anchor a major new discovery. Together with additional polymetallic showings and untested zones of interest, these features make Stellar one of the most compelling early-stage exploration opportunities in the district.

With multiple untested targets and strong potential for both porphyry-scale and high-grade vein-style mineralization, Stellar enhances the company’s exploration pipeline and provides important diversification within a district that is quickly emerging as one of BC’s next copper hubs, offering investors exposure to both scale, grade, and commodity diversity in a single, strategically located project.

Rip Project

Early Stage Copper-Moly Discovery Potential

The Rip Project is a 4,770-hectare porphyry copper-molybdenum property within the emerging Bulkley Porphyry Belt. With excellent road access and proximity to past producers such as Huckleberry (Imperial Metals) and Equity Silver (Newmont), Rip benefits from strong regional infrastructure and a proven metallogenic setting.

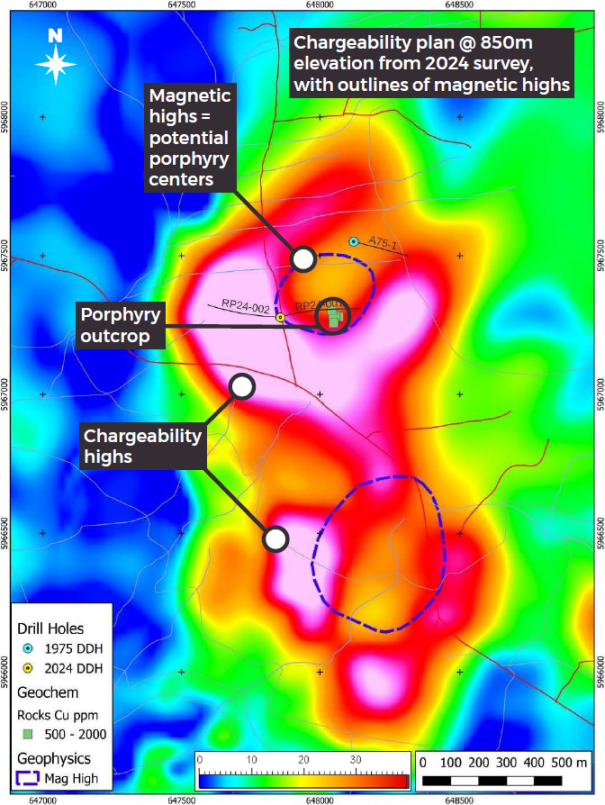

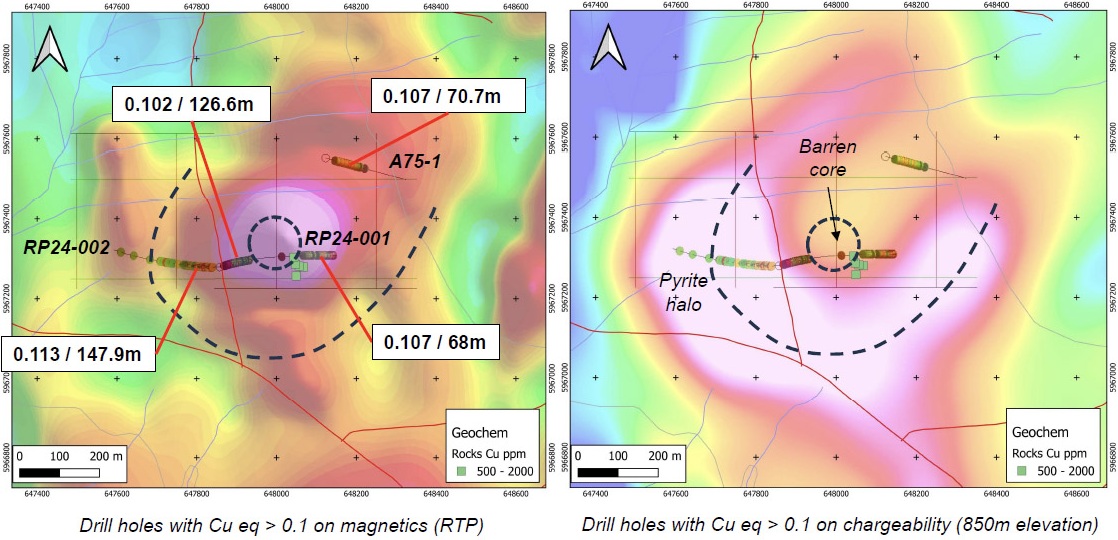

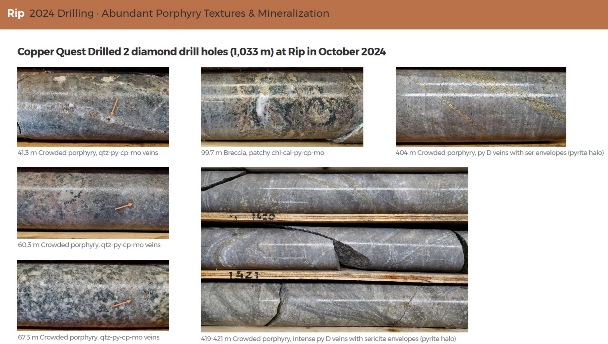

Modern airborne magnetic and 3D-IP geophysical surveys completed in 2024 resolved the historical Rip Anomaly into 2 distinct porphyry centers, each marked by classic pyrite halos surrounding magnetic highs. This geophysical footprint is comparable in scale to other district deposits such as Poplar, Seel, Ox, and Berg, yet Rip remains largely untested by drilling.

Full size / 2024 airborne magnetic and 3D-DCIP surveys at the Rip Project defined 2 distinct porphyry centers: The northern anomaly – partly tested by 2 short drill holes in 2024 – shows a classic chargeability “donut” (pyrite halo) surrounding a magnetic core. The much larger southern anomaly, however, remains completely untested and concealed beneath cover, underscoring strong discovery potential, additional exploration upside, and the clear need for follow-up drilling.

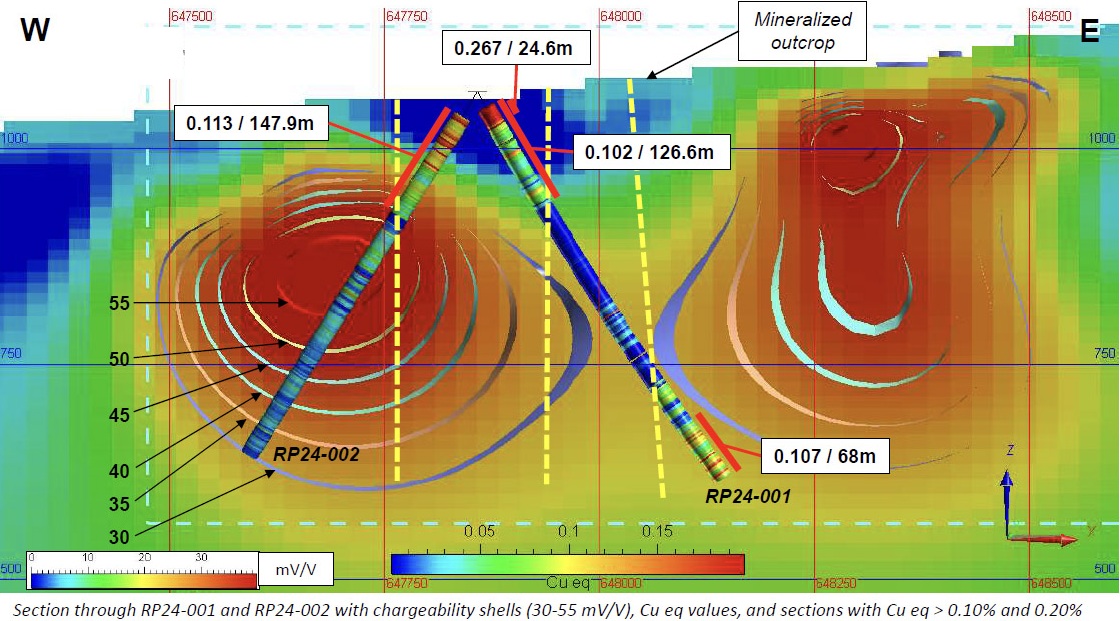

The first-ever Copper Quest drill program in late 2024 was deliberately limited in scope: Just 2 short diamond drill holes (1,033 m total) were completed from a single pad on the northern target. Despite the small scale, results confirmed the presence of a large mineralized porphyry system:

• RP24-001: 126.6 m @ 0.102% CuEq, including 24.6 m @ 0.267% CuEq

• RP24-002: 114.3 m @ 0.113% CuEq, including 72.4 m @ 0.137% CuEq

While not yet ore-grade, these long intervals of copper-moly mineralization with multi-phase veining, QSP alteration, and stockwork textures validate Rip as a porphyry system with significant growth potential. Importantly, the southern target – entirely covered – remains completely untested.

Full size / Cross-section through the northern anomaly showing 2024 drill holes RP24-001 and RP24-002 plotted against chargeability shells (30-55 mV/V). Both holes intersected long intervals of anomalous copper-molybdenum mineralization beginning near surface, confirming a large porphyry system beneath shallow cover. The image highlights the classic “donut-shaped” chargeability halo around a magnetic core – an archetypal geophysical expression of porphyry systems. Zones of intense quartz-sericite-pyrite (QSP) alteration, stockwork veining, and multi-stage intrusive phases were logged in both holes, supporting the interpretation of a vertically continuous mineralized cylinder at least 600 m wide. The strong correlation between geophysics and drill intercepts validates the exploration model, with the magnetic high likely representing a barren intrusive core and the surrounding chargeability ring marking sulphide-rich mineralization.

Full size / Plan view maps of the northern anomaly at Rip, integrating 2024 drill results with geophysical datasets. The left panel shows reduced-to-pole magnetics, while the right panel illustrates chargeability at 850 m elevation. Both highlight the contrast between a magnetic/chargeability high interpreted as a barren intrusive core and the surrounding pyrite halo. Drill holes RP24-001 and RP24-002, along with historical hole A75-1 (1975), all intersected long intervals of anomalous copper-molybdenum mineralization, demonstrating the system’s scale. Rock geochemistry (green squares: 500–2,000 ppm copper) aligns spatially with the modeled halo, providing independent confirmation of surface expressions directly above the geophysical anomaly. It is not unusual in porphyry systems for the central core to be relatively barren, with economic mineralization typically located in the surrounding shell, where sulphide-rich stockwork and alteration are best developed. While the grades encountered to date are not ore-grade, they confirm a fertile porphyry environment and leave open the possibility of significantly higher grades in other parts of the system. The circular geometry of the anomaly, coupled with consistent mineralization in multiple holes, suggests a subvertical cylindrical system – typical of productive porphyry centers. The first holes drilled in 2024 represent “scout holes“, designed to establish the system’s geometry and alteration footprint. Follow-up drilling will vector toward more prospective areas where stronger mineralization may be concentrated. Importantly, only the western margin of this target has been tested, leaving the eastern flank, deeper levels, and the much larger southern anomaly completely untested.

Copper Quest is earning up to an 80% interest from ArcWest Exploration Inc. by funding staged exploration over 4 years. Next steps include drilling the southern anomaly, step-out drilling at the northern zone, and refined geophysical work to vector toward higher-grade centers.

Full size / Drill site at the Rip Project during the 2024 phase-1 program. The road-accessible property allows efficient mobilization of crews and equipment into a heavily forested but infrastructure-rich district. The initial 2-hole program from this setup confirmed that Rip hosts a porphyry copper-molybdenum system, setting the stage for expanded drilling.

Bottom Line

With only a handful of short holes drilled to date, Rip is still in the very earliest stages of testing. Even so, the initial program has already confirmed a large porphyry copper-molybdenum system, validating the geophysical model and demonstrating long intervals of mineralization from surface.

The northern anomaly, tested by only two 2024 holes and one historical hole, shows a classic chargeability halo around a magnetic core – exactly the type of geophysical-structural relationship seen at many large porphyry systems in BC.

It is not unusual for the central core to be relatively barren, as mineralization often concentrates in the surrounding shell where sulfide-rich stockwork veining and alteration are strongest. The grades intersected to date, while not ore-grade, confirm fertility and provide vectors for follow-up exploration. Early holes in world-class porphyries often return similar low-grade results before step-out and deeper drilling discover higher-grade centers.

The larger southern anomaly remains completely untested, yet exhibits a comparable geophysical signature, suggesting a second porphyry center of equal or greater scale. The chance to test such a system in a proven porphyry belt with excellent infrastructure and proximity to past producers is rare.

Strategically, Rip strengthens Copper Quest’s land position in the Bulkley Belt, now host to multiple advancing copper projects, and adds optionality for partnerships, joint ventures, or district-scale consolidation.

In short, Rip is a true discovery-stage opportunity: Fertile, well located, and still at the very beginning of the drill-testing curve. Initial “scout holes“ have proven the concept, and systematic follow-up drilling could quickly elevate Rip into one of the most compelling and strategically positioned copper-molybdenum projects in central BC.

Full size / Comparative footprint maps showing the Rip copper-moly porphyry system alongside several well-known deposits in BC’s Bulkley Belt, including Poplar, Seel, Ox, Berg, and Huckleberry. All maps are presented at approximately the same scale, illustrating that Rip’s geophysical anomaly is of comparable size to deposits that already host substantial copper-moly-(gold-silver) resources.Unlike these neighboring systems, which have been drilled extensively and carry defined resources or production histories (e.g., 154 Mt mined at Huckleberry in 1997-2016; 1,009 Mt @ 0.23% copper, 0.03% moly at Berg), Rip has seen only a few short holes to date. This contrast underscores both its early stage and its upside: Rip’s anomaly has district-scale dimensions but remains virtually untested. The implication is clear: Rip represents one of the last large, intact porphyry footprints in the district without systematic drilling, providing Copper Quest with a rare opportunity to unlock a potential deposit of similar scale.

Full size / Representative drill core from the 2024 phase-1 program at the Rip Project (1,033 m in 2 diamond drill holes). The core displays abundant porphyry-related features, including crowded porphyry phases with quartz-pyrite-chalcopyrite-molybdenite (qtz-py-cp-mo) veins, patchy brecciation with chlorite-calcite alteration, and pyrite-rich D veins with sericite envelopes typical of the pyrite halo. These multi-phase intrusive and alteration textures confirm Rip as a fertile porphyry copper-moly system and provide strong vectors for follow-up drilling toward potentially higher-grade zones. Importantly, the variety of intrusive phases and overprinting alteration styles highlights a dynamic magmatic-hydrothermal system, consistent with large-scale porphyry environments elsewhere in BC. The presence of copper and molybdenum mineralization across broad intervals in both “scout holes“ underscores the strong potential for improved grade, continuity, and scale in future systematic step-out drilling, particularly as deeper and lateral targets are progressively tested.

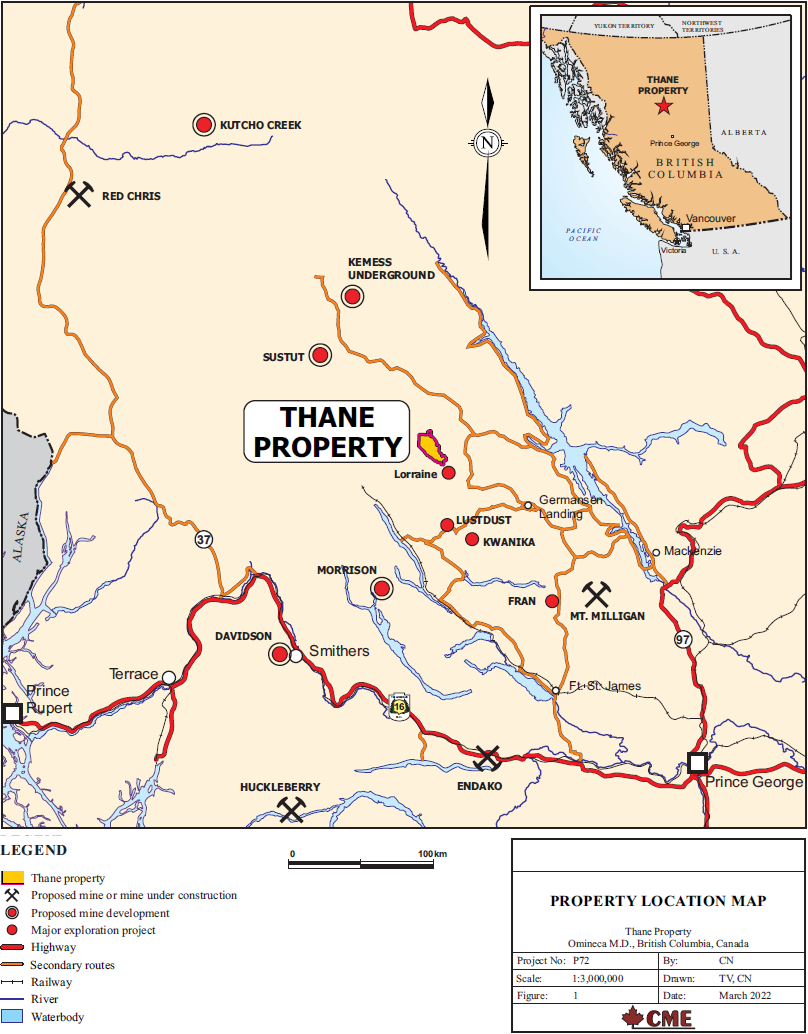

Thane Project

The Thane Project is a 100%-owned, 20,658-hectare copper-gold property situated in the Toodoggone District of north-central BC, an area well known for hosting alkalic and sub-alkalic porphyry copper-gold systems. The Thane Property is strategically situated on the Hogem Batholith within the Quesnel Terrane, positioned between 2 of the region’s most significant copper-gold operations:

• Mt. Milligan Mine: A large-scale producing copper-gold open-pit operation located directly to the south.

• Kemess Mine Complex: A past-producing copper-gold operation located to the north, also controlled by Centerra Gold Inc. (current market capitalization: $3 billion).

Full size / A 240 kV power-line runs along the Kemess Mine Road, approximately 10 km east of the Thane Property, providing excellent infrastructure access and significantly enhancing the project’s potential for future development and cost-effective exploration activities.

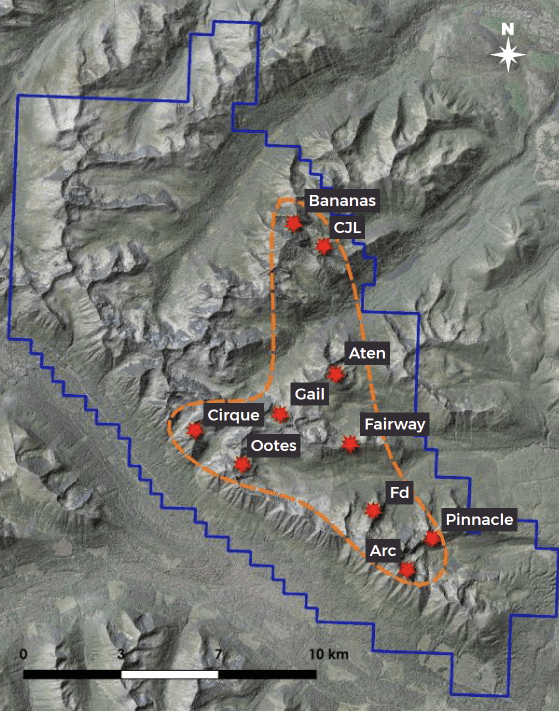

Geological Setting and Targets

Thane covers a 14 x 6 km alteration and mineralization footprint with at least 10 distinct zones of interest. These zones display extensive hydrothermal alteration, anomalous copper-gold-moly geochemistry, and geophysical features consistent with large, buried porphyry intrusions. The property hosts both alkalic porphyry-style copper-gold targets and structurally controlled high-grade veins, including:

• Cathedral & Cirque: Strong chalcopyrite-pyrite mineralization with widespread potassic alteration; with grades up to 5.9% copper and up to 2.5 g/t gold from surface samples.

• Gail & Fairway: Large soil and rock anomalies with disseminated copper mineralization and alteration consistent with porphyry systems.

• Aten & CJL Showing: Magnetite-specularite-chalcopyrite breccias with assays up to 8.8% copper.

• Bananas Zone: Structurally controlled copper-gold mineralization requiring follow-up work.

• Mat Area: Distinct silver- and base-metal-bearing veins in Nicola volcanics, with historical samples up to 2,852 g/t silver.

Full size / The Thane Property hosts a 14 x 6 km alteration and mineralization footprint (dashed orange outline) with multiple high-priority copper-gold targets. Despite strong surface results and geophysical anomalies, most of these zones remain completely untested by drilling, underscoring the project’s discovery potential in a proven porphyry belt.

Exploration History

Despite its size and strong surface footprint, Thane remains dramatically underexplored. A regional Geoscience BC study highlighted it as one of the strongest porphyry-related anomalies in all of BC. Historical work has included stream-sediment reanalysis, airborne geophysics, geological mapping, rock and soil sampling, and a small number of short scout drill holes (12 holes in one area only).

Highlights from historical surface work include:

• Rock samples grading up to 12.8 g/t gold and 3.9% copper;

• Broader zones of 0.4-2.1 g/t gold and 0.1-1% copper across several target areas;

• Multiple anomalies exceeding 3,000 ppm copper (0.3% Cu) in soils;

• IP surveys outlining large chargeability features consistent with porphyry systems.

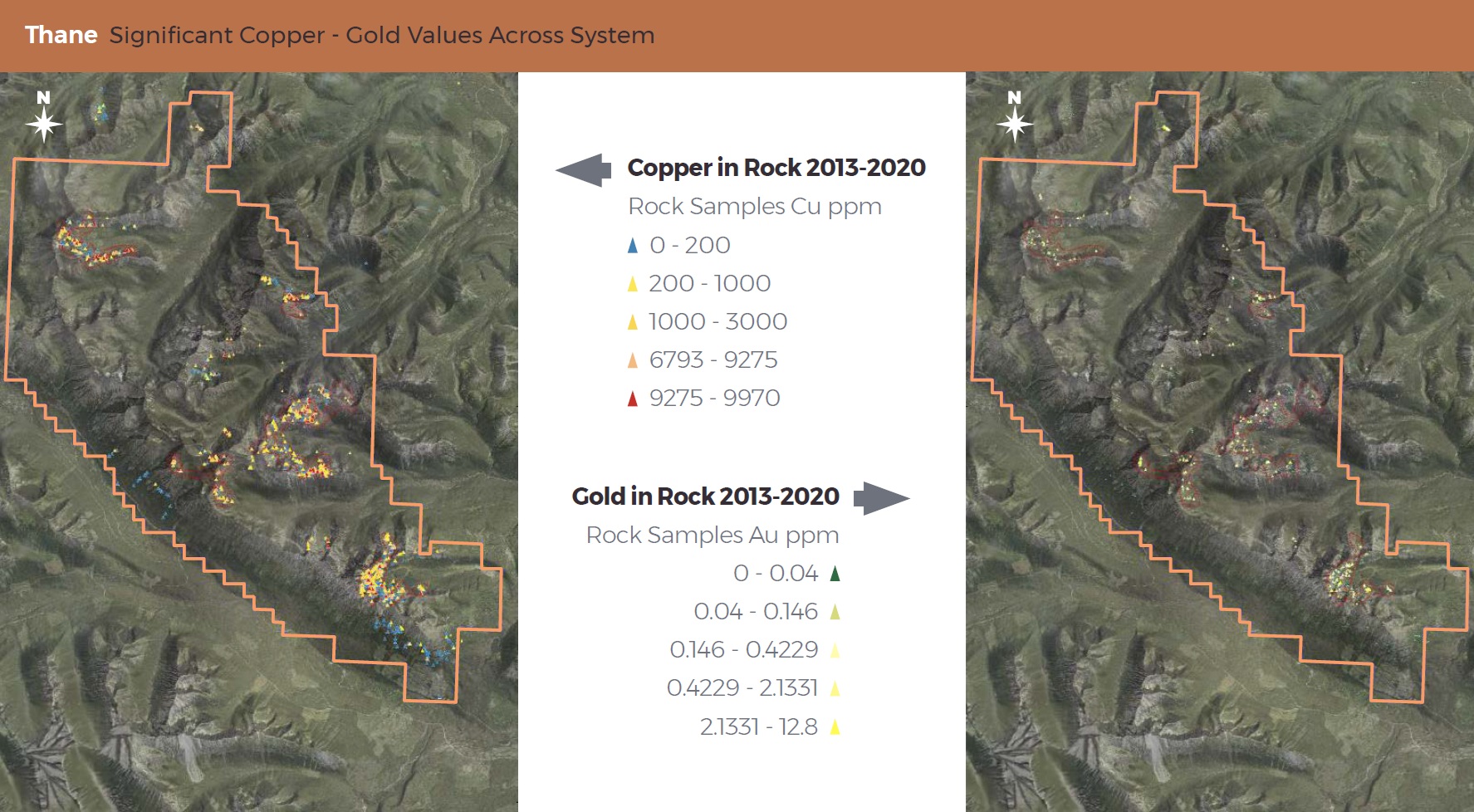

Full size / Thane Project: Significant copper and gold grades across the system. Rock sampling from 2013-2020 across the Thane Property demonstrates widespread high-grade copper and gold mineralization. Copper assays (left map) range from background values up to nearly 10,000 ppm copper (1% Cu), with multiple clusters consistently exceeding 3,000 ppm copper (0.3% Cu). Gold assays (right map) extend from trace values up to 12.8 g/t Au, with numerous zones grading above 1 g/t Au across the 14 x 6 km alteration footprint. These results underscore the presence of multiple mineralized centers and the project’s potential to host a large-scale copper-gold porphyry system.

Strategic Value

While Copper Quest’s exploration focus has shifted toward its flagship Bulkley Belt projects, Thane remains a highly prospective asset in a proven porphyry district. Its location between Mt. Milligan and Kemess, coupled with extensive untested targets, makes it a valuable longer-term option for partnership, joint venture, or staged systematic drilling.

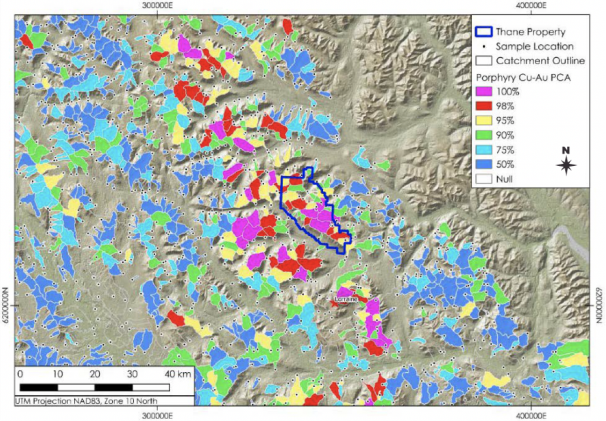

Full size / Thane Project: One of BC’s strongest porphyry anomalies. Regional geochemical data from Geoscience BC highlights the Thane Property (blue outline) as one of the most intense copper-gold porphyry anomalies in BC. With extensive high-percentile copper-gold geochemical signatures overlapping a 14 x 6 km alteration footprint, Thane stands out as a district-scale exploration opportunity strategically located between the past-producing Kemess Mine and Centerra Gold’s large, producing Mt. Milligan operation, within a proven porphyry belt.

Bottom Line

Thane is not Copper Quest’s immediate priority at present, yet it remains a strategically significant landholding positioned within one of British Columbia’s most productive and geologically endowed copper belts.

The Thane Property is underpinned by extensive district-scale anomalies, widespread alteration, and numerous mineralized showings that together define a truly large exploration footprint. Historical work has delivered exceptionally high-grade rock results across multiple zones, while the fact that almost no systematic or modern drilling has ever been carried out leaves the majority of the project’s discovery potential intact and wide open. Taken together, these factors make Thane a valuable long-term asset that provides Copper Quest with considerable optionality, either through future joint-venture partnerships, staged systematic drill campaigns, or as part of a potential consolidation scenario in a proven porphyry corridor that already hosts several producing and past-producing mines.

Nekash Project

The 100% owned Nekash Copper-Gold Project represents a significant new addition to Copper Quest’s North American portfolio. Located in Lemhi County, Idaho, within the prolific Idaho-Montana Porphyry Copper Belt, Nekash offers exposure to one of the United States’ most compelling emerging copper districts. The property covers 70 unpatented federal lode claims across 585 hectares and is fully road-accessible via U.S. highways and forest service roads.

Nekash is strategically positioned along the Trans-Challis Shear Zone, a regional-scale structural corridor that has acted as a conduit for multiple mineralizing events. The project lies in proximity to major porphyry systems including Butte (Montana) and CuMo (Idaho), and sits within a favorable geological corridor that has already delivered new copper-gold porphyry discoveries.

Above map highlights Nekash’s position on the Trans-Challis Fault Zone alongside 3 nearby deposits on the same trend: 1) Lemhi Gold Project (Freeman Gold Corp.; current market cap.: $52 million): ~988,000 ounces gold oxide, near surface, directly south of Nekash along the fault system. 2) Beartrack-Arnett Project (Revival Gold Inc.; current market cap.: $193 million): The largest past-producing gold mine in Idaho, currently ~4.6 million ounces gold (combined Measured + Indicated + Inferred at grades between 0.87 and 1.34 g/t gold), large scale gold system, to the south of Nekash, also tied structurally to the same Trans-Challis shears/faults. 3) Bobcat Gulch Porphyry: A copper-molybearous porphyry prospect interpreted to lie on or near the Trans-Challis Fault Zone in similar geological setting. Implications for Nekash: 1) Structural Controls & Trend: All these deposits lie on or very close to the Trans-Challis Fault Zone or associated shear/fault structures (e.g. Panther Creek Fault etc.). Nekash lying on the same structural trend increases its probability of hosting analogous systems. 2) Diverse Deposit Types on Trend: The trend is not uniform; there are oxide gold deposits (Lemhi Gold), mixed oxide/sulphide with open pit + underground style (Beartrack-Arnett), and porphyry copper‐moly with gold hazards (Bobcat Gulch). That variety suggests exploration models for Nekash should not be too narrow; multiple deposit types may be present. 3) Depth Potential: The 3 deposits near Nekash show that mineralization remains open at depth. For Nekash, blind or deeper porphyry centers under cover are credible targets.

Geological Overview

Surface mapping and historical work highlights:

• Outcropping phyllic alteration and porphyry-style quartz veining.

• Copper-gold stockwork veining with assays up to 6.6% copper and 0.6 g/t gold.

• A stratabound “manto” horizon with grades up to 3.8% copper, 0.9 g/t gold, and 25 g/t silver across 6.4 m.

• Geological interpretation suggests Nekash is a large, blind porphyry copper-gold system intruding Mesoproterozoic sediments of the Dahlonega Creek Formation. Surface anomalies and carbonate-replacement style horizons support the presence of a buried porphyry center at depth.

Exploration & Project Strategy

Copper Quest plans to advance Nekash with a modern, systematic program that builds on the extensive historical groundwork:

1) Property-wide geophysical and geochemical surveys to define porphyry centers.

2) Initial drilling to test high-priority targets beneath strong surface mineralization.

3) Expansion of the “manto” horizon and evaluation of carbonate-replacement potential.

4) Integration of modern 3D modeling with historical Bureau of Mines datasets.

The company is also leveraging the expertise of newly appointed Technical Advisor Joshua White (P.Geo.), and Aqua Terra Geoscientists LLC for project management. Joshua brings more than a decade of porphyry and gold exploration experience across multiple continents.

Strategic Importance

With copper demand accelerating due to electrification, AI-driven infrastructure growth, and renewable energy, Nekash positions Copper Quest to benefit from strong U.S. policy support for domestic copper supply chains. Idaho offers a mining-friendly jurisdiction with infrastructure, supportive regulation, and precedent for major copper development.

Copper Quest views Nekash as a high-impact opportunity to establish a copper-gold discovery in the U.S. and complement its flagship copper projects in Canada.

Above map illustrates porphyry deposits across the Idaho-Montana Porphyry Copper Belt, highlighting Nekash (copper, gold, silver) alongside established systems such as Butte (Montana), CuMo (Idaho), and Bobcat Gulch. Idaho is rapidly emerging as a copper exploration frontier, with the recent discovery of the Grizzly Copper-Gold Porphyry by Hercules Metals Corp. (current market cap.: $217 million) underscoring the potential for large-scale systems. Despite being underexplored compared to neighboring states, Idaho hosts the geological hallmarks for major porphyry copper-gold deposits. Projects like Grizzly demonstrate the potential for blind porphyry systems concealed beneath cover – a model directly relevant to Nekash. Positioned within this favorable corridor, Nekash benefits from proximity to industry-leading comparables, in a mining-friendly U.S. jurisdiction supported by infrastructure, strong regulatory frameworks, and a track record of major copper developments. This is important for Nekash and Copper Quest as it confirms the project’s position in a proven porphyry belt with strong discovery potential. By securing a foothold early in this underexplored U.S. district, the company is strategically positioned to leverage large-scale copper discoveries in a tier-1 jurisdiction.

Management, Directors & Advisors

Copper Quest has assembled a powerhouse team of explorers, operators, financiers, and dealmakers with decades of proven success across every stage of the mining cycle. From grassroots discoveries to billion-dollar acquisitions, from financing juniors to operating tier-one copper assets, this group brings the exceptional blend of technical excellence, corporate leadership, and capital markets savvy. For shareholders, the strength of this team is clear: They’ve done it before, and they are positioned to do it again – advancing Copper Quest’s portfolio of copper projects in British Columbia with the expertise and discipline of industry veterans who know how to create lasting value.

Brian Thurston (P.Geo.)

CEO & Director

Brian brings more than 3 decades of geological and corporate leadership experience to Copper Quest. He has worked on projects from early discovery to feasibility across North and South America, Africa, and India, with a career highlight being his instrumental role in the exploration, land acquisition, and development of Aurelian Resources Inc. in Ecuador – later acquired by Kinross in a landmark $1.2 billion deal. In 2004, Brian transitioned from field geology to the corporate side, where he founded and led multiple public companies, built governance frameworks, and steered successful takeovers, including his tenure as President and CEO of Lion Energy Corp., sold to Lundin’s Africa Oil. His deep technical expertise in porphyry systems, coupled with a proven ability to structure, finance, and monetize exploration companies, makes him uniquely positioned to unlock value from Copper Quest’s growing portfolio in British Columbia. Investor take-away: Brian is a value creator. He has already proven he can take discoveries from concept to billion-dollar exits. With Copper Quest, investors are backing a CEO who knows how to advance assets, attract majors, and crystallize shareholder returns.

Dong Shim

CFO

Dong has built a distinguished career in accounting and finance across both the US and Canada, specializing in guiding high-growth companies through the critical early stages of public market exposure. A dual-qualified CPA (British Columbia and Illinois), he has been the financial backbone for junior mining and technology firms, ensuring regulatory compliance and audit excellence. Dong’s expertise goes beyond accounting – he has played a pivotal role in helping multiple start-ups achieve public listings on the TSX Venture Exchange, the CSE, and the OTC Markets. His proven ability to structure companies for growth, maintain strong financial discipline, and navigate complex reporting requirements makes him an invaluable steward of Copper Quest’s financial strategy. Investor take-away: Dong is a builder of financial foundations. For shareholders, his track record of taking companies public and maintaining credibility in the markets translates into confidence that Copper Quest is on solid financial footing as it advances its copper portfolio.

Janet Francis

Corporate Secretary

Janet brings more than 20 years of expertise in corporate governance and regulatory compliance, having guided companies across the Toronto Stock Exchange, TSX Venture, CSE, Cboe Canada, and NYSE American. She has served as a Director, Corporate Secretary, and Trusted Governance Advisor to numerous public companies, ensuring seamless interaction with regulators and investors alike. As founder and principal of her own corporate services firm, Janet has built a reputation for precision, reliability, and a deep understanding of the complex requirements facing reporting issuers. Her experience ensures that Copper Quest operates with the highest standards of governance – a cornerstone for attracting institutional investors and maintaining market credibility. Investor take-away: Janet is a guardian of governance. For shareholders, her involvement means Copper Quest is not only compliant, but well-positioned to earn the trust of regulators, exchanges, and the capital markets.

Jason Nickel

Director

Jason is a seasoned mining executive, engineer, and entrepreneur with 25 years of hands-on experience across the full mining lifecycle – from exploration and feasibility to operations and development. His career includes senior roles with Canadian gold and copper producers, most recently as Mine Manager, where he oversaw both underground and open-pit operations for a rapidly emerging gold company. Since 2008, Jason has also provided management and consulting services to the industry, playing a key role in launching and advancing junior resource companies in British Columbia and the Arctic. A board veteran, he has served on 4 TSX Venture and CSE-listed company boards since 2011. With a degree in Mine Engineering from UBC and a Graduate Diploma in Business Administration from SFU, Jason blends technical mining expertise with sharp business acumen. Investor take-away: Jason is a builder and operator. For shareholders, his track record in taking projects from early-stage concepts to producing mines ensures Copper Quest’s assets are guided by practical know-how and real-world execution.

Cameron MacDonald

Director

Cameron brings nearly 2 decades of capital markets expertise, specializing in M&A, banking, financial management, and operations. As Founder and CEO of the Macam Group of Companies, he has been at the forefront of structuring and financing ventures across industries, helping raise more than $300 million in equity and over $650 million in debt since 2002. Currently President and CEO of Tenth Avenue Petroleum Corp. and Director of Pacific Bay Minerals Ltd., Cameron also serves as an investor and board member in several other businesses. His experience as both a financier and operator allows him to bridge the gap between the market and the mine site – aligning strategy, capital, and execution. Investor take-away: Cameron is a dealmaker. For shareholders, his proven ability to raise significant capital and execute corporate growth strategies provides Copper Quest with the financial firepower and market access to accelerate project development.

Mike Ciricillo

Board Advisor

Mike is a veteran mining executive with over 30 years of global operational and project leadership, having worked across 5 continents. His career began at INCO in Canada before moving to Phelps Dodge, which later became part of Freeport-McMoRan. At Freeport, he rose through leadership roles across the US, Chile, the Netherlands, and the DRC, ultimately serving as President of Freeport-McMoRan Africa. Notably, he spent 5 years guiding the Tenke Fungurume Project from construction into full-scale operations – one of the world’s most important copper-cobalt mines. In 2014, Mike joined Glencore, where he served as Head of Copper Operations in Peru, then Head of Global Copper Smelting, before being elevated to lead Glencore’s worldwide copper assets. Today, he is President of the Natural Resources Sector for NANA Corporation in Alaska. Mike’s track record of managing multi-billion-dollar copper operations brings invaluable strategic and operational insight to Copper Quest. Investor take-away: Mike is a world-class operator. For shareholders, his deep leadership experience with Freeport and Glencore signals that Copper Quest’s assets are being advanced with the same discipline and vision as tier-1 global copper producers.

Rick Gittleman

Board Advisor

Rick brings over 40 years of mining industry expertise, spanning legal, financial, and executive leadership roles across some of the world’s most significant copper jurisdictions. He began his career as outside Legal Counsel for Gécamines, the DRC’s state-owned mining company, and later as a Project Finance and M&A Lawyer at Akin Gump, where he advised global oil, gas, mining, and power companies entering African markets. Rick then moved into senior executive roles, serving as Senior VP at Freeport-McMoRan, where he worked extensively on the landmark Tenke Fungurume Project in the DRC. He also held key roles in Glencore’s copper division across Africa and South America. Today, Rick is President and CEO of RMG Minerals LLC, focused on tier-1 copper opportunities in the African Copperbelt. Investor take-away: Rick is a dealmaker in the world’s toughest jurisdictions. For shareholders, his deep experience at the intersection of law, finance, and mining operations – including world-class projects with Freeport and Glencore – gives Copper Quest unmatched insight into advancing projects and capturing value on a global scale.

James Dixon

Board Advisor

James brings a unique combination of technical expertise and deep regional knowledge to Copper Quest. He began his career in the 1980s as a Petroleum Reservoir Research Technologist before moving into engineering operations in the 1990s. For more than 2 decades, he has focused on prospecting in the Bulkley-Morice Region of BC, where his family has been directly involved in mineral exploration for over a century. That legacy includes pioneering work at the Sibola and Owen Lake Mines, and more recently, the discovery of a 110-million-tonne resource. Beyond mining, James’s family has long contributed to the development of the region through sawmilling, planning, and fur trading with local First Nations. His generational experience in both resource development and community relations brings Copper Quest a rare advantage: The ability to advance projects with authenticity, respect, and deep-rooted local trust. Investor take-away: James is Copper Quest’s bridge to community and discovery. For shareholders, his combination of exploration success and generational ties to both the land and First Nations strengthens the company’s ability to advance projects responsibly while unlocking value in one of BC’s most prospective copper regions.

Dr. Mark Cruise (P.Geo.)

Technical Advisor

Mark is a Professional Geologist with nearly 3 decades of global exploration and mining experience. His career began as a Polymetallic Commodity Specialist with Anglo American, but he made his mark by founding and leading Trevali Mining Corp. From 2008 to 2019, he transformed Trevali from a single discovery into a top-10 global zinc producer with multi-continent operations across the Americas and Africa. Beyond Trevali, Mark has held senior leadership roles – VP, COO, and CEO – with multiple TSX, TSX Venture, and NYSE American listed companies, guiding organizations with market capitalizations from the tens of millions to well over $1 billion USD. His unique blend of technical expertise and executive leadership brings both credibility and vision to Copper Quest’s board. Investor take-away: Mark is a proven mine builder. For investors, his history of scaling exploration plays into billion-dollar producers signals the growth potential of Copper Quest’s assets under his guidance.

Rich Leveille

Technical Advisor

Rich has devoted his life to mining, growing up in major copper camps in the western US, where his father worked for Kennecott. With a B.S. in Geology from the University of Utah and an M.S. from the University of Alaska, Fairbanks, Rich built a career that spanned AMAX, Kennecott, Rio Tinto, Phelps Dodge, and ultimately Freeport-McMoRan. Along the way, he was directly involved in – and often led – teams responsible for multiple world-class discoveries across the US and abroad. His last corporate role was as Senior VP of Exploration for Freeport-McMoRan, one of the world’s largest copper producers, where he shaped global exploration strategy from the company’s Phoenix headquarters. Since retiring in 2017, Rich has remained active as a geological consultant while dedicating time to writing, hiking, fishing, and advocacy work. Investor take-away: Rich is a discoverer at heart. For shareholders, his lifetime of exploration success with the world’s biggest copper producers provides Copper Quest with discovery expertise and credibility that few junior companies can match.

John Fleishman

Technical Advisor

John brings over 3 decades of exploration and project development experience across the Americas. He began his career in the 1980s with Blackdome Mining Corp. and Ashworth Explorations Ltd. before co-founding Reliance Geological. From 1993 to 2006, John worked throughout South America, Mexico, Canada, and the US with Canabrava Diamonds Corp. and Southwestern Gold Corp., building a strong track record in early-stage discoveries. Among his career highlights, John staked the Blackwater Davidson Property – a project that would ultimately evolve into Artemis Gold Inc.’s flagship Blackwater Mine after he sold the NSR to New Gold Inc. He also served as a Director at West Cirque Resources Ltd. (acquired by Kaizen Discovery Inc.) and as Technical Advisor to QuestEx Gold & Copper Ltd. (later acquired by Skeena Resources Ltd.). Investor take-away: John is a discovery-driven geologist. For shareholders, his history of identifying, advancing, and positioning projects that were later acquired by major players highlights his ability to add value and unlock opportunities that others overlook.

Dr. Tony Barresi (P.Geo.)

Technical Advisor

Tony is a seasoned exploration geologist and corporate leader with more than 20 years of experience advancing mineral discoveries in the Canadian Cordillera. Over his career, he has successfully guided exploration campaigns and corporate development strategies during pivotal growth stages for multiple junior mining companies. He previously served as President and Director of both QuestEx Gold & Copper Ltd. and Triumph Gold Corp., where his leadership helped shape company direction and exploration success. Tony’s academic foundation is equally impressive – his Ph.D. research on island-arc evolution and metallogeny in British Columbia earned him the prestigious Mary-Claire Ward Geoscience Award from the Prospectors and Developers Association of Canada (PDAC) in 2006. Investor take-away: Tony is an innovator in exploration. For shareholders, his deep technical insight and proven leadership record ensure Copper Quest’s exploration strategy is both scientifically rigorous and commercially focused.

Joshua White (P.Geo.)

Technical Advisor

Joshua is an exploration geologist with over 13 years of global experience and Principal of Aqua Terra Geoscientists LLC, which is managing Copper Quest’s Nekash Project. A U.S. Marine combat veteran, he earned geology degrees from the University of Wyoming (B.Sc.) and Montana Tech (M.Sc.), before working with Kinross Gold on projects across 4 continents. His expertise spans epithermal gold, porphyry copper, orogenic gold, and sediment-hosted copper systems, with senior-level experience at Kinross’s Paracatu Mine in Brazil prior to moving into the junior exploration sector. Investor take-away: With Joshua guiding exploration at Nekash, Copper Quest gains seasoned technical leadership and a proven project generator, strengthening confidence in uncovering the district-scale copper-gold potential of Idaho’s emerging porphyry belt.

Chad McMillan

Strategic Advisor

Chad is a seasoned senior executive with more than 20 years of experience in and around the capital markets, where he has built, managed, and financed numerous public companies. His expertise spans executive management, corporate finance, M&A, communications, and community relations, with past roles including President, CEO, Director, VP Corporate Communications, and Strategic Advisor. Chad has led and supported countless financings, mergers, acquisitions, and joint ventures, particularly in the mining and resource sector, but also in technology and entertainment. He is the Founder of McMillan Strategies, Kaypieye Media, and Wokaura Art & Innovations, and holds a Bachelor of Arts in Communications from Simon Fraser University. Most recently, he played a key role in helping Copper Quest source its new US acquisition – underscoring his ability to bridge technical, financial, and strategic opportunities. Investor take-away: Chad is a connector and strategist. For shareholders, his proven ability to manage, finance, and advance resource ventures directly strengthens Copper Quest’s advisory team. As CEO Brian Thurston has emphasized, Chad’s ability to navigate both the technical and capital markets landscapes helps position Copper Quest for long-term growth and unlock the full potential of its projects.

Dave McMillan

Special Advisor

Dave brings more than 4 decades of experience spanning both mining and capital markets. Before retiring from the securities industry in 2000, he spent 17 years as an Investment Advisor, Vice President, Director, and Senior Partner at one of Canada’s leading brokerage firms. During that time, he was instrumental in financing numerous junior exploration companies in North and South America, helping fund the early-stage discoveries that ultimately became the Kemess and Mount Milligan Mines in British Columbia. Since retirement, Dave has continued to shape the sector through executive and director roles in a variety of public and private companies. His unique blend of financing expertise and industry insight, particularly in British Columbia’s copper belts, provides Copper Quest with a strategic advantage in both funding and advancing its exploration portfolio. Investor take-away: Dave is a bridge between the market and the rocks. For shareholders, his track record in financing juniors that grew into producing mines – in the same trend as Copper Quest’s Thane Project – underscores the potential for history to repeat itself.

Copper price rally amid supply shocks – disruptions at Grasberg and Chile keep pressure on copper prices: One of the market’s biggest risks – supply reliability – intensifies. Global supply risks are mounting after Freeport-McMoRan confirmed that operations at its Indonesian Grasberg Mine remain suspended following a mudflow accident. Grasberg is one of the world’s largest copper producers, responsible for 3.6% of global output in 2024. Any prolonged disruption there, combined with Codelco’s warning of stagnant production in Chile due to declining grades and rising costs, could tighten global supply. On the demand side, China continues to anchor the market.

Read more about the recent supply disruptions and looming price escalation in Rockstone´s recent article "Riding the Copper Supply Crunch: Today’s Juniors Are Tomorrow’s Headlines" – an analysis of how structural demand meets fragile supply, why majors are scrambling for growth, and where the real opportunities lie for investors positioning ahead of the next copper supercycle, with a spotlight on juniors poised to become tomorrow’s takeover targets and market leaders.