Disseminated on behalf of Saville Resources Inc. and Zimtu Capital Corp.

In early November 2021, Saville Resources Inc. announced impressive drill results from its Niobium Claim Group (NCG) Property in Quebec, returning the best niobium intercept to date from the property at 1.00% Nb2O5 over 17.1 m, within a larger interval of 0.82% Nb2O5 over 42.3 m, including a peak sample assay of 1.73% Nb2O5. In addition to the high-grades of niobium, drill intercepts continue to return coincident and significant tantalum and phosphate mineralization. More drill results are pending and expected to be released shortly. On Tuesday, November 23, 2021, Saville‘s President Mike Hodge will be discussing the latest results and talking about the niobium market with Chris Grove, President of Commerce Resources Corp. Register now to join the live presentations and Q&A session.

In a recent interview, Chris Grove commented on Saville‘s drill results:

“There was a 17 m intersection of 1% niobium. Considering that niobium right now is at about $45 per kilo, that is 10 kg of niobium per ton, or $450 rock per ton. So you‘re talking about something that actually is more valuable than a 7 g/t gold project. These were excellent results.“

Saville‘s NCG Property is adjacent to Commerce‘s Ashram REE-Fluorspar Deposit, whereas Saville is currently under Earn-In Agreement with Commerce for up to 75% interest in NCG. While Commerce is currently at pre-feasibility stage, Saville is in discovery mode.

Both companies are advancing its exploration and development projects to become future supply for critically needed commodities:

Saville: Niobium + Tantalum + Fluorspar + Phosphate

Commerce: Rare Earth Elements (REEs) + Fluorspar

This report highlights market trends for niobium, tantalum, and rare earths.

Full size / According to a European Commission Report (2020), rare earths (LREEs: Light Rare Earth Elements; HREEs: Heavy Rare Earth Elements) have the greatest supply risk of raw materials for key technologies, niobium ranks as #4 while tantalum and fluorspar rank mid-tier. Commerce Resources Corp. (LREEs + HREEs + Fluorspar) and Saville Resources Inc. (Niobium + Tantalum + Fluorspar + potentially Phosphorous) are developing highly attractive projects in a safe and mining-friendly jurisdiction.

Most recently, US Congress approved a long-debated infrastructure bill totalling $1.2 trillion USD. According to Electrek:

“This cash injection into US infrastructure focuses on improving everything from roads, to bridges, and the promotion of electric vehicle adoption nationwide.

While many of the exact spending details are still to come to light, the approved $1.2 trillion will include $550 billion in new spending and includes the following:

• $110 billion for roads, bridges and other infrastructure rehab nationwide (The US infrastructure system earned a C- from the American Society of Civil Engineers earlier this year)

• $7.5 billion for electric vehicles and EV charging infrastructure

• $2.5 billion in zero-emission buses

• $2.5 billion in low-emission buses

What truly stands out in this approved bill is the $7.5 billion promised to help establish a nationwide network of EV charging stations. Furthermore, an additional $65 billion will be invested toward overall clean energy and renewables for the US electricity grid, hardening a long antiquated system.“

Critical Metals Needed: Niobium + Tantalum + Rare Earths

Let‘s start with niobium.

200 grams of niobium added to a mid-sized automobile reduces its weight by 100 kg, increasing fuel efficiency by 5%, according to the World Steel Institute. The use of niobium in vehicles today is already helping to avoid the emission of an estimated 62 million ton of CO2 per year, according to Niocorp (North-America‘s only niobium producer).

The addition of 0.025% of niobium to the steel in the Millau Viaduct (France) reduced the total weight of steel and concrete needed by 60% in the overall project, according to CBMM (the world‘s largest niobium producer). Niobium helps bridges and other infrastructure elements last longer and reduces overall environment impacts. With the structural demands placed on buildings today, the use of High Strength, Low Alloy (HSLA) steel is increasingly required. HSLA steel with niobium helps make today‘s buildings safer, more energy efficient, and less costly. It also provides building designers with additional flexibility in their designs.

The global Niobium market is currently approximately 125,000 t per annum with a value of $5 billion USD and is forecast to achieve 6% CAGR between 2020 and 2025, according to SWI Partners Research and ONG Commodities:

“Market growth is expected to be underpinned by a shift towards an increasing use of lightweight high-strength steel alloys in construction.Continued use in aircraft engines and additional long-term growth through light-weighting in transportation, defense, space applications and use in battery technology.“

The U.S. imports all of its niobium from Brazil (~83%), Canada (~12%) and others (~5%). With only 3 primary niobium mines globally – all of which have Chinese stakeholders, including a controlling interest at Canada‘s Niobec Mine – a more reliable, long-term niobium supply in North America is needed to secure critical minerals supply chains for strategic industries.

New niobium supply sources from Canada would diversify global supply and create reliable niobium supply volumes.

In 2014, IAMGOLD Corp. sold the Niobec Deposit for $530 million USD to Magris Resources Inc., CEF Holdings Ltd. (a Hong Kong based investment company owned 50% by the Chinese conglomerate CK Hutchison Holdings Ltd. from Hong Kong) and Temasek Holdings Ltd. (an investment company owned by the Government of Singapore).

As the Niobec Mine in Québec is the only major niobium producer in North America, with grades averaging 0.42% Nb2O5 (probable reserves), the benchmark for Saville is clear.

Full size / Most niobium deposits globally have an average grade between 0.3% and 0.7% Nb2O5.

Saville‘s niobium project is also attractive thanks to mineralization identified to date indicating a carbonatite host rock, which is also the dominant niobium source globally, making cost-effective conventional processing possible.

With only 3 primary niobium mines currently in production worldwide, the time appears ripe for new supply, especially on the North American continent as the US is still 100% import-reliant for niobium while having classified this superalloy metal as critical for its economic and national security (used e.g. in military aircraft engines, rockets, gas turbines, superconducting magnets).

NIOBEC (Québec, Canada)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.35-0.44% Nb2O5

• Owners (purchased from IAMGOLD Corp. for $530 million USD in 2014): Magris Resources Inc., CEF Holdings Ltd. (a Hong Kong based investment company owned 50% by the Chinese conglomerate CK Hutchison Holdings Ltd. from Hong Kong) and Temasek Holdings Ltd. (an investment company owned by the Government of Singapore)

CATALAO (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.87-1.48% Nb2O5

• Owner (purchased from Anglo American PLC for $1.5 billion USD in 2016): China Molybdenum Co. Ltd.

ARAXA (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~85%

• Average grade: 1.6-2.48% Nb2O5 (but with a low recovery of ~50%)

• Owners: CBMM as well as Chinese, Japanese and Korean consortiums

Niobium – an extraordinary and highly versatile superalloy material – is a critical and strategic material essential to many defense and civilian applications (e.g. as an alloying element in high-strength and stainless steel, as a superalloy for aerospace and land-based power generation, and in superconductors).

The niobium market is also witnessing a growing usage in the automotive industry as lightweight materials and designs are key to enhance fuel economy in ICEs (Internal Combustion Engines) as well as in EVs (Electric Vehicles).

Phosphate is common in some of the world‘s largest and highest-grade niobium mines, such as Araxa and Catalao in Brazil. The Niobec Mine in Québec is a pyrochlore mine with no tantalum of any significance, as being the case with Araxa and Catalao (see here). Phosphate rock ore was mined by only 5 firms in the US (2017), processing it into marketable products valued at $2.1 billion USD for 100% domestic use as intermediate feedstocks in the manufacture of fertilizers and animal feed supplements, according to the USGS. The Catalao Mine in Brazil (owned by China Molybdenum) not only produces niobium but also phosphate as a highly profitable by-product, providing “strategically important diversification benefits“ as the phosphate sector has “attractive long-term fundamentals and positive outlook“ due to its use as fertilizer in the agricultural industry. Catalao‘s ore reserves average 12.5% P2O5, with resource grades between 8.2% and 11.8% P2O5.

Fluorspar is also critical for the steel industry. More details on fluorspar

Niobium Trends

According to “Niobium company CBMM to acquire 20% of startup Battery Streak“ (October 28, 2021):

CBMM, global leader in Niobium products, has signed an agreement to acquire 20% of the startup Battery Streak. With the investment, the company expects to drive developments in materials for batteries in mobility applications, electronic equipment, and drones.

“This strategic investment is part of CBMM’s new business plan, which aims to accelerate innovation in materials for battery technology, a very promising segment that should represent 25% of the company’s revenue by 2030.“ (Rodrigo Amado, Strategy and New Businesses Manager at CBMM)

Since 2019, CBMM has been tactically investing in startups related to material innovation and connected with the global electrification mega-trend. All startups invested use Niobium in their technologies.

With a long-term vision, CBMM will continue to invest in research and development of Niobium technologies for lithium-ion batteries.

“We are working intensely with large partners to offer to the market, mainly for the automotive sector, batteries with unique characteristics, such as ultra-fast recharging, in less than 10 minutes, greater stability and safety. Battery Streak is fully aligned with this goal and will allow us to take an important step, allowing applications beyond the mobility market.“ (Rodrigo Amado)

Battery Streak (BSI), is a startup linked to the University of California at Los Angeles (UCLA). BSI’s patented technology uses nano-structured Niobium oxide as the anode of lithium-ion batteries. With the partnership, CBMM and BSI intend to offer the first products to the market in 2023.

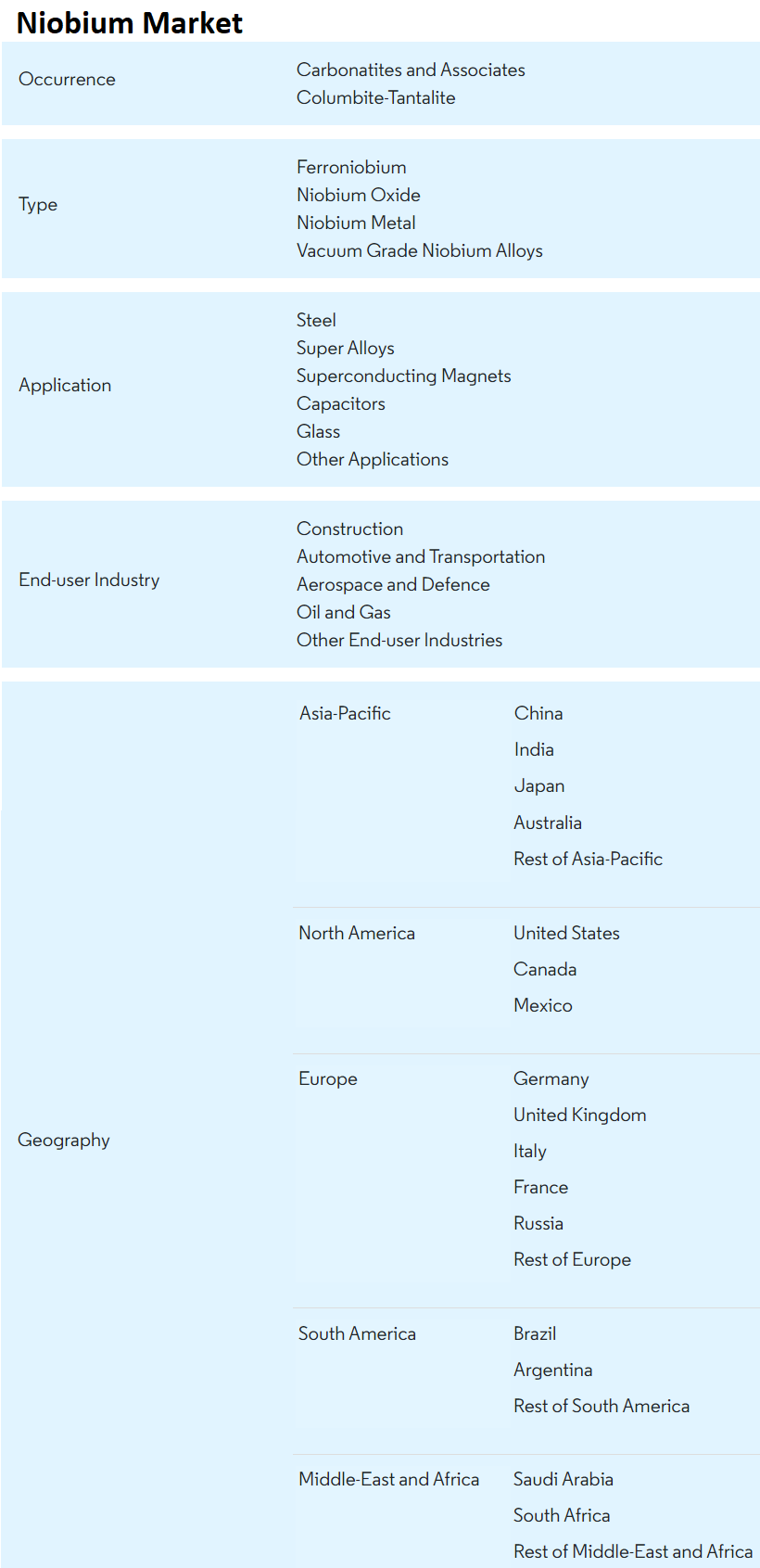

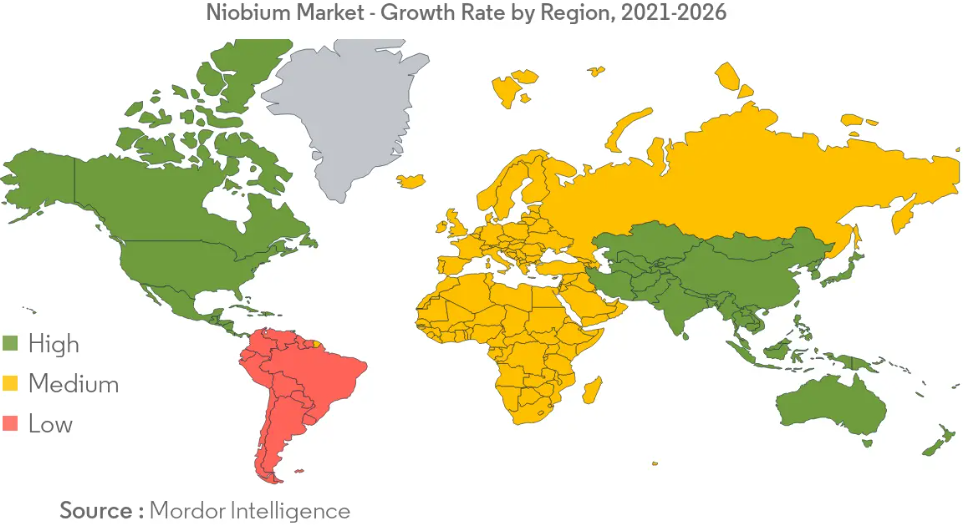

According to Mordor Intelligence‘s “Niobium Market - Growth, Trends, COVID-19 Impact, and Forecasts (2021-2026)“:

Niobium is a gray, lustrous, ductile metal with relatively low density, high ductility, high melting point, and superconductor properties. Niobium is majorly extracted from pegmatite minerals, such as columbite-tantalite and pyrochlore. This is a relatively rare mineral, and the order of abundance is around 24 parts per million. The niobium market is segmented by occurrence, type, application, end-user industry, and geography.

The market was negatively impacted by COVID-19 in 2020. Owing to the pandemic scenario, several countries across the world went into lockdown, which led to a decrease in the demand for niobium from various end-user industries, as all the manufacturing and construction activities were put on hold. This created a negative impact on the niobium market. However, the condition is expected to recover in 2021, thereby driving the market studied during the forecast period.

Over the medium term, accelerating usage in structural steel and increased usage in aerospace applications are driving the market‘s growth.

On the flip side, limited supply sources and the impact of the COVID-19 pandemic are hindering the growth of the market studied.

The construction industry dominated the market, and it is expected to grow at a healthy rate during the forecast period, as niobium-based alloys are exceptionally meeting the challenges regarding fire resistance and seismic requirement of modern artistic construction. Increasing demand for high strength and lightweight steel in oil and gas pipelines is likely to act as an opportunity in the future.

Asia-Pacific dominated the market with the largest consumption from countries, such as China and Japan.

Full size / “In January 2020, NioCorp Developments Ltd secured legal agreements with several additional southeastern Nebraska landowners, primarily to extend the company’s options for purchasing land parcels. These are planned for use as part of its proposed Elk Creek Superalloy Materials Project. This agreement covers a total of 226 acres of land.“ (Source: Mordor Intelligence, 2021)

Full size / “The niobium market is an oligopolistic market, with three major mining companies, including CBMM, China Molybdenum, and Niobec, contributing to around 98% of the global supply. The largest and currently operating niobium deposit is located at Araxa, and it is owned and explored by Companhia Brasileira de Metalurgia e Mineração (CBMM).“ (Source: Mordor Intelligence, 2021)

KEY MARKET TRENDS

Construction Sector to Dominate the Market

• The construction industry is the largest consumer of niobium across the world. The major application of niobium is in the production of steel. About half of all steel produced worldwide goes to the construction industry.

• High-strength niobium microalloyed plate products are used in the construction of bridges, viaducts, high-rise buildings, etc. Heavy machinery, pressure vessels, etc., represent additional applications of microalloyed plates.

• Structural sections are widely used in civil construction, railway wagons, transmission towers, etc., where niobium competes with vanadium. Similarly, a steel reinforcing bar is used in large concrete structures to increase their resistance to tensile loads. Larger diameter, high-strength grades are produced via the addition of niobium and/or vanadium, although some modern steel mills also use water cooling, which negates the need for microalloying. Finally, niobium has also found application in high-strength and wear-resistant rails for railway tracks operating under high axle loads.

• The building and construction industry is currently a thriving industry in several emerging economies of the Asia-Pacific and European regions, and this is going to drive the demand for HSLA steel, which provides cost savings through reduction of weight in buildings while also preventing infrastructure failures.

• The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next ten years, creating a major scope for the market studied.

• The construction sector in North America has witnessed significant growth in the past few years. According to the United States Census Bureau, the value of the construction industry in the United States increased from USD 1,007.62 million in 2014 to USD 1,306.03 million in 2019. The total residential housing units authorized by building permits in March 2020 were at a seasonally adjusted annual rate of 1,353,000, representing 5% growth over the March 2019 rate of 1,288,000. The total number of privatelyâ€owned housing starts in March 2020 was at a seasonally adjusted annual rate of 1,216,000, representing 1.4% growth over the March 2019 rate of 1,199,000.

• The factors driving the building and construction industry are the ever-increasing populations, rapid urbanization, and the rise in purchasing power. As a result of which, investments in infrastructure are being made and are in the pipeline.

• Adding to these, several vanity projects in the Middle East and building of commercial constructions, such as airports, etc., are expected to drive the market in the future.

• Therefore, such robust growth in construction across the world is likely to boost the demand for the consumption of niobium during the forecast period.

Full size / “The niobium market size was estimated at over 120 kiloton in 2020, and the market is projected to register a CAGR of over 5% during the forecast period.“ (Source: Mordor Intelligence, 2021)

Asia-Pacific to Dominate the Market

• Asia-Pacific dominated the global market. With accelerating usage in structural steel and growing usage in the automobile and aerospace industry in countries such as China, India, and Japan, the consumption of niobium is increasing in the region.

• The consumption of niobium is very high in steel manufacturing in the form of ferroniobium, and the construction industry is thriving in several emerging economies, such as China and India, among others.

• The infrastructure sector is an important pillar of the Indian economy. The government is taking various initiatives to ensure the timely creation of excellent infrastructure in the country. The government is focusing on railways, road development, housing and urban development, and airport development.

• India is likely to witness an investment of around USD 1.3 trillion in housing over the next seven years, where the country is likely to witness the construction of 60 million new homes. The availability of affordable housing is expected to rise around 70% by 2025 in India.

• Currently, China is majorly focusing on increasing the production and sale of electric vehicles in the country. For this purpose, the country planned to increase the production of electric vehicles (EVs) to 2 million a year by 2020, and 7 million a year by 2025. The target, if achieved, will increase the share of electric vehicles to 20% of total new car production for China by 2025. This is further likely to increase the production of vehicles in the country in the coming years.

• China has been replacing the use of vanadium from niobium or a compound of both in the steel industry, especially to produce rebars. Thus, the demand for niobium is expected to increase in the future.

• Japan’s electrical and electronics industry is also one of the world’s leading industries. The country is a world leader in the production of video cameras, compact discs, computers, photocopiers, fax machines, cell phones, and various other key computer components.

• Consumer electronics account for a third of Japan‘s economic output. There has been a constant rise in the demand for consumer electronics from the country due to its durability and quality.

• Similarly, in Australia, the building and construction sector contributes around 8% of the GDP. The country is expected to recover, with non-residential building activity and engineering construction increasing in the next two years, owing to the upcoming major road and rail projects, which may further uplift the consumption of steel during the forecast period.

• The COVID-19 has presented a problematic situation for niobium in the region in early 2020. However, the conditions got better now, which concreted the probability of market recovery over the forecast period.

Tantalum Trends

According to “USGS Seeks Public Comment on Draft List of 50 Minerals Deemed Critical to US National Security and the Economy“ (USGS, November 8, 2021):

Tantalum (Ta) is ductile, easily fabricated, highly resistant to corrosion by acids, and a good conductor of heat and electricity and has a high melting point. The major use for tantalum, as tantalum metal powder, is in the production of electronic components, mainly tantalum capacitors. Major end uses for tantalum capacitors include portable telephones, pagers, personal computers, and automotive electronics. Alloyed with other metals, tantalum is also used in making carbide tools for metalworking equipment and in the production of superalloys for jet engine components.

The United States must import all of its niobium and tantalum source materials for processing, although a project is currently underway in Nebraska that would be the only niobium mine and primary niobium processing facility in the United States. Brazil and Canada are the major producers of niobium mineral concentrates, and Australia, Brazil, and Canada are the major producers of tantalum mineral concentrates. The value of tantalum consumed [in the United States] in 2020 was estimated to exceed $210 million as measured by the value of imports.

According to USGS‘ 2021-Tantalum-Report:

Significant U.S. tantalum mine production has not been reported since 1959. Domestic tantalum resources are of low grade, some are mineralogically complex, and most are not commercially recoverable... Globally, consumption of tantalum decreased because of disruptions in transportation and electronics manufacturing supply chains caused by the global COVID-19 pandemic; a leading end use for tantalum was in capacitors... World production was lower in part because of temporary mine closures in Brazil and Rwanda caused by the COVID-19 pandemic. Continued low prices for tantalum was also a factor. In Australia, lithium mines that had produced tantalum as a byproduct in 2019 remained on care-and-maintenance status in 2020 because of continued low prices for lithium. Production in Congo (Kinshasa) was estimated to have increased in 2020 based on reported ore production through August 2020; China was the main export destination. Brazil, Congo (Kinshasa), and Rwanda accounted for 77% of estimated global tantalum mine production in 2020. The U.S. Department of Defense issued an interim rule effective October 1, 2020, amending the Defense Federal Acquisition Regulation Supplement to implement a section of the National Defense Authorization Act for Fiscal Year 2020 that prohibits the acquisition of tantalum metal and alloys from China, Iran, North Korea, and Russia.

Acording to MSP-REFRAM, a multi-stakeholder platform for a secure supply of refractory metals in Europe:

Tantalum is used in different sectors of the industry thanks to its corrosion-resistant qualities and its applicability as capacitor, the latter being the most important application, with billions of units produced every year. Other applications in electric and electronic equipment (EEE) are sputtering targets (Ta metal, Ta2O5, TaN) and surface acoustic wave filters, of which the applications are cellular and wireless telephones, television sets, video recorders, tire pressure control and keyless entry systems. Tantalum is also used for high temperature applications, e.g. aircraft engines, in the form of super alloys based on nickel and cobalt. Tantalum carbide is used for the fabrication of cemented carbides. Tantalum oxide is used for manufacturing of special types of glass.

Rare Earths Trends

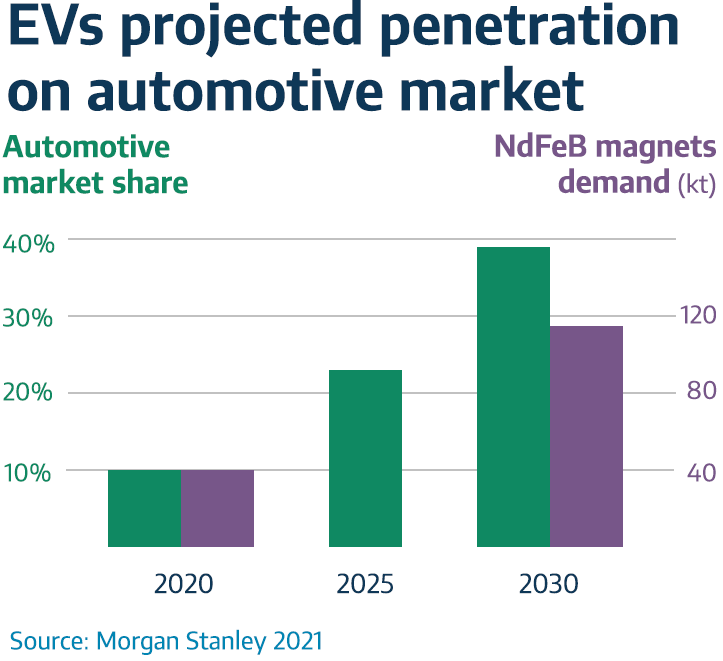

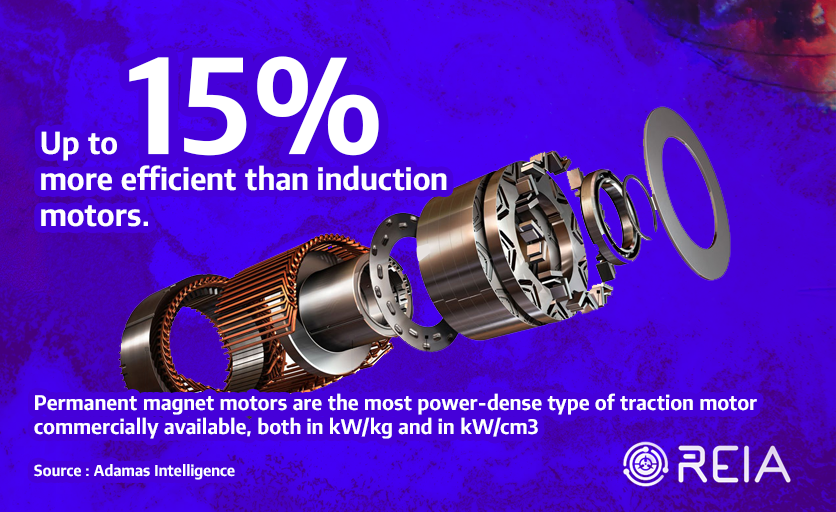

Neodymium and praseodymium (NdPr) are the most important rare earths used in electric vehicles (EV). 90% of EVs use rare earth permanent magnet motors. Each permanent magnet motor uses 0.7 kg NdPr.

According to Adamas Intelligence, the rapid rise in EV sales is expected to result in a 275% increase in demand for rare earths used in EV motors between 2019 and 2025. According to the European Commission (2020), rare earths (LREE & HREE) are highlighted as having the greatest supply risk of raw materials for key technologies.

Excerpts from “U.S. needs more mines to boost rare earths supply chain, Pentagon says“ (Reuters, October 19, 2021):

The United States and ally nations should mine and process more rare earths to ensure adequate global supply of the strategic minerals for military and commercial uses, a U.S. Department of Defense official said on Tuesday.

The remarks underscore the Pentagon‘s rising interest in public-private mining partnerships to counter China‘s status as the top global producer of rare earths, the 17 minerals used to make specialized magnets for weaponry and electric vehicles (EVs).

“We know we cannot resolve our shared exposure to supply chain risk without a close partnership with industry,“ Danielle Miller of the Pentagon‘s Office of Industrial Policy told the Adamas Intelligence North American Critical Minerals Days conference.

“New primary production of strategic and critical minerals - in a word, mining - is a necessity to increase resilience in global supply chains.“

“Domestic production of strategic and critical materials is the ultimate hedge against the risk of deliberate non-market interference in extended overseas supply chains,“ Miller said, a likely reference to China‘s hints it could curtail rare earth exports to the United States. “We are under no illusions about the competing pressures facing“ the U.S. mining industry. Miller also said the Pentagon wants to help mining companies in ally nations “create a common understanding of sustainability.“ U.S. environmental standards for mining are among the tightest in the world. “We want to work with (miners) to accelerate the transition from the lowest cost, technically acceptable sourcing, to one that reflects our values,“ Miller said.

According to “Renewable Energy Powering Rare Earths Upside“ (September 13, 2021):

Rare earth minerals are essential to producing an array of clean energy technologies, and with demand for the latter soaring, the rare earths investment thesis is experiencing a renaissance.

Following a long period of anonymity, the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) is back in style. REMX, which turns 11 years old next month, now has $1.1 billion in assets under management — a testament to a broad audience of investors discovering the importance of rare earths in the clean energy equation. More importantly, REMX is up 78.38% year-to-date. That’s confirmation that the fund’s 20 member firms are positively correlated to demand trends facilitated by the renewable energy industry.

“The minerals intensity of clean energy technologies may accelerate demand by as much as four to six times, depending on the technology,” says VanEck analyst Charl Malan. “An offshore wind plant requires thirteen times more mineral resources than a similarly sized gas-fired power plant... As the energy transition continues to accelerate, it seems feasible that decarbonization becomes the leading consumer of minerals. In other words, the global economy is transforming from one that is highly dependent on fossil fuels (coal, natural gas and crude oil) for its energy needs to one that is reliant on minerals.“

According to “Update on the global transition to electric vehicles through 2020“ (October 11, 2021):

In 2020, global cumulative electric passenger vehicle sales exceeded 10 million, and the electric share of new passenger vehicle sales hit a record-high 4.6%. Thanks to sustained policy adoption and technology deployment, 2020 saw a 49% increase in the number of high-volume electric passenger vehicle models, a 12% decline of average battery pack cost, and a 48% increase in public electric vehicle charger stock. Europe overtook China to become the world’s largest single market of electric passenger vehicles. This appears to put European countries, such as France, the Netherlands, Norway, and United Kingdom, on track toward their 100% electric vehicle sales share goals.

There was substantial progress on the development of vehicle regulations. Such policies include the world’s first electric vehicle regulation requiring 100% zero-emission vehicle sales share in British Columbia, the world’s first electric vehicle regulation for medium- and heavy-duty vehicles in California, the extension of China’s electric vehicle regulation from 2020 to 2023, and the implementation of EU’s tightened CO2 emission requirements for the new light-duty vehicle fleet. Additional policy efforts include sustaining financial incentives for electric vehicle purchases and investing in the development of charging infrastructure networks.

At least 21 national and provincial-level governments, including Canada, China, France, Scotland, South Korea, the United Kingdom, and 15 states of the United States announced new targets for vehicle electrification in 2020. As of end 2020, more than 20 countries, provinces and states globally, mostly in Europe and North America, have proposed to phase out new sales of ICE passenger cars or to only sell new electric models in the 2025–2050 time frame. These ambitious targets provide a clear signal to automakers, charging infrastructure providers, and vehicle fleet managers to make the transition to electric vehicles.

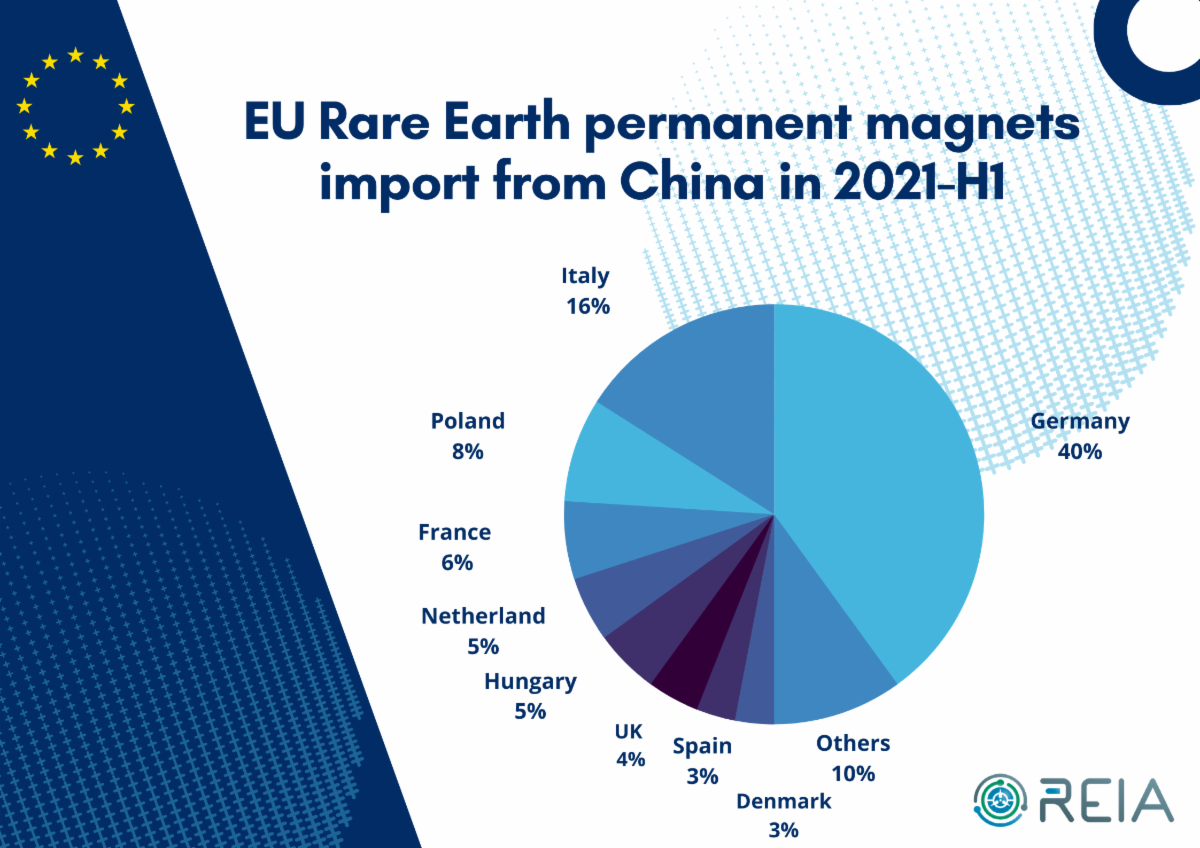

According to “EU considers help for rare earth magnet production-sources“ (Reuters, August 23, 2021):

The EU is working on proposals to jump-start home output of a type of specialist magnet vital in electric car motors by offering support to local producers so they can compete with Chinese rivals, sources close to the situation said. The moves to support production of rare earth permanent magnets would mirror legislation introduced in the United States earlier this month to offer tax credits to makers of the devices there. The United States, the EU and Britain aim to expand output of the super-strong magnets used in electric vehicles (EVs) and wind turbines to help meet targets to cut carbon emissions and lessen dependence on China, whose producers currently dominate the global sector. European firms say they cannot compete with Chinese producers, which they say get subsidies worth about a fifth of their raw materials costs, helping them to supply 90% of the global market for the magnets.

The EU launched the European Raw Materials Alliance (ERMA) late last year to ensure the bloc has a range of critical minerals needed for its green transition and gave top priority to rare earths. The bloc aims to create a domestic industry of rare earth mining, processing and magnets to lessen vulnerability to any disruption in Chinese supplies. China supplies 98% of EU demand for magnets made from rare earths, a set of 17 minerals used in range of applications including electronics, defence and aerospace.

At the recent World Climate Conference in Glasgow, 30 countries, 11 carmakers and other partners issued a joint declaration to move away from the internal combustion engine. The goal is to be emission-free worldwide for passenger cars and LCVs by 2040. But some of the signatories have already set themselves stricter targets. According to the British government, the signatories declare: “Together, we will work towards all sales of new cars and vans being zero-emission globally by 2040, and by no later than 2035 in leading markets”. (Source)

“Volvo Cars has committed to only sell fully electric cars by 2030. This is the most ambitious transformation into electrification from any established car manufacturer and it is a key step for Volvo Cars to reach full climate neutrality across its entire value chain by 2040. In the short-term Volvo Cars is working towards reducing its life cycle carbon footprint per average vehicle by 40 per cent between 2018 and 2025. This plan, one of the most ambitious in the industry, is validated by the Science Based Target Initiative to be in line with the Paris Agreement of 2015, which seeks to limit global temperature rise to 1.5C above pre-industrial levels. Volvo Cars has also committed to communicating improvements from concrete short-term actions in a trustworthy way, including the disclosure of the carbon footprint of all new models. The Volvo C40 Recharge is Volvo Cars’ second fully electric car, and the first model Volvo Cars launches that is only available as a fully electric version. The carbon footprint shows a great reduction in greenhouse gas emissions compared to that of an internal combustion engine (ICE) vehicle, especially if the car is charged with renewable electricity. The carbon footprint is also lower than that of the XC40 Recharge, mainly thanks to improved aerodynamics.“ (Source: Volvo‘s “Carbon Footprint Report“, 2021)

Full size / “Breakdown of the carbon footprint for the C40 Recharge with different electricity mixes in the use phase. The carbon footprint becomes approximately 50, 42 and 27 tonnes CO2-equivalents when charging C40 Recharge with global electricity mix, EU-28 electricity mix or wind power respectively. Thus, the choice of electricity mix is crucial for the carbon footprint.“ (Source: Volvo‘s “Carbon Footprint Report“, 2021)

Company Details

Saville Resources Inc.

#1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: mhodge@savilleres.com

www.savilleres.com

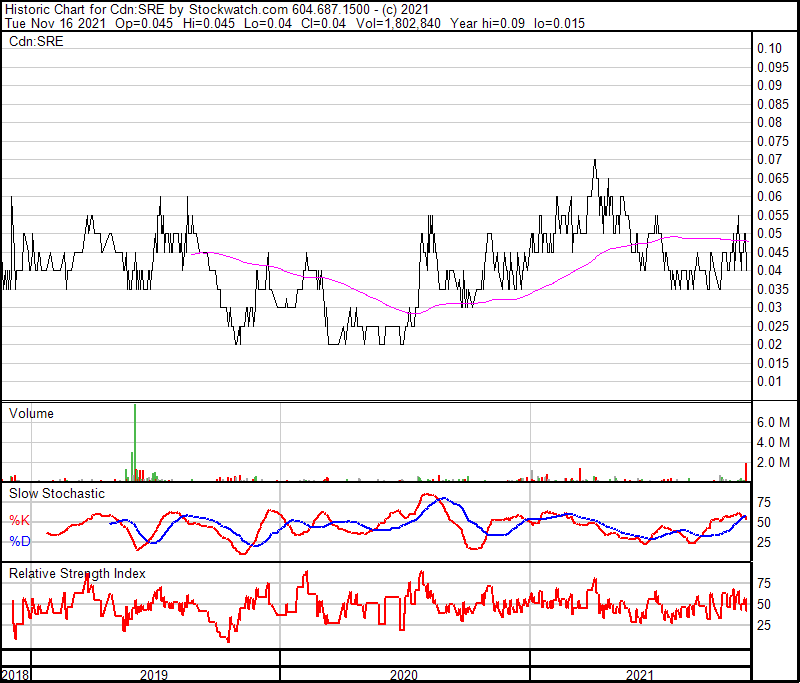

Shares Issued & Outstanding: 91,971,567

Canada Symbol (TSX.V): SRE

Current Price: $0.04 CAD (11/17/2021)

Market Capitalization: $4 Million CAD

Germany Symbol / WKN (Frankfurt): S0J / A2DY3Z

Current Price: €0.023 EUR (11/18/2021)

Market Capitalization: €2 Million EUR

Previous Coverage

Report #11 “Saville: Making Niobium Great Again“

Report #10 “Fluorspar: The Sweet Spot for Quebec‘s Steel and Aluminium Industries“

Report #9: “Saville reports impressive niobium drill results from Quebec, outshining previous holes and many other niobium projects globally“

Report #8: “On A Winning Streak In The Midst Of Trade Wars: Saville Drills High-Grade Niobium In Quebec“

Report #7: “Saville to start drilling for a niobium discovery in Quebec“

Report #6: “Saville Discovers High-Grade Niobium-Tantalum Boulders, And Possibly The Source, Ahead Of Drilling“

Report #5: “Strong potential for discovery of niobium-tantalum deposit(s) of significance, says independent report filed today“

Report #4: “Saville Releases High-Grade Assays from the Niobium Claim Group“

Report #3: “Eager to Start the Treasure Hunt for Niobium in Quebec“

Report #2: “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #1: “Saville Resources: Getting Ready“

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 83,013,201

Canada Symbol (TSX.V): CCE

Current Price: $0.215 CAD (11/17/2021)

Market Capitalization: $18 Million CAD

Germany Symbol / WKN (Tradegate): D7H0 / A2PQKV

Current Price: €0.149 EUR (11/17/2021)

Market Capitalization: €9 Million EUR

Previous Coverage

Report #34 “All Roads Lead To Ashram, Eventually“

Report #33 “Research & Advisory Firm looks into the Ashram REE & Fluorspar Project from Commerce Resources“

Report #32 “Already Big Ashram Gets Bigger And Bigger“

Report #32 “Already Big Ashram Gets Bigger And Bigger“

Report #31 “Fluorspar: The Sweet Spot for Quebec‘s Steel and Aluminium Industries“

Report #30 “Lean and Mean: A Fighting Machine“

Report #29 “Like A Phoenix From The Ashes“

Report #28 “SENKAKU 2: Total Embargo“

Report #27 “Technological Breakthrough in the Niobium-Tantalum Space“

Report #26 “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Saville Resources Inc.´s and Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their respective profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp., and is being paid by Zimtu Capital Corp., which company also holds a long position in Saville Resources Inc. and Commerce Resources Corp. Note that Saville Resources Inc. and Commerce Resources Corp. pay Zimtu Capital Corp. to provide this report and other investor awareness services. Also, Zimtu Capital Corp. is an insider and control block of Saville Resources Inc. by virtue of owning more than 20% of Saville Resources Inc.’s outstanding stock. The cover picture (amended) has been obtained and licenced from Blue Planet Studio.