Disseminated on behalf of Copper Quest Exploration Inc. and Zimtu Capital Corp.

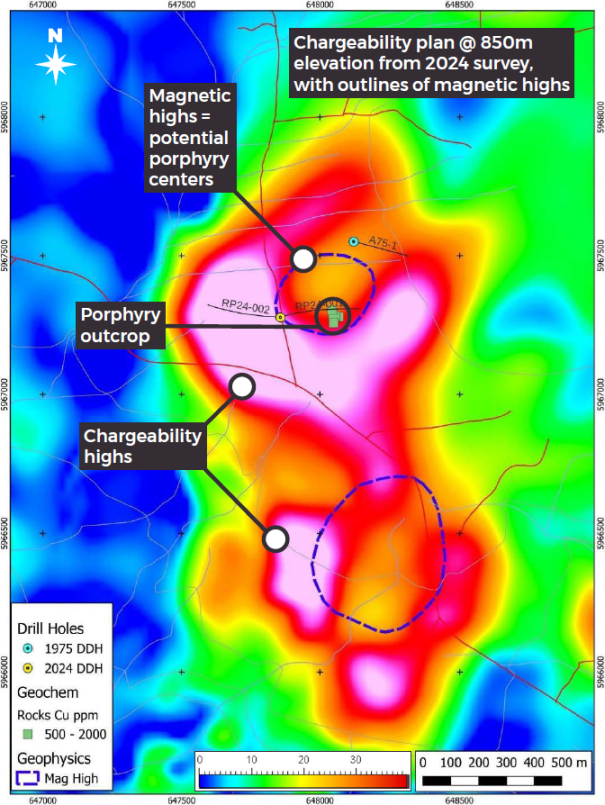

On Tuesday, Copper Quest Exploration Inc. announced plans for a minimum 2,000-metre Phase 2 drilling program at its RIP Copper-Molybdenum Project in British Columbia’s prolific Bulkley Porphyry Belt – a campaign that could be far more revealing than last year’s initial drilling. The fully permitted drill program will test the large, completely un-drilled southern geophysical anomaly – a circular “donut-shaped” chargeability feature interpreted as a second porphyry centre of equal or greater scale than the northern zone tested in 2024 with 2 short scout holes. The southern anomaly remains hidden beneath cover and has never seen a drill bit – yet geophysics indicates it may represent the core mineralizing engine of the system.

CEO Brian Thurston commented in the news-release: “We are excited to plan the first ever drill campaign targeting the highly prospective southern geophysical anomaly at RIP. The Phase One drill program successfully demonstrated that a multi-phase, mineralized porphyry system is defined by the geophysical targets interpreted by Copper Quest with extensive Cu-Mo mineralized intersections in both holes of that limited drill program. The drilling of the northern target chargeability high is host to impressive porphyry style stockwork that has potential to improve in grade down plunge and laterally. The majority of the system, including the entirety of the southern target, remains untested and is highly deserving of additional exploration. Copper Quest has assembled a dominant land position in the Bulkley Porphyry Belt and created a unique opportunity that unlocks a district scale copper porphyry pursuit.“

Full size / 2024 airborne magnetic and 3D-DCIP surveys at the Rip Project defined 2 distinct porphyry centers: The northern anomaly – partly tested by 2 short drill holes in 2024 – shows a classic chargeability “donut” (pyrite halo) surrounding a magnetic core. The much larger southern anomaly, however, remains completely untested and concealed beneath cover, underscoring strong discovery potential, additional exploration upside, and the clear need for follow-up drilling.

“An airborne magnetic survey flown in 2024 revealed for the first time two separate circular magnetic highs within the historical chargeability high, suggesting that RIP contains two porphyry centers. The southern mag high is significantly larger than the northern one but does not crop out. Following the airborne mag survey, a 3D-DCIP induced polarization and resistivity survey was completed over the Rip target in 2024. The new IP survey resolved the original 1980 chargeability anomaly into two chargeability “donuts” around the two separate magnetic highs, the classic “pyrite halo” signature of porphyry systems, providing more evidence for the interpretation that RIP contains two adjacent porphyry systems.“ (Copper Quest‘s news-release on October 14, 2025)

The limited 2024-drilling (just 2 scout holes totaling 1,033 m) proved the concept: A large, fertile copper-moly system characterized by quartz-sericite-pyrite alteration and stockwork veining. However, both holes were drilled only into the northern anomaly, interpreted mainly as the outer pyrite halo surrounding a magnetic core – a zone typically lower in copper grade within porphyry systems.

By contrast, the upcoming drilling will:

1) Target the southern anomaly – never before drill-tested – where the magnetic-IP signature suggests stronger sulphide mineralization closer to the intrusive core.

2) Drill deeper and laterally into the chargeability shell, where copper-bearing veins are typically most concentrated – the sulphide-rich zone that often surrounds the barren magnetic core in porphyry systems and hosts the strongest copper grades. In many porphyry systems, this shell marks the transition from weakly mineralized core zones to the sulphide-rich margins that deliver higher copper grades and continuity.

3) Follow-up on vectors defined by multi-phase intrusive textures and alteration from the 2024-core.

In short, Phase 1 confirmed fertility – Phase 2 is designed to find grade.

Amended Option Agreement Enables Expansion

Copper Quest and ArcWest Exploration Inc. have signed an Amended Option Agreement extending the drilling requirement to December 31, 2026, providing additional flexibility and ensuring sufficient time to complete the planned Phase 2 drill program and earn Copper Quest its initial 60% ownership of the RIP Project.

At the same time, 5 new mineral claims have been strategically staked, more than doubling the project area to 4,770 hectares and solidifying Copper Quest’s dominant land position in one of British Columbia’s most active and infrastructure-rich porphyry districts.

RIP Within a Growing District-Scale Story

As outlined in Rockstone Report #1 (September 30, 2025), the RIP Project anchors Copper Quest’s expanding presence in the Bulkley Belt, alongside its 100%-owned Stars and Stellar Properties. The report described RIP as “one of the last large, intact porphyry footprints in the district without systematic drilling” and emphasized its strategic proximity to the past-producing Huckleberry Mine from Imperial Metals Corp. (current market cap.: $1.2 billion) and the advanced-stage Berg, Ox, and Seel copper deposits from Surge Copper Corp. (current market cap.: $97 million).

Momentum Building

The confirmation of a mineralized porphyry system, the clear geophysical targets ahead, and a fully permitted, funded follow-up drill program mark a pivotal turning point for Copper Quest. With the northern anomaly now confirmed as a Cu-Mo mineralized porphyry system, and the larger southern anomaly still completely untested, the company is positioned to drill directly into what could represent the core of a major new copper-molybdenum discovery in British Columbia.

Unlike many early-stage explorers still searching for mineralization, Copper Quest has already proven the system’s fertility. The 2024 drilling intersected long intervals of Cu-Mo mineralization and characteristic quartz-sericite-pyrite alteration – exactly the features that define large, productive porphyry systems.

The next holes will focus on the southern chargeability “donut”, where magnetic and IP data suggest the sulphide-rich halo that often hosts the highest copper grades and continuity around the intrusive core. It is precisely at this stage – after confirmation of mineralization but before systematic definition drilling – that many of the world’s most significant porphyry discoveries have been made.

The opportunity is compelling. With a current market capitalization of roughly $10 million, Copper Quest trades at a fraction of peers exploring comparable copper systems in British Columbia – despite already having confirmed mineralization and a district-scale land package.

Together, these factors create one of the most attractive early-stage copper discovery opportunities in the market:

• A confirmed fertile porphyry system at the northern anomaly.

• A second, larger porphyry centre to the south remains completely untested by drilling.

• A fully planned Phase 2 drill program targeting that untested southern anomaly.

• A tight market cap providing maximum leverage to discovery success.

In a global copper market defined by supply shortages and surging demand from electrification, AI infrastructure, and renewable power, new discoveries in stable jurisdictions like British Columbia are increasingly rare – and increasingly valuable.

With drilling imminent, Copper Quest stands on the threshold of a potential discovery that could redefine its position within the North American copper landscape. Investors now have a defined, near-term catalyst: Drilling that could move RIP from early-stage discovery to a new porphyry copper deposit in one of North America’s safest jurisdictions.

As Rockstone Report #1 concluded: “With multiple catalysts ahead in 2025-2026, Copper Quest offers rare exposure to scale, discovery, and jurisdictional strength in copper – the world’s most strategic, supply-constrained metal.”

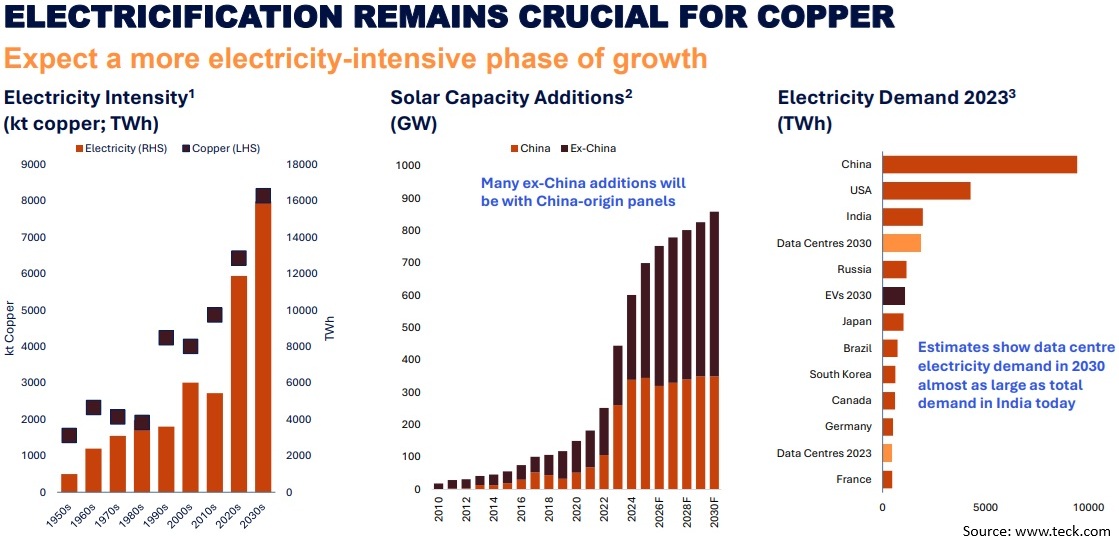

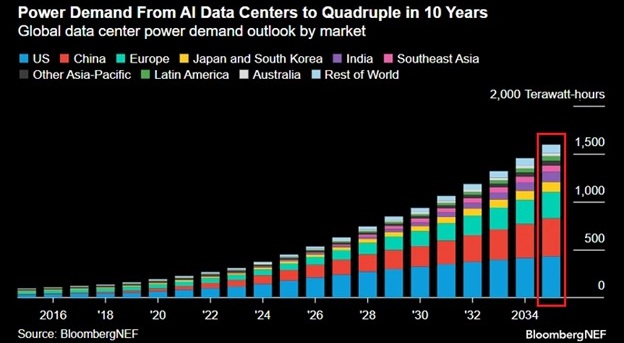

Copper Demand Driven by Electrification: As illustrated in above figure to the left, the relationship between global electricity generation and copper consumption has become exponentially stronger over time. Each new wave of electrification – from post-war industrial growth to today’s renewable-energy and AI data-center boom – has increased the amount of copper required per unit of power produced. The chart shows that while global electricity output (red) has surged since the 1950s, copper demand (black) is now rising even faster, with projections for the 2030s approaching record levels. Every megawatt of new solar, wind, EV charging, or data-center capacity requires substantial copper wiring and transmission infrastructure. This accelerating “electricity intensity” underscores why analysts expect copper demand to outpace supply for years to come – a structural trend that positions discovery-stage explorers like Copper Quest at the forefront of the next supply wave.

Full size / Source / This explosive growth underscores the surging global demand for electricity – and the massive copper requirements – driven by artificial intelligence and digital infrastructure.

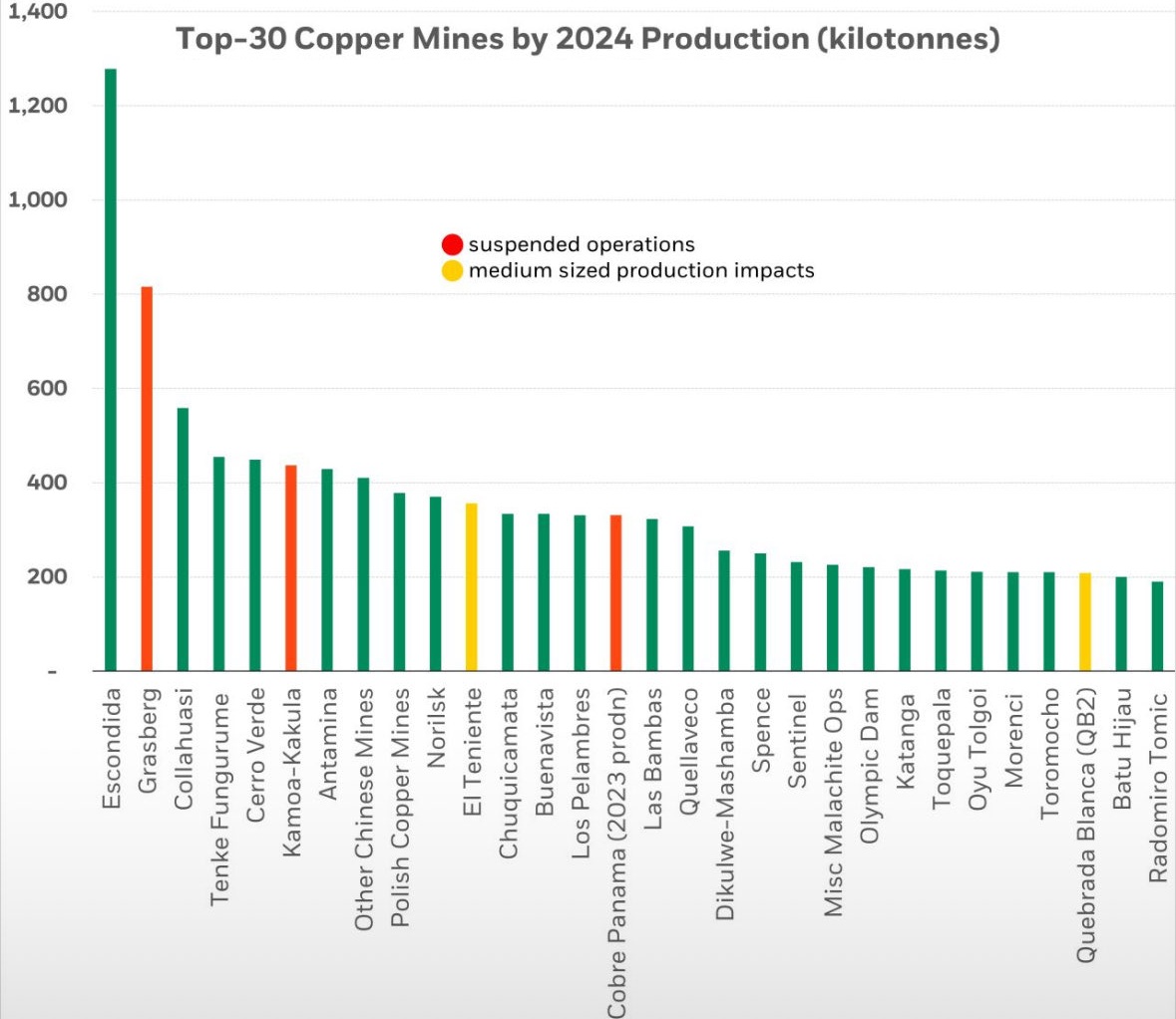

Production disruptions at 3 of the world’s top copper mines – Grasberg in Indonesia, Kamoa-Kakula in the Democratic Republic of Congo, and Cobre Panama – have collectively sidelined an estimated 1.6 million tonnes of annual copper output. That’s roughly 7% of global supply, effectively removing 1 out of every 14 tonnes of copper that the world depends on. Each of these mines is a global-scale operation that plays a critical role in meeting surging demand from electrification, renewable energy, and data-center infrastructure. With Grasberg facing operational challenges, Kamoa-Kakula undergoing production interruptions, and Cobre Panama forced offline due to regulatory and environmental disputes, the market has suddenly lost a significant portion of its high-quality supply. Adding to the pressure, Codelco’s losses from the recent accident at its El Teniente Mine are now estimated to be 45% higher than previously reported, while Chilean copper output in August fell 9.9% – the largest monthly drop in 2 years. This erosion of available tonnage comes at a time when global exchange inventories are already near multi-year lows and few new large-scale mines are advancing toward production. The result is a tightening structural deficit that continues to drive upward pressure on copper prices and amplifies the strategic importance of new discoveries, particularly in politically stable jurisdictions such as Canada and the United States. For explorers such as Copper Quest, this backdrop magnifies the leverage to discovery: As existing supply falters and demand accelerates, new district-scale discoveries in safe jurisdictions are drawing growing attention from major producers and investors seeking the next generation of copper supply.

According to a recent Bank of America analysis highlighted by Mining.com, artificial intelligence is driving an unexpected boom in commodities. “AI devours commodities,” writes strategist Michael Hartnett, noting that resource stocks now offer a cheaper, more diversified way to gain exposure to the AI revolution than overvalued mega-cap tech names. Copper has emerged as the critical metal powering AI infrastructure – from data centers and power grids to electric vehicles and renewable energy. BloombergNEF forecasts AI-related copper demand to average 400,000 tonnes annually through 2035, peaking near 572,000 tonnes in 2028. Yet global supply growth remains slow, leaving a projected 6-million-tonne deficit by 2035. With major producers facing operational setbacks, declining ore grades, and few new mines entering production, the spotlight is shifting toward new discoveries in safe, infrastructure-rich jurisdictions. For investors, that makes Copper Quest – advancing multiple district-scale porphyry copper projects in Canada and the U.S. – a strategically positioned, high-leverage opportunity to participate in the structural copper bull market and the essential metal powering the AI and electrification era.

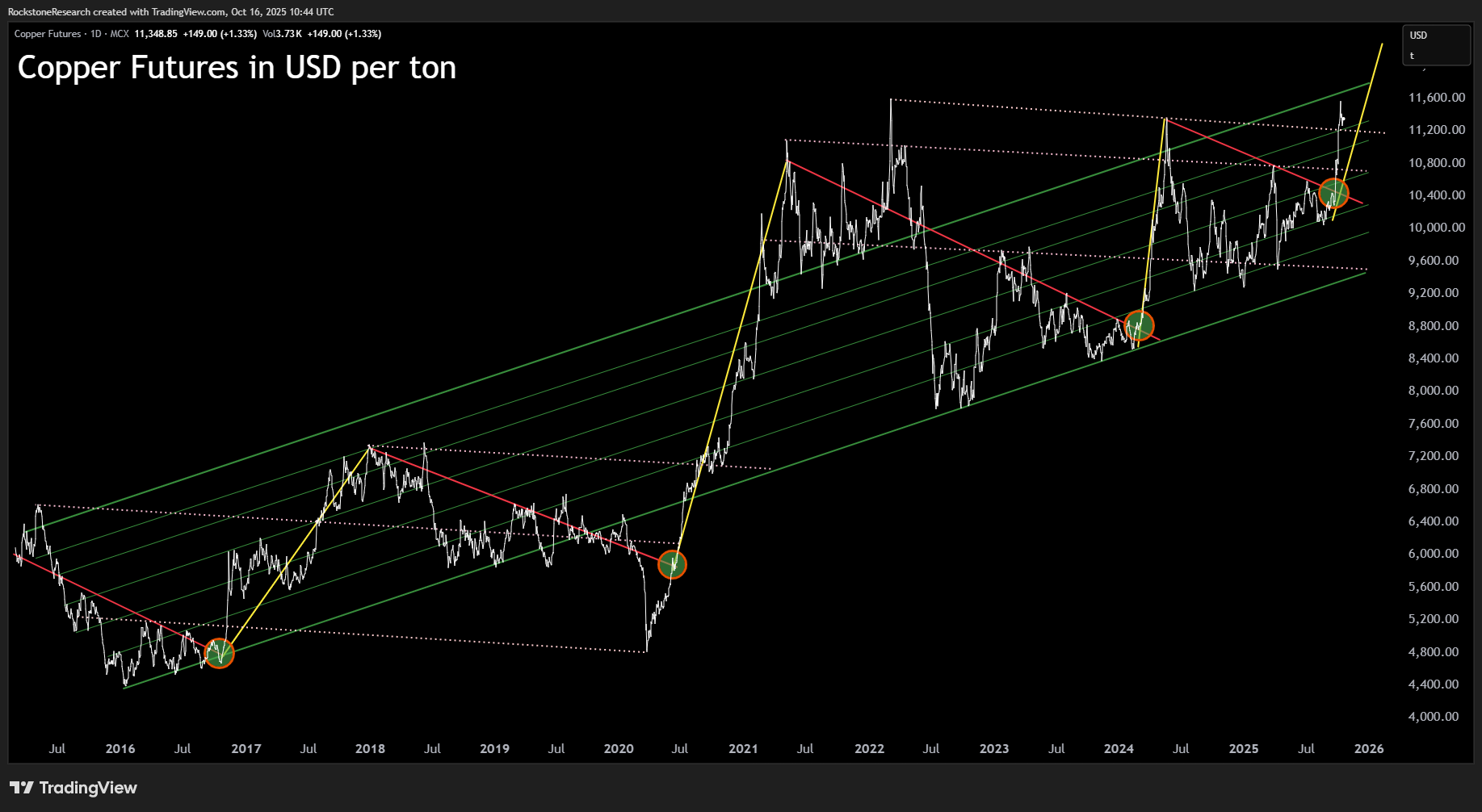

Full size / Source / Copper has broken out of a 2-year consolidation pattern, climbing decisively above the long-term descending resistance line near $10.50/kg – signaling renewed bullish momentum. The red resistance line, repeatedly tested since 2022, has finally given way to upward pressure as supply disruptions, falling inventories, and AI-related demand forecasts tighten the market.

Full size / Source / Long-term copper price chart showing recurring breakout patterns from descending resistance (red) – each followed by steep rallies (yellow) within a rising multi-year channel.

The technical picture aligns perfectly with fundamentals: A tightening supply chain, record-low inventories, and surging demand from electrification, renewable energy, and AI data centers. Each confirmed breakout in copper’s long-term chart has coincided with the onset of new industrial growth phases. If history repeats, the current breakout could signal the next sustained bull cycle – a backdrop that directly benefits exploration and development companies such as Copper Quest, positioned to deliver the next generation of copper supply in safe jurisdictions.

Company Details

Copper Quest Exploration Inc.

#2501 – 550 Burrard Street

Vancouver, BC, V6C 2B5 Canada

Phone: +1 778 949 1829

Email: investors@copperquestexploration.com

www.copper.quest

CUSIP: 217523 / ISIN: CA2175231091

Shares Issued & Outstanding: 71,243,806

Canada Symbol (CSE): CQX

Current Price: 0.14 CAD (10/15/2025)

Market Capitalization: 10 Million CAD

Germany Symbol / WKN: 3MX0 / A40ZSP

Current Price: 0.089 EUR (10/16/2025)

Market Capitalization: 6 Million EUR

Contact:

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Copper Quest Exploration Inc. (“Copper Quest“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Copper Quest‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward-looking include, but are not limited to, statements that Copper Quest is positioned to deliver scale and value, advance and unlock the next generation of copper supply in North America, and create shareholder value through the discovery and development of porphyry copper-molybdenum systems; the fully permitted Phase 2 drill program at the RIP Project will test the un-drilled southern geophysical anomaly and could define a higher-grade copper-molybdenum centre; additional drilling, mapping, and geophysical work at RIP may expand known mineralization, vector toward stronger grades, and confirm a district-scale system comprising 2 porphyry centres; Copper Quest may earn up to an 80% interest in the RIP Project by completing staged exploration expenditures, cash payments, and share issuances under the amended option agreement with ArcWest Exploration Inc.; ongoing exploration at Copper Quest’s 100%-owned Stars, Stellar, and Thane Properties may identify additional copper centres and provide opportunities for strategic partnerships or regional consolidation; market conditions, including electrification, renewable energy, AI-driven data centres, and declining global copper supply, may support higher copper prices and valuations for discovery-stage companies; the Company’s small market capitalization offers significant leverage to exploration success and potential future resource definition; and that management will be able to finance, permit, execute, and interpret exploration programs as planned, and to attract partners or acquirers interested in the Company’s North American copper portfolio. Such statements are based on assumptions including, but not limited to: The continued availability of capital and technical expertise; successful completion of exploration activities; favourable commodity pricing; stable regulatory and social environments; and accurate geological interpretation of data and drill results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include, but are not limited to: Permitting and Approvals: While the RIP Phase 2 drill program is fully permitted, future exploration or expansion activities on other projects may still require additional governmental, regulatory, Indigenous, or third-party approvals that could be delayed or denied. Market Risks: Adequate buyers, partners, or acquirers for Copper Quest’s copper, gold, silver, or molybdenum resources may not be secured; demand projections for copper related to electrification, AI data centers, EV adoption, renewable energy, and defense applications may not materialize as expected. Technical Risks: Exploration drilling may not confirm mineral grades, continuity, or thickness consistent with previous results; historical data may not be reliable or indicative of future economic viability; metallurgical recoveries may be lower than expected. Geology and Resource Risks: The geological characteristics of the RIP Project and other Copper Quest properties may differ from current interpretations; mineralization encountered to date may not continue at depth or laterally; and even if future resources are defined, they may not prove economically viable for development. Operational Risks: Although the 2025 RIP drill program is fully permitted and financed, unforeseen operational challenges, such as drilling conditions, weather, or logistics, could increase costs or cause delays; infrastructure limitations may also affect future development. Financing Risks: Required capital expenditures for exploration and project advancement may exceed estimates; financing may not be available on reasonable terms, or at all, which could delay or prevent development. Geopolitical and Regulatory Risks: Legislative, political, social, or economic developments in Canada, the U.S., or other jurisdictions may hinder progress or add costs; agreements with governments, First Nations, or local communities may not be reached or maintained. Human Capital Risks: Copper Quest may not be able to retain or attract key employees, advisors, contractors, or technical partners needed to execute its exploration and corporate strategy. Commodity Price Risks: Prices for copper, gold, silver, and molybdenum may fluctuate and may not be sufficient to support profitable development or attract financing. Comparability Risks: What appear to be similarities with other successful porphyry copper projects in British Columbia or elsewhere may not be substantially comparable in geology, costs, recoveries, or economics. Environmental and ESG Risks: Environmental opposition, stricter permitting requirements, or evolving ESG standards could delay or prevent exploration and development; failure to comply with sustainability standards could limit financing, partnerships, or investor interest. Offtake and Counterparty Risks: Potential offtake agreements, joint ventures, or partnerships may not be secured; counterparties may fail to perform or may renegotiate terms under adverse market conditions. Currency and Macroeconomic Risks: Fluctuations in the Canadian Dollar relative to the US Dollar and other currencies may affect capital and operating costs; inflation, interest rate shifts, or global economic downturns could weaken project economics and investor appetite. Timing Risks: Project milestones, permitting, drilling campaigns, exploration results, or potential transactions may take longer than anticipated, leading to delays in advancement and value creation. Force Majeure / Natural Events Risks: Extreme weather, wildfires, flooding, earthquakes, pandemics, or other uncontrollable events could disrupt exploration, logistics, or operations in remote project areas. Logistics and Infrastructure Risks: Project success relies on dependable road access, power supply, and regional infrastructure (e.g. processing facilities, mills, and transmission lines); delays, failures, or cost overruns in infrastructure development could materially impact timelines and economics. Third-Party Information Risks: Certain information contained in this report, including market data, industry statistics, and third-party commentary, has been obtained from sources believed to be reliable but has not been independently verified. Rockstone and the author make no representation or warranty as to its accuracy, completeness, or reliability. Liquidity and Trading Risks: Securities of small-cap issuers such as Copper Quest often involve a high degree of risk and may be subject to volatility, limited trading liquidity, wide bid/ask spreads, and potential loss of invested capital. Investors should be prepared to bear the risk of illiquidity and price fluctuations. Statements herein assume the availability of financing, successful permitting, exploration results that validate historical data, continued favorable commodity pricing, and supportive regulatory and social conditions. There can be no assurance that these assumptions will prove accurate. Caution to Readers: Forward-looking statements are not guarantees of future performance. Actual results may differ materially due to the risks and uncertainties described above and in Copper Quest’s public disclosure. Readers should not place undue reliance on forward-looking information. Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on Copper Quest’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of Copper Quest’s projects is no guarantee for mineralization on the properties from Copper Quest, and all of Copper Quest’s projects are exploration projects. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Copper Quest Exploration Inc. (“Copper Quest“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of Copper Quests stock prices. Copper Quest pays Zimtu Capital Corp. to provide this report and other services. As per news on August 27, 2025: “Copper Quest Exploration Inc. (CSE: CQX; OTCQB: IMIMF; FRA: 3MX) (“Copper Quest” or the “Company”) is pleased to announce that it has signed an agreement with Zimtu Capital Corp. (TSX.V: ZC) (FSE: ZCT1) (“Zimtu”) whereby Zimtu will provide marketing services under its ZimtuADVANTAGE program (https://www.zimtu.com/zimtu-advantage/), effective September 1, 2025 for an initial term of 12 months at a cost of $12,500 per month. Marketing Agreement: The ZimtuADVANTAGE program is designed to provide opportunities, guidance, marketing and assistance. Services include investor presentations, email marketing, lead generation campaigns, blog posts, digital campaigns, social media management, Rockstone Research reports & distribution, video news releases and related marketing & awareness activities. Zimtu is based in Vancouver, at Suite 1450 – 789 West Pender Street, Vancouver, BC V6C 1H2. Zimtu may be reached at 604.681.1568, or info@zimtu.com. Zimtu’s compensation does not include securities of the Company; as of the date hereof, Zimtu owns 2,633,333 shares of the Company and 2,333,333 warrants to acquire common shares of the Company.“ The author owns equity of Copper Quest and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Copper Quest (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Copper Quest Exploration Inc., Tradingview, Stockwatch, and the public domain. The cover picture on page 1 has been obtained and licenced from Shutterstock.com.